We review what Bitcoin is, why one may want to invest in it, the benefits of adding it to a portfolio, and the various ways to access crypto’s apex asset.

An Overview of Bitcoin

Satoshi Nakamoto, the anonymous developer of Bitcoin, first released the Bitcoin whitepaper in 2008 describing his or her vision for a “peer-to-peer electronic cash system.” At a high level, the Bitcoin blockchain can be thought of as a decentralized database or distributed ledger comprised of a network of computers called nodes that simply record and keep a local copy of who paid what to whom and when. Such payments are denominated in bitcoin, a digital asset by the same name, and the network uses cryptography and a consensus mechanism to record transactions in a trustless, open, and transparent manner. More specifically, special nodes called miners compete to be the first to solve a puzzle to have their proposed block of transactions added to the blockchain and receive a reward (and transaction fees) paid in bitcoin. By selecting the winning miner according to prespecified, codified rules and requiring miners to expend energy and computational resources to solve the puzzle, the network of unknown parties is able to agree on which valid transactions to add to the decentralized ledger without a central leader and despite the potential presence of bad actors. In addition, the protocol encodes a maximum supply of 21 million bitcoin, effectuated by cutting the block reward in half roughly every four years. Finally, each node on the network adds new valid blocks to the blockchain with transactions and blocks both linked historically, making it easily searchable and tamper-evident.

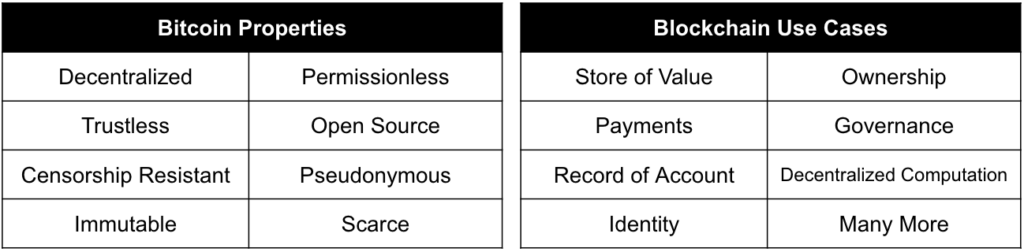

While there were certainly previous attempts at a digital currency, Bitcoin was the first to include the proof-of-work consensus mechanism to enable transactions to be independently verified and settled without a central leader. Moreover, as an open network, anyone in the world can permissionlessly interact with Bitcoin, either by using the coin itself or by operating a node/miner. And with an open network of ~50,000 nodes around the world executing code as written and storing data in a transparent manner, no single party can shut down Bitcoin or alter its operations without very high agreement among stakeholders. Lastly, Bitcoin utilizes new, internet and blockchain-based rails, rather than the existing, antiquated financial rails rife with intermediaries. Such properties make Bitcoin a non-sovereign money, engender the key attributes of decentralization, trustlessness, censorship resistance, and immutability, and may allow it to one day solve financial exclusion, state-backed censorship, and central bank currency devaluation to name just a few.

While Bitcoin was originally designed to be a P2P electronic cash system, it has evolved into a store of value/monetary good given throughput limitations and a fixed supply. In fact, developers intentionally chose security and decentralization over speed in Bitcoin’s design to ensure permisionlessness and trustlessness despite hindering its use as a medium of exchange. Note too that while Bitcoin is the original cryptocurrency, later cryptocurrencies allowed nodes to not only record payments but also process code known as smart contracts, adding programmability and arbitrary computation to the decentralized ledger. As such, the technology underlying Bitcoin forms the basis for novel use cases like identity, ownership, governance, computation, and more, and it enables the democratization of value exchange, the removal of rent-extracting intermediaries, and the establishment of new paradigms around ownership and governance.

Bitcoin exhibits all the key properties of money including durability, portability, divisibility, uniformity, scarcity, and acceptability, and it is precisely its simple and narrow monetary use case, undying code, and provable scarcity that puts Bitcoin in a class by itself as the apex monetary asset and reserve currency of the digital realm. It is highly unlikely that another token can challenge bitcoin’s non-sovereign digital reserve currency status, as it is by far the most decentralized and secure digital asset, and network effects will only compound this lead over time.

Bitcoin Properties & Blockchain Use Cases

Source: GSR

While Bitcoin introduced the first truly secure and decentralized digital money, it does have its share of misconceptions and potential weaknesses. For example, some still view Bitcoin as a mechanism for fraud, money laundering, and general malfeasance. However, leading blockchain forensics company Chainalysis estimates that the elicit share of all cryptocurrency transaction volume was just 0.24% last year, much lower than that for fiat currency. Another misconception revolves around Bitcoin’s environmental impact. While the network is currently utilizing an annualized 137 terawatt hours (TWh) of electricity, or 0.5% of global electricity production and 0.1% of global energy production, bitcoin miners are financially incentivized to utilize the cheapest electricity available, which in most cases is now renewables. This results in miners being over-indexed to renewables and makes Bitcoin’s carbon emissions lower than its electricity consumption would suggest at less than 0.1% of total global carbon emissions. Moreover, bitcoin mining can actually enhance grid resiliency and encourage renewables development that would otherwise be uneconomical, given mining’s ability to operate anywhere and act as a flexible baseload for new renewables sites. Lastly, while Bitcoin’s fixed supply is a major contributor to its moneyness, its constantly declining block rewards amount to a declining security budget that may fail to incentivize miners from processing transactions and protecting the network in the future. While this is indeed a risk, a rising bitcoin price can more than offset reduced block rewards, transaction fees may rise to sufficiently and fully compensate miners for their work, large holders may simply choose to maintain the network to preserve bitcoin’s value, and/or the protocol may implement changes through the intentionally slow, onerous, and conservative Bitcoin Improvement Proposal process. For much more information on Bitcoin, see our in-depth primer How Bitcoin Works.

Why Invest in Bitcoin?

The main reason to invest in bitcoin is its status as the apex monetary asset of the digital realm in an increasingly digital world. Bitcoin’s leading decentralization and security as well as its first mover advantage and network effects make it nearly impossible for another digital asset to unseat it in this role. Anyone looking for a decentralized digital store of value is highly likely to select bitcoin, which then furthers its status in this regard.

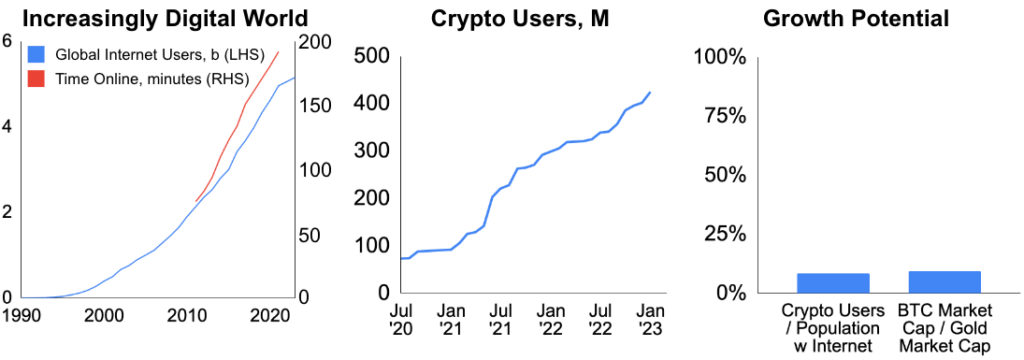

Moreover, as the world becomes increasingly digitized, proxied below by the number of internet users and time spent online, the need for and importance of a non-sovereign native store of value should follow suit. From remote work to gaming to the metaverse, internet users may increasingly demand a borderless, internet-native form of money that is not reliant on restrictive centralized entities for transferring value. In fact, the 425m crypto users today represent just 8% of the population with internet access, a far cry from the potential upside scenario of ubiquity. And from a financial perspective, the market cap of bitcoin represents just 9% that of gold.

The Crypto Opportunity

Source: Datareportal.com, Zenith, Crypto.com, CoinGecko, Gold.org, GSR

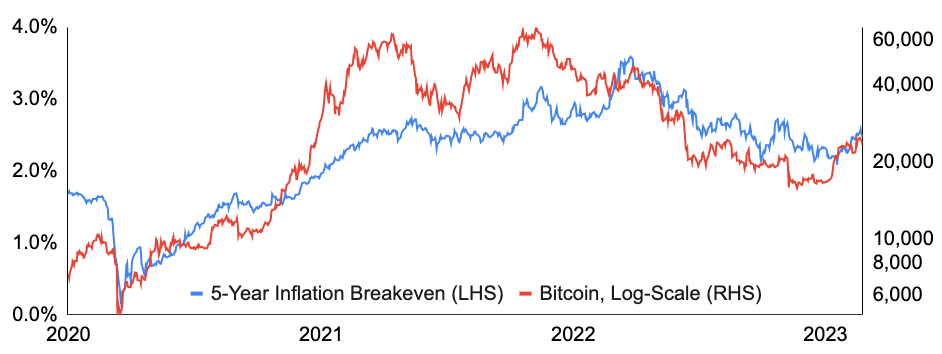

In addition, Bitcoin may act as a non-sovereign hedge against government policy missteps, which may be of particular importance with increasingly large fiscal and monetary intervention around the globe. In fact, bitcoin’s provably finite supply has caused many to refer to it as “digital gold,” suggesting that it could similarly provide some insulation from inflation, negative interest rates, and other consequences of unorthodox or potentially harmful policy. Bitcoin’s history is too limited to say whether this has thus far been the case, though there has been a significant correlation between inflation expectations and the price of bitcoin, as shown below. And, there are multiple examples of investors flocking to bitcoin during periods of stress in the traditional financial system and/or worries around rising future inflation, with both on display during the recent banking crisis that caused BTC to rally ~25% in response.

Bitcoin Price vs. Five-Year Breakeven Inflation Rates

Source: Santiment, Federal Reserve Bank of St. Louis, GSR

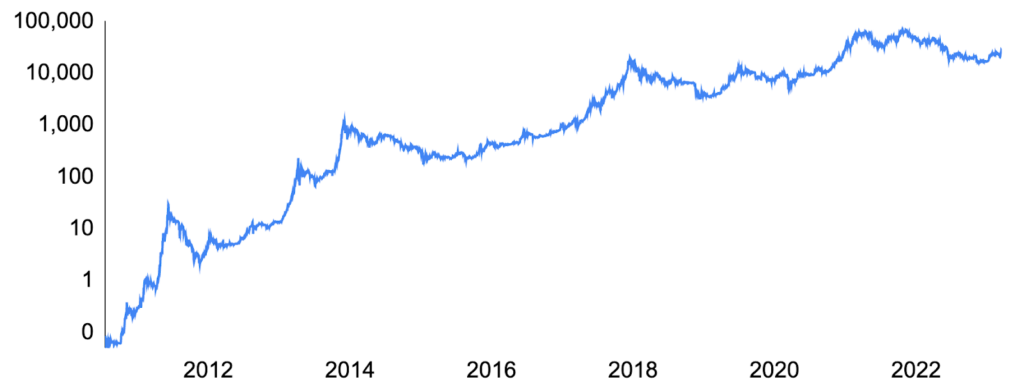

Bitcoin’s Historical Returns & Valuation Constructs

Bitcoin’s historical returns have been nothing short of phenomenal, with the asset increasing 570,000x since July 2010 and 160x since October 2013 when bitcoin first crossed $10b in market cap and had sufficient liquidity to be investable in size. Below we show bitcoin’s price on a logarithmic scale, which displays percentage changes equally regardless of price and is better for showing long-term trends, particularly for exponentially increasing data. While prices have certainly declined over some periods and past performance is not indicative of the future, there is a clear uptrend in price throughout Bitcoin’s history.

Bitcoin’s Historical Price Performance

Source: Glassnode, GSR

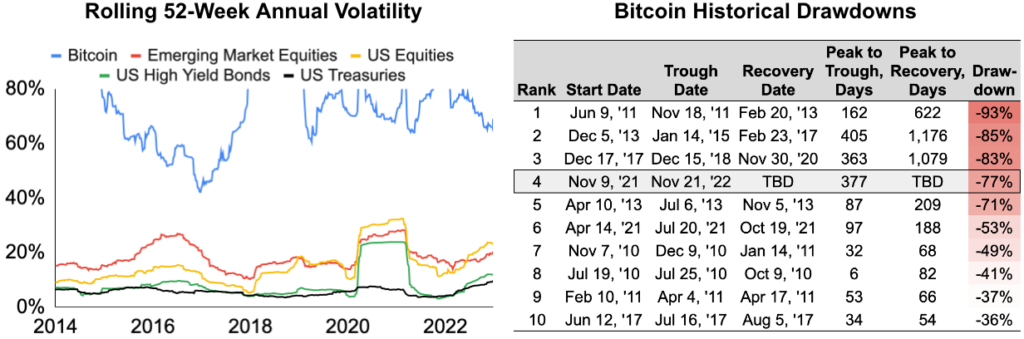

One notable characteristic of bitcoin’s price outside of the sheer magnitude of increase since inception is its high volatility. Indeed, investing in bitcoin isn’t for the faint of heart, as the asset is many times more volatile than other assets, including other notably volatile assets like emerging market equities. Moreover, bitcoin has experienced several significant drawdowns, falling by 70% or more five times in its history. However, we see bitcoin’s volatility as a feature rather than a bug, as it emanates partly from its inelastic supply that helps enable its digital asset reserve currency status and as it makes bitcoin an extremely capital efficient asset from a portfolio construction perspective. We expand on both of these two points later on.

Bitcoin’s Historical Volatility

Source: Yahoo Finance, Glassnode, GSR. Note: We limit the Y-axis to show more detail for the other asset classes. We use the following ETFs in our calculation: VWO for Emerging Market Equities, SPY for US Equities, HYG for US High Yield Bonds, and IEF for US Treasuries.

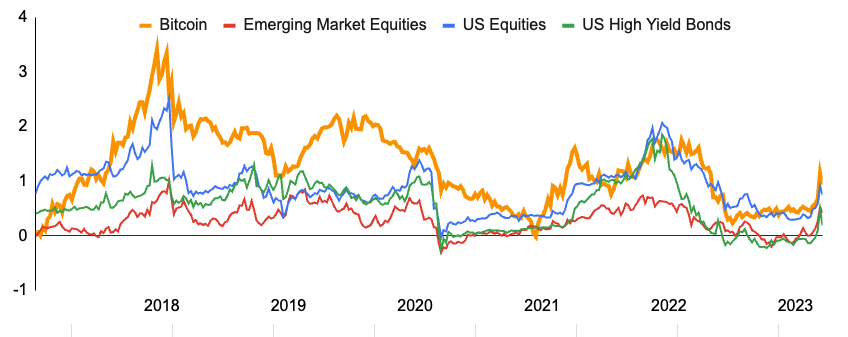

Moreover, despite its high volatility, bitcoin’s returns have more than compensated for such fluctuations for anyone with a medium-term investment horizon. Below we show the rolling three-year Sharpe Ratio, which compares annualized excess returns per unit of volatility, for bitcoin and other major asset classes. From January 2014 to present, bitcoin produced a 0.64 Sharpe Ratio, outpacing US equities as the next closest asset class at 0.56¹.

Rolling Three-Year Sharpe Ratio by Asset Class

Source: Yahoo Finance, GSR. Weekly data as of Mar 20, 2023. Note: We use the following ETFs in our calculation: VWO for Emerging Market Equities, SPY for US Equities, and HYG for US High Yield Bonds.

When thinking about how bitcoin may perform in the future, it’s instructive to examine both supply side and demand side factors. Some measures, such as PlanB’s stock-to-flow model, focus on the former, with the stock-to-flow ratio specifically comparing bitcoin’s total stock (supply) to new bitcoin production and with a higher number indicating greater scarcity. Historically, there has been a strong correlation between the stock-to-flow ratio and the price of bitcoin, though correlation does not equal causation and the model has been criticized not only for examining just the supply side of the equation, but also for the potentially declining efficacy of supply as an explanatory variable. This is because Bitcoin’s early halvings had a much larger marginal impact on supply growth than later halvings, exemplified by 2012’s halving cutting inflation from 16% to 8% annually compared to 2024’s upcoming halving that will lower inflation from 2% to 1%.

With a more stable bitcoin supply going forward and an inelastic supply causing changes in demand to translate directly to price, it’s likely that demand factors will play the predominant role in determining bitcoin’s price going forward. Here, analysts often turn to adoption curves and Metcalfe’s Law, which surmises that a network’s value is proportional to the square of the number of users connected to the system. In other words, a larger network is more valuable, and if one assumes Bitcoin adoption and usage will continue, its price should follow. It’s not a given that adoption will continue, however, and network size is informative but insufficient to explain valuation by itself. Finally, note that there are various other valuation constructs, such as examining price as a multiple of mining costs or comparing bitcoin’s market cap to that of gold, though just like the stock-to-flow and adoption curve/Metcalfe’s Law models, each have their own shortcomings.

All told, bitcoin’s returns may not match the phenomenal returns displayed historically, though its volatility may also fall in the future, preserving its strong risk-adjusted performance. Regarding price, despite its market cap representing just a fraction of that of other asset classes including gold, absolute returns may fall in the future due simply to both the magnitude of its historical performance and its current larger market cap compared to its early days. And while volatility may remain structurally higher on a relative basis due to its inelastic supply, it too may fall over time as bitcoin grows, matures, and de-risks.

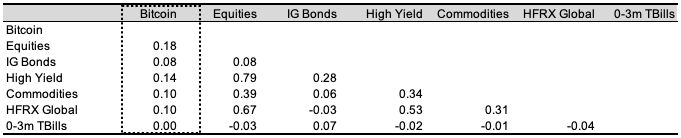

Bitcoin’s Impact on a Portfolio

The key benefit of adding bitcoin to a balanced portfolio is the diversification it provides. Indeed, Modern Portfolio Theory dictates that a portfolio of multiple uncorrelated assets generates better returns per unit of risk than that of a single asset. This can be seen in the formula for the Sharpe Ratio of a two-asset portfolio, where the volatility in the denominator is a function of the correlation between the two assets, or by examining The Efficient Frontier, which plots the maximum return across varying levels of risk to again show diversification will yield a greater return per unit of risk compared to investing in a single asset. Bitcoin is particularly powerful in this regard given its historically low correlation with traditional asset classes. And while this correlation has indeed increased over the last few years, likely due to greater institutional participation, bitcoin’s correlation with traditional assets may fall in the future under different macro and market regimes, and even if not, it can still help diversify a balanced portfolio.

Bitcoin’s Historical Correlation vs. Traditional Asset Classes

Source: GSR. Yahoo Finance, Santiment, HFR data. Note: Daily data from Jan 2nd, 2014 to Mar 20, 2023. ETFs/ETNs are used as proxies for certain asset classes. ACWI for Equities, AGG for IG Bonds, HYG for High Yield, DJP for Commodities (BCOM ETN). HFRX Global Hedge Fund Index and S&P 0-3M TBill Index were used due to a lack of traded vehicles. Bitcoin is used instead of broader crypto due to its long track record.

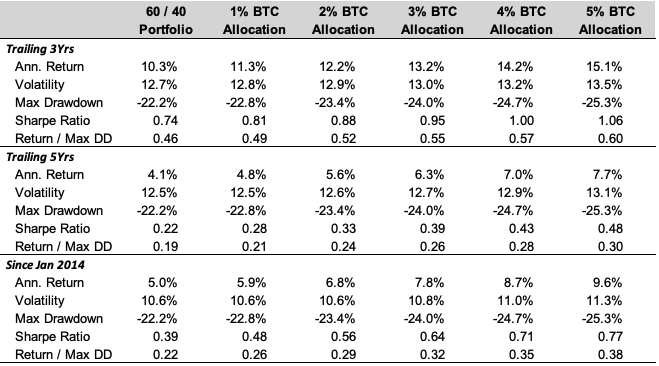

In fact, adding bitcoin to a standard 60/40 portfolio materially improves its Sharpe Ratio over all periods measured. Specifically, allocating 1% of the portfolio to bitcoin tended to generate a roughly 1% increase in annual return with much smaller increases in portfolio volatility and maximum drawdown. And though with a declining marginal impact, these benefits increase as the allocation to bitcoin increases.

Risk & Return Statistics of a Balanced Portfolio with a BTC Allocation

Source: Santiment, Yahoo Finance, Santiment. Note: Daily data as of Mar 20, 2023, with quarterly rebalancing. The 60/40 Portfolio is 60% ACWI and 40% US Agg. Bitcoin exposure is funded from the ACWI exposure. 1% BTC Allocation represents a 59/40/1 portfolio. S&P 0-3M TBill Index used as the risk-free rate. The analysis excludes early periods of bitcoin’s history to hone in on the timeframe after bitcoin was sufficiently large and liquid, which we deem to start in 2014 after bitcoin reached a market cap of $10b and regularly had daily volume of $10m+. Including bitcoin returns before 2014 would have made the results look even better, but institutional portfolios could not have made a reasonably-sized allocation much earlier than this without materially impacting bitcoin’s price.

One common concern from institutional investors regarding Bitcoin revolves around its high volatility, which emanates partly from its inelasticity, as changes in demand translate directly to price. That said, it is precisely this preprogrammed and limited supply that makes it a great store of value. And its high volatility is one major reason for the large Sharpe Ratio improvement for a standard portfolio from just a small allocation, making it a very capital efficient asset from a portfolio construction perspective. In other words, risk-reward is skewed positively, as the most one can lose from a small investment is that investment itself, but that small investment could potentially have a large impact on the portfolio should it increase many times over. Lastly, such volatility also makes it an extremely efficient asset from an expense standpoint, as fees paid per unit of volatility are extremely small.

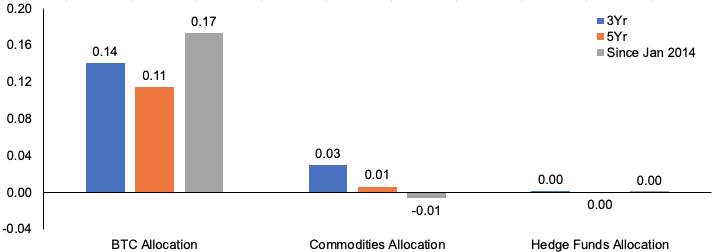

Sharpe Ratio Improvement From Adding a 2% Allocation to a 60/40 Portfolio

Source: Santiment, Yahoo Finance, HFR, GSR. Note: Daily data as of Mar 20, 2023, with quarterly rebalancing. We use a standard 60/40 Portfolio with 60% ACWI and 40% US Agg as a base portfolio. We then create three portfolios that allocate 2% from the ACWI allocation to the following: Bitcoin (BTC), Commodities (DJP), and the HFRX Global Hedge Fund Index. The graph measures the excess Sharpe Ratio generated by these portfolios versus the base 60/40 portfolio.

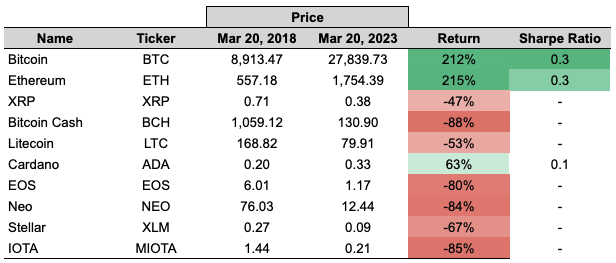

Finally, one additional concern is whether other digital assets are seeing greater innovation and may therefore exhibit greater returns. However, while individual altcoins may indeed provide a better return, they are also much more risky, as most face considerably more competition and lack the extreme network effects inherent in Bitcoin’s monetary good use case. As an example, it appears less clear that even Ethereum, with its first mover advantage and immense ecosystem network effects, will be the smart contract blockchain end-game winner with over 150 competitors trying to unseat it, while bitcoin’s status as the non-sovereign digital reserve currency appears rather cemented. To illustrate, seven of the top ten tokens as of five years ago have produced negative returns and the two others have produced significantly lower absolute returns though with a similar Sharpe Ratio. In this regard, Bitcoin benefits from the Lindy effect, which theorizes that the older something is, the more likely it is to be around in the future.

Risk-Adjusted Return of Top 10 Tokens as of Five Years Ago

Source: CoinMarketCap, Sansheets, GSR. Data as of Mar 20, 2023.

Institutional Bitcoin Investment Options

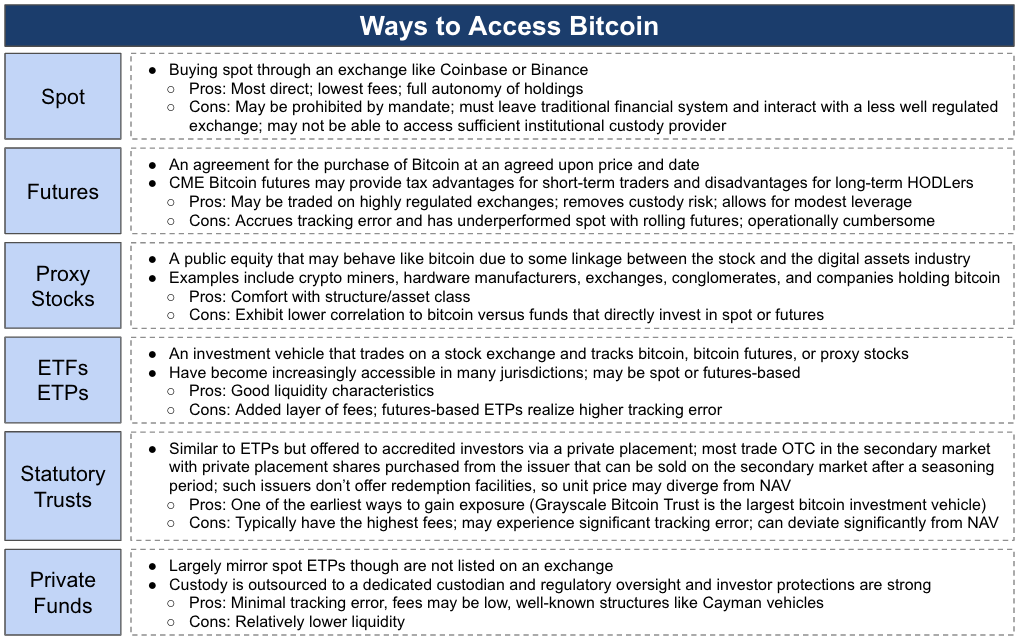

There are multiple ways institutional investors may access bitcoin. These include purchasing bitcoin from a cryptocurrency exchange, buying a futures contract, buying stocks that may exhibit bitcoin-like returns, purchasing an exchange traded product, buying into a statutory trust, or accessing via a private fund. Below we summarize each, as well as their advantages and disadvantages.

Types of Investment Funds

Source: GSR

Given the varying advantages and disadvantages of each fund type, different investors tend to prefer different vehicles. For example, crypto purists or investors with open mandates and the ability to integrate new systems and processes tend to prefer direct spot investments with outsourced custody in order to access the cheapest fees. Investors who need or prefer a managed solution and are focused on timing the market or attaining the highest liquidity tend to choose ETPs. Lastly, institutional investors with medium-term investment horizons (ie. without daily liquidity needs) tend to prefer private funds for their cheap fees, low tracking error, and strong oversight/investor protections in a familiar investment vehicle.

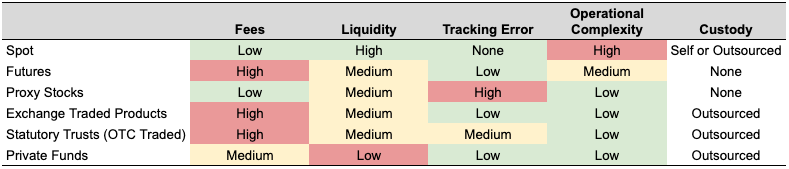

Institutional Investment Options Matrix

Source: GSR. Notes: Some Private Funds may self custody (e.g., NYDIG); investors should weigh the cost savings from vertical integration versus increased operational risks that may arise without a third-party custodian. Exchange Traded Products are covered in the context of spot bitcoin ETPs; proxy stock ETPs or futures-based ETPs would tend to have higher tracking error, lower fees (higher if futures are used and funding is considered), and no custody considerations. Statutory Trusts strictly evaluate OTC-traded trusts; non-listed trusts are more accurately described by the Private Funds row. Liquidity is framed in the context of trading/redemptions (i.e., 24/7/365 spot liquidity versus exchange traded products that are based on market hours). OTC-traded trust liquidity is based on liquidity at market prices, note that there is zero liquidity for these products at NAV currently. Futures fees are more variable than other instruments as we include funding costs which have been high historically.

Conclusion

All told, Bitcoin is truly a novel creation. Tens of thousands of computers around the world come together to keep a decentralized, trustless, permissionless, open, censorship resistant, and immutable ledger of payments without a central authority and in the potential presence of bad actors. Bitcoin reimagines the financial rails from the ground up and enables novel use cases and benefits like the removal of intermediaries, democratization of value exchange, and introduction of new paradigms around ownership and governance.

Bitcoin’s finite supply, first mover advantage, and leading decentralization and security have made Bitcoin the apex monetary asset and non-sovereign reserve currency of the digital realm. Moreover, Bitcoin’s extreme network effects will only add to its lead and make it highly unlikely to be displaced in this regard. And, as the world becomes increasingly digital, the importance of bitcoin as the world’s non-sovereign digital money should only compound.

Bitcoin’s historical price performance has been nothing short of phenomenal, and balanced portfolios with even a small bitcoin position benefit from its profound positive impact. This is due to both the diversification that bitcoin provides, as well as its high volatility, which emanates from its provable scarcity and has been more than compensated for by its returns. In fact, adding just a 1-2% allocation to bitcoin has a large positive impact on that portfolio’s risk-adjusted returns, both on an absolute basis and relative to that of other asset classes.

Investors may access bitcoin through a number of vehicles, each with their own advantages and disadvantages. Those with open mandates and an ability to implement new processes often choose spot, those wanting top liquidity may access via ETPs, and those with a medium-term investment horizon looking for reasonable fees and low tracking error in a safe and well-understood structure generally choose private funds.

Lastly, now may be the perfect time to act. Bitcoin is down ~60% from its all-time high in November 2021, and the asset has historically performed extremely well after large price declines, increasing an average of 82% off the bottom in the year following the three largest price declines since 2014. Further, the recent decline has occurred despite continued strength in Bitcoin’s underlying fundamentals, with adoption, development, capital, and talent continuing to increase. Lastly, with the material current stress in the traditional financial system, central bankers caught between banking turmoil and high inflation, and the potential for a significant increase in global liquidity, bitcoin may just be both the perfect hiding place and the biggest beneficiary.

¹While some consider bitcoin to be separate and distinct from other digital assets, effectively making bitcoin an asset class in its own right, others see bitcoin as one cryptocurrency in the larger universe. Given its digital dominance and unique role, our view lies somewhere in the middle – buying bitcoin may be somewhat analogous to buying a very large Amazon, though this is not the same as buying the NASDAQ Composite (ie., the digital universe). All told, digital assets represent many things to many people, and different investors hold them based on their own circumstances and views, potentially categorizing them as a commodity, alternative asset, technology, macro hedge, frontier market, or currency.

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

View Bitcoin for Institutions PDF

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.