The rise of cryptoassets and the institutionalization of the ecosystem has caused investors to debate whether crypto is a new asset class. This report dives into crypto’s development and evolution, evaluates the impact a crypto allocation could have on a traditional investment portfolio, and hypothesizes what may lie ahead.

The Evolution of Cryptoassets

The cryptocurrency industry was born out of Satoshi Nakamoto’s creation of Bitcoin in 2009. Leveraging blockchain technology, Satoshi created both a digital currency and a new set of financial rails, providing individuals with the autonomy to transfer value to any internet-connected individual without the use of a financial intermediary. While the concept of a blockchain previously existed from prior research on time-stamping digital documents in the 1990s, Bitcoin’s novelty came from its inclusion of a proof-of-work mechanism that created a trustless solution to the double-spending problem. That is, Bitcoin created a digital currency and payment system where transactions were independently verified and settled without requiring a trusted third party, adding integrity to the ledger by making it incredibly difficult for a bad actor to unfairly spend the same bitcoin more than once.

In essence, Bitcoin is a shared ledger of transactions that is distributed and maintained amongst an open network of nodes. Nodes are the computers running the Bitcoin software that track bitcoin ownership and allow users to spend their bitcoin after cryptographically verifying transactions via digital signatures. Bitcoin is a digital bearer asset, bestowing upon the private key holder property rights and the freedom to autonomously exchange value. In addition, the rules codified in the Bitcoin software cap the total supply of bitcoin at 21 million, making its supply immune from rampant money printing by any government or centralized authority. While Bitcoin is in a constant but intentionally slow process of improvement through its Bitcoin Improvement Proposals, Bitcoin’s code makes the ability to change the Bitcoin blockchain, or alter the ownership of bitcoin on the ledger, virtually impossible. These characteristics have made Bitcoin a rules-based, non-sovereign money with readily apparent real-world value, such as protecting holders from currency debasement, poorly defined property rights, and high money transfer costs.

In the first few years following Bitcoin’s creation, many new cryptocurrencies were simple forks of Bitcoin’s code base that failed to make material advancements. Many of these coins iterated on Bitcoin’s codebase by adjusting variables such as the hashing algorithm, the block size, or the block time, but they predominantly stayed within the realm of creating a decentralized payment network. The launch of Ethereum in 2015 supplanted this trend and ushered in a new era of innovation in the industry. Expanding beyond simple payments, Ethereum incorporated a Turing-complete programming language that allowed for the creation and facilitation of smart contracts, or sets of codified rules deployed on the network that are automatically enforced when particular conditions are met. Smart contracts can simply be thought of as code that is run by every node on a blockchain, but more technically they are a type of Ethereum account that can hold a balance and send transactions determined by said code. Leveraging Nick Szabo’s famous analogy, a smart contract can be thought of as a digital vending machine. Vending machines are programmed to return an output (snack + change) based on the input data it receives (money + snack identifier). In this example, the vending machine disintermediates the storefront operator and removes a layer of costs by allowing the consumer to purchase snacks directly from a piece of preprogrammed hardware. Smart contracts do this as well, but they vastly expand the opportunity set into the digital realm and provide trustless solutions for an increasing set of use cases.

The introduction of smart contracts led to a wave of innovation in the industry, including many competing smart contract platforms aiming to dethrone Ethereum or target more application-specific use cases. Decentralized applications started to be built leveraging immutable smart contracts, offering decentralized financial primitives such as trading, payments, borrowing, lending, asset management, insurance, and more. Most of these newly created applications built their own fungible token to be used as a coordinating mechanism, facilitating decentralized governance and incentivizing behavior, to name a few examples. In addition to their utility, tokens present an opportunity for users of a protocol to potentially benefit financially from the growth of the network or the market’s perceived potential for future network growth based on a variety of factors including user activity, developer talent, protocol monetization, token distribution strategies, emission schedules, and other mechanisms for value accrual. In this way, well-designed “tokenomics” can increase adoption amongst ordinary users as their interest in the token creates incentives that are more closely aligned with traditional owners. In addition to fungible tokens, Ethereum smart contracts and the ERC-721 token standard specifically, allowed for the mainstream proliferation of non-fungible tokens, or NFTs. As the name implies, NFTs are distinct digital representations of ownership. While mainly used today for digital art, collectibles, domain names, and event tickets, NFT use cases are rapidly expanding and have paradigm-changing potential.

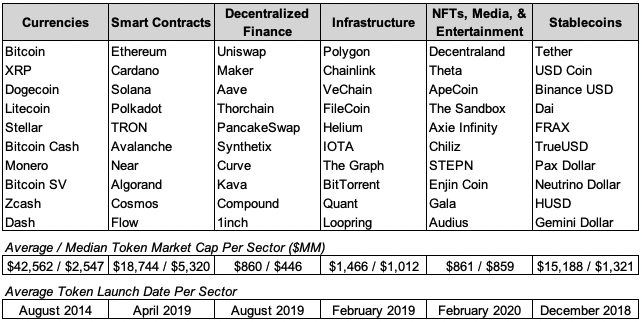

Much of the development in the space is occurring on smart contract platforms outside of Bitcoin, suggesting that diversification within crypto may be increasingly important going forward. For example, bitcoin’s share of trading volume on Coinbase, the largest U.S. crypto exchange by spot volume, has fallen from about 90% in 2017 to less than 25% today. In addition, digital assets are being used to power a variety of use cases, many of which are still in their infancy. In more detail, we categorize several primary sectors within crypto below, as well as the largest tokens in each. While bitcoin is still the juggernaut in the space from a market cap perspective, the smart contract sector is the largest by a sizable margin if bitcoin were to be excluded from the categorization. Moreover, the average token launch date for smart contract-related tokens is April 2019, illustrating the nascency of the sector. Given that blockchain-based smart contracts are an emerging technology having only been developed in 2015, we likely haven’t even scratched the surface of the technology’s full potential. Developers are still learning to build on these new platforms and to use new platform-specific programming languages like Ethereum’s Solidity. Despite this, nearly every large token across categories leverages smart contracts to varying degrees with a few notable exceptions in the currency category.

Exhibit 1: Top Tokens by Crypto Sector Illustrated

Source: GSR. MVIS and Messari categorizations. Market cap and launch date data from Santiment as of June 23rd. Categorizations are not exhaustive and they are meant for illustrative purposes only in an attempt to highlight some of the primary types of tokens in the market. Other categorizations could have included privacy tokens, meme coins, exchange tokens, and more. The average token launch date is calculated based on the earliest price data for each token in Santiment and then averaged by sector. Notably, this methodology makes sectors look even more established than they truly are in some cases. Decentraland, for example, launched its token via an ICO in 2017 despite not launching its mainnet until 2020.

The Institutionalization of the Crypto Ecosystem

In addition to protocol and application development in the crypto ecosystem, businesses providing services to the crypto industry have developed substantially in recent years. A multitude of regulated and insured custodians have entered the market with multiple layers of resiliency, helping to alleviate institutional investors’ concerns around private key management. Market makers now connect liquidity that is fragmented across multiple different exchanges, centralized and decentralized, helping to maintain orderly markets and decrease price discrepancies between venues. Many OTC trading desks now offer a suite of prime brokerage services, providing trading in spot, futures, and options, as well as lending and borrowing services that are important for obtaining leverage, short positions, and yield generation. Improved data and analytics offerings have also been developed, providing reports and visualizations into on-chain information as it occurs in real-time. More sophisticated research teams have also been built, authoring higher quality, crypto-native research content. And we are beginning to see an acceleration of traditional businesses beginning to explore offerings in the space directly or through partnerships. Banks like JPMorgan, Goldman Sachs, and Citi have been ramping up their involvement in the ecosystem. Payment operators like Paypal, Stripe, and Block (formerly Square) all operate in the space to varying degrees. Social media giants like Meta and Twitter are experimenting with crypto payments and NFTs. The increasing interest and involvement from traditional financial institutions and tech companies continue to add legitimacy to the crypto ecosystem alongside the robust development of crypto-native service providers.

The investable options to access the space have also developed meaningfully beyond direct token exposure. In the U.S., investors can gain access to an array of passively managed, single-asset or index-based crypto portfolios through OTC-traded trust structures or direct private placements. Both long and short Bitcoin futures ETFs are now available as well. There has also been a large increase in the number of publicly traded companies that offer a highly correlated exposure to the space such as Coinbase, Microstrategy, and a large number of cryptocurrency miners. On a global level, investment managers in Canada, Australia, and Brazil have launched spot Bitcoin ETFs and multiple crypto ETPs are available in Europe.

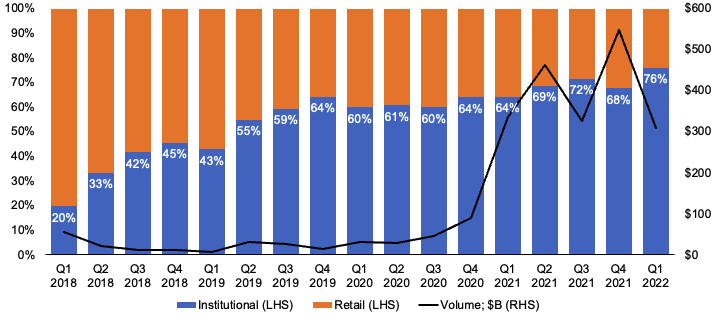

The maturation of the crypto ecosystem has helped increase the participation of institutional investors in recent years. PwC’s 2022 Global Crypto Hedge Fund Report indicated that more than one-third of traditional, non-crypto hedge funds have added an allocation to cryptoassets, nearly doubling the participation from traditional hedge funds compared to the prior year. Many of these funds are just dipping their toes into the ecosystem with allocations around 1% of AUM, however, the average exposure is closer to 4% across them. Beyond hedge funds, endowments, insurance companies, sovereign wealth funds, corporates, and even some pension funds have begun allocating to crypto. Evaluating the breakdown between institutional and retail trading volume on Coinbase over the past four years paints a clear picture of this trend.

Exhibit 2: Coinbase’s Trading Volume Mix

Source: GSR. Coinbase’s S-1, 10-K, and 10-Qs.

Parallels to the Rise of Commodities as an Investable Asset Class

The development of the crypto ecosystem in recent years has resulted in many investors asserting that cryptoassets represent a new, distinct asset class today and one which is perhaps best paralleled by the rise of commodities in the early 2000s. While derivative contracts in commodities have existed for thousands of years, participation was predominantly limited to the hedging strategies deployed by the producers and consumers of commodities with little involvement from institutional asset allocators. As Fidelity astutely pointed out in a piece last December, commodities were generally not considered to be an asset class until a series of events occurred that simplified access and eased investor concerns. Most prominently was the creation of commodity indexes and cash-settled financial derivatives that simplified the process of obtaining broad commodity market exposure and alleviated custody considerations. This was followed by deregulatory events in financial and energy markets that allowed banks to scale operations significantly, resulting in more competition amongst a larger set of banks offering commodity services. Exchange-traded products followed with the launch of the first gold ETF in 2004, and then a set of diversified commodity index ETNs in 2006. Further, as electronic trading venues steadily began to replace open outcry trading floors, information asymmetries were remediated and transparency was democratized. These developments in the commodities market helped drive ~$275b of institutional inflows into the space between 2000 and 2010 according to Barclays Commodity Research.

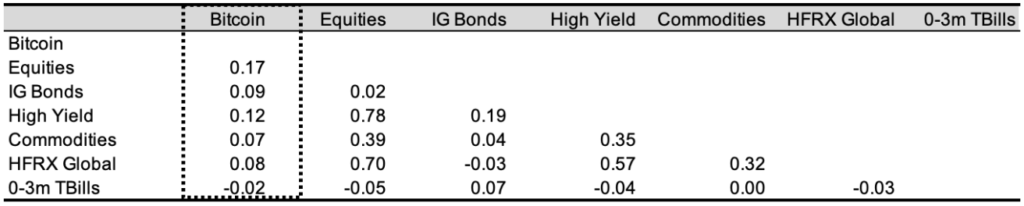

There are strong parallels between the evolution of the crypto-financial markets and the commodities industry in the early 2000s, including the establishment of reputable service providers, increased market transparency, improved market efficiency, and increased accessibility. While crypto is certainly more nascent and the regulatory framework less developed, investor acceptance is trending in the right direction. CoinShares data indicates that over $17b has been invested in passive crypto funds over the last ~3.5 years, including ~$400m year-to-date despite the challenging market conditions. While formal approaches to defining asset classes vary and there is no consensus definition, it seems a majority of individuals and institutions have begun to recognize crypto as a new asset class due to its increased adoption in investment portfolios and its historically low correlation to traditional asset classes.

Exhibit 3: Bitcoin’s Historical Correlation vs. Traditional Asset Classes

Source: GSR. Yahoo Finance, Santiment, HFR data. Daily data from Jan 2nd, 2014 to June 14, 2022. ETFs/ETNs are used as proxies for certain asset classes. ACWI for Equities, AGG for IG Bonds, HYG for High Yield, DJP for Commodities (BCOM ETN). HFRX Global Hedge Fund Index and S&P 0-3M TBill Index were used due to a lack of traded vehicles. Bitcoin is used instead of broader crypto due to its long track record.

The Impact of Crypto on a Diversified Portfolio

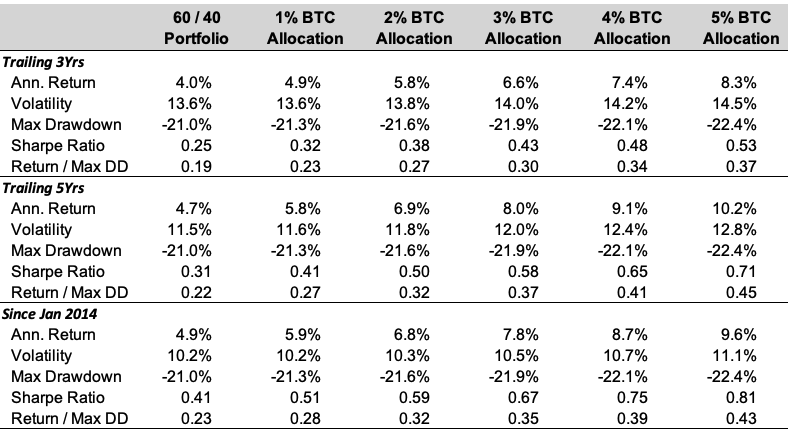

This section considers an allocation to crypto in a balanced portfolio, evaluating the historical impact on portfolio risk and return characteristics when funded from a portfolio’s equity allocation. This analysis leverages bitcoin specifically for the crypto allocation given its long track record, and it uses a standard 60 / 40 portfolio as the starting point, leveraging ETFs that provide exposure to the MSCI All Country World Index (ACWI) and the Bloomberg US Aggregate Bond Index (AGG). The analysis leverages daily returns as of 4 pm EST, and the portfolio is rebalanced on a calendar-quarter basis. Additionally, the analysis excludes early periods of bitcoin’s history to hone in on the timeframe after bitcoin was sufficiently large and liquid. We deemed this period to start in 2014 when bitcoin reached a market cap of $10b and regularly had daily volume in the double-digit millions of dollars, occasionally breaking into the hundred million dollar range. For context, these characteristics are relatively in line with many of the smaller companies in the S&P 500 today. Lastly, including bitcoin returns before 2014 would have made the results look even better, but institutional portfolios could not have made a reasonably-sized allocation much earlier than this without materially impacting bitcoin’s price.

In sum, we find that allocating a modest 1% exposure to bitcoin would have had a materially positive impact on the portfolio’s efficiency as measured by the Sharpe Ratio over all periods measured. Portfolios with a 1% allocation tended to generate an excess return of about 1% annually with much smaller increases in portfolio volatility and maximum drawdown. The material improvement in portfolio efficiency on such a small allocation is a feature of bitcoin’s historically low correlation to both stocks and bonds, as well as its immense volatility on a standalone basis, making it a very capital efficient asset from a portfolio construction perspective.

Exhibit 4: Risk & Return Statistics of a Balanced Portfolio with a BTC Allocation

Source: GSR. Santiment, Yahoo Finance data. Daily data as of June 14, 2022, with quarterly rebalancing. The 60 / 40 Portfolio is 60% ACWI and 40% US Agg. Bitcoin exposure is funded from the ACWI exposure. 1% BTC Allocation represents a 59/40/1 portfolio. S&P 0-3M TBill Index used as the risk-free rate.

Further, the portfolio’s Sharpe Ratio continues to improve as more bitcoin is added to the portfolio beyond 1%, indicating that an investor is generating a sufficient amount of returns relative to the increase in risk. However, it is important to note that overall portfolio volatility does start to increase beyond that of a vanilla 60 / 40 when more bitcoin is added, effectively levering up the returns of the portfolio. A prudent allocator could still optimize their portfolio further by including a higher percentage of bitcoin offset by a smaller allocation to equities along with a higher allocation to either bonds or cash. This strategy would increase the portfolio’s Sharpe Ratio further by benefitting from bitcoin’s unique risk and return profile, allowing the investor to generate a higher return without taking any incremental risk at the portfolio level

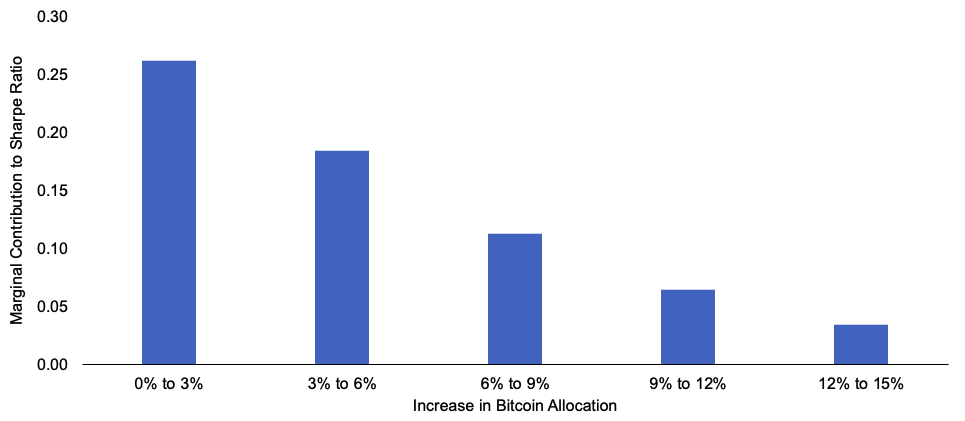

Note that the marginal improvement in Sharpe Ratio falls as more bitcoin is added to the portfolio, showing the diversification benefit is at its maximum when it’s first added to the portfolio. Indeed, any asset becomes more correlated to a portfolio when that portfolio incorporates more of the asset, hence, increasing the exposure to the asset offers a decreasing marginal benefit. It would still be optimal to increase exposure to the higher Sharpe Ratio asset, but given the decreasing marginal benefit, the failure to allocate the first 1% to bitcoin is a more severe mistake than failing to increase the allocation from 3% to 4% or deciding to decrease the allocation from 4% to 3%, for example.

Exhibit 5: Marginal Sharpe Ratio Contribution From Increasing the Bitcoin Allocation in a Balanced Portfolio

Source: GSR. Santiment, Yahoo Finance data. Daily data from Jan 2, 2014, to June 14, 2022, with quarterly rebalancing. The portfolio starts as a 60% ACWI / 40% US Agg blend. Bitcoin exposure is funded from the ACWI exposure, and each bar shows the marginal contribution to a portfolio’s Sharpe Ratio by adding bitcoin to the portfolio at the expense of equities in 3% increments. As an example, the first bar shows the increase in Sharpe Ratio from shifting a 60 / 40 portfolio to a 57/40/3 portfolio.

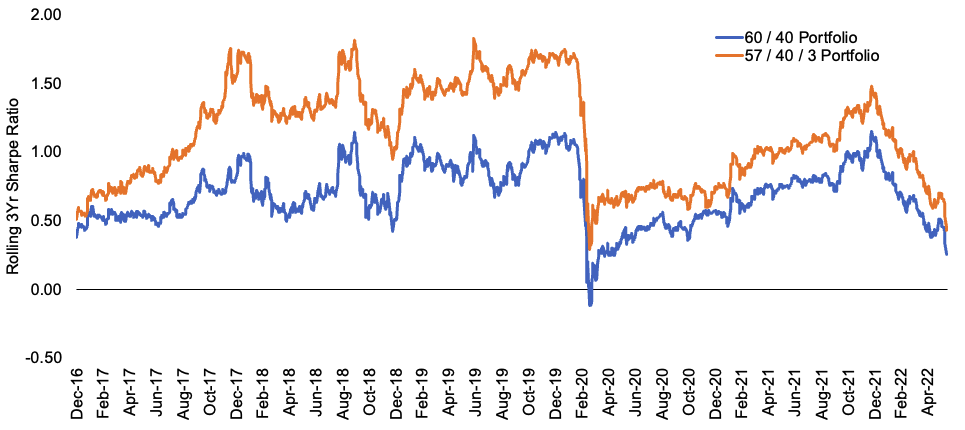

Lastly, adding bitcoin to a portfolio consistently improved its Sharpe Ratio during every three-year period historically. This consistency is exemplified in the exhibit below which illustrates a Sharpe Ratio improvement attributable to bitcoin in every one of the 1,373 periods observed. Notably, December 9th, 2020, the three-year window which includes the beginning of the December 2017 crypto crash, generated the smallest improvement with the Sharpe Ratio increasing from 0.56 to 0.60.

Exhibit 6: Rolling Three-Year Sharpe Ratio

Source: GSR. Santiment, Yahoo Finance data. Daily data from Jan 2, 2014, to June 14, 2022, with quarterly rebalancing. The 60 / 40 Portfolio is 60% ACWI and 40% US Agg. Bitcoin exposure of 3% is funded from the ACWI exposure. S&P 0-3m TBill Index used as the risk-free rate.

Bitcoin as an Inflation Hedge

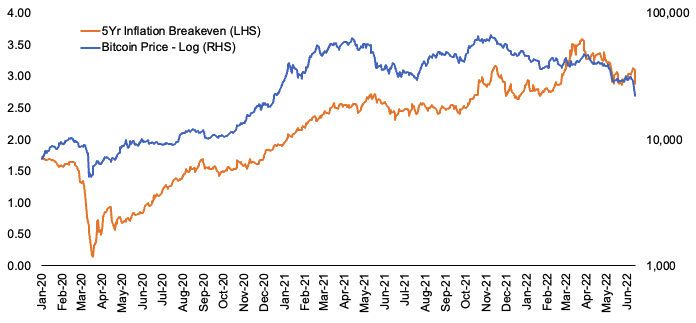

While Bitcoin was originally conceived as a peer-to-peer electronic cash system, its technological limitations and finite supply have helped evolve the narrative towards it being considered a store of value, frequently referred to as ‘digital gold’. And like gold, proponents of bitcoin suggest that it should act as an inflation hedge for a portfolio. The value of assets like bitcoin and gold is inherently based on social constructs, with their value based on widespread social adoption and a common belief that they are valuable. If the trend of growing adoption and conviction in bitcoin’s value continues, it’s not hard to reason why it could be deemed an inflation hedge in a theoretical environment characterized by excessive money printing and fiat currency debasement. In reality, however, there has not been enough data to quantitatively verify this claim. With that said, bitcoin skeptics have been increasingly making criticisms of bitcoin’s ability to hedge inflation, contrasting the poor recent performance with the elevated global inflation data. However, we’d note that inflation readings such as the CPI are low-frequency, backward-looking data that are not predictive of future changes in inflation. Evaluating these same claims using inflation breakeven data is a better approach, in our opinion, as it represents higher frequency forward-looking expectations for inflation. To reiterate, we do not believe there is sufficient evidence to quantitatively show a causal relationship, but bitcoin’s returns have been positively correlated to the change in inflation expectations since the beginning of Covid-19, particularly so if you exclude the more recent market environment characterized by macro shocks including global supply chain issues and the war in Ukraine.

Exhibit 7: Bitcoin Price vs. Five-Year Breakeven Inflation Rates

Source: GSR. Santiment, Federal Reserve Bank of St. Louis data. Weekly data from Jan 3, 2020, to June 10, 2022.

Crypto’s Diversification Properties Moving Forward

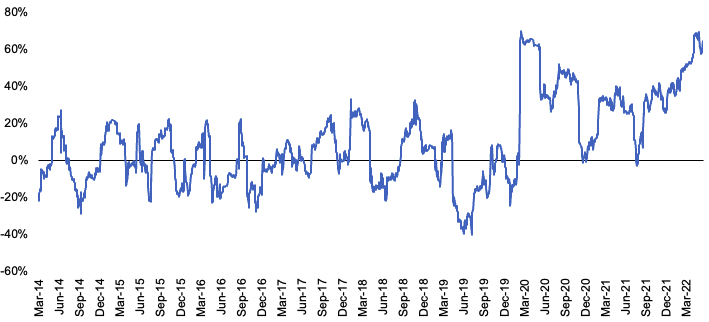

While bitcoin has exhibited a low correlation with traditional asset classes historically, its correlation may be structurally higher today than in the past. While the crypto industry historically operated in a silo largely outside of the scope of the traditional financial system, this is clearly no longer the case and institutional participation in the crypto market has grown meaningfully. As institutional investors are more likely to consider their crypto exposure in the context of a broader asset allocation, they are generally more likely to adjust their exposure in response to changing conditions in traditional markets, likely increasing the correlation between crypto and traditional asset classes relative to prior periods when institutional involvement was limited. Despite this, we believe cryptoassets still offer a unique source of return that may continue to enhance the diversification properties of traditional portfolios moving forward. Additionally, we’d note that most asset classes tend to exhibit increased correlations in times of market stress, so it’s possible that the outsized correlations realized in recent months are higher than what we may see in the future. Both of these features can be visualized in the next exhibit depicting the rolling three-month correlation of daily bitcoin returns versus a 60 / 40 portfolio. Correlations have stepped up meaningfully since 2020, and the peaks have occurred at times of market stress, most notably during the beginning of Covid-19 and the macro shocks exhibited in the last few months.

Exhibit 8: Bitcoin’s Rolling Three-Month Correlation vs. a 60 / 40 Portfolio

Source: GSR. Yahoo Finance, Santiment. Daily data from Jan 2nd, 2014, to June 14, 2022.

Lastly, there may be an increased benefit to diversification between cryptoassets on a go-forward basis. Different cryptoassets provide different fundamental use cases which we believe will be better recognized by market participants as the industry matures. Smart contract platforms have ushered in an array of new projects with wide sweeping potential and fundamentally speaking, their successes (or failures) should not be too closely tied to bitcoin’s adoption as a decentralized store of value.

Looking Forward

While we are clearly in a cyclical downturn, the secular bull thesis for crypto remains intact, in our view. Cryptoassets have the potential to democratize value exchange, remove rent-seeking intermediaries, and usher in new paradigms around ownership, governance, and business models, to name a few. Unlike fintech, which innovates on the front-end, operates on antiquated financial rails, and simply exchanges one intermediary for another, blockchain technology, by contrast, innovates on the back-end, reimagining the rails themselves and removing the intermediaries altogether.

While cryptoasset prices may fluctuate with sentiment and general macroeconomic conditions, underlying fundamental data paints a picture of continued growth. The number of crypto users has continued its upswing, nearly tripling in 2021 and reaching 295m users, according to Crypto.com. Developer count and technological development continue to increase as well. The number of monthly active developers reached an all-time high of nearly 18,500 as of year-end, per Electric Capital, and more than 34,000 developers committed open-source code to a crypto project last year. Looking at higher frequency GitHub data for Bitcoin, Ethereum, Polkadot, Solana, and Cosmos, the five chains with the largest base of developers, activity has continued to tick up in 2022 amongst all of them. Lastly, developer growth data also highlights the diversity of crypto today. The Ethereum network possesses the largest developer base, however, its ecosystem still only attracts about 20% of new crypto developers and there were 11 distinct blockchain networks with more than 250 monthly active developers as of year-end.

Beyond developer counts, there has been a palpable migration of talent from traditional tech and financial firms to crypto-native companies. While this is more difficult to measure quantitatively, the number of crypto-related job postings on LinkedIn grew by nearly 400% in 2021. This trend was further illustrated by The Block which collected hiring data from 27 of the most prominent crypto firms. This report indicated that every firm surveyed expanded its headcount last year, with many of them doubling or tripling headcount.

Another growing trend is the increased use of smart contract platforms. One of the most prominent applications of which has been the creation of decentralized exchanges (DEXs) for permissionless trading. Monthly trading volume on decentralized exchanges has grown from about $1b in early 2020 to levels more commonly in the $100-$200b range today. Uniswap, which is the largest DEX by trading volume, has at times generated more volume than Coinbase. In aggregate, the trading volume across DEXs has grown from approximately 0% of total market trading volume to nearly 15% over the last 2.5 years.

The industry has also attracted immense levels of financing which should help support its growth trajectory into the future. According to Dove Metrics, crypto companies raised more than $30b across ~1,300 funding rounds last year. While this trend may decelerate near-term given the recent decline in market prices, crypto companies have already raised more capital in the first half of this year than in all of 2021. In addition, crypto venture capital funds have raised an enormous amount of dry powder to continue funneling capital into the ecosystem’s best projects. Crypto VC funds raised nearly $19b in 2021, and so far in 2022, a16z, FTX, Huobi, and Haun Ventures have all launched funds raising north of $1b with a16z standing out at $4.5b. These vast inflows of capital may have contributed to periods of exuberance before the recent sell-off, but this capital availability will help the maturation and development of the industry over the long term.

Lastly, several catalysts may further expedite the adoption of crypto. On the institutional side, 83% of the traditional hedge fund respondents in the PwC Global Crypto Hedge Fund survey cited regulatory uncertainty as their rationale for not investing in crypto, indicating that regulatory clarity can usher in the next wave of institutional participation. Additionally, continued improvement in user experience, such as the continued development of scaling solutions and improvements in the UI / UX of decentralized applications, as well as slow but steady changes in consumer behavior will likely also support continued retail adoption. Regulatory clarity, improved user experience, and changing consumer behavior are longer-term catalysts, but will be transformative to onboarding the next billion users to the crypto ecosystem.

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Telegram, LinkedIn

Sources:

Bitwise – The Case for Crypto in an Institutional Portfolio, Bitwise – Unpacking the Intricate Relationship Between Bitcoin and Inflation, The Block, The Block – A Look at the Crazy Hiring Spree Crypto Firms Went on This Year, Dove Metrics, Electric Capital – Developer Report 2021, Fidelity – Digital Assets & Commodities: A Comparison of Institutional Portfolio Allocation, Glassnode, Man AHL – An Investor’s Guide to Crypto, Nick Szabo – The Idea of Smart Contracts, PwC – Global Crypto Hedge Fund Report 2022

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.