Bitcoin and Ethereum

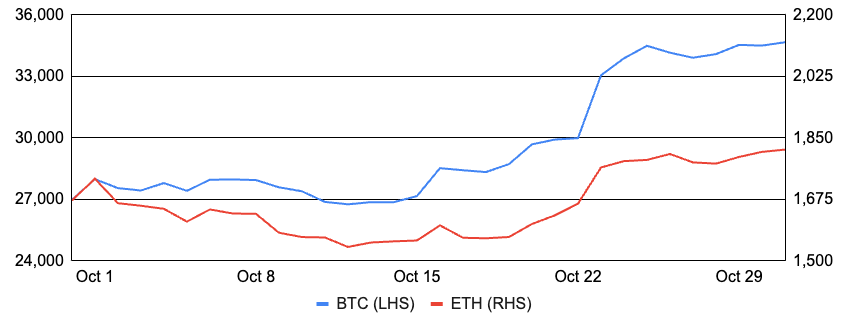

Bitcoin gained ~29% during October after entering the month around $27,000 and finishing at ~$34,700. Performance trended sideways until mid-month when speculative euphoria around a spot Bitcoin ETF approval gained steam and prices rallied sharply despite little material news, discussed more below. Bitcoin’s performance decoupled positively from other cryptocurrencies during the month, outperforming the field with the exception of a few alts like Solana, and bitcoin dominance rose to its highest level in ~2.5 years as it temporarily breached 54%. In addition, bitcoin’s correlation to ETH fell to its lowest level since the regional banking crisis earlier this year where bitcoin similarly outperformed. In development news, Nomic’s bitcoin bridge went live and its bitcoin-backed nBTC token is now transferable in the Cosmos’ ecosystem via IBC, with native bitcoin deposits/withdrawals collectively managed by Nomic validators. Lightning Labs unveiled the mainnet alpha release of Taproot Assets, a protocol designed to facilitate asset tokenization on Bitcoin that’s interoperable with the broader Lightning Network. Lastly, BitVM was proposed for arbitrary computation on Bitcoin, covered more below. In other Bitcoin news, MicroStrategy acquired 155 bitcoin during the month, Tesla maintained its bitcoin through Q3, and the Bitcoin whitepaper turned 15 years old.

Ethereum failed to keep pace with bitcoin and many other alts, though it did gain ~9% during the month after entering October around $1,670 and finishing at ~$1,820. ETH’s supply increased for the second consecutive month, as net supply grew by ~30.7k ETH despite net issuance flatlining in the final third of the month as gas prices picked up. Ethereum has now absorbed the massive influx of staking demand that materialized after the introduction of withdrawals in April, and queues to enter or exit Ethereum’s validator set are now empty. Turning to protocol development, progress continues to be made testing the Dencun upgrade that will include proto-danksharding and will expand Ethereum’s data throughput, but the upgrade is expected to come later than initially anticipated, likely towards the end of Q1. There was also an interesting pull request merged into Ethereum’s consensus spec allowing clients and node operators to optionally ignore late blocks under certain conditions to incentivize timely block dissemination.1 Another major theme during the month was L2 development, with Scroll launching its zkEVM, Base open-sourcing its code base, Optimism adding fault proofs to testnet, and Manta announcing plans to shift from the OP Stack to the Polygon CDK. In addition, L2Beat penned a critique of TPS as a faulty measure of throughput that is worsening as account abstraction proliferates, and Vitalik authored a blog post on L2s. Liquid staking and Lido’s dominance was another topic of fierce debate, and the Arbitrum and Aave communities each took small stands against its growing dominance during the month.

BTC and ETH

Source: Santiment, GSR.

Perceived ETF Progress and Market Dynamics

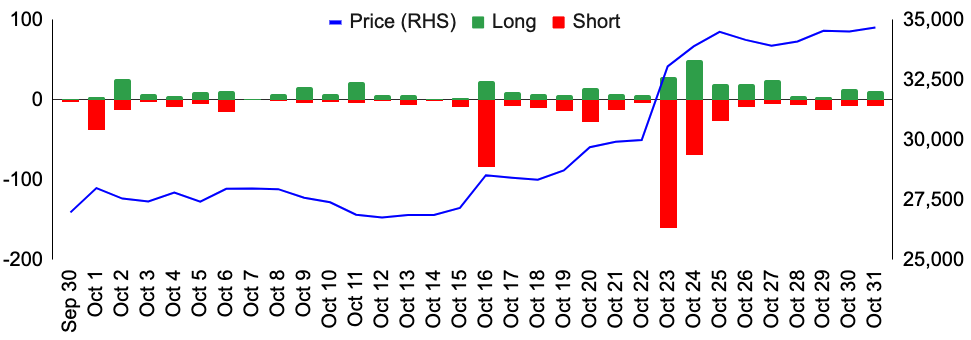

On October 16th, Cointelegraph falsely tweeted that BlackRock’s iShares Bitcoin Trust had been approved by the SEC, and BTC quickly gapped 6% higher. While the news was soon proven untrue, it demonstrated the positive impact an approval may have on BTC’s price, and the market spent the rest of the month bidding up perceived ETF progress. For example, a tweet pointing out that BlackRock’s ETF was listed by the DTCC, a key piece of US market infrastructure, made the rounds on October 23rd, and while the listing had actually been there since August and the DTCC stated it was part of normal procedure and not indicative of approval, BTC still increased 10% on the day. To be sure, there was some modest procedural progress towards a spot ETF, such as BlackRock amending its filing to say it would likely seed its ETF in October and the DC Circuit Court of Appeals formally closed the Grayscale case to kickstart the SEC’s reconsideration of Grayscale’s bid to convert GBTC to an ETF. However, the move to us was more about exuberance around an approval and what it may do for bitcoin’s price rather than demonstrated progress towards an approval or increased odds thereof.

In addition to the excitement, much of the move was also likely due to market positioning and hedging activities. Short dealer gamma positioning, which requires dealers to buy (sell) the underlying when prices move up (down) to maintain delta neutrality, was said to exacerbate the move. And many were caught offside, with over $300m of total liquidations during a 24 hour period spanning October 23rd and 24th.

BTC Liquidations vs. Price

Source: Coinglass, Santiment, GSR.

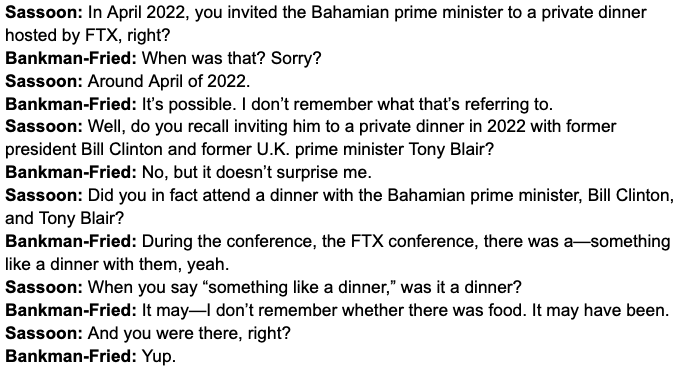

Sam Bankman-Fried Guilty of Fraud

October also featured the highly anticipated trial of Sam Bankman-Fried, where the former FTX founder was accused of fraud and conspiracy. The trial started out with senior leaders from FTX and its sister company Alameda Research testifying against SBF. Former CTO Gary Wang admitted that Alameda used customer funds for its own purposes, former director of engineering Nishad Singh stated that he knew $8b of FTX customer money had gone missing, and ex-Alameda Research CEO Caroline Ellison stated that SBF directed her to commit crimes. Ellison also made several salacious allegations, claiming that SBF paid a $150m bribe to Chinese government officials to access $1b in frozen funds, and that she and SBF conspired to keep BTC below $20,000. Perhaps the highlight of the trial was SBF himself testifying in his own defense, where he attempted to place the blame on his colleagues, but frequently was unable to remember any details.

In the end, 12 jurors took less than five hours to unanimously find SBF guilty on all seven counts of fraud. He now faces up to 110 years in prison, with sentencing scheduled for March, though the timing could change as federal prosecutors also plan to hold a second trial regarding alleged bribery, bank fraud, and campaign finance violations.

SBF Testimony in United States of America v. Samuel Bankman-Fried

Source: BitMEX Research, GSR.

Celestia’s Mainnet Launch

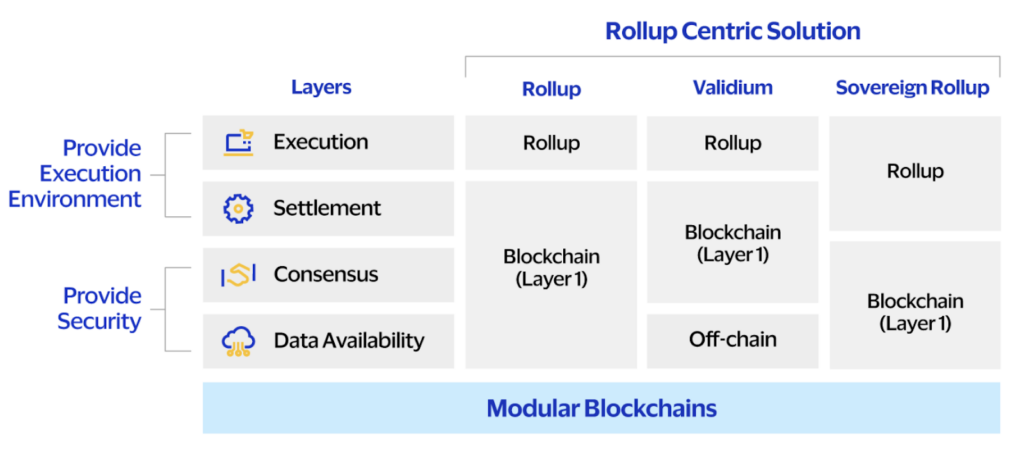

Nearly five years after the LazyLedger (now Celestia) white paper described a blockchain optimized strictly for transaction ordering and data availability, the modular era kicked off in earnest with Celestia’s mainnet launch and the airdrop of its TIA token.2 Unlike most familiar layer 1 blockchains like Bitcoin and Solana, which are monoliths and facilitate consensus, data availability, execution, and settlement directly on mainnet, Celestia has pioneered a less encompassing modular architecture optimized specifically for enhanced data throughput without providing settlement or execution functionality directly. Celestia’s modular design enables other chains to leverage its best-in-class data throughput while maintaining autonomy to choose amongst other optimized execution and settlement layers.

In simplified terms, Celestia can be viewed as a large, public bulletin board that provides consensus on transaction ordering and guarantees that data was made publicly available, but it has no ability to interpret the data posted to it and relies on other blockchains to interpret the data and execute transactions accordingly. Forgoing execution in this regard enables meaningful scalability improvements as block verification (validity) reduces down to verification of data availability, which can be achieved probabilistically via sampling techniques. In short, Celestia leverages data availability sampling (DAS) to allow light clients to ensure all the data was made available while only sampling some of it3; a key distinction from legacy blockchain designs built on the premise of every participant downloading all historical data. Indeed, DAS has been described as the feature that could invert the blockchain scalability trilemma as a highly decentralized set of light clients allows for larger blocks to be sampled while statistically preserving data availability guarantees, improving scalability without sacrificing security.

Modular Blockchains

Source: Visa, GSR. Note: As more modular components come to fruition, more hybrid solutions, like Eclipse, may emerge.

Arbitrary Computation on Bitcoin with BitVM

Robin Linus released the BitVM whitepaper on October 10, describing a method enabling arbitrary computation and the ability to solve any problem on Bitcoin (i.e., making Bitcoin Turing complete). BitVM is highly complex and uses logic gates and the universal gate NAND to function similarly to an optimistic rollup – computation occurs offchain, avoiding congestion on the network, and Bitcoin can verify that the computation was done correctly. And perhaps most importantly, BitVM is available now and does not require a soft fork to work.

BitVM received widespread praise and enthusiasm, though there are a number of current limitations that many believe to be temporary. First, BitVM is restricted to two parties, so multiparty smart contracts are not currently possible. In addition, every smart contract interaction between two parties requires a new Bitcoin transaction, making smart contracts one-time use. Lastly, BitVM is highly complex with high data requirements, leading to high costs, especially in the event of a dispute. Despite these limitations, however, many believe they will ultimately be overcome with time and allow BitVM to one day bring step-change functionality to the world’s largest cryptocurrency network.

The BitVM Whitepaper

Source: BitVM.org, GSR.

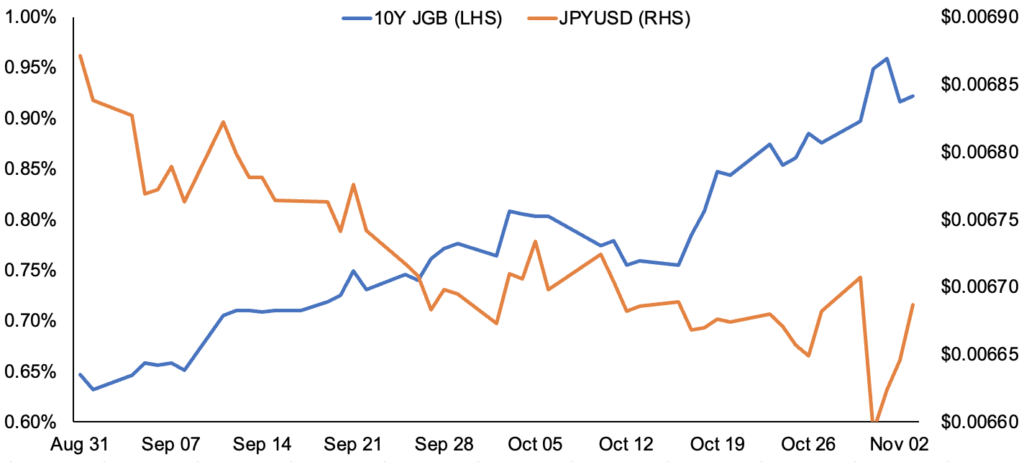

Monetary and Fiscal Policy

It was another prominent month for monetary and fiscal policy developments, particularly during the final week of October and into early November. Notably, the Bank of Japan (BoJ) took another step towards slowly dismantling its unconventional stimulus and yield curve control policy. While the BoJ kept its short-term and long-term target rates unchanged as expected, it backtracked on its rigid plan to defend the 1% yield level on the 10Y JGB, rephrasing the 1% cap “as a reference” upper bound and softening its hardline defense established just three months earlier. The BoJ also revised higher its 2024 and 2025 inflation forecasts, further foreshadowing a likely end to stimulative policy in the months ahead.

Other central banks, including the Fed, ECB, and BoE kept policy rates unchanged, but treasuries rallied sharply in response to Powell’s commentary that many observers called a dovish pivot despite Powell’s warning that rate cuts are not yet being considered at all. Still, Powell noted that higher long-term interest rates may weigh on economic activity, and inflation appears to be moderating while the labor market is showing early signs of softening from very tight levels. Treasury yields fell across the curve, especially on the longer-end as the Treasury’s newly-revealed Q4 financing plans included more short-term bills to reduce the supply pressure on the longer-dated bond market.

10Y Japanese Government Bond Yields Rise and JPY Depreciates vs USD

Source: Marketwatch, GSR.

Footnotes:

- The high-frequency MEV arena is one motivation for this upgrade as proposers are incentivized to delay block publication as long as possible to extract the most MEV. This change to the spec should help provide a balancing force here.

- Prior to the launch of Celestia, modular blockchains were commonly viewed through the lens of Ethereum rollups, which are modular execution environments that rely on Ethereum for consensus, data availability, and settlement. Celestia’s modular data layer expands the scope of the modular ecosystem as it previously existed. Indeed, with data throughput being the primary constraint on scaling via L2 rollups today, Celestia’s role as the first modular data layer leveraging data availability sampling is a big win for blockchain scaling endeavors generally.

- Ethereum’s scaling roadmap will similarly introduce DAS in its danksharding upgrade to increase its own data availability throughput and decrease the data posting costs for rollups. We describe data availability sampling and erasure coding in greater detail in our Ethereum Roadmap report. The primary distinction is that Ethereum will use KZG commitments to ensure that data was encoded correctly, whereas Celestia relies on fraud proofs. Danksharding is also years away, so Celestia will enable greater data throughput than Ethereum for several years, at a minimum.

GSR in the News

- Business Wire – GSR Receives In-Principle Approval from the Monetary Authority of Singapore

- Cointelegraph – Crypto liquidity provider GSR receives regulatory approval in Singapore

- CryptoNews – Crypto Trading Platform GSR Receives In-Principal MPI License in Singapore

- Blockchain.news – GSR Secures Major Payment Institution Licence from Singapore’s MAS

- Forbes India – GSR Secures Regulatory Approval As Crypto Liquidity Provider In Singapore

- Investing.com – GSR Secures Regulatory Approval As Crypto Liquidity Provider In Singapore

- CoinDesk – Crypto Prime Broker Membrane Labs Raises $20M From Brevan Howard, Point72 Ventures and Jane Street

- CoinDesk – First Mover Americas: Bitcoin Extends Decline for a Fifth Day, Touches $26.6K

- Blockchain News – GSR Secures Major Payment Institution Licence from Singapore’s MAS

- CoinDesk TV – GSR Markets President on Bitcoin’s Role in Geopolitical Conflicts

- CoinDesk – Crypto for Advisors: What Will Trigger Crypto Mass Adoption?

- Bloomberg – A Year After FTX, Crypto Market Makers Adapt to Survive

- Bloomberg – Bitcoin’s ETF Momentum is Spurring the Biggest Monthly Gains Since January

- Blockworks – Bitcoin faces ‘upside catalysts’ in the next few months

- CMC – GSR: Lido DAO’s Staking Dominance

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View October 2023 Market Update

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.