The Market

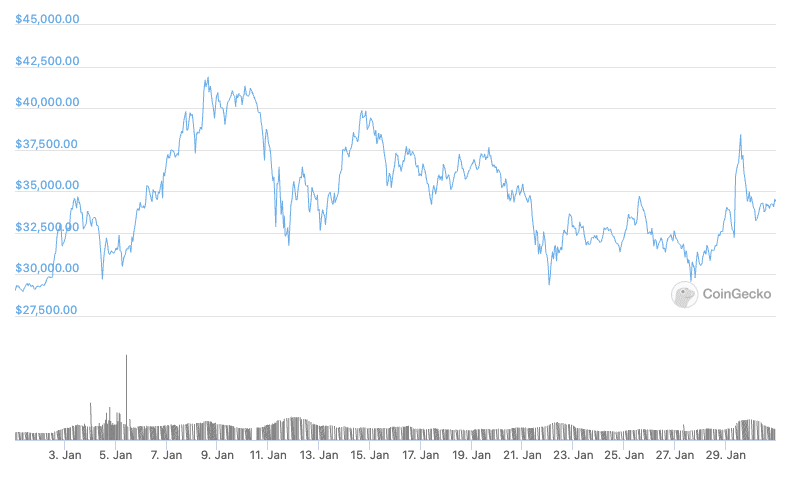

Bitcoin has made a momentous start to the year, breaching $30,000, then $40,000 in quick succession. Additionally, the overall market cap of cryptocurrencies has broken through $1 trillion for the first time, a landmark moment that has many skeptics starting to acknowledge the validity of the asset class.

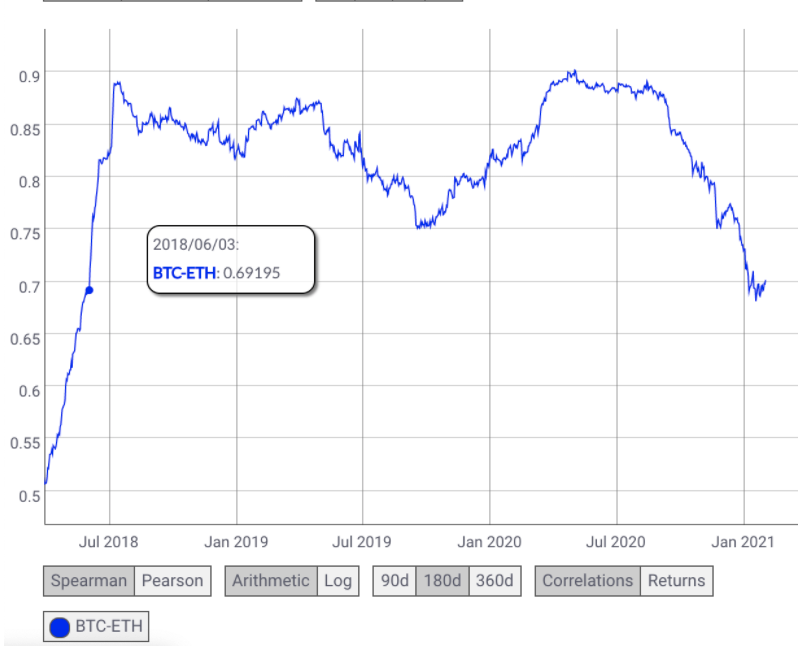

BTC and ETH vol remain elevated particularly on the front end of the curve. BTC’s 15 day RV is sitting within its 90th percentile. Since ETH 2.0, BTC-ETH correlation continues to deteriorate, we have not seen this level (0.7) of weakened correlation since July 2018. ETH continues to make all time highs in anticipation of next week’s CME launch on Feb 8th.

BTC – ETH Correlation

Bitcoin surged as much as 15% on Friday the 29th of January after Tesla founder Elon Musk changed his Twitter bio to “#bitcoin”, sparking $387 million worth in liquidations. Despite the flurry, BTC reverted back to pre-tweet levels within hours.

Crypto topped the $1 trillion mark on Jan 7. Source CoinGecko

Spot trading volume on cryptocurrency exchanges has crossed all previous records to reach over $900 billion in January, according to data from The Block. Binance leads the pack accounting for almost 60% of the volume with Coinbase and Kraken following. So far, 2021 has been an action packed start. The world’s largest asset manager Blackrock, which has over $7 trillion under management, filed for two funds to invest in Bitcoin futures. Microstrategy continues to be stalwarts of the industry, adding a further $10 million to their position, the amount may not be sizable in comparison to previous allocations, but their persistence and conviction is astounding.

Macro giant and billionaire hedge fund manager Ray Dalio, wrote a blog post devoted to the asset class. Dalio had made neutral comments about Bitcoin in past weeks, which had a substantial reaction. As a result he clarified his view, and described Bitcoin as “one hell of an invention”. On January 4th, The OCC (Office of the Comptroller of the Currency) published Interpretive Letter 1174, which outlined how banks may use stablecoins to facilitate payment transactions for customers. This letter adds to the release in July 2020, which allowed banks to custody crypto assets.

Skybridge Capital, the hedge-fund led by Anthony Scaramucci, confirmed its exposure to bitcoin has already reached $310 million. Additionally, One River CEO Eric Peter stated that crypto is ‘dramatically undervalued relative to some of these other stories of value.’ If that wasn’t enough bullish commentary, Scott Minerd, chief investment officer of the multi-billion dollar investment firm Guggenheim, has called for a bitcoin price target of $600,000.

Bitcoin price action in January 2021, source Coingecko

The Perfect Storm

The Gamestop saga has been well documented over the past two weeks. This story will no doubt be recounted when we sit down in December 2021 to review the year. A list of circumstances collided to create a moment that will go down in financial history.

“The most unusual thing about Wall Street’s being challenged by a rowdy band of Redditors is that it took so long to happen.” New York Times, 30/01/2021

There has been a growing presence of retail traders in options markets. This is due to the rise of consumer applications like Robinhood that made the process of trading complex products extremely easy, almost gamifying calls and puts. The New York Times recently highlighted how trading options is as easy as buying a burrito.

Retail options market growth, source ft.com

When this new accessibility to the market gathered pace, it was combined with unprecedented amounts of liquidity that gave birth to a dynamic not seen before in financial markets. Naturally, the volatility of the trading occurring on the Reddit forums has similarities to the crypto world.

The aftermath of the Reddit vs Wall Street short squeeze moved into the digital asset space with significant impact. DOGE saw an 800% increase on Jan 28th as Reddit group SatoshiStreetBets was thought to have influenced the rise. Despite DOGE being created to poke fun at cryptocurrencies, it is still garnering serious attention. At the height of markets rise, its market cap swelled to $8.2 billion, making it the ninth largest cryptocurrency. With no fixed supply and a third derivative of BTC’s protocol, daily memes and social media posts are seemingly becoming heavily weighted catalysts. Such an audience may be even more compatible with Defi.

The growing case for decentralization

The decentralization of infrastructure, not only in finance, but in communications and other industries has long been touted by the crypto community as a natural progression to the centralized internet we have today. Loosely coined as web 3.0, services in the future will be built on open source networks that have no center point of failure or decision making. This will be a slow process, and two major factors need to occur, the first being more scalable blockchain infrastructure. The second factor is general awareness of the need for this infrastructure from the wider public, this has made substantial progress in 2021 due to two incidents.

Parler, the alternative social media platform favored by conservatives, was deplatformed by Amazon, Apple, and Google in the same 24hr period due to its alleged role in the riots on Capitol Hill. Additionally, Robinhood blocked access to Gamestop (GME) and other stocks due to a period of high market volatility and extreme stress on the clearing houses used to settle their trades.

Both of these incidents were global news, and highlight the need for public decentralized infrastructure for both financial products and communication services. Presently, a handful of centralized technology companies have too much control. When it comes to value itself, Bitcoin is still gathering momentum as more institutions take their first steps into the market. This bull market has a long way to run.

Reports, market reports, and other information (“Information”) provided by GSR or its affiliates have been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Information provided is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services and is not a recommendation to buy, sell, or hold any asset. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page. Trading from Singapore, please review The Monetary Authority of Singapore (MAS) compliance note.