Bitcoin and Ethereum

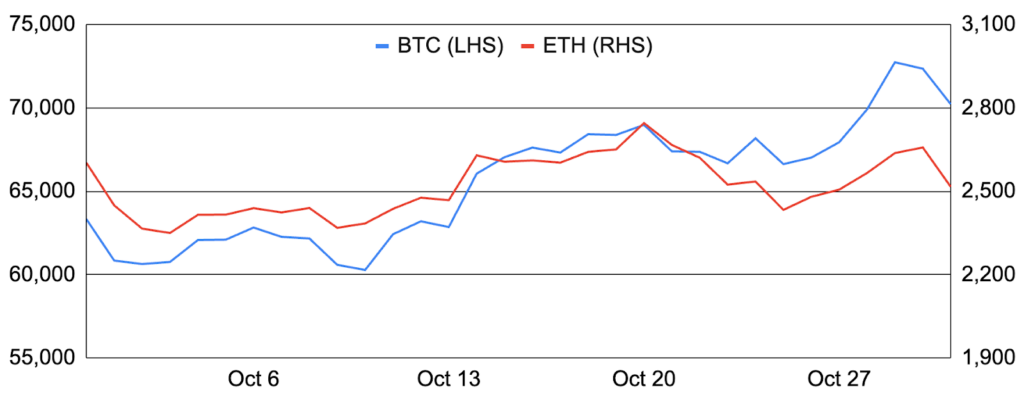

Bitcoin entered October around $63,300 and rose 11% during the month to $70,200. Crypto’s apex asset traded sideways for the first two weeks of the month due to various factors including rising tensions in the Middle East and poor spot ETFs flows. However, Bitcoin spent the remainder of October generally moving higher on US election enthusiasm as the pro-Bitcoin Trump gathered momentum and on what ultimately turned out to be phenomenal spot ETF flows that totaled $5.4b. During the month the Bitcoin network hashrate hit an all-time high, CME Bitcoin futures open interest also recorded a record high, and Bitcoin dominance reached its highest level since 2021. There were also several notable state-level developments, including BRICS leaders suggesting Bitcoin could be used in global trade and Argentina reportedly improving its stance on Bitcoin. Corporates, too, got in on the act, highlighted by MicroStrategy announcing plans to raise $42b over three years to buy Bitcoin and Microsoft shareholders preparing to vote on adding Bitcoin as a treasury asset. Further, the US Supreme Court declined to hear an appeal regarding the ownership of ~$4.8b of seized Bitcoin related to Silk Road, freeing the government to potentially sell this Bitcoin in accordance with the law. There were also notable development items during the month from Stacks, Botanix, Core, Fractal, BitcoinOS, and Solv, among others. Lastly, HBO’s documentary “Money Electric: The Bitcoin Mystery” created a stir after claiming to have discovered the true identity of Satoshi, though its evidence ultimately underwhelmed and the named individual himself, Bitcoin developer Peter Todd, vehemently denied the claim.

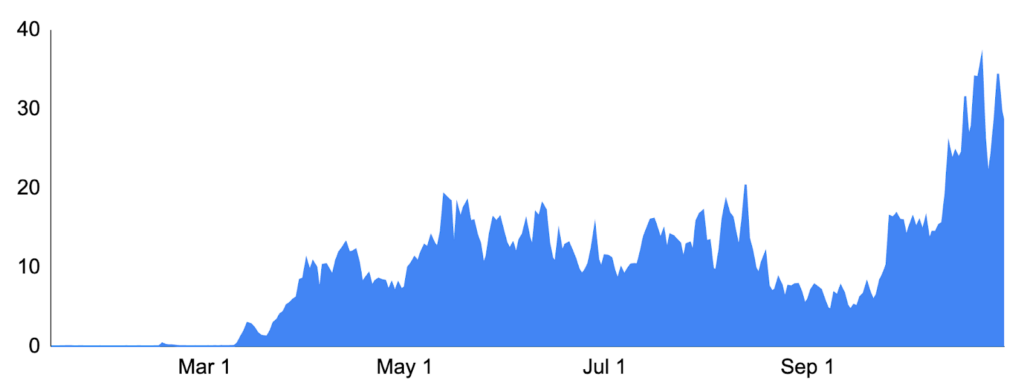

Ethereum materially trailed Bitcoin during the month, falling 3% after entering October around $2,600 and finishing at ~$2,500. While subject to the same macro factors, sentiment around Ethereum remained particularly low, the spot Ethereum ETFs gathered just $55m of net flows, and the ETH/BTC ratio hit its lowest mark since 2021. Notably, network revenues increased 55% from the prior month, the ETH supply increased by ~38,000 (0.4% annually), blob fees finally moved off their 1 wei minimum towards at end of the month, and Beaverbuild and Titan Builder combined to build ~95% of all blocks in October. In addition, EIP-7781, which proposes to reduce slot times from 12s to 8s and increase blobs per block from 6 to 9, gained momentum, while Vitalik penned a “Possible Futures of the Ethereum Protocol” blog series, discussed more below. Further, there were notable token launches during the month, including EIGEN debuting at a $7b valuation and ZK rollup Scroll launching its token. Lastly, there were notable L2 developments, including new launches or announcements of forthcoming launches (egs. Unichain, Kraken’s Ink, World Chain), as well as continued progress from existing chains like Offchain Labs launching a 15-minute withdrawal service for Arbitrum Orbit chains, Base announcing a permissionless fault proof system, and Consensys’s Linea outlining steps to decentralize.

BTC and ETH

Source: Santiment, GSR.

Reading the US Election Tea Leaves

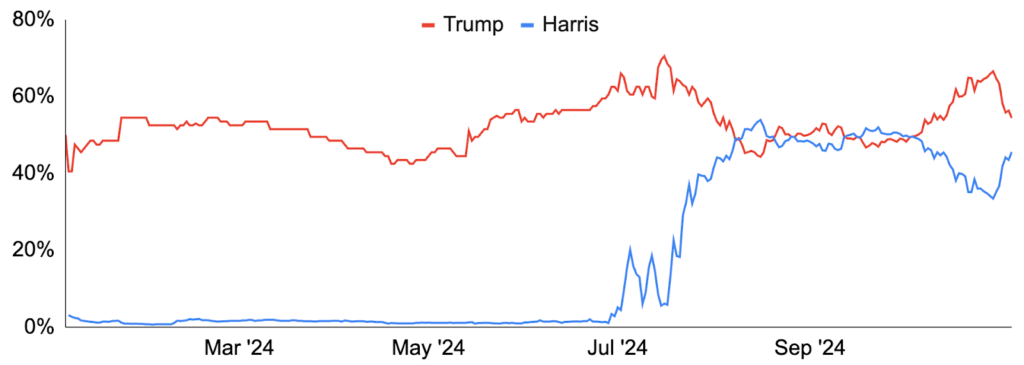

All eyes are focused on tomorrow’s US election, not only because of its likely large impact on crypto prices, but also due to its immense effect on the future of the industry in America. Indeed, Donald Trump is generally seen as the more pro-crypto candidate after promising to deliver on the industry’s collective wish list, though Kamala Harris too has offered glimmers of hope, pledging to both protect investors and foster innovation within the industry.

With so much at stake, many have closely watched Polymarket, a decentralized predictions market and crypto’s breakout app of 2024, for clues regarding who may win. And with Trump garnering a 33 percentage point lead over Harris at the end of the month – well above polls and election models – many have debated whether Trump’s Polymarket odds could be accurate. Those who believe the odds are incorrect point to predictions markets having a mixed elections track record, whales potentially skewing the market, or potential bias due to a greater preponderance of men, crypto-natives, and non-US traders using the platform. However, those who believe Trump’s odds are accurate point to polls measuring the popular vote rather than the electoral college and elections models using backwards-looking polls as inputs, nearly all betting markets having similar odds as Polymarket making it unlikely they are being manipulated, academic studies concluding that predictions markets are more accurate than surveys or expert opinions, and transparency / wisdom of the crowds / market forces all pushing the odds to be accurate. While we side with predictions markets as being accurate, there is still plenty of room for either candidate to win. And whether led by Trump or Harris, our hope is for regulatory clarity, which may ignite a new wave of institutional activity and ultimately throttle crypto to new heights.

Polymarket Presidential Election Winner 2024 Odds

Source: Polymarket, GSR.

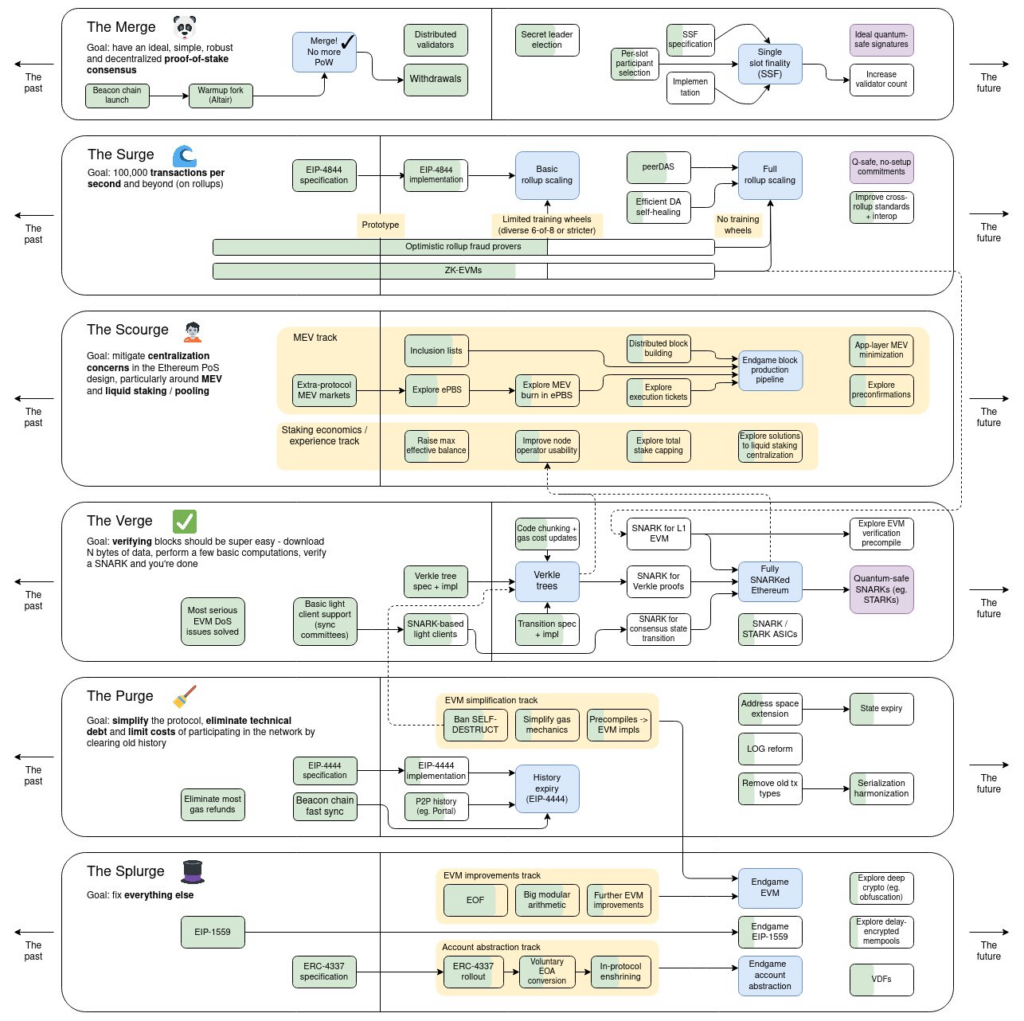

Possible Futures of the Ethereum Protocol

Amidst the significant debate around Ethereum’s rollup-centric strategy, Vitalik published a series of blog posts titled ‘Possible Futures of the Ethereum Protocol’ covering key areas of the roadmap in depth. As a quick refresher, the Ethereum roadmap, which we cover in detail here, consists of six categories of upgrades being pursued in parallel. The first of these is The Merge, which focuses on upgrading Ethereum’s consensus mechanism to make it simpler, more robust, and decentralized. A key part of this upgrade track was the eponymous ‘The Merge’ event in 2022, during which Ethereum’s consensus switched from Proof-of-Work to Proof-of-Stake. The second track is The Surge which is all about scaling Ethereum to 100,000 TPS and beyond, primarily through rollups. The third is The Scourge which looks to mitigate centralization risks to the Ethereum protocol, primarily those emanating from liquid staking/pooling and MEV. The fourth is The Verge which aims to make Ethereum blocks easy to verify through cryptographic upgrades that enable statelessness. The fifth is The Purge which has the goal of simplifying the protocol and eliminating technical debt. Finally, The Splurge represents a catch-all category that captures various remaining improvements that don’t neatly fit into a single category.

Vitalik’s blog series provides the clearest and most comprehensive single articulation of the current thinking for each of the upgrade tracks. It further serves as a much needed resource to help frame discussions around Ethereum’s development with a clear view of the available options and their tradeoffs. While each post is worth reading in full, they discuss:

- The Merge: This post primarily focuses on framing the discussion around how to achieve two goals for consensus which are in tension with one another: achieving single-slot finality and reducing the validator staking requirement such that more validators can participate. Vitalik sketches out a few possible paths with different tradeoffs which range from introducing technological complexity to relaxing requirements around economic finality and possible centralization.

- The Surge: This post discusses how Ethereum will scale by fundamentally relying on two technologies: ZK-SNARKs (ZK) and Data Availability Sampling (DAS). Given potential bottlenecks in data availability, Vitalik outlines potential paths forward, including bringing back improved Plasma based designs which do not need onchain data availability. The post also explores other complementary paths to scaling L2 throughput and improving interoperability.

- The Scourge: This post discusses two different approaches to mitigating MEV centralization in 1) a variant of Proposer-Builder Separation combined with inclusion lists and 2) multiple concurrent proposers. Both approaches address censorship resistance concerns arising from highly centralized block building, but they differ in terms of how they split the value generated from MEV across different parties. The post also addresses staking centralization through liquid staking and discusses a couple of solutions including modifying the ETH issuance curve to disincentivize staking past a certain level and creating a maximally decentralized, trustless, and neutral liquid staking token.

- The Verge: This post explores two possible approaches to enabling stateless validation in Verkle Trees and STARKed binary hash trees. While the former has been the leading option for a long time, improvements in STARK proving have made the latter option practical faster than expected, making it a potentially viable candidate for implementation in the near future. The post also discusses plans to implement ZK-SNARKs at the L1 level to prove both consensus and execution, thus greatly easing the burden of verification for clients.

- The Purge: This post goes over approaches to implementing history expiry and state expiry, which would help ease the storage burden that current Ethereum clients face. Vitalik also covers other ways of simplifying the protocol like removing unused features.

- The Splurge: This post discusses a variety of miscellaneous upgrades including improvements to the EVM, approaches for enshrining account abstraction into the protocol, changes to the protocol fee mechanism, implementation of Verifiable Delay Functions (VDFs), and experimentation with powerful emerging cryptographic primitives including Fully Homomorphic Encryption (FHE), Indistinguishability Obfuscation, and quantum one-shot signatures.

Ethereum’s Roadmap as of 2023

Source: @VitalikButerin, GSR.

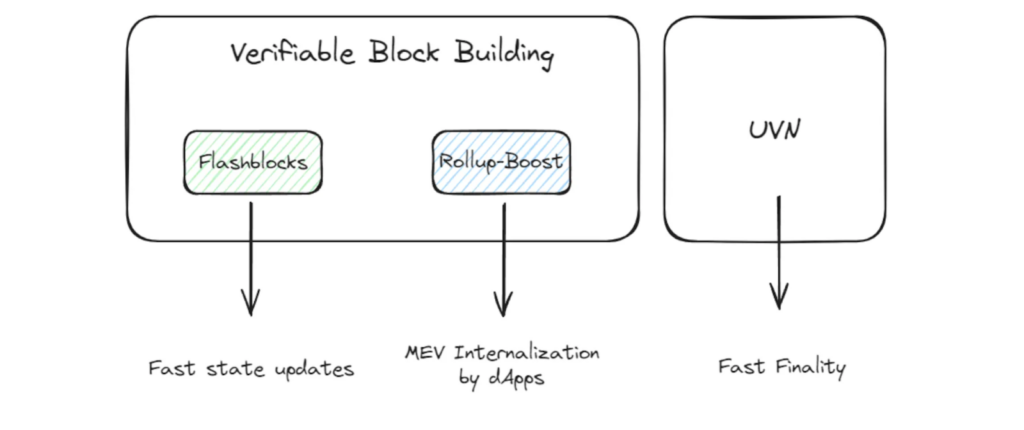

Uniswap’s Long-Awaited Unichain L2

After years of speculation, Uniswap announced the development of its Ethereum layer 2 Unichain. Unichain, which ultimately aims to become the liquidity hub for DeFi, will be an L2 optimized for speed, efficiency, and cross-chain interactions, and employs several innovative features. First, Unichain will create a decentralized validation network that sees nodes verify blocks to add an additional layer of finality and reduce the risk of invalid blocks. In addition, Uniswap partnered with Flashbots to create a new block builder that utilizes a trusted execution environment. Not only will this enable 250ms sub-blocks for near-instant UX, but it will also enable the transparent enforcement of priority transaction ordering to allow applications to allocate some MEV back to users. Lastly, Unichain is being built on Optimism’s Superchain for native interoperability via single-block cross-chain message passing with other Superchain L2s like OP Mainnet, Base, Soneium, and World Chain, and will work towards cross-chain liquidity beyond the Superchain through initiatives like ERC-7683. Looking ahead, the Unichain public testnet is already live, public mainnet is expected to launch later this year, and features like provable block building and the Unichain Validation Network are slated for early next year.

Core Features of Unichain

Source: Gate.io, GSR.

Memecoin Activity Accelerates on ‘Supercycle’ Talk

After first taking off earlier this year in March, memecoins have seen a resurgence of late. Perhaps the largest catalyst has been crypto investor and influencer Murad’s Memecoin Supercycle thesis, which he first presented at Token 2049 in September but which has since gone viral. During the presentation, Murad points to memecoin outperformance due in part to the over-production of more traditional altcoins with high valuations and forthcoming unlocks. Murad further argues that not only are memecoins the most efficient vehicle for speculation, but also that they offer high utility by way of simplicity, fun, community, and shared culture. He then concludes his presentation with various predictions, including that memecoins will hit a $1T market cap. Murad frequently posts about his favorite memecoins, such as SPX6900 that has skyrocketed from a $10m market cap to $700m, and the success of his picks has not only solidified his place in memecoin investing, but also increased the popularity of the memecoin space as a whole.

While not everyone agrees with Murad and there is considerable debate around whether memecoins are good or bad for crypto, one recent memecoin trend has been so-called AI memecoins. The trend first caught on after LLM-powered Twitter account Terminal of Truths was baited into promoting the Goatseus Maximus (GOAT) memecoin. While some initially and mistakenly believed the LLM created the memecoin or that the memecoin and its Twitter account was sentient, GOAT soon skyrocketed past an $800m market cap. It remains to be seen whether AI-related memecoins have staying power, though proponents believe that linking memecoins with LLMs is an innovative way to foster communities and that it encompasses two of the hottest tech trends in AI and memecoins.

Memecoins Created on Pump.fun Per Day, Thousands

GSR in the News

- DL News – Three factors driving Bitcoin’s $71,000 rally and what analysts say will happen next

- Cointelegraph – TON could help DeFi break into mainstream: Report

- OKX Institutional – GSR The Market View, October 2024

- DL News – The $4bn cloud hanging over Bitcoin

- DL News – Can the $12bn rollup token market break its 2024 slump?

- CMC – The Open Network DeFi Opportunity

- DL News – The $4.2bn Silk Road sale and three other big drivers of Bitcoin’s price

- Decrypt – Wall Street Is on a Bull Run—It’s Nothing Compared to Bitcoin

- Coindesk – Four Reasons Ether ETFs Have Underperformed

- Cointelegraph – Don’t underestimate Ethereum

- Coindesk – Bitcoin Slides to $66K, Ether Dives 5% in Market-Wide Selloff

- Blockworks – BTC hits $69K again 8 days from election. What’s next?

- Coindesk – Crypto Slumps Alongside Trump’s Victory Odds on Polymarket as Uncertainty and Profit-Taking Rise

Authors:

Brian Rudick, Head of Research | Twitter, Telegram, LinkedIn

Carlos Guzman, Research Analyst | Twitter, Telegram, LinkedIn

Toe Bautista, Research Analyst | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.