The Market

Bitcoin finished the month trading around $9,600, down 7%, with the total market cap of all assets decreasing by $29 billion in August. We have seen some bearish analysis return to the market this month. However, it is probable that Bitcoin is just consolidating its gains after its rise in Q2, with the altcoin market continuing to struggle.

August Bitcoin Market Cap — Coin Market Cap

As Bitcoin’s market dominance holds strong, the majority of altcoins in the market saw a considerable price decrease in August. The majority of assets in the top 20 had substantial losses: Ethereum (-21%), Ripple (-19%), EOS (-23%), Tron (-30%), Stellar (-25%), BNB (-27%) and Dash (-25%).

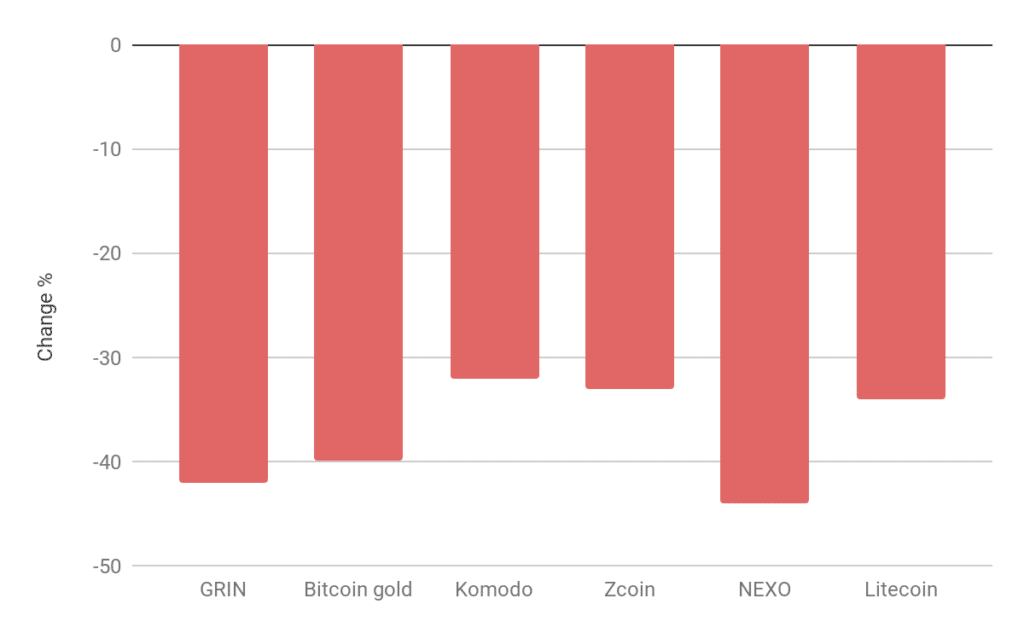

This biggest losers in the market top 100 were GRIN (-42%), Bitcoin Gold BTG (-40%), Komodo (-32%), Zcoin (-33%), NEXO (-44%), and Litecoin (-34%).

Biggest losers from Messari Liquid Top 100

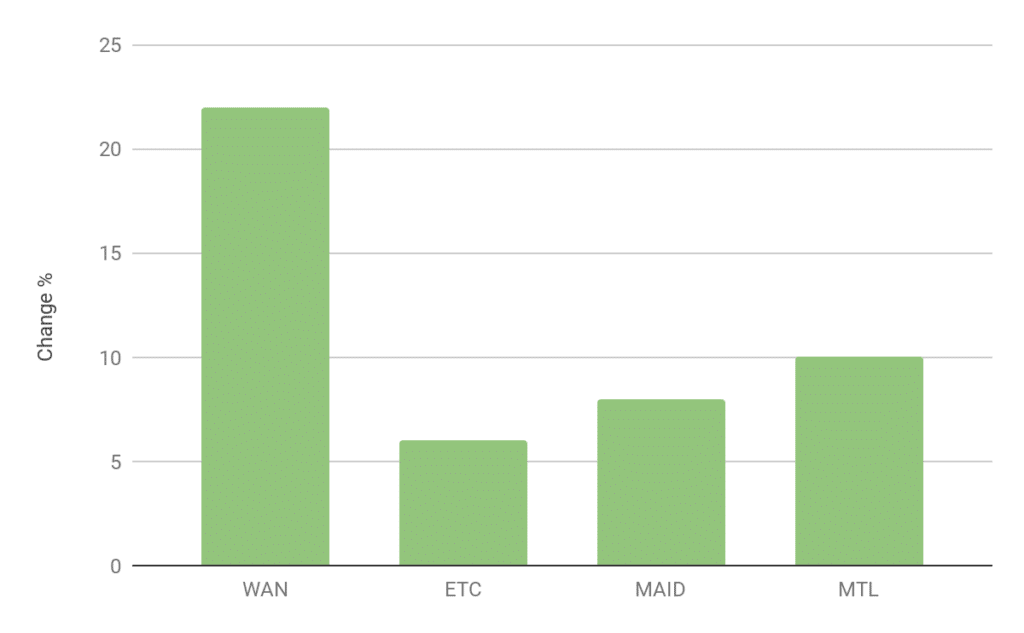

Inside the top 20, Ethereum Classic (ETC) was the only winner this month, up 6%, with Wanchain (WAN), MadeSafeCoin (MAID) and Metal (MTL) all making gains.

Biggest winners Messari Liquid Top 100

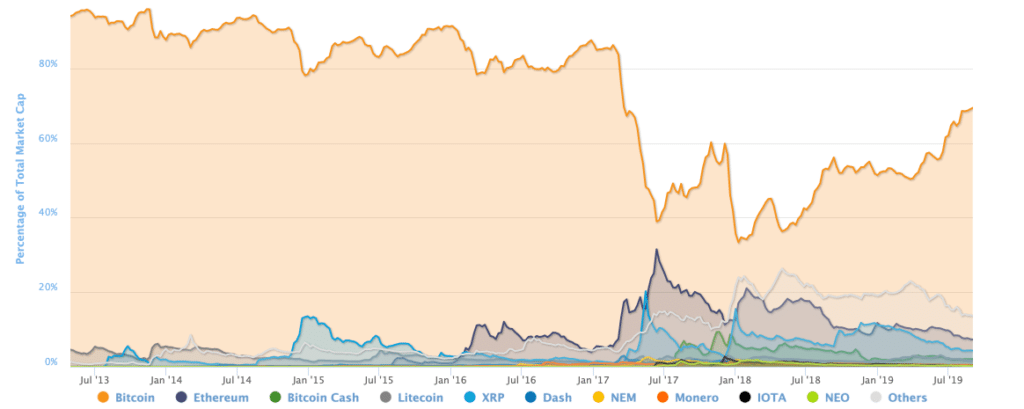

Alt Season Remains Elusive

Despite bullish sentiment returning to the crypto market makers in 2019, the renowned ‘alt season’ still remains elusive. Many public figures and analysts in the industry have been calling for an increase in the value of the leading altcoins for many months. Throughout the history of the cryptocurrency market, a rise in Bitcoin dominance has usually been followed by ‘alt season’, a time where the majority of altcoins post major gains, resetting the balance of market dominance against Bitcoin. Despite the markets cyclical nature and Bitcoin’s current dominance strengthening, this is yet to occur.

Bitcoin’s dominance currently stands at 69.5% according to Coin Market Cap. However, a report released this month by Arcane Research raises the valid point that this percentage could stand much higher in reality, as the widely used metric does not take the liquidity of exchanges into account. The report solely used volumes from the 10 exchanges outlined in the Bitwise report earlier this year, and also excluded the volumes of stablecoins. The analysis implied Bitcoin dominance could be over 90%.

Bitcoin dominance January 2019 — August 2019 — Coin Market Cap

ver the last 8 months, Bitcoin’s dominance has steadily been rising, with the rest of the market gradually retreating. The last time Bitcoin’s dominance was this high, at 69.5%, was March 2017. Three months later it had dropped to 38%, as Ethereum led the altcoin charge, reaching 31%. Currently, Ethereum stands at 7.3%, a far cry away from its highs that were fueled by the ICO craze. With Ethereum 2.0 supposedly shipping in Q1 of 2020, it’s interesting to observe how little the new bull market has affected it in comparison to Bitcoin. Bitcoin is up over 150% this year compared to Ethereum at 21%. Ethereum still stands as the clear leader in terms of development when compared to other smart contract platforms, but a rise to its former price ratio with Bitcoin, along with a wider alt season, is yet to take shape. Maybe this is due to Bitcoin’s narrative and use being more cemented as a store of value, while alts are still developing their infrastructure and use case. Bitcoin’s use case as a non-sovereign store of value is beginning to be accepted by some in the wider financial community, especially as unrest and global populism grows. However, the use cases for altcoins have not really evolved since the bull market of 2017.

The Battle of the Futures

The futures contracts of the Chicago Mercantile Exchange (CME) expired on Friday the 30th, the anticipation of this is being reported as a factor that could have led the market down by roughly 10% on August 28th. Forbes recently reported that CME Bitcoin futures now trade $370 million a day.

Cryptocurrency trading platform Bakkt will launch its physically-delivered Bitcoin futures on September 23rd, with its custodian arm, Bakkt Warehouse, providing storage services for customers on September 6th. Having a regulated physically settled futures exchange under ICE is a further step in the right direction for the asset class, its impact on institutional investing should be interesting to monitor in the coming weeks and months. The expectations on Bakkt are high, one of the bigger convictions from the market was the reported series A raise of $180M at a $740M (post-money) valuation earlier this year.

Having more regulated products being offered by reputable institutions like Bakkt helps move crypto towards becoming a legitimate asset class, and hopefully will help achieve the regulatory clarity the industry needs. When compared to the CME, it may be too early to make assumptions about comparable volumes. The CME is the more established contract that will likely maintain volumes for the medium term, but then time will tell. Bakkt futures is a new product, it’s physically settled as opposed to cash-settled. This gives rise to certain possible trading and hedging strategies that some investors may find helpful and drive popularity in the contract. However, at the end of the day, most institutional investors will migrate towards the most liquid contract, regardless of settlement method.

When it comes to price action, futures can have a mixed influence on the market. In December 2017 the launch of futures was arguably the main factor that led the Bitcoin market down after its high of $20,000, the price peak coincided with the day Bitcoin futures started trading on the Chicago Mercantile Exchange (CME), it allowed for traders to be short Bitcoin for the first time. Conversely, In more recent times, we have seen the volume of futures increase when bullish sentiment returned to the market. In general, a healthy derivative and options market is pivotal to any institutional asset class so the effect in that respect is unambiguously positive. It allows investors to go short and trade more efficiently using implied leverage, which in turn allows you to express more dynamic risk views.

In the market, demand has increased in spot volume and there is a growing interest across structured products where investors can design their own risk exposure to the asset class with trusted counterparts, so less operational risk. It’s too early to celebrate any widespread institutional adoption just yet. But Bakkt is an important piece of infrastructure for the crypto ecosystem and the regulatory signalling is encouraging for the growth of the asset class, it is definitely a step in the right direction during a time when institutional interest is steadily rising.

Macro Uncertainty Provides Opportunity for Bitcoin & Gold

There was a time when Bitcoin and its relationship with the macro environment was rarely discussed, in 2019 this has drastically changed. As the global markets remain at the mercy of Donald Trump’s tweets, the narrative has emerged that Bitcoin is being used as a hedge to the mass uncertainty that currently grips the traditional financial world. As of July 1st, the current expansion of the US economy is now the longest in its history. Due to its success, some believe the US economy can rely on quantitative easing indefinitely for economic prosperity. However, as each round of easing has become less effective than the last, this seems unlikely. Recently the traditional relationship between stocks and bonds in the US has been flipped on its head. A dramatic decline in US Treasury bonds means that investors can now get more income dividends from the S&P 500. For the first time since the financial crisis, stocks are earning more for investors when compared to the longest-dated government debt. Investors have poured into safe-haven assets like bonds as the trade war has escalated, sending yields to historic low levels.

The negative effects of the central banks aggressive quantitative easing, set in motion 10 years ago, have potentially been seeping into the markets in recent months. Printing money and buying financial assets has been a strong stimulative force since 2009 that has helped bolster asset prices. However, it can be argued that this form of easing is approaching its limits, as interest rates can’t be lowered much more and it is having diminishing effects on the US economy. When this money that has been excessively printed ends up in the hands of investors, they buy more investments with it, which continues to drive up asset prices and ultimately drives down future returns. Do these government actions permanently raise the level of demand in an economy, by injecting bank reserves into the financial system, or are they essentially borrowing the demand of the future.

Those hungry for yield are hunting for safe US stocks. Despite the reasonably optimistic outlook of the near future of stocks, it is prudent to remember the reason bond yields fell in the first place, is the slowing growth of the global economy. Long-term there is still mass uncertainty. The trade war and the economy will no doubt play a major role in the 2020 elections, and escalating tensions in Hong Kong are adding fuel to the fire.

The US economy is doing well when compared to the rest of the world, and foreign investors are looking to the US for safety. However in recent years, not only has the US economy created a massive amount of debt, but it has also experienced low inflation (despite the best unemployment market in 50 years), rising financial markets, low-interest rates, and the longest expanding economy in the country’s history. Surely, things cannot get better forever. The only certainty of this bull market is that it will end.

On the global scale, Bitcoin’s role is a tiny one. It is still not on the radar as a viable asset for most investors, despite its widespread awareness. With ‘the halvening’ on the horizon, the next 24 months should be a fascinating test of Bitcoin as a safe haven asset. It is likely that investors continue to flock to gold rather than Bitcoin when looking for an uncorrelated store of value. But even if a tiny portion of them decide to allocate a portion of their portfolio to crypto, it would have a large impact, as Bitcoin’s market cap is only 2% of gold’s.