As a commodity industry with few differentiating competitive strategies, porting in best financial practices from more mature commodity producers can offer tremendous benefits for public bitcoin miners including increased earnings, reduced risks, and boosted market valuations.

Introduction

The bitcoin mining business model is a strong one, allowing miners to create bitcoin at structurally lower prices than the market and achieve extraordinary profit margins when the price of bitcoin is high. Indeed, many public miners have a marginal cost of production well below $15,000 per bitcoin. Moreover, bitcoin miners may enjoy scale advantages resulting in lower energy, facilities, and rig costs. Lastly, there are opportunities for outsized growth, whether from individual miners taking hashrate market share or from bitcoin’s price outpacing the decrease in mining rewards from periodic halvings. These key attributes may lead to exceptional profitability and growth under the right price and difficulty conditions.

Notwithstanding these positives, miners face a number of unique challenges that may hamper their performance and even put them out of business. First, miners must deal with unpredictable inputs, where future mining profits are determined by volatile, unpredictable, and uncontrollable items like the price of bitcoin and the network hashrate. This makes it exceedingly difficult to predict earnings over the medium-term and nearly impossible to determine the “correct” strategy ex ante, such as whether a miner should buy all rigs immediately or purchase them ratably over time, or whether it should utilize a third party hosting provider or build and operate its own facilities. Another challenge faced by miners is the need to increase their hashrate commensurate with that of the network, else mine a decreasing number of bitcoin. This leads to a hashrate arms race that often results in widespread over-leverage, increased earnings volatility, and difficulty meeting required cash outlays when the price of bitcoin materially falls (which happens often!). Lastly, most public miners suffer from an inefficient capital stack that largely relies on high-priced debt and costly/dilutive equity issuance to fund operational expansion. Combined, these challenges lead to high earnings volatility, poor earnings visibility, and a high cost of capital that results in exceedingly low valuation multiples and market capitalizations.

Fortunately for bitcoin miners, a close corollary exists with more mature commodity producers, who have developed and honed methods to manage such formidable challenges over centuries. After all, both bitcoin miners and other commodity producers require high, upfront capital investment that later produces a fungible asset at an unknown price. Exploration and production (E&P) companies, for example, drill for oil and gas that will be sold in the future when the price is likely to have materially changed. However, rather than rolling the dice on the future price of oil or gas, which would result in uncertain future financial performance, E&Ps actively manage price risk, often with consistent, well-developed, and robust hedging programs. In fact, 90%1 of E&P companies hedge at least some of their future oil or gas production, resulting in valuable benefits such as the assurance of meeting required future cash outflows, locked-in expansion economics, access to cheap capital, and increased market valuations.

Bitcoin miners too may port in these tried-and-true financial strategies and enjoy their many benefits. No longer do miners need to “bet the company” when competing in the hashrate arms race, issue expensive and dilutive equity to finance expansion, or see their shares exhibit extreme volatility and garner rock-bottom valuation multiples. With sound risk management programs, miners, business partners, and investors alike can significantly improve upon these issues, not only gaining a much better idea of future mining economics (i.e., some), but also taking solace in knowing the miner will actually exist in a few years.

Lastly, we believe there to be a virtuous cycle, where miners may borrow against hedged future production to fund hashrate market share growth, accelerating gains using future earnings rather than high cost capital and doing so in a way that actually minimizes risk given the presence of downside protection (self-repaying rigs, anyone?). To boot, such a strategy compounds over time, where the employing miner may accumulate an ever-expanding hashrate lead that may ultimately become insurmountable to any and all competition.

Due to the nascency of the industry, a dearth of financial products, and the paradigm shift that employing such strategies represents, usage of advanced financial strategies in the space has been minimal, to say the least. However, spurred by recent industry carnage and the coming halving, many top management teams are actively evaluating such strategies, with some even hiring dedicated portfolio managers with derivatives, treasury, and risk management expertise. And with the recent uptick in prices above fully loaded costs per coin, downside protection cheap by historical measures, and development of the market with institutions taking the other side to natural producers, now may just be the perfect time to act.

Producer/Mining Market Size & Hedging Activity

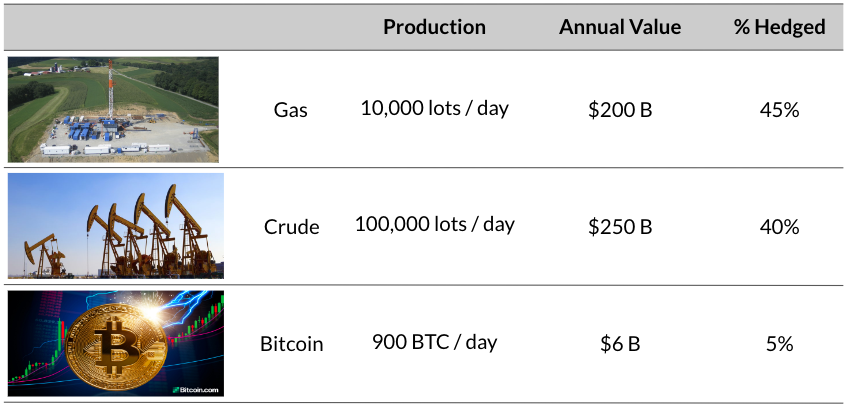

Source: CoinMarketCap, IEA, GSR. Note: Estimates above represent our best understanding of recent multi-year averages.

Table of Contents

-

Oil & Gas Producer Hedging Strategies

-

Bitcoin Miner Hedging

-

Benefits of Hedging for Bitcoin Miners

-

-

Going Concern Protection

-

Improved Expansion Economics

-

Increased Market Capitalizations

-

-

Self-Repaying Rigs and Leveraging Hedged Future Production

-

-

Self-Repaying Rigs

-

Self-Repaying Rigs en Masse

-

Leveraging Hedged Future Production

-

-

The Time to Act is Nigh

Oil & Gas Producer Hedging Strategies

Before diving into bitcoin miner financial strategy, we review hedging practices for exploration and production (E&P) companies that produce oil and natural gas. E&Ps provide a natural corollary for bitcoin miners as they require significant upfront capital investment and later produce a commodity with little differentiation at an unknown price. Like bitcoin miners, the price of their main output may fluctuate wildly and impact financial performance significantly. And, E&Ps must constantly expand operations, otherwise their output will decline. After centuries of dealing with these issues, there are certainly lessons to be learned and even financial strategy and risk management best practices to be gleaned.

While almost all E&P companies currently hedge at least some of their future oil or gas production, the amount of production that’s hedged has varied considerably by firm and over time. Internationally diversified firms with large balance sheets better able to withstand commodity price volatility tend to hedge less or forgo hedging entirely. By contrast, smaller, more levered firms or those with lower risk appetites tend to hedge the majority or even all of their future production. At the firm level, some producers vary their hedging strategy considerably over time based on their view of the commodity markets, while others adhere to a consistent and well-defined hedging program.

Per energy consultancy firm Woods MacKenzie, E&Ps are currently hedging 15% of expected 2023 oil production and 33% of expected gas production, both down substantially from prior years for several reasons. First, E&Ps have moved away from a historical “drill drill drill” mentality to focus on free cash flows and as the world decreases its dependence on fossil fuels. This has materially improved E&P balance sheets and reduced the need to hedge similar levels of production as in the past. Second, oil futures prices remain below spot, a phenomenon known as backwardation, lessening the appeal of locking in (lower) future prices now. And lastly, energy companies recorded significant mark-to-market hedging losses in 2021 as their swaps lost value against rising oil and gas prices. Nevertheless, while the current level of hedging is lower than in the past, Ovintiv, one of the largest independent oil and gas producers, estimates that hedging 20-25% of future production is enough to ensure positive free cash flows after paying its dividend.

E&Ps hedge for many reasons. First, hedging allows E&Ps to meet known cash outlays, ensuring they can pay operating expenses, exploration costs, debt payments, and dividends. In addition, the improved line of sight into future earnings facilitates planning and budgeting and helps lock in new project ROI in advance, whether it be drilling a new well or acquiring a competitor. Lastly, hedging enables access to cheap capital via bank loans as hedges aid loan repayment when commodity prices fall. In fact, hedging is typically required to receive a bank loan or is included as a debt covenant.

E&Ps use a variety of products for hedging purposes – fixed price contracts, basis swaps, and a variety of options structures – but the two most prominent are swaps and options collars. Swaps allow E&Ps to exchange a floating price for a fixed price based on an agreed notional quantity at a defined interval, effectively locking in the price for the producer. As such, the E&P’s hedge benefits if commodity prices drop but loses out if they rise (though a higher price is still a net positive for them when not fully hedged). Swaps have the benefit of not requiring an upfront payment, though E&Ps do give up potential upside with the instrument if prices rise. Options, by contrast, give the owner the right but not the obligation to sell (in the case of a put option) or buy (for a call option) a given amount of production at a predetermined strike price and date, effectively establishing the minimum price a producer receives for the commodity in the case of a put option. When purchasing a put option, the E&P benefits if the underlying price falls below the strike price at expiry, but if not, it will only lose the cost of the option. And while put options do have a cost, they enable E&Ps to participate in the upside should commodity prices rise. It is for this reason – a desire to benefit from rising commodity prices – and periodic swap-based hedging losses in the past that is causing producers to increasingly gravitate from swaps, historically the most popular product, towards options-based hedging. In fact, this high use of options-based strategies combined with the historically low level of hedging overall has caused some to characterize the current hedging paradigm as a “rainy day insurance” approach aimed at protecting free cash flows and dividend payments from materially adverse price moves while still maintaining upside exposure.

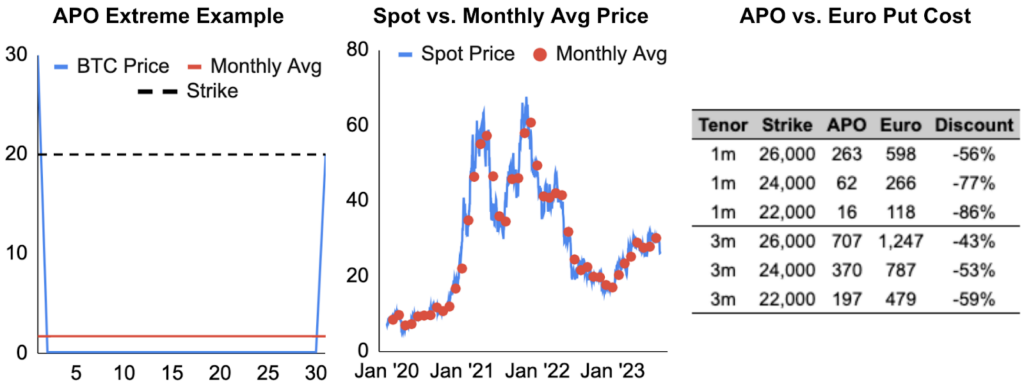

When utilizing options, producers generally choose average price options (APOs), which compare the average price of the commodity over the life of the option against the strike price, rather than European options, which compare the spot price at expiration against the strike price. Doing so provides a hedge more aligned with the E&Ps daily production of oil and gas, and APOs are also materially cheaper, as volatility, a major input into options pricing, is much lower with average rather than spot prices. Also note that producers employ various strategies to reduce or eliminate the cost of options-based hedging, most notably with costless collars and three-way collars, discussed more later on. Finally, note that the price at which the E&P chooses to hedge is subjective and is typically influenced by management’s risk appetite, debt compliance requirements, production costs, and operating budgets/cash flow needs.

In total, the exact level and method of hedging is tailored and can vary by company, but hedging is an inextricable part of the E&P industry with clear benefits. Hedging enables E&Ps to borrow billions of dollars in inexpensive bank loans to finance working capital and development opportunities. It allows E&Ps to better predict financial performance, more easily budget, and optimize decision-making with greater clarity on future economics. Lastly, it allows them to safeguard against falling prices, secure positive cash flows, and ensure survival in even the most severe market downturns.

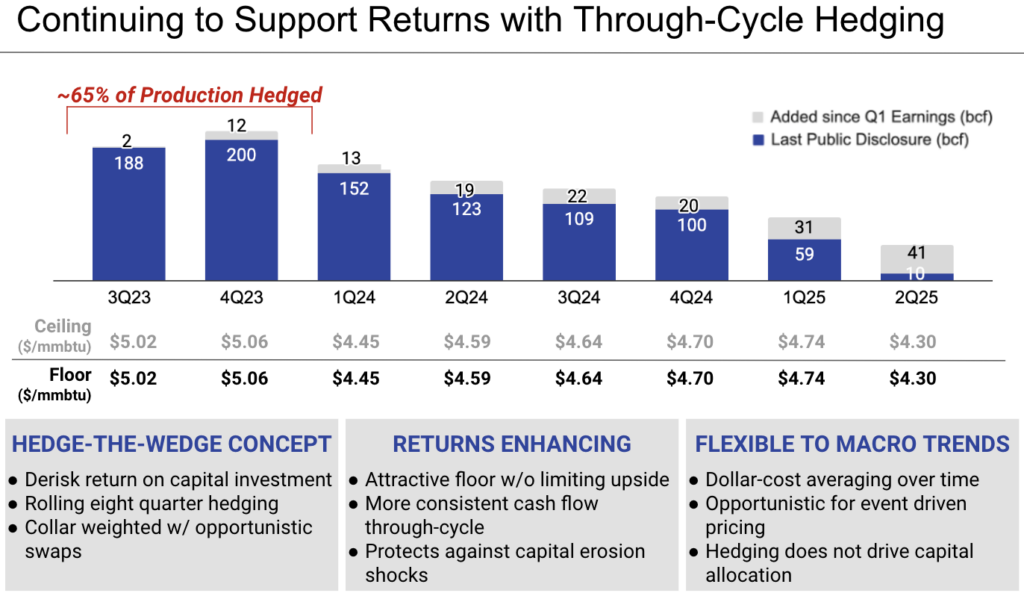

Chesapeake Energy Hedging Strategy Overview Slide

Source: Chesapeake investor relations website, GSR. Note: Hedge position as of 7/26/23. Slide reproduced to increase font size for readability. The original is from the 2Q23 earnings presentation and can be found here.

Bitcoin Miner Hedging

Given the aforementioned hashrate arms race, the background of many management teams, and the enormous benefits from being the low-cost producer, most miners have prioritized operational excellence, looking to lower input costs and improve efficiency as much as possible. As such, porting in best financial practices from more mature commodity producers has not been a top priority, and there has been minimal hedging to date. In fact, based on conversations with management teams, we believe instituting a large-scale hedging program would represent a paradigm shift for the industry.

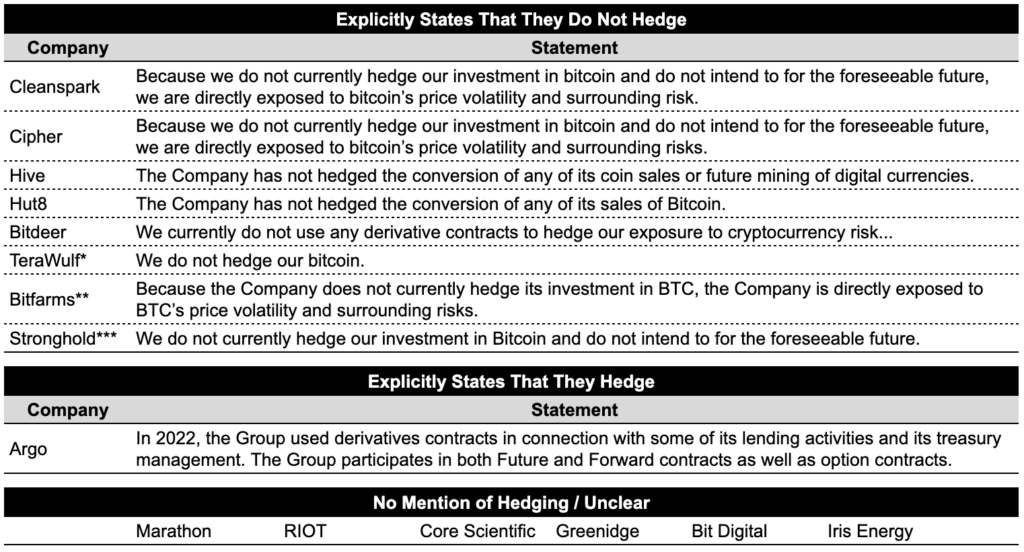

A review of the data confirms a dearth of derivatives usage for risk management purposes. A benchmarking study in 2020 by the University of Cambridge found that just 12% of miners surveyed used crypto-asset derivatives while only 14% used hashrate derivatives. Moreover, our review of annual regulatory filings from the largest public miners, whom we believe to be more likely to hedge than smaller private miners, also found almost no evidence of such activity. In fact, of the 15 companies examined, it appears only one miner may currently hedge price risk (and the extent of which is unclear), and zero miners disclosed hedging network hashrate. Firms are required to disclose material usage of hedging derivatives in their regulatory filings, so we believe its absence in financial reports indicates a lack of hedging rather than simply not reporting it – a fact that aligns with our conversations with management teams as well. Finally, this lack of hedging occurs despite most miners noting in their annual filings the risks imparted by the high level of price volatility, affectionately referred to as “momentum pricing”, including the potential for adverse price action to force the miner to cease operations.

Annual Filing Disclosures on Price or Hashrate Hedging Activity

Source: Company websites, SEC, Sedar+, GSR. Note: Searches for the terms hedg*, option*, derivative*, and risk management, and only includes discussions around hedging the price of bitcoin or network hashrate/difficulty. Uses annual regulatory filings per each company’s jurisdiction (eg. US filers search 10-Ks; Canadian filers search annual AIF, financial statement and MD&A, etc). *TeraWulf 10-K also states “Incremental revenues may be generated through the hedging and sale of mined bitcoin” **Bitfarms also states “In the future, the Company may enter into certain hedging transactions to mitigate its exposure to aspects of the economy or specific economic conditions that are particularly volatile, including the market price of BTC and interest rates.” ***Stronghold had previously entered into a variable prepaid forward sales contract derivative, and the 10K states “The Company also uses derivative instruments to mitigate the risks of Bitcoin market pricing volatility” though it appears they are not currently hedging given the above statement.

Benefits of Hedging for Bitcoin Miners

We see three main benefits of hedging for bitcoin miners: going concern protection, improved expansion economics, and increased market capitalizations, each discussed more below.

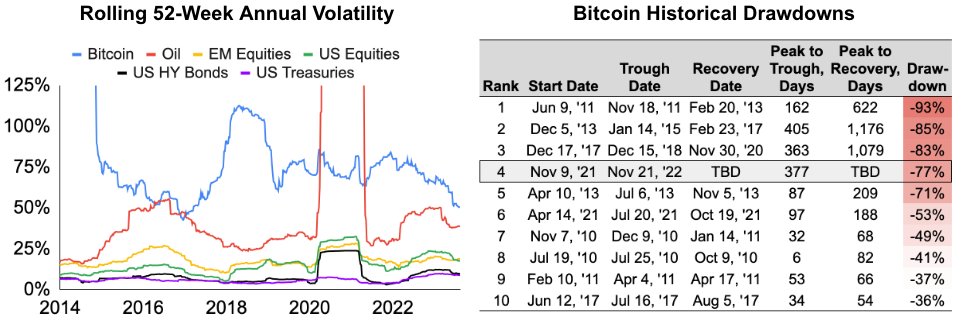

Going Concern Protection

Bitcoin is a particularly volatile asset with routine, large drawdowns that can threaten mining economics and even put a miner’s continuing viability in question. Indeed, bitcoin’s volatility is multiples that of other assets, for example, averaging 8x that of high yield bonds and 4x that of domestic equities. Moreover, bitcoin routinely experiences extremely large drawdowns, demonstrated by its recent 77% decline between November 2021 and November 2022 and its 83% decline between December 2017 and December 2018. Such high volatility and frequent drawdowns directly impact miner earnings and has put many miners in peril.

BTC Volatility & Drawdowns

Source: Yahoo Finance, Santiment, GSR.

Fortunately, miners may protect against this risk using derivatives, exactly as E&P and other commodity producers do. For example, a miner may sell all or a portion of its future production forward using a swap to lock in the price it sells each bitcoin for. And, because the futures curve is generally upward sloping2, known as in contango, the miner can often lock in a price per BTC that is higher than the spot price. Alternatively, a miner may buy a put option, giving it the right (but not the obligation) to sell bitcoin at a prespecified price in the future. For example, with bitcoin at $30,000, the miner may buy a put option with a strike price of $25,000, allowing it to sell bitcoin at expiry for $25,000 regardless of how low BTC falls (if BTC is above the strike at expiry, the miner simply lets the option expire worthless and only loses the cost of the option). Such transactions lock in a specific future price (in the case of a swap) or a minimum future price (in the case of a put option), enabling the miner to achieve a pre-set minimum profitability and ensure it will meet required cash outflows, even if it would have otherwise been unprofitable to mine. Lastly, a hedged bitcoin miner may actually benefit from a large drawdown in price, as the hedge will offset the fall in price, and the miner may also produce more bitcoin if the price decline causes a lower network hashrate and a higher miner hashrate market share.

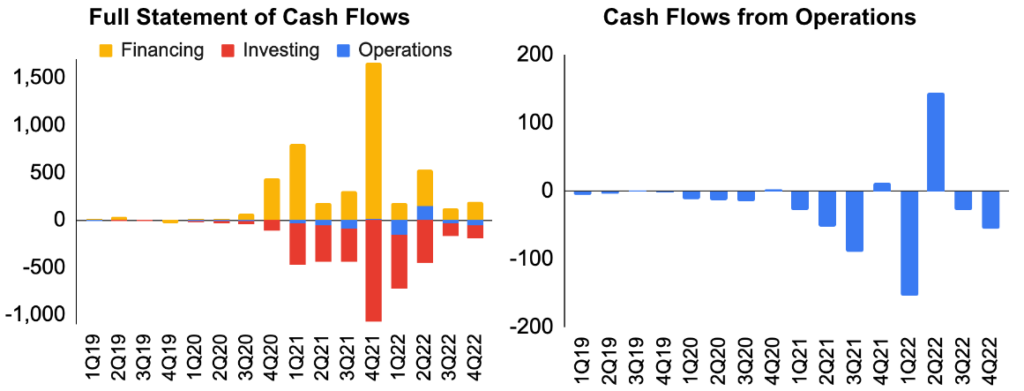

Note that hedging to ensure required cash outlays can be met is of particular importance for bitcoin miners given industry cash flow dynamics. Unlike other industries that can consistently self-fund via operations, miners often produce negative operating cash flow and have turned to financings or asset sales to generate cash. However, as we’ve seen in the latest downturn, debt and equity financing (included below in the cash flow from financing activity category) is not always available and a miner only has so many assets that it can sell (which typically occurs when asset prices are low; also, cash flow from investing activity is typically negative as miners use cash to buy rigs and facilities). As such, hedging is particularly important to ensure that cash flow from operations is at least breakeven and the miner generates enough cash to sustain itself even when the financing markets and asset sales are unavailable.

Industry Statement of Cash Flows (Net Cash Used/Provided By Source)

Source: Company websites, GSR. Note: Aggregates statements of cash flows from BITF, CLSK, HIVE, HUT, MARA, and RIOT.

Lastly, controlling for price risk is likely more important for bitcoin miners than for traditional commodity producers for several reasons. First, bitcoin exhibits greater price volatility than oil, and significantly so if we exclude the period around oil’s retrenchment into negative territory. This makes it more likely that the bitcoin miner will come under financial duress, all else equal. Second, unless offset by price increases or large declines in network hashrate, bitcoin mining economics are pre-programmed to fall due to the periodic halvings. As an example, we’re just 4.5 years away from the block reward falling by 75%, at which point the price of bitcoin will need to be $251,000 just to maintain current economics (using a current $30,000 price of bitcoin and Nicehash’s 800 EH/s April 2028 network hashrate forecast). Lastly, while there are plenty of potential positive catalysts, there are also many negative ones, and though unlikely, it is entirely possible that bitcoin falls to $15,000 and mining rewards are halved, a scenario that if of material duration, would likely cause many in the industry to fail. To say the least, it’s prudent to protect against this.

Improved Expansion Economics

In addition to ensuring the miner is a going concern, managing price risk can lead to improved economics around operational expansion. Look no further than E&Ps, who finance expansion efforts via inexpensive bank loans rather than issuing expensive debt or costly and dilutive equity as bitcoin miners do. And while the construct is the same – a large capital investment is required to produce a commodity asset at an unknown future price – banks are happy to lend to E&Ps as the E&P hedges future prices. Thus, with the bank knowing roughly how much oil and gas the E&P will extract and, thanks to the hedges, the price it will get for it, the bank can be reasonably assured that future cash flows are sufficient to service the debt.

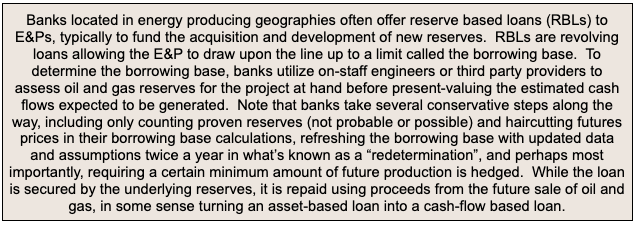

Spotlight on E&P Lending

Source: FDIC, GSR.

We see no reason why lenders won’t eventually offer similar cash flow-based loans to bitcoin miners. After all, a miner can hedge both the price of bitcoin and network hashrate so that the bank can be reasonably assured the cash flows generated by the new site/rigs can repay the loan. Admittedly, there are some differences, such as the oil and gas still remaining in the ground if something happens to the E&P, whereas a bitcoin miner can fry its ASICs, which then never produce any bitcoin. However, we don’t see any issues that can’t be overcome, such as with insurance in the case of damaged ASICs. To be clear, we do not expect such lending to occur anytime soon. In fact, we’ve spoken with many bank and non-bank lenders who are far from entertaining such lending, with reasons given ranging from regulatory uncertainty to substantial recent mining loan losses to a general belief that such lending is too risky (we actually think lending against hedged future production may be less risky than lending against ASICs that can go from $100/TH to $12/TH). Moreover, much of finance works this way, where future cash flows are accessed immediately for financing purposes, whether it be credit cards with master trusts, mortgages with mortgage-backed securities, or accounts receivable with factoring. Lastly, there are plenty of firms working on innovative financing solutions while we wait for the lenders to come around (see www.block.green for their innovative on-chain financing solution, or The Bitcoin Miner Toolbox section for an overview of the GSR Hedged Loan, which utilizes a costless collar on bitcoin collateral to enable a rock-bottom interest rate).

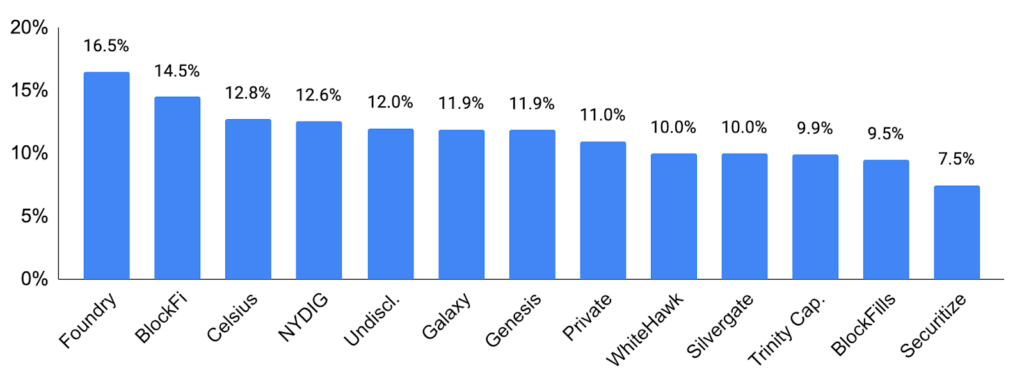

Bitcoin Mining Loan Interest Costs

Source: The Block Research, GSR. Note: Data is from 2021, when bitcoin miners were substantially more profitable and interest rates in general were substantially lower.

To drive home just how value-enhancing access to low-cost debt is, we show a simple earnings accretion model where capital is raised in three different ways: via a low-cost loan, a high-cost loan, and equity issuance. We assume $50m of funding is needed for a new project that will generate $20m of incremental run-rate revenue. As shown below, raising capital via low-cost debt leads to substantially higher earnings accretion compared to the other funding options, while equity issuance, which does not come with interest expense but does lead to an increase in the share count, results in the least amount of earnings accretion. Note that the industry funding mechanism du jour is the at-the-money equity issuance program, where a miner issues shares into the market at prevailing prices and dribbles them out gradually over time. While equity has the highest cost of capital, dilutes existing shareholders, and puts all the risk on them, it may be justified, particularly if lending markets are closed, as it may help a miner navigate a downturn with no contractual obligations (i.e., debt payments), and as expansion is necessary for survival. At any rate, a low-cost, cash flow-based loan would solve these issues and drastically improve expansion economics.

Earnings Accretion Using Various Forms of Capital Raises

Source: GSR.

Finally, hedging can improve the timing around when expansion projects are embarked upon and help improve decision-making and certainty around project returns. In fact, the current model of expanding more rapidly when industry profits are high is likely the wrong time to do so, as input costs are bid up and lower the projected return (it’s somewhat tantamount to buying high and selling low). Hedging can help smooth the timing of investment or let the miner invest when industry profits are low and the returns from doing so are at their highest. In addition, hedging improves decision-making and the certainty around returns. For example, a miner may issue equity via an ATM to finance a new site, but the project must have a return on invested capital that is greater than the cost of equity in order for it to actually create shareholder value. Whether this is the case, however, is unknowable in advance without hedging, meaning a miner may embark on an expansion opportunity that ends up destroying value. Instead, when a miner hedges volatile inputs like bitcoin’s price and network hashrate, it can lock in project economics, create sensitivity analyses by flexing unhedgeable inputs like uptime, better compare competing opportunities, and be assured that the project is creating rather than destroying value.

Increased Market Capitalizations

In theory, a stock is worth the present value of its expected future cash flows. However, due to the significant uncertainty in out-year estimates and immense sensitivity to key inputs like the discount rate, investment professionals often eschew discounted cash flow analyses for valuation multiples, which are in fact themselves simply a short-hand DCF. Valuation multiples bifurcate the price of a stock into historical or forward earnings (or revenue or EBITDA) and the multiple that the market ascribes to those earnings (or revenue or EBITDA). For example, if a stock is currently trading at $50 and the company is expected to make $5 per share next year, then the market currently ascribes a 10x P/E multiple ($50/5) to the company. When deciding whether to buy a stock, an analyst will typically set a price target derived from multiplying their forward EPS estimate from a detailed financial model by a target PE multiple, which is often based on historical multiples that are themselves determined by various drivers.

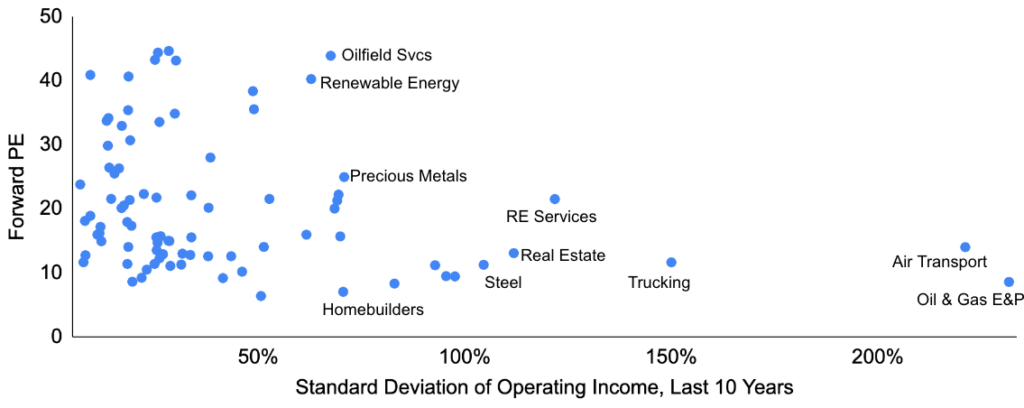

In our experience, there are three main drivers of valuation multiples: profitability, growth, and earnings visibility/volatility, with investors awarding a higher multiple to companies with high profitability, high growth, and high earnings visibility / low earnings volatility. Zeroing in on earnings visibility/volatility, as it is both particularly challenging for miners and able to be significantly improved upon via risk management strategies, we show the forward P/E multiple for various industries against historical earnings volatility and observe that industries with low earnings volatility tend to command higher valuation multiples and vice versa. And beyond our simple analysis, academic studies also find a significant negative relationship between earnings volatility and valuation after controlling for other variables like profitability, growth, leverage, etc.

Earnings Volatility vs. Earnings Multiple by Subsector

Source: NYU/Aswath Damodaran, GSR. Note: Forward PE data is as of January 2023. Excludes 12 subsectors with missing data or PEs over 50.

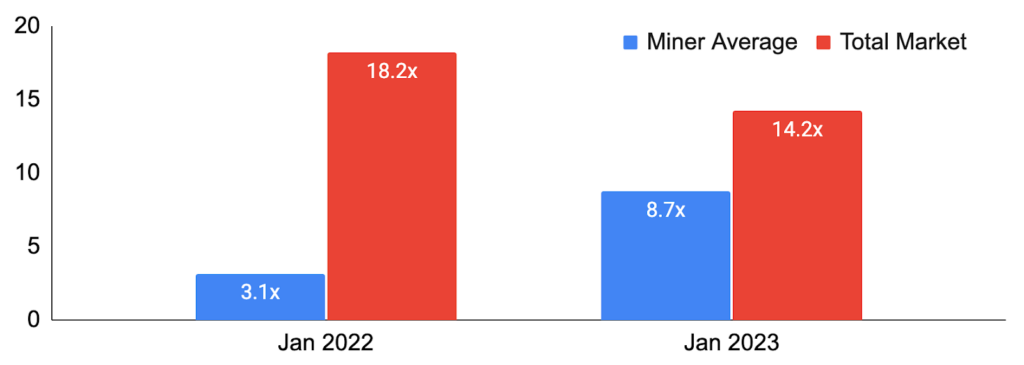

Unfortunately for the mining industry, earnings visibility is low and earnings volatility is high, due to the unpredictability and volatility of inputs like the price of bitcoin and network hashrate. As such, the market ascribes a lower multiple to the miners than it otherwise would. In fact, we believe low earnings visibility / high earnings volatility is by far the biggest reason for the industry’s low valuation multiples compared to the market. Put another way, we have tried many times to convince former buy side colleagues to invest in bitcoin mining stocks, but are frequently met with the common refrain that they don’t know if the miner will put up 90% mining margins or cease to exist in two years. Very simply, there is a huge uncertainty discount placed on miner earnings and on mining stocks.

Public Miner EBITDA Multiples vs. the Market

Source: B Riley, NYU/Damodaran, GSR. Note: Excludes negative valuation multiples. Miner average is composed of RIOT, MARA, SDIG, and GREE and uses forward EBITDA based on the current bitcoin price at the time. We show January 2022 and 2023 as we believe they are indicative of through-the-cycle valuation multiples. The constituents for miner consensus estimates have very high dispersion, and as such, we use estimates from B Riley, which we believe are particularly well modeled.

Fortunately for miners, hedging the price of bitcoin can materially improve earnings visibility and volatility, which should, in our opinion, lead to higher valuation multiples and higher stock prices. While there is no way to tell for sure, we believe it could be worth a couple turns on the multiple. Also note that positions are often sized based on volatility, as an investor only needs a small position to have the same potential impact when dealing with a highly volatile stock. Thus, even absent the higher multiple awarded to a more predictable earnings stream, reducing earnings volatility and resulting stock price volatility should theoretically lead to increased position sizes, greater demand for the stock, and a higher stock price.

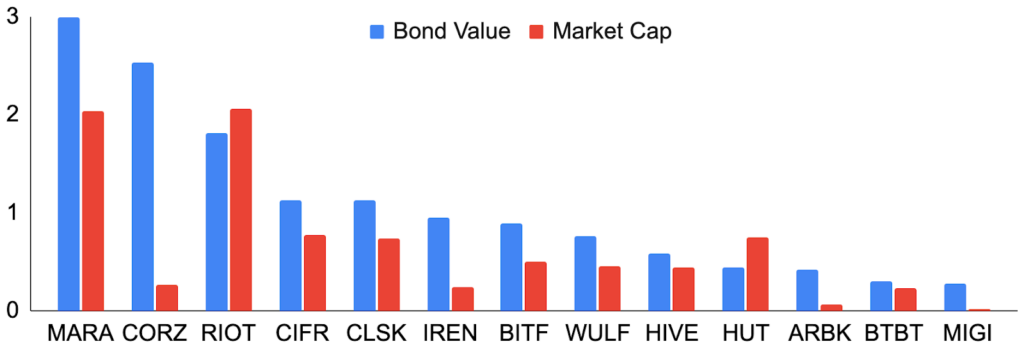

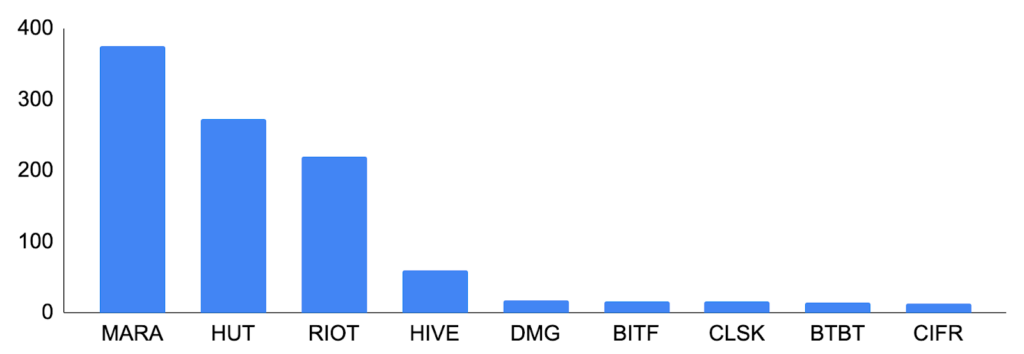

Finally, to illustrate just how large this uncertainty discount from poor earnings visibility/volatility is, we offer the following thought experiment, where we contend that if each miner were able to hedge energy costs, the price of bitcoin, and network hashrate into perpetuity, it would generate a known stream of future cash flows and effectively turn itself into a bond that would be easy to value and worth much more than their current market caps. To do so, we took recently reported installed hashrate for 13 public miners and calculated future earnings over the next 20 years before taking the present value, using the assumptions outlined in the exhibit notes below. We caution that results are highly sensitive to the inputs, particularly around future bitcoin price growth and the discount rate used, and the model is presented as a thought experiment moreso than a precise valuation model. Nevertheless, it suggests that removing uncertainty around miner future cash flows may unlock significant value for shareholders.

Miners Valued as Bonds vs. Current Market Caps, $b

Source: Google Finance, GSR. Note: Market cap data is from August 23, 2023. To calculate the “bond values”, we took recently reported installed hashrate for several large, public miners, and assumed 90% uptime before comparing to the average network hashrate during the month to get an operating hashrate market share for each miner. We then modeled each miner’s current hashrate market share to steadily double over the coming four years before flatlining its hashrate market share thereafter. We consider this a reasonable assumption, given historical public miner hashrate market share growth as well as recent large-scale expansion plan announcements. We next applied each year’s hashrate market share to total network production, including halvings as they occur, to get each miners’ annual production going forward. We then took a price of $30,000 per BTC and grew it by 25% annually to calculate each miners’ revenues. Finally, we assumed a 25% through-the-cycle profit margin and discounted these future cash flows at a 5% rate to get the present value of these future cash flows for each miner. We consider 5% an appropriate discount rate, given the certainty of the cash flows in this hypothetical example with earnings drivers hedged. Note that we only model out 20 years into the future, and therefore assign no value to earnings thereafter.

Self-Repaying Rigs and Leveraging Hedged Future Production

Beyond the immense benefits that hedging provides – going concern protection, improved expansion economics, and increased market capitalizations – derivatives open the door to new financial strategies that can further expedite growth. In what follows, we show how derivatives can be used to procure self-repaying rigs and how idle HODL can be turned into additional hashrate in a low-cost and risk-reduced fashion. Finally, while banks are not yet lending on hedged future production (like they do for E&Ps), we show how such a construct can throttle hashrate, HODL, earnings, and ultimately market valuations.

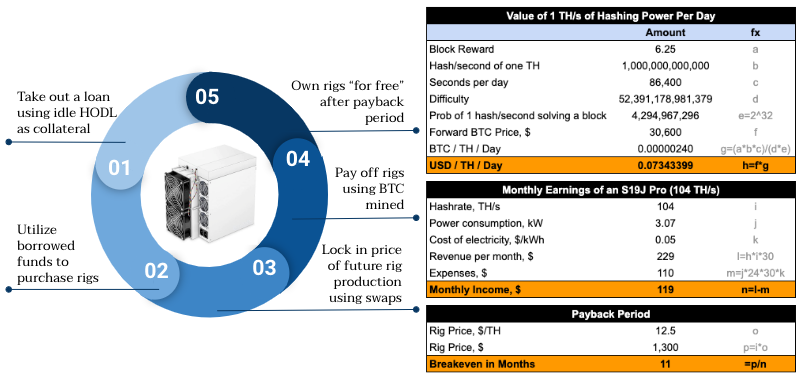

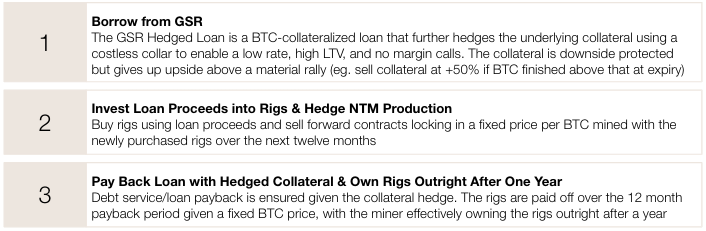

Self-Repaying Rigs

Miner returns from buying rigs may vary significantly from projected, depending on how the price of bitcoin and network hashrate unfold relative to expectations. However, miners may use derivatives to not only lock in future rig economics in advance, but do so in a way where the rig pays for itself over a locked-in payback period, effectively turning it into a self-repaying rig. To do so, a miner with idle bitcoin on balance sheet may borrow against their HODL and use the loan proceeds to purchase a new rig. Next, the miner may then estimate the number of BTC it expects to mine with the rig using the hashrate of the rig and its projection of network hashrate. The miner may then lock in the price it will receive for its expected bitcoin production from the new rig over the life of the loan using a swap or forward contract, and may optionally hedge network hashrate as well. Finally, the miner will pay off the loan using cash flows generated by the rig, paying back the loan in full and owning the rigs outright after the locked-in payback period. Such a strategy helps lock in expansion economics ex ante and effectively enables idle HODL to birth self-repaying rigs.

As an example, an S19J Pro (104 TH/s) is currently selling for around $12.50 per TH. Using the current network difficulty, a $0.05 / kWh electricity cost, and a $30,000 bitcoin price, a simplified calculation puts the payback period of the rig at 11 months. Adding in interest cost, and the earnings from the rig, which are now more certain given a fixed bitcoin price, fully pays off the loan that was used to purchase the rig over the one-year life of the loan. Thus, in a year the miner will be in the same state it started in (no debt, same HODL), but will own an additional rig.

Anatomy of a Self-Repaying Rig

Source: GSR. Note: For simplicity and given the uncertainty around future hashrate on the halving, we ignore the halving in this example. In addition, a higher energy cost will simply extend the payback period, while a lower energy cost will shorten it.

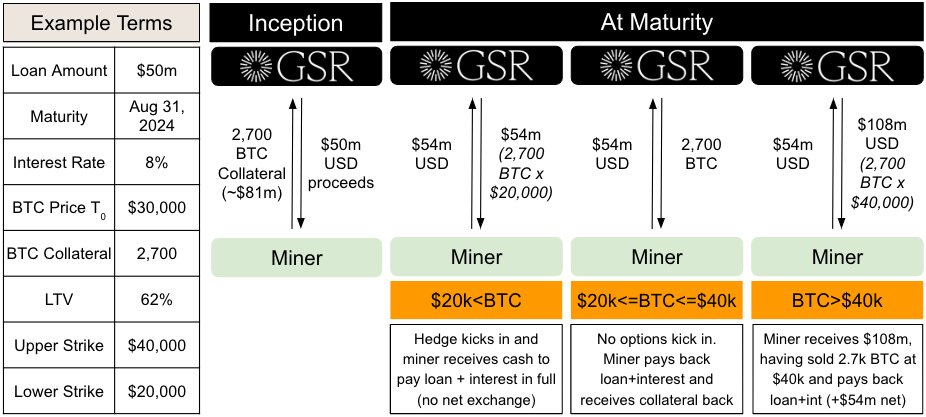

Self-Repaying Rigs en Masse

A miner doesn’t have to stop at just one self-repaying rig, and can in fact replicate this strategy in size simply by doing this for more rigs. One way to potentially reduce the risk around the strategy further is using a GSR Hedged Loan, which uses a costless collar on the bitcoin collateral to protect against downside, ensure loan payback, eliminate margin calls, and enable a low-interest rate in exchange for potentially giving up upside (we discuss the GSR Hedged Loan in more detail in the appendix). We believe such a loan reduces the risk inherent in leverage, thus minimizing the risk associated with this strategy.

Self-Repaying Rigs en Masse Strategy Overview

Source: GSR.

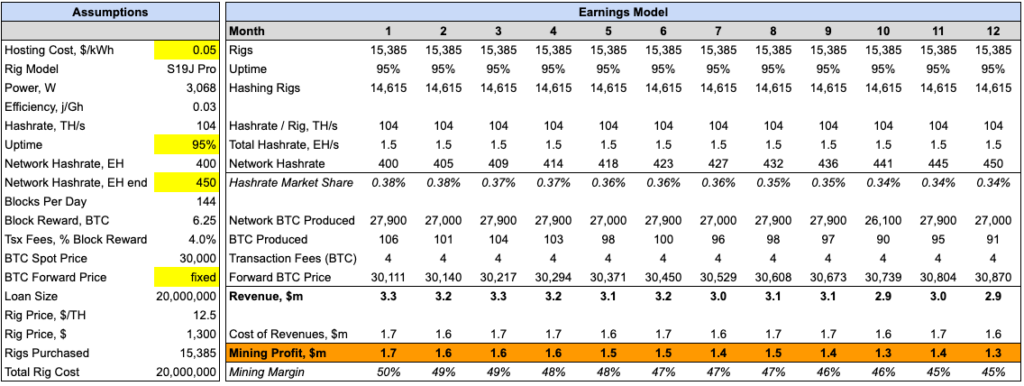

Adding in numbers and modeling out more fully compared to the simple payback period calculation above, a miner with 1,700 BTC in idle HODL worth about $50m can use a portion of it as collateral to take out a $20m loan. The miner may then purchase ~15,400 S19J Pros (104 TH/s) for $12.50 / TH or $1,300 each. The miner can then use the remaining HODL as collateral to sell forward the bitcoin it expects to mine with the newly purchased rigs to fix the price it sells its production for in the future, effectively locking in the cash flows to pay off the loan and allowing the miner to own the rigs outright after the payback period. Note that given current economics, a 15-month loan / 15 months of operating the rigs are required to pay back the loan and own the rigs in full, though this return period may be longer or shorter depending on miner-specific inputs like electricity cost and variables when it is initiated like the price of bitcoin.

Self-RePaying Rigs en Masse Strategy Financial Model

Source: GSR. Note: For simplicity and given the uncertainty around what network hashrate will do, we ignore the halving in this example. In addition, we assume that the network hashrate moves from 400 EH/s currently to 450 EH/s over the coming year, and also that the new rigs will be operated with 95% uptime.

The results are compelling. After the payback period, the miner will have an additional ~15,400 rigs producing 1.5 EH/s in additional hashrate. Thus, $50m in idle HODL has, in a risk-minimized and low-cost fashion, birthed 15,400 rigs with 1.5 EH/s in hashrate.

Self-Repaying Rigs en Masse Strategy Results (using $50m in HODL)

Source: GSR.

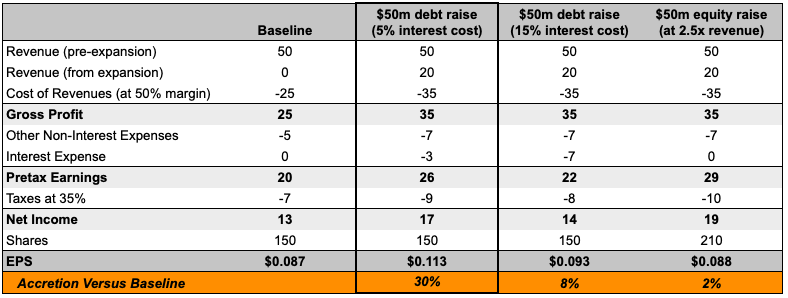

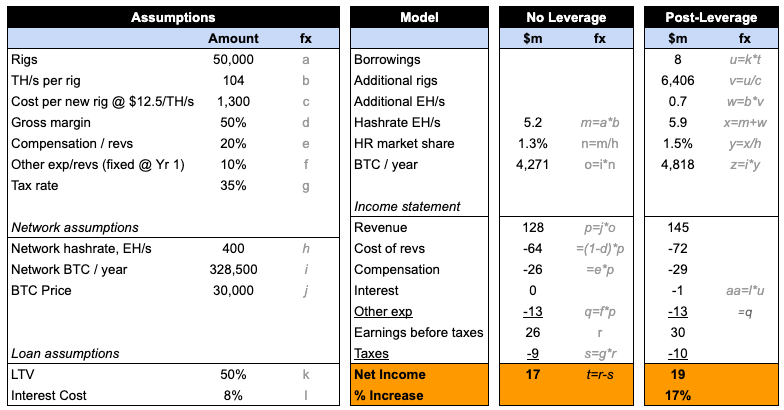

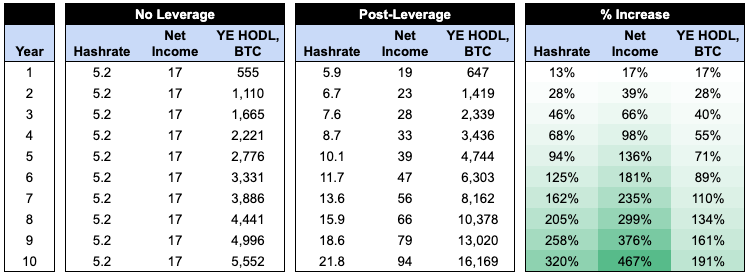

Leveraging Hedged Future Production

We believe banks or non-bank lenders may eventually lend against hedged future production, as they do with E&P energy producers. While not available now, we show the below model to demonstrate just how powerful such a construct is. Here, a miner with ~5 EH/s in hashrate and no leverage generates $17m in net income. But, if the miner is able to borrow against half of its future earnings, the miner may immediately increase its hashrate by 13% and net income by 17%.

Borrowing Against Hedged Future Production

Source: GSR.

In addition, the benefits of such a strategy compound over time. This is because a miner who borrows against hedged future production can grow faster now, which increases its earnings in a year, enabling it to borrow more a year from now, continually increasing the amount of hashrate it may add each year. In fact, a miner employing this strategy for ten years will increase its hashrate 4.2x, net income 5.7x, and HODL 2.9x compared to baseline.

Note a few items. First, and perhaps most importantly, such a construct levers up hashrate using future earnings, but arguably reduces risk given the presence of hedges. Second, the scenario where this strategy loses out is when the price of bitcoin expands very materially and the miner gives up significant upside; however, the miner may structure the hedge to capture upside and it’s also likely that over time any upside given up will be offset by its benefits during downturns. In addition, while hashrate expands significantly, net income expands even faster, due to the presence of fixed expenses. Lastly, for simplicity and to zero in on the impact of the strategy, we do not model halvings or changes in the price of bitcoin or network hashrate, though the impact of each would affect both the baseline and strategy scenario, producing similar results on a relative change basis.

Compounding Benefits Over Time

Source: GSR.

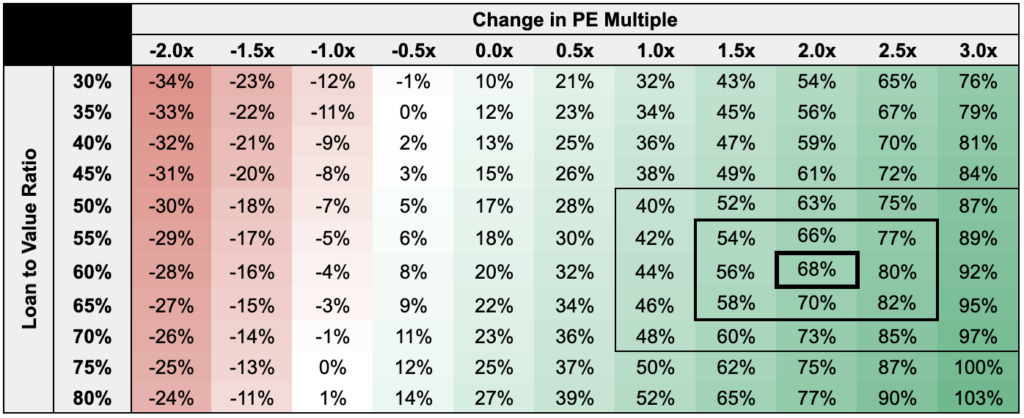

Finally, such a strategy will not only positively impact earnings, but it should have a positive impact on the multiple as well, given the faster growth and improved earnings visibility/volatility due to the hedges. As such, the higher earnings and higher multiple should lead to an increase in miner market capitalizations and stock prices. In fact, a miner who is able to borrow against future earnings at a 60% loan-to-value ratio and garnered a two turn increase in their PE multiple should theoretically see an immediate 68% increase in its stock price. Note that the increased earnings and higher multiple leading to a higher stock price applies to the self-repaying rigs en masse strategy as well.

Increase in Market Capitalizations

Source: GSR. Note: Calculation uses a starting point of 5.0x PE.

The Time to Act is Nigh

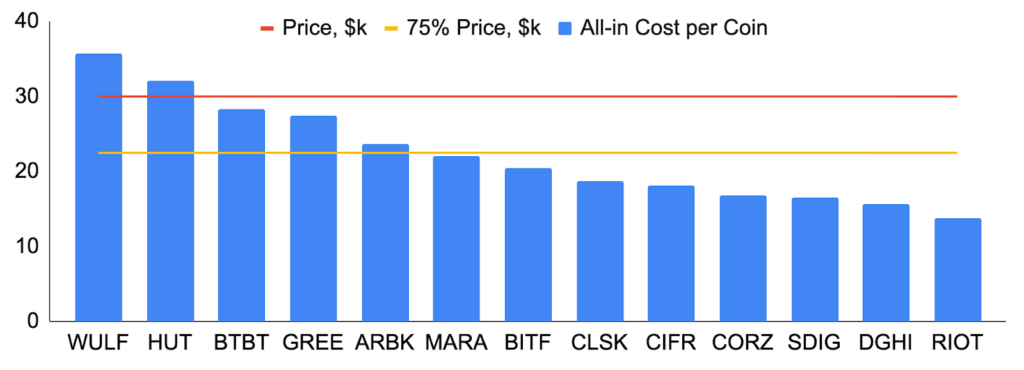

With the current price of bitcoin squarely above most miners’ fully loaded cost per coin, now is the perfect time to act. In fact, we were frequently rebuffed when speaking with most public miners in 2021 as they believed the price of bitcoin would continue its astronomical run. And while management teams began to appreciate the benefits of hedging after the large drawdown in 2022, bitcoin quickly sank below many of their fully loaded costs per coin, providing a large disincentive to hedge and lock in losses. Now, with miners in a much better financial position and with the current price of bitcoin above mining costs, many management teams are actively evaluating their risk management strategies.

Estimated Fully Loaded Cost per Coin vs. BTC Price

Source: TheMinerMag, GSR. Note: Estimates by TheMinerMag.com and are for 1Q23. All-in mining costs include the cost of bitcoin production as well as corporate overhead and financial expenses.

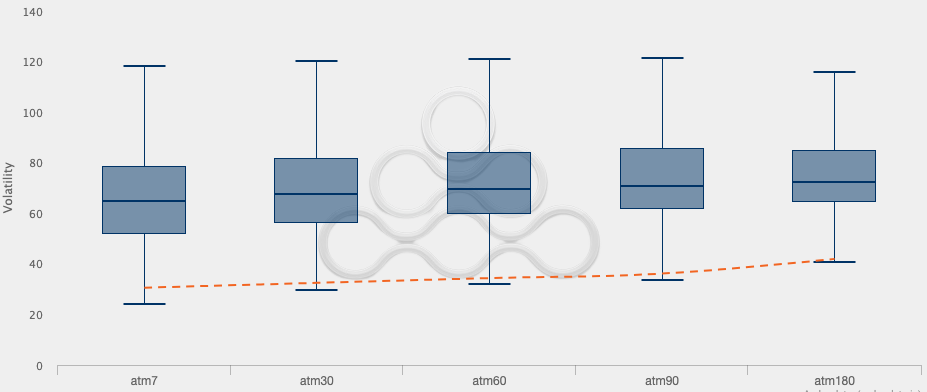

In addition, now may also be the perfect time to act as hedges are cheap by historical standards. In fact, options implied volatility, essentially the market’s view of what volatility of the underlying will be over the life of the option and a way to think about the expensiveness of the option, is in the single digit percentile of its history, meaning it’s almost never been cheaper to enact such a strategy.

BTC Options Implied Volatility Versus History (Since 2019)

Source: Amberdata, GSR. Note: The chart depicts the boxplots of ATM volatility in constant maturity. Besides the information about the percentile distribution (0.25, 0.50, 0.75), the lower and upper fences are calculated using the standard metrics of Q1 – 1.5 * IQR and Q3 + 1.5 * IQR (where IQR = Q3-Q1). This tool helps to identify cheap/rich implied volatility compared to its historical values. The dotted line represents the current value, as of August 8, 2023.

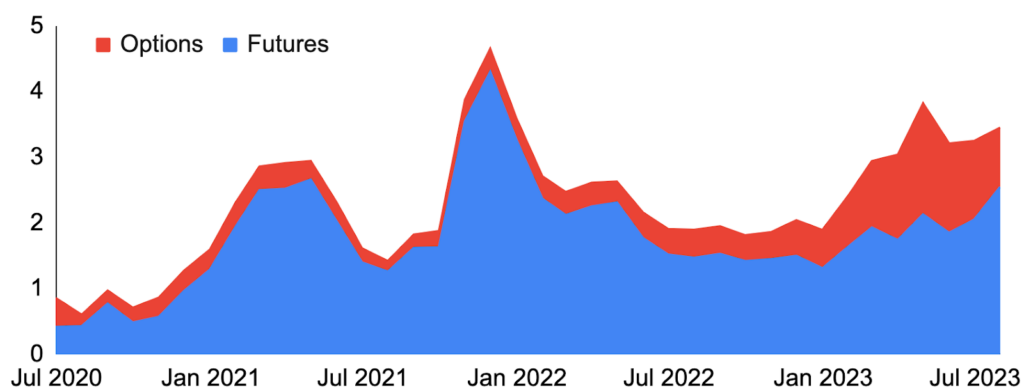

Lastly, the derivatives market continues to grow and develop and is now able to support such miner hedging, just as we saw with E&Ps. Indeed, E&P hedging accelerated after the introduction of crude oil benchmarks like West Texas Intermediate (WTI) in the 1980s, but it wasn’t until three events brought about institutional investor demand to form the other side of the market to natural producers. First, new financial products on broad-based commodity indexes and the deregulation of commodity markets led to increased broker-dealer activity and improved market access. Second, transparency and usability also improved as markets transitioned from the pits to computers. And third, commodities, in general, began to be seen as a separate, investable asset class, leading to billions in demand. We believe we are at a similar point in the market with natural producers and institutions with bitcoin.

Open Interest of CME Bitcoin Futures and Options, $B

Source: The Block, GSR. Note: Options OI is not delta adjusted and thus OI across options and futures does not denote equivalent economic exposure.

All in, the bitcoin mining business model is an attractive one, but one fraught with unique challenges – challenges that can be materially mitigated by porting in best practices from more mature commodity producers like E&Ps. By hedging price risk and other volatile inputs, miners will help assure their survival no matter the depth and duration of the next inevitable downturn. Moreover, finally able to know project returns in advance, miners may optimize decision making and lock in expansion economics to engage in the highest value-accreting opportunities. Also, with hedging providing a secondary source of repayment, miners can access inexpensive capital to expand hashrate in a low-cost and risk-reduced fashion. And, improved earnings visibility / volatility should help miners no longer be seen as just levered plays on bitcoin, but rather as serious businesses with a steady and repeatable business model, resulting in higher valuations and share prices. Finally, in a commodity industry where the merits of various competitive strategies are difficult to ascertain in advance, porting in such strategies represents one of the few distinct competitive differentiators. So with the economics and cost of hedging right and the many vital benefits doing so bestows, miners may finally be ready to live the mantra “if you’re not hedging, you’re speculating.”

APPENDIX A: About GSR Mining Financial Services

Founded in 2013 and with over 225 employees around the globe, GSR is a top digital asset market maker and OTC derivatives trading firm. GSR provides financial services to miners, helping them programmatically liquidate bitcoin, generate yield on HODL, and hedge against price declines. Quite uniquely, GSR operates as a principal, allowing us to provide hedges in greater size/duration than most and to offer innovative products such as Average Price Options that are cheaper and better match miner production as well as a new hedged loan product with a low interest rate, no margin calls, and an attractive LTV. GSR employs a risk management-first stance, and typically faces large miners via ISDAs and tri-party arrangements.

APPENDIX B: The Bitcoin Miner Financial Toolkit

We review the basic financial tools for miners before highlighting a few unique structures that may be particularly helpful. The basic building blocks include:

- Programmatic Liquidations: Miners may work with a trading firm to sell bitcoin via a programmatic liquidation. Such a sale takes large orders and algorithmically breaks them into pieces and executes them across multiple venues to limit the market impact of selling. Miners pay a nominal fee for such sales, which is overwhelmingly outweighed by a materially reduced price impact.

- Yield Enhancement: Instead of the aforementioned put options, which gives the put buyer the right to sell the underlying at a prespecified date and price, a miner may sell a call option, which gives the call buyer the right to buy the underlying at a prespecified date and price, in order to generate income from the sale of the option. Miners will typically sell options with a strike price significantly above spot, known as out-of-the-money, and will be obligated to sell the underlying bitcoin at expiration should the owner execute the option. The premium the miner receives for selling the option generates yield on the underlying bitcoin, currently around 5-20% annually depending on the strike price and expiration date, with a lower strike price and longer time to expiration resulting in a higher premium. For example, with bitcoin at $30,000, a miner may sell a call option on one BTC with a strike price of $40,000 and expiry of one month in exchange for receiving an upfront premium, which when annualized and compared to the one BTC notional, equates to an annualized yield. If BTC is less than or equal to the $40,000 strike price on the expiration date, the miner does not have to do anything, and is simply left with the premium it had collected. However, if bitcoin is above $40,000 upon expiry, the miner keeps the premium but must sell one BTC at $40,000, effectively losing out on upside beyond the strike price. Selling out-of-the-money call options, a strategy known as covered calls or call overwrites, turns idle HODL into a productive asset, and works out particularly well for miners who are often happy to formulaically sell bitcoin after a rally.

- Futures, Forwards, and Swaps: We have thus far spoken about futures, forwards, and swaps fairly interchangeably, as they all accomplish the same goal of locking in a price for the asset at hand. Without getting into the details, the differences revolve around whether it is traded on an exchange or bilaterally, how frequently it settles, and the degree of customization. One criticism of futures, forwards, and swaps as it pertains to hedging is that it locks in future economics, thus eliminating the ability to participate in upside for the protection buyer should the underlying asset move in its favor. One common retort, however, is that a commodity producer doesn’t have to hedge all of its production, which enables it to still benefit from rising prices.

- Hashrate Derivatives: There are a number of firms offering hashrate derivatives, some physically-settled and others cash-settled, though to our knowledge, uptake until recently has been quite low. One offering that is seeing solid activity is Luxor’s Hashprice Non-Deliverable Forward (NDF). Luxor’s product allows miners to hedge against changes in hashprice, which quantifies how much revenue one PH/s of hashrate will generate each day. As hashprice is a function of bitcoin’s price, network difficulty, the block reward, and transaction fees, hedging with a Hashprice NDF allows miners to hedge all four variables at once. While the price of bitcoin is the most volatile and unpredictable input into mining economics in our view, changes in network difficulty are also very impactful, and particularly so over the medium to long-term when network hashrate can move substantially more than expected, thus making network hashrate important to hedge as well. Moreover, when combined with a forward, the Hashprice NDF can be used as a funding mechanism with the added benefit of downside protection for the miner.

- Energy Derivatives: In addition to hedging against factors that impact revenue, many miners hedge against factors that impact costs as well, with energy prices the main example. Most energy price hedging is done via a Power Purchase Agreements (PPA) between the miner and its energy provider, where longer-term, fixed price PPAs are preferable when possible given the volatility of energy prices. Outside of PPAs, some miners have looked to hedge the price of natural gas, as it is a large input into electricity prices, though we do not believe this to be prevalent throughout the industry.

- Others: In addition to the above, we zero in on a few derivatives strategies below that may be particularly helpful.

Average Price Options

There are various types of options available, most notably American options, European options, and Average Price Options (APOs). Both American and European options compare the spot price of the underlying to the strike price when determining intrinsic value, though American options can be executed anytime on or before expiry while European options can only be executed upon expiry. Average Price Options, by contrast, compare the average price of the underlying over the life of the option to the strike price to determine its value at expiry. This has two main advantages for miners. First, since miners constantly produce bitcoin throughout the month, the average price better matches the price at which the miner produces bitcoin, making it a much better hedge for miners who sell BTC when produced. For example, with bitcoin at $30,000, a miner who is constantly producing and selling bitcoin throughout the month could buy put options to hedge its production with a strike price of $20,000. In an extreme example, bitcoin could fall to $1,000 for the entire month before recovering to $20,000 on the expiry date. If the option was a European option, it would expire worthless, as the spot price at expiry matched the strike price, making the European option ineffective as a production hedge. However, if it was an average price option, the average price for the month would effectively be $1,000, and the miner would make $19,000 per bitcoin hedged less the cost of the option ($20,000 strike price – $1,000 average price), offsetting the decline in mining revenue below the $20,000 price point and proving to be a much more effective hedge. The second reason why APOs are a good choice for miners is that the average price is much less volatile than the spot price, and as volatility is a main determinant of options pricing, APOs are much cheaper than European or American style options. Below we show a comparison of recent example pricing for APO puts vs. European puts with different strike prices and tenors. The APO is significantly cheaper in every case, offering a 40-85% discount to a comparable European option. Finally, note that most options in crypto are far and away European style, and very few trading firms offer APOs. GSR co-underwrote the first APO in the space and has consistently underwritten them since.

Average Price Options

Source: Santiment, GSR. Note: Pricing uses a $30,000 price of bitcoin and is for illustrative/educational purposes only.

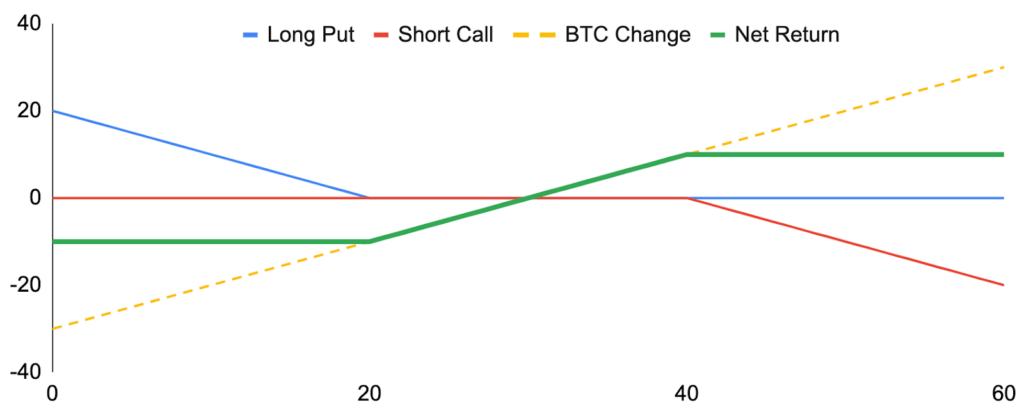

Costless Collars

While swaps require both parties to exchange cash flows and thus fully lock in future prices, some market participants prefer options, as it confers the right, but not the obligation to transact for the option buyer. Buying an outright option on bitcoin, however, can be expensive given the high volatility of bitcoin. As such, a miner may use a strategy known as a costless collar, where it sells an out-of-the-money call option and uses the premium generated from the sale to finance the purchase of a protective put. In doing so, the miner protects against large losses in exchange for giving up some upside. For example and as shown below, with the price of bitcoin at $30,000, the miner may sell a call option that expires in one month (or any expiration they choose) with a strike price at $40,000, obligating the miner to sell bitcoin to the buyer for $40,000 should bitcoin move above $40,000 at expiry. The miner will then use the premium it received for the call option to finance the purchase of a put option, say, with a strike price of $20,000. Thus, if the price of bitcoin falls below $20,000 at expiration, the miner will be able to sell bitcoin at $20,000 at expiry. Note that put and call strikes can be customized based on risk appetite, desired upside capture, and desired cost, and can even be set up to have a negative cost (ie. the miner can get paid to hedge by selling more expensive upside participation to finance cheaper downside protection). Moreover, there are various strategies that uniquely fit well with miners, such as selling an out-of-the-money European call option, which generates a higher premium given the greater volatility of spot bitcoin, and buying an APO put option, which will be cheaper and better hedge mining revenues. Such a strategy enables the miner to increase the call strike price for greater upside participation, increase the put strike price for greater downside protection, or some combination of both.

Costless Collar Payoff Diagram, $Thou

Source: GSR.

The GSR Hedged Loan

The GSR Hedged Loan puts a twist on typical bitcoin-backed loans by adding a costless collar to protect the collateral, ensure loan payback, and enable a rock-bottom interest rate. In effect, the collateral hedge provides “optionality”, protecting the miner if bitcoin falls below the lower strike in exchange for giving up some of the upside upon a very material rally. Other significant benefits versus a traditional loan include a relatively high loan-to-value, no margin calls, and advantaged tax treatment. In addition, loan terms are customizable, so loan pricing and upper/lower strikes can be changed depending on miner goals.

The GSR Hedged Loan Payoff Diagram

Source: GSR.

Finally, while some derivatives strategies such as buying a put option do not require collateral, strategies where the miner inherits an obligation do (i.e., is short an option). As such, miners with bitcoin on balance sheet are able to access a much wider array of value-preserving and enhancing derivatives strategies, including access to cheap capital and self-repaying rigs, a larger array of downside protection strategies, and the ability to generate yield…in addition to having an additional buffer during industry downturns and a greater ability to take advantage of opportunities as they arise. We believe this provides miners with HODL with a large advantage. That said, HODLing isn’t for everyone, and if a miner is unwilling or unable to hedge, we actually prefer that miners sell bitcoin when it is mined as selling over time is a form of risk management – an almost reverse-dollar cost averaging if you will – while miners who HODL without hedging are often most able to HODL when the price of bitcoin is high and forced to sell when mining economics fall and the price of bitcoin is low, systematically ingraining a buy high – sell low strategy if anything goes wrong.

Bitcoin on Balance Sheet, $m

Source: TheMinerMag, GSR. Note: Amount of bitcoin on balance sheet represents the most recently reported number of bitcoin valued at $30,000 per BTC.

Note: The authors would like to thank Lucas Pipes of B Riley for helpful conversations and feedback on the miners.

Footnotes:

1 37 of 41 US and Canadian independent crude oil producers tracked by Woods MacKenzie used swaps or options for oil price hedging purposes as of 2Q22, while 39 of 41 US and Canadian independent natural gas producers used swaps or options to hedge gas prices as of 2Q22.

2 Many institutions are structurally limited to holding futures or futures-based ETFs, which has caused the basis to trade at a premium, compared to other commodities where supply shocks can cause steep backwardation.

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Disclaimer

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.