Bitcoin and Ethereum

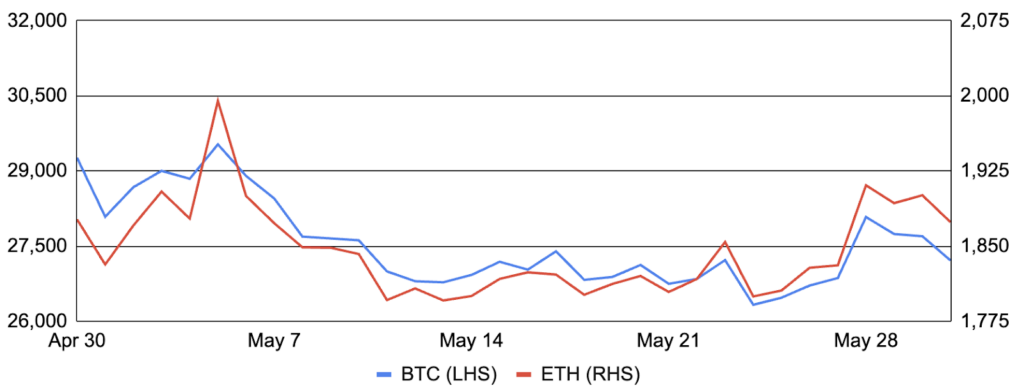

Bitcoin realized its first down month of the year, falling ~7% after entering May at ~$29,300 and finishing at ~$27,200. Performance was strong during the first several days of the month after the FDIC seized troubled bank First Republic and trading in BRC-20 tokens and other memecoins continued to set records. Sentiment waned shortly thereafter, however, with woes escalating on May 10th as a transaction sending ~9,820 BTC mislabeled as Silk Road was shared on crypto Twitter and sparked renewed speculation of government selling.1 Bitcoin largely traded sideways for the remainder of the month outside of a sharp yet brief rally on the 28th that was fueled by nearly $110m of short liquidations. Beyond price dynamics, Casey Rodarmor stepped down as the lead maintainer of the Ordinals project, and while the number of inscriptions breached 10 million during the month, new inscriptions peaked in early May, and network transaction fees returned towards more typical levels, though remain higher than prior to Ordinals. Elsewhere, the Bitcoin network hashrate hit a record ~375 EH/s during the month, Tether revealed plans to mine bitcoin in Uruguay, MicroBT unveiled its next-generation mining rig dubbed the WhatsMiner 53S++, and Bitcoin’s fourth halving is less than 50,000 blocks away and is likely to commence in April or May 2024.

Ethereum also broke its streak of positive monthly returns, though it was essentially flat over the month after finishing May around $1,875. Despite ETH’s muted price performance, onchain activity accelerated substantially in early May on memecoin exuberance, and the total ETH supply decreased by nearly ~144,000, surpassing the prior supply reduction record from April by nearly threefold. At the protocol level, Ethereum experienced temporary finality delays on May 11th and 12th due to issues with certain consensus layer client implementations, causing Ethereum’s inactivity leak to activate for the first time ever (detailed further below). More positively, Lido activated withdrawals and enabled direct redeemability for stETH, the ecosystem’s largest liquid staking token. Even with Lido activating withdrawals during the month, the demand to activate new validators has substantially outpaced the demand for withdrawals, with more than 4,000,000 net ETH staking inflows since Shapella, extending the trend discussed in last month’s post-Shapella recap. In fact, there are less than 100 validators currently waiting to exit while ~94,000 validators are queued to begin staking; it would take ~45 days for a new validator to begin staking currently with the existing backlog of demand.2 In other news: Vitalik Buterin urged caution around re-staking in a new blog post; a16z developers unveiled a new private, onchain voting tool for Ethereum dubbed Cicada; and, Nym released mixnet routing software to improve Ethereum validator privacy.

BTC and ETH

Source: Santiment, GSR.

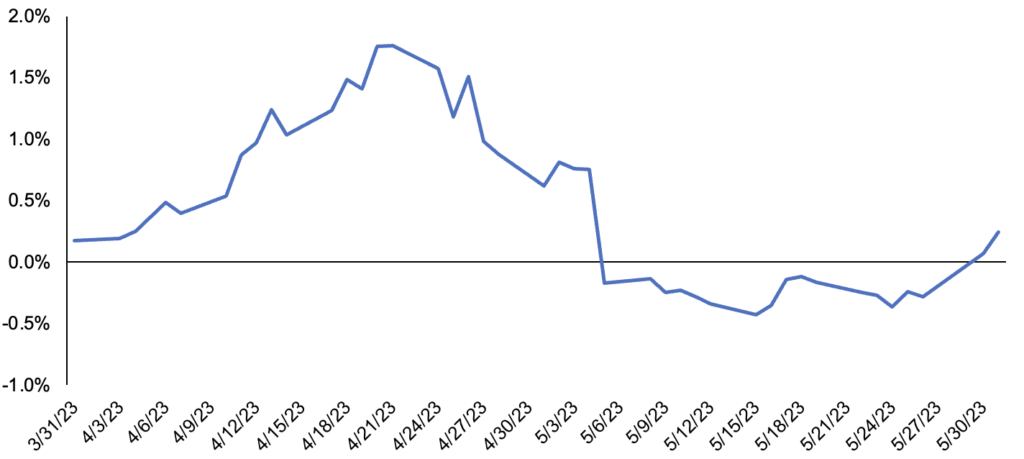

A Fiscal and Monetary Policy Update

May was a prominent month for fiscal and monetary policy developments, with ongoing debt ceiling negotiations in the US and several notable interest rate hikes globally. On the former, the drama began in January when Treasury Secretary Yellen informed Congress that she would invoke extraordinary measures to extend the timeline for debt ceiling legislation to be enacted, and warned that the US might default on its debt as soon as June 1st if Congress failed to act. Markets began displaying concerns in April as credit default swap spreads, which measure the cost of insuring against a US government default, skyrocketed and as the 1M vs. 3M treasury yield spread widened (the 1M being the only treasury bill at the time that would be paid before a government default if Congress failed to act). In fact, the 1M treasury yield fell as much as ~155 bps during April before rising sharply in May as the potential default deadline approached and 1M bills lost their insulation from default risks. Credit rating agencies like Fitch warned that the US credit rating was at risk of downgrade amidst the highly politicized uncertainty. Nevertheless, the risk of a near-term US default was removed after a bill to suspend the debt ceiling until January 2025 passed in the House on May 31st before passing in the Senate and being signed into law by President Biden in early June.

As for monetary policy, the Fed, BoE, and ECB all hiked interest rates by 25 bps in the month, in line with expectations. While the ECB and BoE signaled more hikes are likely to come, Fed Chair Powell took a more dovish tone, acknowledging the lagged effect of interest rate hikes and the indirect tightening arising from banking sector turmoil, and signaled that the Fed may pause in June. While other Fed officials have expressed a preference for continued rate hikes to curb inflation, markets are now calling for a Fed pause in June.

US Treasury Bill Yield Spread (1M – 3M Yield)

Source: Marketwatch, GSR

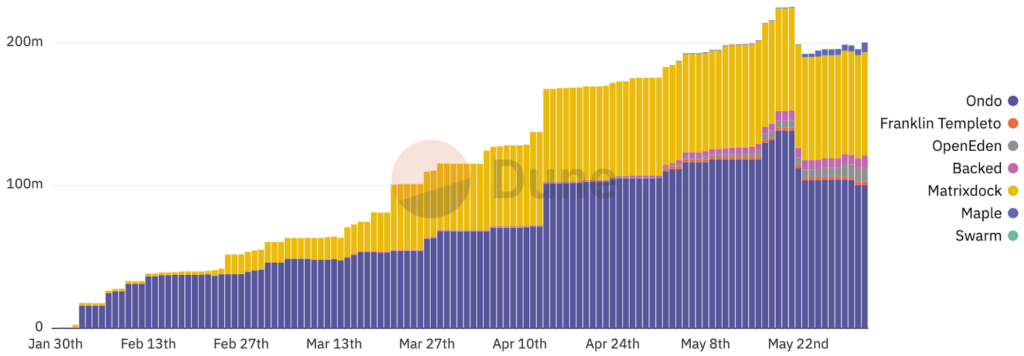

A Search for Onchain Yield

With most central banks 12 to 18 months into their interest rate hiking cycle, yields in traditional financial markets have risen from zero or even negative in some countries to mid-single digits, such as in the US. Conversely, as the crypto bear market lingers on and the demand for leverage has fallen, yields available on bluechip DeFi protocols have followed suit and are now lower than US treasury bill yields in many cases. As such, several projects began tokenizing public securities to enable onchain access to traditional interest rates, with the market cap of such projects growing to ~$225m by mid-May.3 While this includes a broad set of public security tokenization projects, the vast majority of demand has so far been for tokenized short-duration treasury bills.

At a high level, tokenizing treasuries isn’t much different than existing fiat-backed stablecoins except the interest income accrues to the stablecoin holder instead of the issuer. Ondo’s OUSG and Matrixdock’s STBT tokens have been two of the largest success stories so far, accounting for ~85% of the industry’s market cap. Additionally, since these are tokenized securities, a more clear regulatory framework exists and thus minting OUSG or STBT is a permissioned activity limited to qualified investors that have gone through KYC. Notably, protocols like Flux allow users to to borrow stablecoins against OUSG collateral, giving whitelisted investors access to leveraged onchain treasury yields, which naturally pushes up stablecoin lending yields for market participants more broadly (i.e. investors may post yield-bearing OUSG collateral to borrow stablecoins, sell the stablecoins for more yield-bearing OUSG, and repeat the process).

Elsewhere, a Maker DAO proposal aims to raise the competitiveness of onchain yields by increasing the DAI Savings Rate (DSR) from 1% to 3.33%. Unlike with traditional centralized stablecoins such as USDC and USDT, Maker’s DSR allows DAI holders to earn yield by locking DAI in the DSR vault. The DSR is a governance-set yield that’s funded from the stability fees collected on collateralized debt positions (CDPs). With the proposal, Maker team members have expressed a desire to fix the unhealthy disconnect between rates in traditional and crypto markets. Additionally, given composability, an increased DSR has multiple avenues for increasing onchain yields across other protocols beyond Maker.

Market Cap of Securities Token Issuers

Source: Steakhouse, GSR. Data only includes Ethereum, Gnosis, and Polygon-based chains

A Tale of Two Regulatory Environments

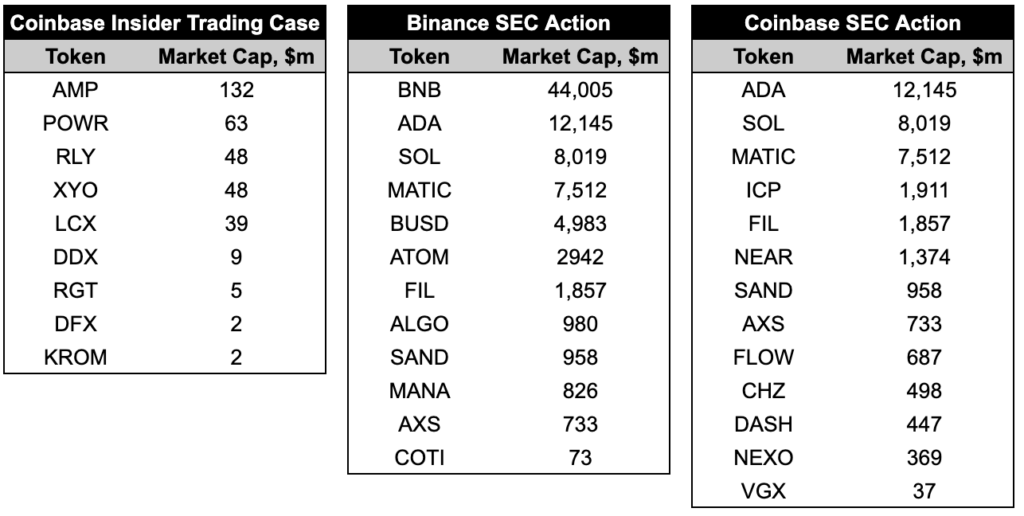

After taking action against Kraken and Paxos in February, Binance, KuCoin, and Tron in March, and Bittrex in April, US regulators continued to be particularly active in May. The SEC, for example, requested that Grayscale withdraw its registration statement for the Grayscale Filecoin Trust after stating that the FIL token “meets the definition of a security”. The SEC further sought a court order to dismiss Coinbase’s writ of mandamus that sought to force the SEC to respond to Coinbase’s petition for rulemaking seeking greater regulatory clarity for the industry. SEC Chair Gensler further stated at a conference that crypto markets are ‘generally noncompliant’ and based on a ‘false narrative’ of decentralization. And subsequent to month end, the SEC sued Binance for allegedly offering unregistered securities, failing to register as a clearing agency, broker, and exchange, and commingling customer funds, among other accusations, and a day later sued Coinbase for allegedly violating securities laws and failing to register as a clearing agency, broker, and exchange.

Not all jurisdictions are taking the same tact, however, with major European and Asian regulators implementing digital asset-specific regulatory frameworks. The EU, for example, officially signed its landmark crypto regulatory regime, MiCA, into law, with its publication in the Official Journal of the European Union expected shortly and many of the provisions starting in 2024. Elsewhere, Hong Kong’s new crypto regulation kicked in on June 1, offering investor protections around custody, asset segregation, and cybersecurity and enabling licensed crypto exchanges to offer services to retail customers in the region. China also unveiled a ‘Web3 White Paper’ discussing the future of the internet that, while not an official government document, suggests that China may be looking to foster web3 innovation and development within the country.

Given the diverging regulatory climates, many crypto companies, particularly exchanges, have sought jurisdictions with relative clarity and reduced risk. For example, Coinbase launched its non-US derivatives platform, partnered with Bitpanda to offer institutional trading services outside of the US, and revealed that it may target the UAE as a strategic hub. Gemini similarly launched a non-US derivatives platform and is reportedly considering opening up a second headquarters in the UK. And other exchanges secured licenses in additional jurisdictions, such as Gate in Hong Kong, Crypto.com in Singapore, and Gulf Binance, a joint venture between Gulf Innova and Binance, in Thailand.

SEC Alleged Securities per Recent Actions

Source: SEC, GSR. Note: Based on an exhibit in Fortune. Token market caps as of June 7. The SEC actions above can be found here, here, and here

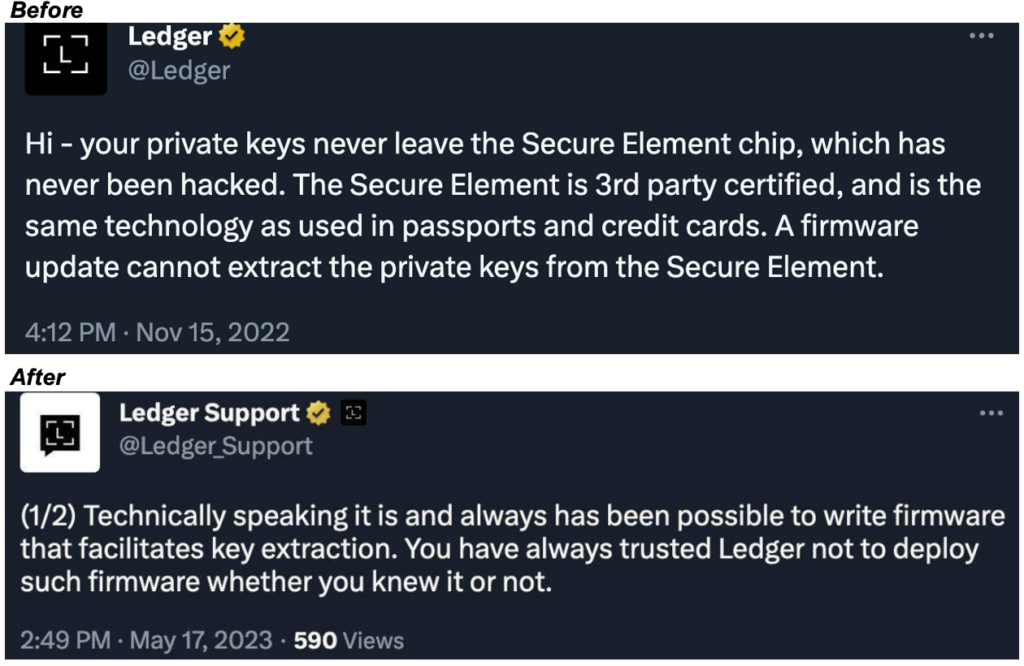

Ledger Controversy

May was a tough month for hardware wallet manufacturer Ledger after its latest product launch revealed misunderstandings around the trust assumptions inherent in its products. Namely, it was commonly believed that a Ledger wallet’s seed recovery phrase lived inside the device’s Secure Element and that it was impossible to be extracted by anyone, including by Ledger itself. Indeed, Ledger implied as much in a November Twitter post stating, “your private keys never leave the Secure Element chip…A firmware update cannot extract the private keys from the Secure Element.” However, suspicions quickly arose mid-month as Ledger revealed a new service named Ledger Recover that allows users to back up their seed phrase by splitting it into three encrypted shards stored across three custody providers. The service was introduced as an ID-based key recovery service available on an opt-in basis for those that update to the latest firmware on the Ledger Nano X. While some saw the benefits of an improved user experience and reduced risk around a lost seed phrase, many more were critical of the disconnect between Ledger Recover and their understanding of the potential for the seed to be extracted from the Secure Element. In a since-deleted tweet, Ledger Support confirmed it “always has been possible to write firmware that facilitates key extraction. You have always trusted Ledger not to deploy such firmware whether you knew it or not.” The controversy caused sales of competing hardware wallet Trezor to soar 900% week-over-week and for GridPlus to commit to open-source its firmware, though much still remains up to debate (eg. there is no way to verify the firmware actually loaded on a hardware device is the same as the audited open source firmware). Ultimately, community uproar caused Ledger to delay the Ledger Recover release, accelerate its open-source roadmap, and promise a forthcoming Recover Protocol white paper to be released in the coming days.

Ledger Tweets

Source: Twitter, GSR.

Ethereum Temporarily Fails to Finalize (Twice)

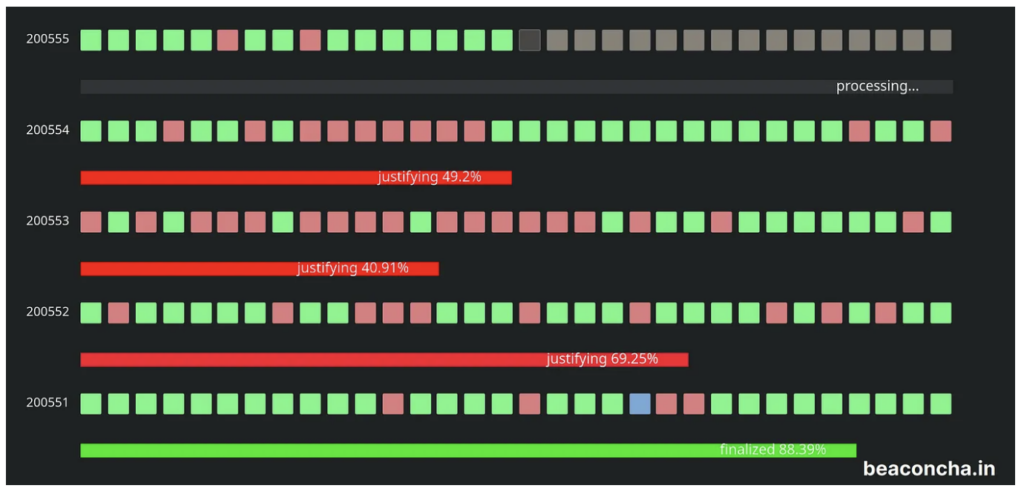

While Ethereum blocks occur every twelve seconds, it typically takes about 15 minutes for an Ethereum transaction to become final.4 However, shortly after 4 pm EST on May 11th and again after 1 pm EST on May 12th, Ethereum’s typical ~15-minute finality time was temporarily lengthened to ~25 minutes and a little over an hour, respectively.5 The delays stemmed from periods of high load on two of the consensus layer client implementations, Prysm and Teku, but Ethereum’s resiliency was on display as it course corrected without manual intervention during both incidents. Additionally, the teams behind the impacted clients subsequently rolled out new optimizations that should prevent this issue from recurring.

Contrary to what some proclaimed, the finality delays did not halt the Ethereum blockchain or prevent it from processing transactions or blocks, and Ethereum users generally were not impacted or even noticed the finality delay in the overwhelming majority of cases. Ethereum’s notion of transaction finality is economic finality, meaning once a transaction is finalized, it becomes prohibitively expensive to reverse due to the protocol’s slashing mechanism and as such, it cannot be practically reverted (i.e., at least one-third of all ETH would be slashed to revert a finalized transaction). In addition, Ethereum’s implementation of proof-of-stake (Gasper) prioritizes “liveness” over “safety,” meaning the chain does not halt if one-third of validators fail to attest to a block, but it will continue to produce blocks optimistically even when finality thresholds aren’t reached. Ethereum blocks are regularly finalized up until a given epoch, and the blocks in subsequent epochs are optimistic and have the potential to be forked before finality occurs, typically ~15 minutes later. During both of these scenarios, Ethereum blocks were still being produced, but they were simply taking longer than usual to finalize as certain overloaded clients missed attestations and prevented the 2/3rds finality threshold from being reached. This series of events explicitly highlights the benefits of Ethereum’s multi-client design approach and the importance of client diversity for network resiliency. If a supermajority of validators were still using the Prysm consensus layer client, as they were in 2021, the impact could’ve been far more severe, but fortunately, validators running the Lighthouse client continued attesting throughout the event.

Lastly, the finality delay on May 12th caused Ethereum’s inactivity leak to kick in for the first time in Ethereum’s history. The inactivity leak halts all validator rewards when finality is sufficiently delayed (four epochs), but even more importantly, quadratically growing penalties accrue to inactive validators as time passes. The design ensures that finality will eventually be restored as the stake of inactive validators deteriorates until active validators reclaim a supermajority. In addition, this mechanism incentivizes running a minority client as a bug occurring in a client with more than one-third of the network stake could impede finality and quickly erode the stake of validators running that client if it cannot be remediated quickly. All in all, this series of events highlighted the importance of such topics, but the actual impact was negligible, with Offchain Labs estimating the average cost was less than 0.00015 ETH per validator. We highly recommend reading our past Twitter thread on client diversity and the inactivity leak, Offchain Labs’ post-mortem for full details of the finality delays, and/or reviewing all these topics in greater depth in our Ethereum report6 for the interested reader.

Beacon Chain Slot Visualizer During the May 11th Finality Delay

Source: beaconcha.in, Offchain Labs, GSR. Note: Each row represents an epoch and each square represents one of the 32 slots per epoch. Green squares illustrate a block was proposed, red squares illustrate a block was missed, purple squares illustrate a proposed block was orphaned, and brown squares illustrate future slots

Footnote:

- This was not an Arkham error but a user-created tag that was mislabeled and shared. Arkham has since made it easier to identify Arkham tags versus user-created tags to help avoid these issues in the future.

- Assumptions: Current active validators of ~606,000, 94,000 validators waiting to activate, 0 validators waiting to exit, no new validators join the exit queue over this period. This last assumption is relevant as the validator churn threshold per epoch is set based on the total number of active validators, so new exits would shift the calculation slightly. Currently nine validators can exit per epoch but that will increase to ten validators partway through the existing queue. See here for a deeper explanation of the churn formula.

- Data only includes Ethereum, Gnosis, Polygon-based chains. Franklin Templeton was the first mover in the space, tokenizing a money market fund on the Stellar blockchain and more recently expanding to Polygon. The AUM is meaningful relative to the field ($296m), but the scope of its use is seemingly minimal as far as we can tell. Further, the trajectory of its AUM growth (piecewise jumps of $25m to $100m clips) leads us to believe is predominantly Franklin Templeton seed money.

- Ethereum slots are 12 seconds long, so blocks can take longer than 12 seconds in the case where a proposer fails to deliver a block in their assigned slot. Stating that blocks come every 12 seconds assumes there are no missed slots.

- A commonly cited rule for large bitcoin transactions is to wait for six confirmations for it to be deemed probabilistically final. This takes about one hour on average, just as long as the finality delay experienced on May 12th.

- For further reading, search for liveness, economic finality, client implementations, client diversity, inactivity leak, and correlation penalty in our Ethereum report.

GSR in the News

- Decrypt – Leading Crypto Teams and Investors Launch $50M Cross-Chain Fund powered by Wormhole

- CoinDesk – Ribbon Finance’s Decentralized Exchange Aevo Unveils Altcoin Options Trading

- Campden FB – Why now is the time for family offices to regrow confidence in digital assets

- Blockworks – Oped: Give Crypto the Presidential Stage

- Blockworks – Crypto Has Never Seen a Long Recession

- Decrypt – Leading Crypto Teams and Investors Launch $50M Cross-Chain Fund

- Blockworks – Bitcoin Price Analysts Eyeing $25K as Support Following Momentum Shift

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.