The Market

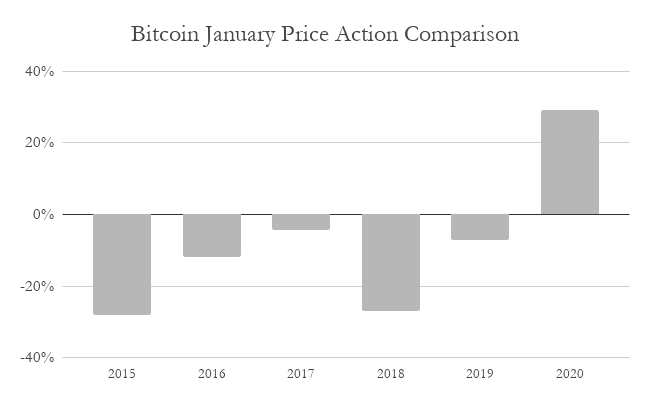

Bitcoin started off the year hovering above $7,000 and finished January at $9,500, its market capitalisation rising by almost $40 billion. It has been the most optimistic start to the market in 7 years. Not only is Bitcoin up 29% this January, it is the first time since 2014 that Bitcoin has started the year with a positive price movement. Even in the bull market year of 2017, Bitcoin finished January of that year down over 4%.

Bitcoin’s past performance in January. Data source: Coin Market Cap.

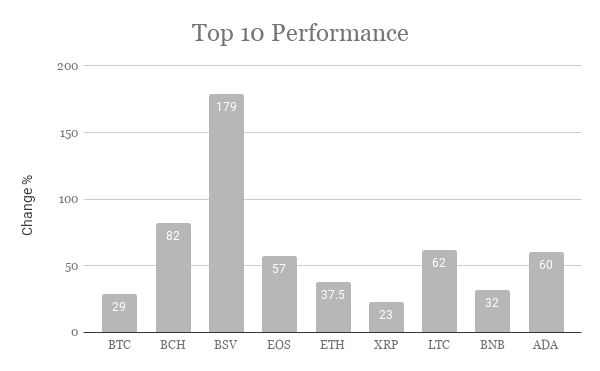

There was a strong performance across all assets in January with Bitcoin forks BSV (up 179%) and BCH (up 82%) leading the charge. The only project of note that had a poor January performance was WAVES (#59) down over 15% for the month. However, this was more of a cooling off period for the project after a substantial gain in mid December.

How the top ten digital assets performed in January. Data Source: Coin360.com

Options Growth Slow but Steady

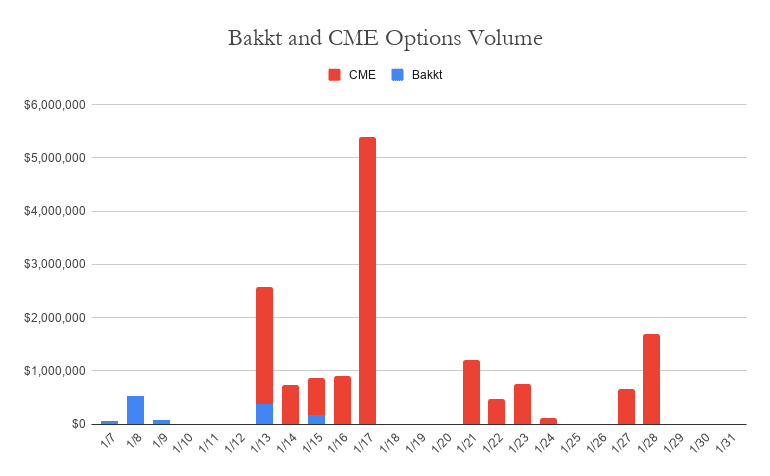

Like futures, the launch of Bitcoin options on major exchanges has been met with anticipation. Hopeful observers believe that the CME and Bakkt’s entry into the burgeoning options market will further encourage institutional entry into the market. These two organisations have been competing since the CME launched their futures product in late 2017. Bakkt attempted to beat the CME to the chase by launching their options product early, however, this appears to have given them no advantage. The CME has dwarfed Bakkt since its options launch, and there is no evidence to suggest this will change in the foreseeable future. Despite the CME winning this battle in the regulated options market, their overall volumes are still small.

Bakkt Volumes and CME Volumes for January. Data sourced from skew.com

The CME leads the market on the regulatory front, and plays a very important role in keeping the door open to traditional and intuitional traders who wish to get exposure to the asset class. It possible that January’s positive market move with entice more traders to the CME, however, for the time being volumes are not noteworthy.

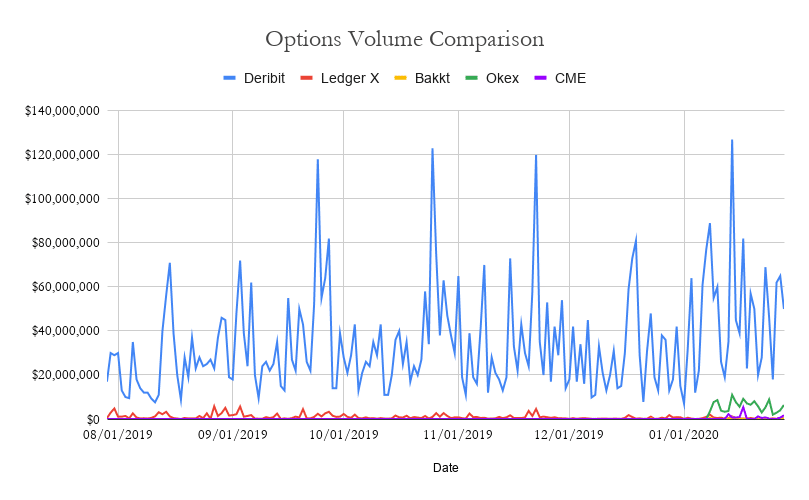

Deribit, who had their recent valuation set at 9 figures, are still king of the wider options market. OKEx has seen reasonable success since their launch in early January, however they still are losing out on the majority of the market to Deribit. Both Ledger X and Bakkt have a hard battle ahead in a market with increasing competition on the horizon.

A comparison of Bitcoin options volume on Deribit, Ledger X, Bakkt, Okex, and the CME. Data sourced from skew.com

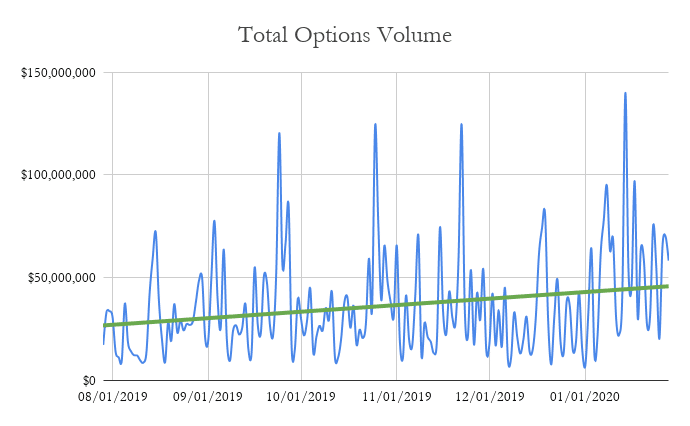

Overall, it is clear that options volume is moving consistently in one direction. In December 2019, it can estimated that the total volume was over 900mm, and January 2020 $1.4 billion.

Total Bitcoin Options Volume. Data sourced from skew.com

The Hidden Innovation

For major institutions, miners and other corporates involved in the space, options open a new, powerful tool for managing risk and volatility. But, as we can see from other financial markets, these capabilities won’t come from the listed options themselves. Instead, the real action will take place in over-the-counter hedges. While these corporate focused products will rely on vanilla option liquidity, they will not take place on exchanges like the CME.

Characteristics of listed options products are not a good fit for corporate risk, they are more meant for specialists and speculation. Corporate entities prefer to trade products that are specifically built for them, that utilize the liquidity of the exchange listed products. The single-day expiration date of these products means traders need to deal with the volatility of the expiry day and the emotional factors that come with it. Because they expire on a certain date, companies are hedging Bitcoin on that day rather than the entire month or year that came before it. Custom built swap and options strategies provide a better solution for many in the ecosystem as a hedge, as they would allow the parties to hedge ratably each day as they balance out exposure over longer periods.

In addition to the temporal mismatch resulting from hedging daily risk with a single-day ‘bullet’ expiry, futures exchanges are difficult to connect to, as entities must trade through an FCM (Futures Clearing Merchant). This is where companies are stepping in to provide products tailor made for crypto-native firms. However, they still need to hedge the core volatility risk somewhere, so it is first necessary for liquidity to build on listed products. The emergence of liquidity in the listed options market will be the foundation for these types of hedges and are key to the maturation of these markets.

A Long Road Ahead

When we think about the total volume of futures and options in relation to traditional markets it is tiny from two viewpoints. Not only in overall size, but also in its correlation to the market it is based on. In 2019, global GDP was $90 trillion, and the derivative market was $900 trillion. Digital asset derivatives and options volumes are still far behind total capitalisation of the crypto market, never-mind ten times the size of it. In traditional markets, it is normal for markets in commodities to outsize the trading of the asset itself by many factors. However, for all crypto market makers there still is a long way to go.

A regulated futures market allows investors to “rely on” better “price discovery, hedging and risk management.”

“By allowing [cryptocurrencies] to come into the world of the CFTC,” investors can better access trusted and regulated financial products, improving overall confidence in the asset class. It’s helping to legitimize [digital assets], in my view, and add liquidity to these markets.” Heath Tarbert, chairman of the Commodities and Futures Trading Commission (CFTC).

Heath Tarbert, chairman of the Commodities and Futures Trading Commission (CFTC) believes regulated derivatives will instill market confidence in cryptocurrencies.

Response to Political Turmoil

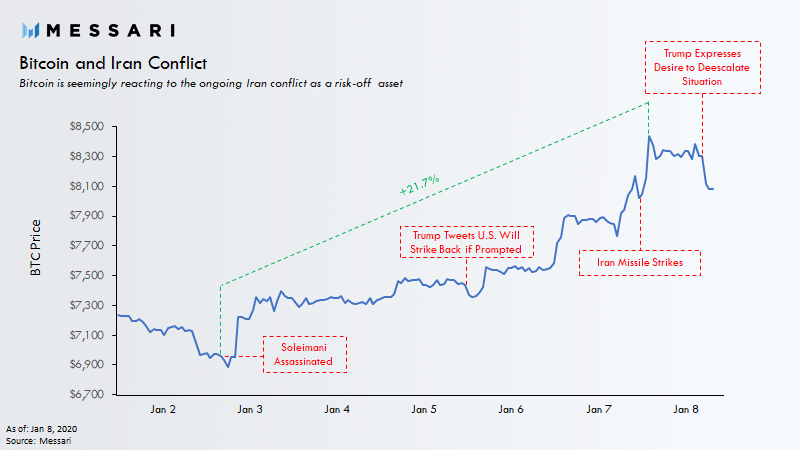

At 1am local time (UTC+3) in Iran on January 3rd, the US military carried out an airstrike near the Baghdad International Airport killing Iranian major general Qasem Soleimani of the Islamic Revolutionary Guard Corps. The act would cause mass uncertainty and political turmoil over the following days. Bitcoin rose from $6,918 to $7,214 on January 3rd, a rise of over 4%, and would continue to rise over 20% until tensions died down a few days later. On initial inspection this bodes well for Bitcon as a safe haven asset as well as a hedge to mass political uncertainty. However, it is quite difficult to prove the events have a strict correlation.

Bitcoin appeared to cool off after tensions subsided. Messari visualised this price reaction well in the below image. The narrative of bitcoin as a safe haven asset or hedge to political turmoil is not a new one. However, it appears this is the most substantial price reaction we have seen to political events. It does not necessarily prove the thesis correct, but it provides a foundation to study the correlation in more detail, as 2020 will more than likely be a year of political theatre on an international scale.

messari.com

It is straightforward and convenient for the cryptocurrency industry to pair these events together. On January second, Bitcoin had dropped over 2% to $7,000. An argument that the price move was solely rebounding on a level of natural support merits the same consideration. Bitcoin is now being grouped with Gold and Oil, however Bitcoins correlation to gold stands at 0.4, closer to 0 than 1, which would imply perfect correlation. These relationships are important to monitor as Bitcoin carves out its usage in the financial system, if a consistent correlation was to arise, it would be a clear bull case for the asset. Currently Bitcoins market cap sits at 2% of golds. This is an interesting development in the use case discussion that surrounds the non-sovereign digital asset.

GSR Update

Read GSR’s latest opinion piece in Coindesk. Co-Founder of GSR Rich Rosenblum gave his thought on how the emergence of liquidity in the listed options market will be the foundation for a new array of products and services.

Read about GSR’s role in the first Bitcoin-U.S. dollar trade using a proprietary artificial intelligence system.

‘GSR said it supports new institutional platforms that aim to make the market more efficient’ Bloomberg, February 4th, 2020.

Some good reports in January from Fidelity Digital Assets on the challenges facing Bitcoin miners, and how products like GSR’s risk management solutions can help hedge their risk.

‘An area that has received increasing attention is new types of derivatives contracts targeted at players in the mining industry to help them manage risk. To date, there have been few options to hedge against changes in hash rate and difficulty, high-impact factors that are specific to digital asset networks like Bitcoin. GSR Markets recently announced a partnership with Interhash to launch bespoke risk management products such as swaps, collars, and other customized solutions to enhance mining risk management.’ Fidelity Digital Assets, Bitcoin Retrospective, January 9th.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.