The Market

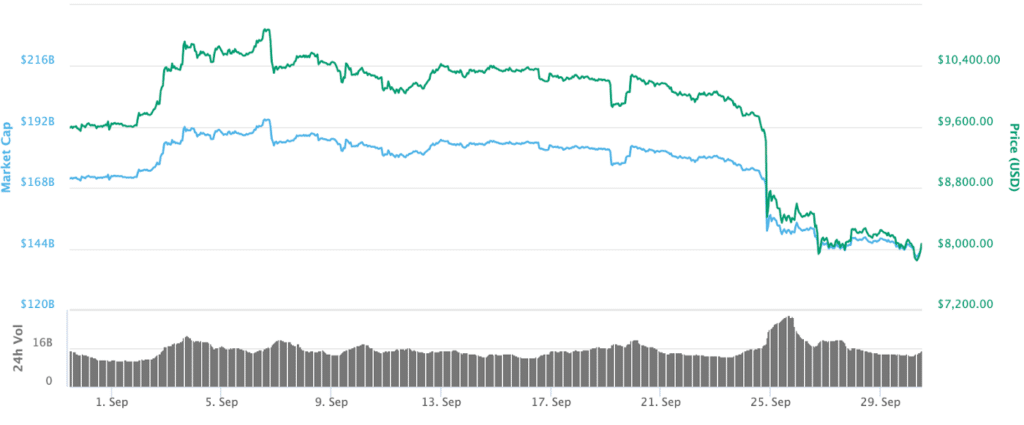

Bitcoin finished the month trading at $8,200 down over 15% after a major market move. Cryptocurrencies lost almost $30 billion in value in September, with substantial selling occurring across the market on the 24th and 25th. For the first few weeks of the month, Bitcoin held steady around the $10,000 price mark. Some Altcoins had posted 10–20% gains mid-month, inspiring a handful of market commentators to call for the return of ‘alt season’. However, ‘alt season’ did not come to fruition as these gains were wiped out a week later. The majority of projects posted recent new lows, some posting new lows for the year on September 25th. Despite the widespread selling, Ethereum (ETH) reported a gain of 4.8%, finishing the month at $179. ETH is the best performing asset in the top 10 for September, its daily gas usage is now standing at an all-time high, hitting 61 billion gas units on September 29th.

In last month’s market commentary we outlined how Bitcoin’s dominance had been consistently rising for many months and that a cool off was probable. This rise continued into September hitting a peak of 70.42% on the 2nd, however, it has since begun to decline, and currently sits at 67.3%. The wider market sell-off was one of the most substantial this year, Bitcoin has not traded in the $8,000 range since early June. However, Bitcoin has already seen double-digit daily losses four times this year, so the sell-off should not cause too much concern. The biggest single-day loss of 2019 occurred on June 27th, which was a healthy correction from a 17-month high of $13,880. It’s worth noting the Bitcoin is still up over 125% percent in the last 12 months.

September Bitcoin Market Cap — Coin Market Cap

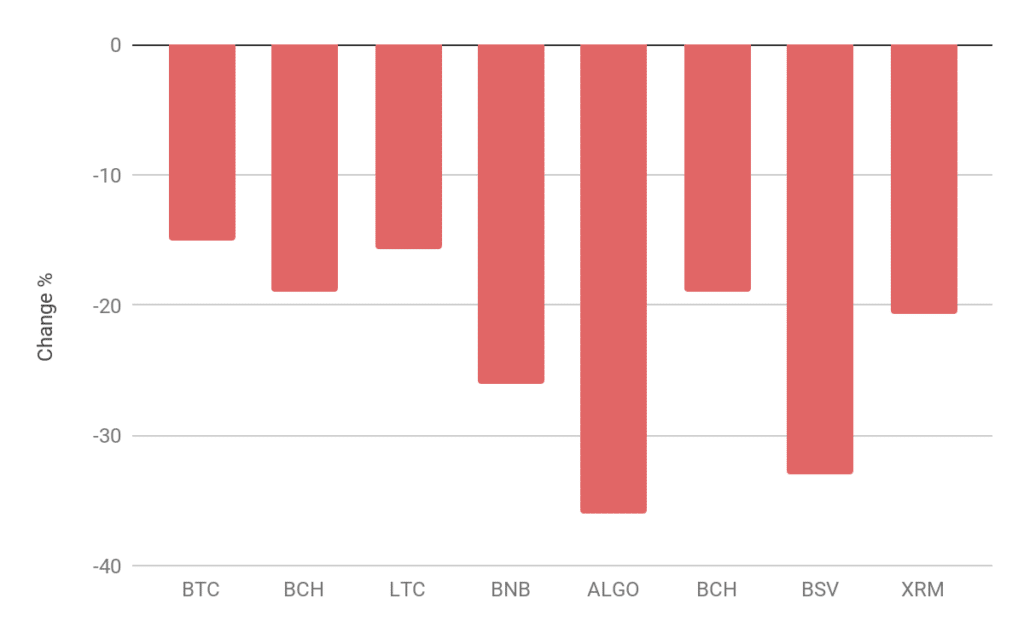

The majority of assets in the top 15 saw price decreases this month. Bitcoin (-15%), BCH (-19%), Litecoin (15.7%), BNB (-26%), ALGO (-36%), BSV (-33%), XRM (-20.7%).

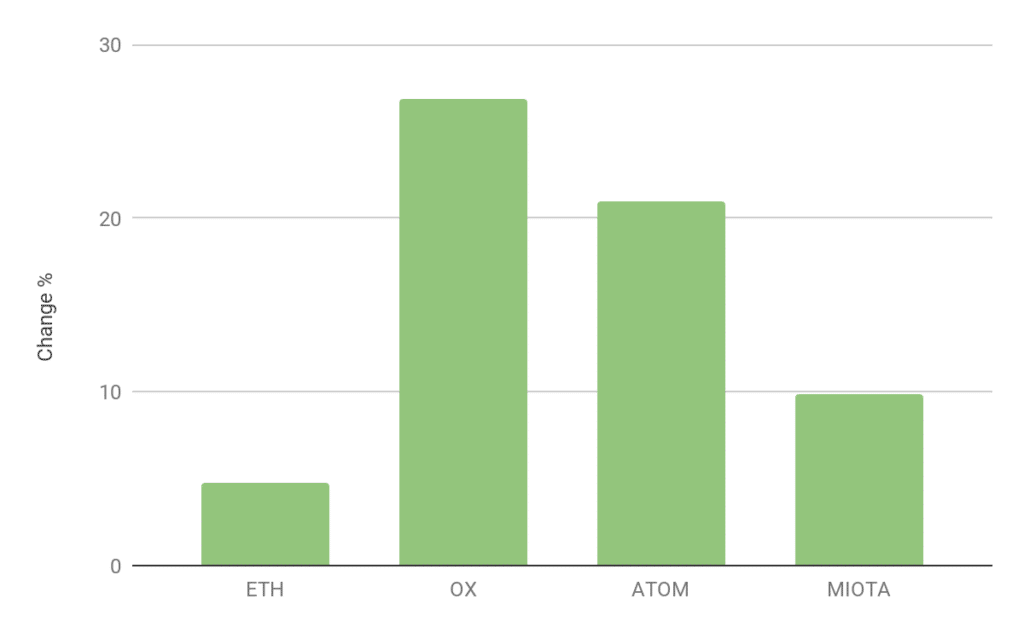

Ethereum (ETH) was the only winner in the top 10 this month, up 4.8%. Inside the top 50, OX, ATOM and MIOTA all posted strong gains.

Bakkt’s Disappointing Volumes

The Bakkt futures exchange launched this month but with disappointing volumes. It brought in $6.8 million in its first week. By comparison, CME Bitcoin futures traded $48.2M in its first 24hrs and $460 million in its first week. The CME did launch its futures product when the cryptocurrency market was at the height of its hysteria in December of 2017, but the difference in volume is still substantial. The launch of Bakkt futures has been widely discussed for many months but did not live up to the hype that was created with its initial announcement.

Many believed its launch would be favorable to the Bitcoin price, due to the reputation of Bakkt’s parent organization, its regulatory clarity, and Bakkt being a viable option for institutional investors. However, new institutional players did not arrive, what transpired instead was a first day of low volumes and a market sell-off the day after.

Jeff Sprecher, Intercontinental Exchange chairman and CEO, with his wife Kelly Loeffler, an ICE executive who will be CEO of the startup Bakkt, on the trading flo

Many crypto-market commentators have cited lower-than-expected volumes for the ICE futures contract as the main contributor to the market’s recent drop. The influence of Bakkt on Bitcoin’s recent losses is difficult to define with certainty. Rather than the market move being tied to one catalyst, it’s also highly possible that the market was cooling off from the recent bullish gains that began in May — it stands to reason that large traders and/or miners may have wanted to hedge their exposure and take profits. Regardless of the volumes traded, having more regulated products being offered by reputable institutions like Bakkt helps move crypto towards becoming a legitimate asset class.

Bitcoin in the Face of Mass Uncertainty

The narrative emerged in recent months that Bitcoin is being used as a hedge to the mass uncertainty that currently grips the financial and political world. Interestingly, during what was arguably the most volatile political month in recent memory, Bitcoin’s performance was poor.

This month, House Speaker Nancy Pelosi announced that a formal impeachment inquiry would be launched in response to an alleged conversation between Mr. Trump and the president of Ukraine, Volodymyr Zelensky. In the same week, the British Supreme Court unanimously ruled that UK Prime Minister Boris Johnson acted unlawfully when he shut down parliament for five weeks in the run-up to Brexit.

On September 18th, the New York Federal Reserve launched a special operation aimed at easing stress in the financial markets. This repo operation was conducted with primary dealers for up to an aggregate amount of $75 billion. The central bank attempted to ease pressure in markets by purchasing treasuries and other securities. The goal was to pump money into the system to keep borrowing costs from rising above the Fed’s target range. It was the first time New York Fed’s had carried out such a rescue operation since the financial crash of 2008. Reserve balances have now fallen to an 8 year low. Such drastic measures may put confidence in the Fed at risk, as its actions did seem slightly abrupt.

John C. Williams, the president of Federal Reserve Bank of New York. The bank is the Fed’s primary conduit to — and supervisor of — Wall Street.

Bitcoin’s recent poor performance highlights that maybe it is premature to call it an uncorrelated safe-haven asset, as some would like to believe. The current combination of financial precariousness and political uncertainty is a powerful mix that should inspire investors to look for a safe asset to store their wealth. Gold is currently trading around the $1,500 mark and has held on to its substantial gains from this Summer. Seeing large financial institutions in trouble should play into the hands of the crypto market, as a shift away from traditional monetary policy is at the core of why Bitcoin was developed. It is more likely, however, that major players in the crypto market, such as miners and whale traders, still have more influence than any overarching narrative that would appeal to the masses.

Regulatory Cat and Mouse

A collection of companies and exchanges in the space announced a new council this week which attempts to determine if popular digital assets are complying with U.S. securities law. The general cryptocurrency market is in agreement that most digital assets should not fall under an existing regulatory approach, as the traditionally used Howey Test appears outdated when considering digital assets. The consortium of companies, called the Crypto Ratings Council, consists of Coinbase, Kraken, Circle, Bittrex, Cumberland, Genesis, Anchorage and Grayscale. This movement was likely born from frustration with a perceived lack of action and on the regulatory front. Exchanges have the arduous task of determining which assets are more than likely not securities, so they can then list and offer them to their retail trading base.

Coinbase, co-founded by Chief Executive Brian Armstrong, conceived of the ratings. PHOTO: MICHAEL SHORT/BLOOMBERG NEWS

The announcement of the Crypto Ratings Council has been met by a mixed reaction from the crypto community. Although the initiative has been commended by many, others claim the exchanges are not in a position to give an unbiased opinion on the assets, especially when the have their own investments and listing strategies.

The framework itself is derived directly from case law and past guidance published by the SEC. It is an ambitious effort, in what is an ongoing conversation both with regulators and within the wider crypto community. It is not clear whether the SEC will take this guidance into account when developing new legislation, however, it may have a positive effect in terms of encouraging the SEC to define the assets. The thought of the crypto industry deciding for itself which digital assets are and are not securities could compel them to act, as it might add additional headaches to an already tricky multifaceted issue.

GSR Update

London: There was a great turn out to our Institutional Talks about the current regulatory landscape in crypto on September 18th. Thank you to all who attended, we look forward to the next one!

Director of Investment, Jakob Palmstierna, gives his thoughts on the current regulatory environment at ‘Institutional Talks’ run by GSR & OKEx this September.

Hangzhou: GSR was grateful to take part in the ‘How Blockchain Technology Can Deliver Economic Value’ event hosted at B-LABS, the blockchain incubator supported by Canaan Creative. Xin Song spoke about the current state of market-making services in the crypto industry, and the benefits of algorithmic trading when compared to traditional OTC desks.

Xin Song highlighting the benefits of algorithmic trading

New York: GSR partnered with The Trading Show in New York on September 25th. GSR Co-Founder Richard Rosenblum gave his detailed perspective on the liquidity of the cryptocurrency market, while also having a panel discussion with Michael Shaulov, CEO of Fireblocks, about the technology being used to secure the transfer of digital assets. On October 17th, GSR Director of Investments Jakob Palmstierna will be discussing high-frequency trading at the Trading Show in London.

Frankfurt: The GSR team is looking forward to the World Digital Mining Summit in Frankfurt next week, reach out to mining@gsr.io to get in touch with our team.

Chengdu: GSR is proud to partner with the MinerSummit in Chengdu this month, created by MinerUpdate. Both Rich Rosenblum and Xin Song will be speaking on the topic of Risk Management Solutions. When compared to more mature industries, very few companies in the crypto industry have sophisticated risk management strategies. However, the need is far greater, due to the extreme volatility experienced in digital assets. Reach out to mining@gsr.io to meet the team there!