Bitcoin and Ethereum

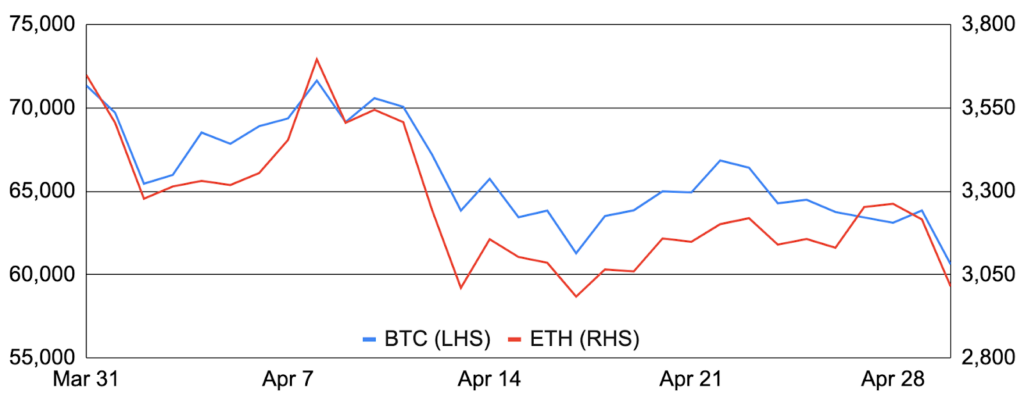

Bitcoin entered April around $71,300 and ended the month at ~$60,600, decreasing 15% for its first monthly decline since August. While several pieces of positive news led to temporary price reprieves (egs. Genesis finished redeeming GBTC early in the month; Bitcoin completed its fourth halving on April 20th and the runes fungible token standard launch temporarily increased network fees), Bitcoin spent most of the month trending downward as several key variables steadily worsened. First, worries that persistent inflation could cause the Fed to delay rate cuts increased as key inflation readings came in hotter than expected. In addition, inflows into the US spot Bitcoin ETFs steadily worsened throughout April culminating in $450m of total outflows for the month, as flows are proving to be retail-driven and therefore fairly volatile and price-dependent. Lastly, Bitcoin was negatively impacted by several other notable items, such as material stock market underperformance mid-month, rising tensions in the Middle East, and news of Mt Gox creditors starting to receive updates and/or disbursements. Outside of market related news and the halving / runes launch covered more below, there were several notable items during the month, including: Bitcoin futures trading went live on Brazil’s stock exchange; spot Bitcoin and Ethereum ETFs launched in Hong Kong; Strike launched its Bitcoin services in Europe; Tether continued to buy Bitcoin; Coinbase integrated Bitcoin Lightning; and Ethena’s USDe added Bitcoin collateral. Lastly, innovation on Bitcoin continues at a breakneck pace, with the OP_CAT opcode being assigned a BIP number, and various innovation-related news items out of Stacks, MerlinSwap, dWallet/Avail, Internet Computer, Nomic, Babylon, BitVMX, and Alpen Labs, among others.

Ethereum moved along with Bitcoin for much of the month, entering April around $3,650 and finishing around $3,000 for a 17% monthly decline. While Ethereum was impacted by the same macroeconomic events as Bitcoin, it also saw several idiosyncratic price-moving events such as news reports that the US SEC believes Ethereum is a security, which came out in Consensys’s lawsuit against the SEC, and dwindling hopes that spot Ethereum ETFs will be approved this month. Also during April, ETH fell to its lowest level versus BTC in three years and the ETH supply flipped to inflationary. However, driven in part by lower L2 fees in the wake of Dencun and rising memecoin trading activity, the number of Ethereum ecosystem transactions (ie. including L2s) and the number of active weekly wallets both set new records. Meanwhile, EigenLayer launched on mainnet, introduced several AVSs, debuted its EIGEN token whitepaper, and caused the Ethereum validator entry queue to reach its highest level since September. In addition, Ethereum devs added EIP-3074 to the coming Pectra upgrade; Lido implemented Simple DVT; Renzo’s ezETH traded at a temporary but material discount to ETH; and, E&Y launched an Ethereum-based tool to simplify business agreements. Finally, there were a number of updates from various L2s, including from Base, Zircuit, Starknet, Scroll, and Celo, among others.

BTC and ETH

Source: Santiment, GSR.

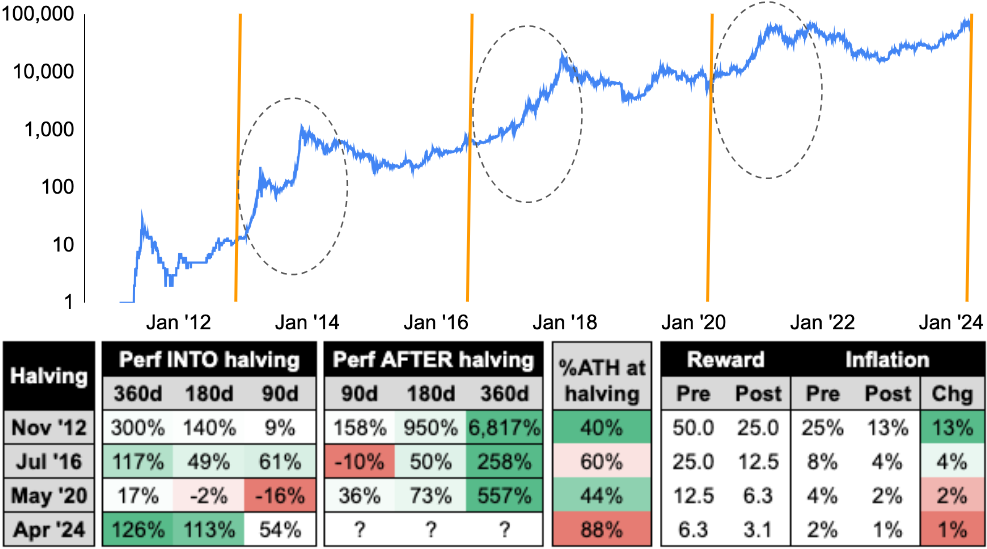

The Fourth Bitcoin Halving

The Bitcoin blockchain underwent its fourth halving on April 20th at 0:09 UTC at block 840,000. Mining pool ViaBTC mined the block and collected the newly halved 3.125 BTC block reward as well as 38 BTC ($2.1m) in fees as users bid up to be included in the halving block. ViaBTC also received the first Satoshi mined after the halving, known as an Epic Sat (Sat 1,968,750,000,000,000), which it subsequently sold for $2.1m. The average fee paid in the block was 0.0123 BTC (~$800), with someone paying $500,000 to send $0.70. Much of the heightened demand for block space was driven by runes, a new Bitcoin fungible token standard that went live at the halving and where users attempted to etch early runes. While fees remained elevated for several days after the halving, they have now normalized, with it currently costing ~$2 to send a transaction. Finally, there are both negatives and positives when thinking about the impact of the recent halving on Bitcoin’s price – while the marginal decline in network emissions is lower than in prior halvings and Bitcoin’s price entered the halving as a higher percentage of the previous all-time highs than ever before, prior halvings have certainly been a catalyst for Bitcoin and there are several unique positives compared to the past such as greater access through the spot ETFs and a flurry of innovation.

Post-Halving BTC Price Performance (log-scale) & Halving Statistics

Source: Santiment, Blockchain.com, GSR; Note: Inflation is annualized block reward / circulating supply at halving.

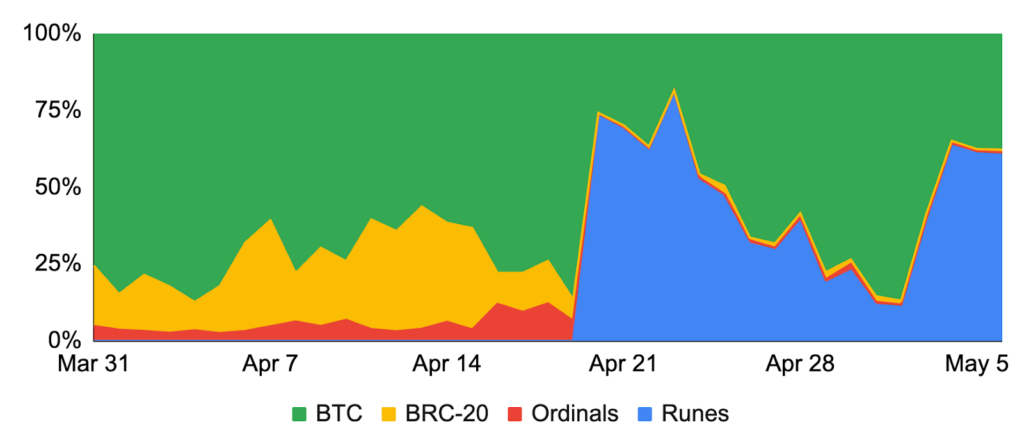

Runes Goes Live at the Halving

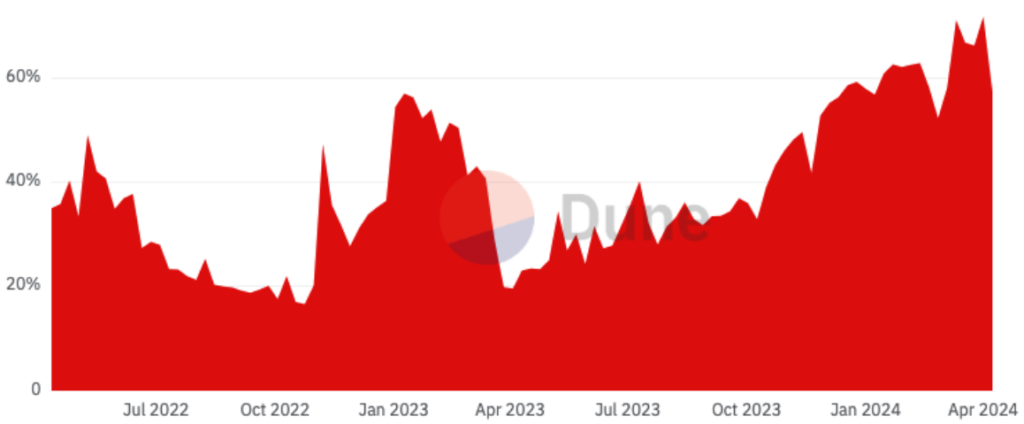

Runes, a new fungible token standard on Bitcoin allowing users to etch, mint, and transfer Bitcoin-native digital commodities, launched at the halving to much anticipation. Runes was created by Casey Rodarmor, the inventor of the sat-numbering Bitcoin meta-protocol Ordinal Theory and Bitcoin inscription NFTs. Unlike BRC-20s, the current/dominant fungible token standard on Bitcoin, runes are UTXO-based, record transaction data entirely onchain, and have a much smaller onchain footprint. As such, some believe activity may migrate from BRC-20s to runes. Even before they launched, many runes-themed ordinals NFTs that promised to airdrop runes to holders like Runestones and many pre-runes BRC-20s with plans to convert to the runes standard like Bitcoin Wizards saw their token prices perform extremely well. And with runes successfully launching at the halving, there are already many runes with market caps in the hundreds of millions of dollars including Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z, DOG•GO•TO•THE•MOON, and RSIC•GENESIS•RUNE (runes has a minimum name length, which will be reduced by one every 17,500 blocks). All in, there have been ~67,000 etchings and nearly six million runes transactions. And with runes touching on two of the hottest trends in bitcoin innovation and memecoins, the future of runes looks bright.

Share of Bitcoin Transactions by Type

Source: Dune @cryptokoryo, GSR.

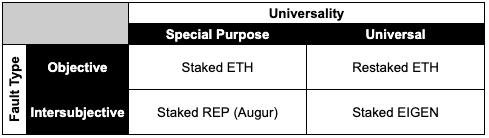

EigenLayer Launches on Mainnet & Announces EIGEN Token Details

EigenLayer, a security-as-a-service protocol that allows users to restake their staked ETH to provide security for arbitrary programs beyond Ethereum dapps such as bridges, oracles, and sidechains, launched on mainnet during the month. EigenLayer enables restakers to earn additional yield in exchange for taking on increased slashing conditions, while the arbitrary programs, referred to as Actively Validated Services (AVSs), can simply rent economic security from restakers rather than having to build their own blockchain, procure a validator network, and offer high inflation staking rewards. While EigenLayer’s initial launch had just one live AVS in data availability solution EigenDA and does not include payments from AVSs to operators or operator slashing to limit risk, EigenLayer is one of the biggest innovations in Ethereum in years and may both expand Ethereum’s settlement/security addressable market beyond Ethereum itself and change the way blockchains are constructed, with the potential for applications to simply concatenate AVSs in the future, similar to how webpages use various hyper-specialized SaaS solutions running in the background for authentication, payments, databases, etc.

In addition to launching on mainnet, EigenLayer unveiled its EIGEN token whitepaper, with EIGEN as the “universal intersubjective work token”. Put simply, the EIGEN token utilizes a novel token staking and forking mechanism to address a range (ie. universal) of debates (ie. faults) beyond those that are fully objective in nature and discernable onchain, and that are therefore able to garner economic security from restaked ETH. Specifically, EIGEN staking and forking extends EIGEN security to debates where there is broad-based agreement among reasonable observers but which cannot be proven cryptographically onchain, with such debates dubbed intersubjective faults. This latter category works by allowing holders to stake EIGEN to provide economic security, but if the majority of EIGEN token stakers misbehave, a challenger can create a fork of the EIGEN token and users and AVSs can respect and value only the forked token if there is general agreement that the stakers misbehaved. And with the malicious EIGEN stakers not having an allocation to the forked token, such a system effectively enables “slashing-by-forking”, and ultimately utilizes social consensus to judge faults where implementation by smart contract is not possible. While EIGEN will launch in a “meta-setup phase” to study the novel mechanism, it ultimately intends to accrue value to both ETH and EIGEN without burdening Ethereum’s social consensus, and expands the capabilities of EigenLayer (ie. the types of faults EigenLayer security can address) to enable novel use cases ranging from blockchain construction, databases, intents, gaming, AI, cloud, and more. For readers wanting to learn more, we recommend EigenLayer’s token blog post or the token whitepaper.

Work Token Types

Source: Twitter @jon_charb, GSR.

Solana Network Congestion

Solana experienced significant network congestion in the wake of high memecoin and bot-related transaction volumes over the last month, with the congestion due to two separate issues. The first issue concerns transactions that are submitted to the chain but correctly not executed as the transaction conditions were not met, such as when a swap is submitted with slippage tolerance set too low or when a transaction attempts an arbitrage trade that doesn’t exist anymore. While the percentage of these “failed” transactions increased materially of late as shown below, this is not a big deal, both as these transactions were correctly not executed and as they are nearly all bot spam since user wallets simulate transactions ahead of time and inform users prior to the transaction that they will not be successful.

The bigger issue, however, relates to dropped transactions that never reach the block leader due to issues with Solana’s networking layer, and this is a bigger issue as it causes everyday users to be unable to execute transactions. The issue stems from Solana’s recently upgraded networking layer QUIC, which sets the rules regarding how data is sent between network participants and is designed to merge TCP’s reliability with UDP’s low latency. As Solana has continuous block production (ie. no mempool), QUIC performs the ever-important role of helping to set up connections between users and block leaders, and it also allows block leaders to drop certain connections during periods of high demand to help prevent the blockchain from halting. Unfortunately, however, the logic around dropping connections is poor and is currently essentially random. Thus, during times of exceptionally high demand, not only are many transactions dropped by the block leader before they can be executed, but also such a construct encourages users and bots to increase their odds of a successful transaction by submitting more transactions, where bots have a large advantage to the detriment of everyday users. While there are no silver bullets, developers are hard at work implementing better logic on which transactions block leaders should drop and how to deter bot spam. For example, developers rolled out version 1.17.31 mid-month for stake-weighted Quality-of-Service (a controversial mechanism allowing block leaders to prioritize transactions sent through a staked connection for additional sybil resistance), and have a series of additional planned updates that will help with network congestion over time.

Solana Failed Non-Vote Transaction Rate Share

Source: Dune @scarn_eth, GSR.

GSR in the News

- Bloomberg – Singapore Licenses Crypto Market Maker GSR in Rare Step for Industry

- CoinDesk – Crypto Market Maker GSR Receives Singapore Crypto License

- The Block – GSR markets granted ‘major payment institution’ license in Singapore

- PYMNTS – Singapore Licenses Crypto Platform GSR Markets

- Yahoo! Finance – GSR Obtains Major Payment Institution Licence from Monetary Authority of Singapore

- Cointelegraph – Crypto liquidity firm GSR secures MPI license in Singapore

- Coinspeaker – GSR Markets Bags Major Payments License In Singapore

- The Paypers – GSR Markets receives Singapore license for crypto trading

- Crypto.news – GSR Markets secures license in Singapore to offer OTC services

- Coingape – Singapore Sets Precedent with Licensing of Crypto Market Maker GSR Markets

- Cryptonews – Crypto Market Maker GSR Wins Singapore’s Stringent License

- The Crypto Times – GSR Secures Major Payment Institution License in Singapore

- Fintech Singapore – Crypto Trading Firm GSR Granted Full License in Singapore

- DL News – How Bitcoin maxis will save the crypto rally from Mt. Gox’s $9bn sell-off

- Unchained – Crypto Market Retreats as Investors Wonder if There Are Enough Bullish Catalysts

- Bloomberg – Token Launches Are Back as Startups Embrace Now-or-Never Mantra

- DL News – Solana surge to $140 shows investors couldn’t care less about the Fed

- DL News – Bitcoin’s halving rally gives way to worries about geopolitical risks and the Fed’s rate move

- DL News – Memecoins on Bitcoin are about to get supercharged. Here’s how

- CoinDesk – ‘DePIN’ Is Venture Capitalists’ Latest Crypto Obsession. Can It Match the Hype?

- Bloomberg – Bitcoin Miner Boosting Memecoins Allure Already Begins to Wane

Author:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.