Author: Brian Rudick, Senior Strategist

Several institutions have added millions of dollars worth of Bitcoin to their corporate treasuries this year. We examine the current state of Bitcoin balance sheets in this week’s Chart of the Week.

- Institutionalization of Crypto: There have been many defining trends of 2021, from NFTs to DeFi to regulation, though perhaps none have been bigger than the institutionalization of crypto. Indeed, companies such as Square, PayPal, Visa, Morgan Stanley, Goldman Sachs, and State Street are adding crypto products and services at a breakneck pace in an effort to meet customer demand and not get left behind. Investment has skyrocketed too, whether measured by institutional crypto product AUM moving from $19b at year-end 2020 to $79b as of last week, per CoinShares, or crypto venture investment moving from $3b in 2020 to $18b in the first nine months of 2021. And myriad companies, from MicroStrategy to Tesla to Square, have added Bitcoin to their balance sheets as a store of value to protect against currency debasement. Pioneered by business software firm Microstrategy, with its $250m BTC purchase in the summer of 2020, it was Tesla’s $1.5b BTC investment and acceptance of BTC as payment in February that was arguably the shot across the bow, raising awareness and bringing further legitimacy to Bitcoin both as a treasury reserve asset and more generally.

- Benefits of a Bitcoin Balance Sheet: The oft-cited reason to include Bitcoin as a corporate asset is to hedge against currency debasement, given Bitcoin’s fixed supply relative to unprecedented central bank money printing around the world. Such quantitative easing has also suppressed global yields, leaving corporate treasurers often generating negative spreads on short duration assets and making the potential price appreciation from even a small investment in BTC all the more enticing. Adding Bitcoin to a corporate treasury may also further a corporate culture of embracing modern technologies or compliment the acceptance of digital payments within the business. Indeed, Square cited the “rapid evolution of cryptocurrency and unprecedented uncertainty from a macroeconomic and currency regime perspective” in its Bitcoin Investment Whitepaper as reasons for its investment. MicroStrategy even has a dedicated website for corporates interested in adding Bitcoin to their treasuries, complete with a downloadable playbook.

- Why Adoption May be Slow: While corporate buying of Bitcoin has been a wise investment to this point, treasurers face an uphill battle in adding the digital asset to their balance sheet for several reasons. First, the accounting for Bitcoin can be a headache, especially in the US where it’s treated as an intangible asset that’s written down when its price falls but not up when it rises. Such volatility also makes it harder to manage working capital requirements. Add to that reputational risk, custody risk, incongruent treasury policies, regulatory concerns, and typically conservative corporate treasurers whose main focus is to ensure liquidity and protect the balance sheet and it’s easy to see why we haven’t seen a flurry of corporate investment activity to date. In fact, a February survey by Gartner revealed that just 5% of financial executives plan to add Bitcoin as a corporate asset in 2021, with 84% citing financial risk due to volatility as the main concern with holding BTC, with additional worries around board risk aversion, low use as a medium of exchange, and regulatory considerations.

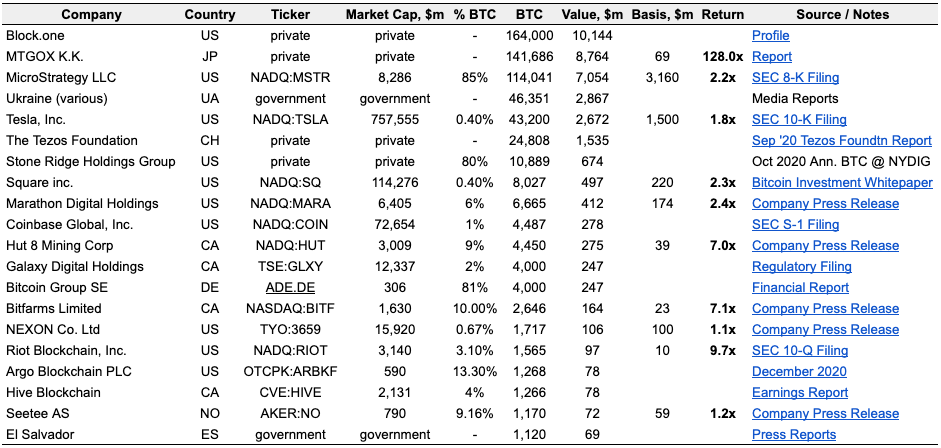

- Fortress Balance Sheets: We show the largest Bitcoin balances in Exhibit 1 below, as compiled by bitcointreasuries.net. Blockchain software company Block.one and defunct crypto exchange Mt. Gox are actually the two largest corporate holders of BTC, with MicroStrategy being the largest publicly traded firm. In fact, MicroStrategy’s 114,041 BTC constitute 85% of its market cap, represent over 0.5% of BTC’s 21m total supply, and have generated a nearly $4b profit for the company. Tesla is the next publicly traded company on the list, and like MicroStrategy, has generated a roughly 2x return on its BTC investment. Square, Bitcoin miner Marathon Digital, and Coinbase, which recently announced a $500m corporate allocation to cryptocurrencies, also have material Bitcoin holdings. While the hurdles for corporates to add BTC to their balance sheets are high, falling Bitcoin volatility, rising liquidity, and rising inflation just might usher in the next wave of corporate Bitcoin investment.

Source:Bitcointreasuries.net, GSR

To download this article as a PDF, click here.

Sources

Deloitte: Making Change: Should Bitcoin be on your Balance Sheet?, Gartner: Gartner Survey Suggests Most Finance Executives Not Planning to Hold Bitcoin as a Corporate Asset, Reuters: Rush to bitcoin? Not so fast, say keepers of corporate coffers, Wall Street Journal: Bitcoin on the Balance Sheet Is an Accounting Headache for Tesla, Others, Cointelegraph: Inflation winds stiffen as Bitcoin ballast on balance sheets proves its value

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.