Bitcoin and Ethereum

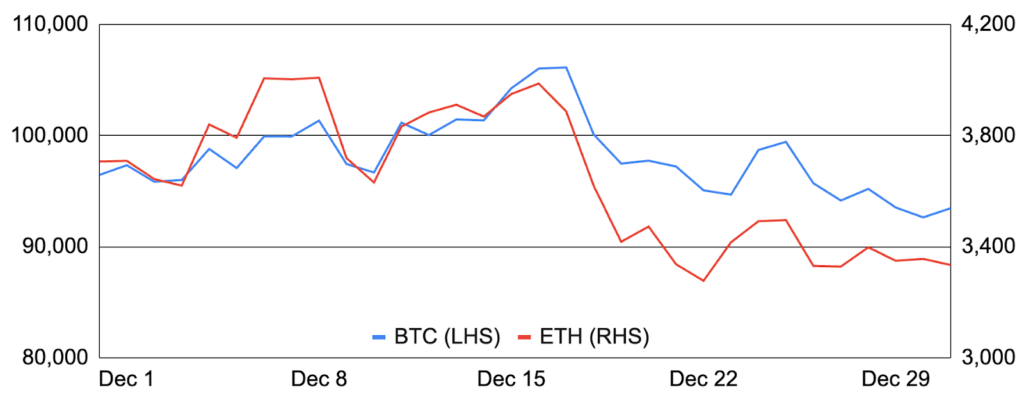

Bitcoin entered December around $96,500 and fell 3% during the month to $93,500. However, this was not before Bitcoin broke $100,000 for the first time on December 5th, a monumental accomplishment that coincided with its market cap surpassing $2T for the first time and placing it as the world’s seventh largest asset behind Google and Amazon. Bitcoin further climbed higher on rising enthusiasm for a US strategic Bitcoin reserve, pushing Bitcoin to a new all-time high of $108,135 on December 17th before a hawkish FOMC meeting reset expectations for Fed rate cuts in 2025 and weighed on crypto prices. In addition to the Fed, there were various negative items during the month, including Mt Gox transferring $2.8b of BTC to an unknown address, the US government transferring $1.9b of seized Silk Road BTC to Coinbase Prime, El Salvador softening its Bitcoin activities to secure an IMF loan, BlackRock stating that there is “no guarantee” Bitcoin’s 21m total supply won’t change, and Google’s new quantum computing chip raising questions about Bitcoin security. Despite this, Bitcoin garnered positive attention from key leaders, including US President-Elect Trump, US Fed Chair Powell, and Russian President Putin, corporates and countries continued to add or explore adding Bitcoin to their balance sheets, and ETF inflows remained stellar at $4.6b during the month. Lastly, Bitcoin development continued to flourish, with Stacks launching its sBTC upgrade on mainnet (with deposit-only functionality), Babylon TVL surpassing $5b, and Botanix launching its final testnet prior to its 2025 mainnet launch.

Ethereum also fell in December, after entering the month around $3,700 and finishing at $3,350 for a 10% decline. ETH was impacted by the same market and macro factors as Bitcoin, and its decline occurred despite improving fundamentals. Indeed, inflation remained low at just a 0.3% annualized rate, network revenues increased 20% during the month, and active addresses, daily transactions, and DEX trading volumes all improved. It was also a record month for spot ETH ETF inflows, which totaled $2.1b, though strong flows predominantly occurred during the first half of the month. Elsewhere, the community debated raising the gas limit and Vitalik penned a blog post on wallets, while Flashbots migrated to its decentralized block production software BuilderNet and Eigenlayer introduced upgraded staking rewards and added slashing on testnet. Lastly, L2s remained busy as ZKsync unveiled its 2025 roadmap that includes targeting 10,000 TPS, Optimism introduced a new Superchain token standard, Scroll announced a new zkVM called OpenVM, and ENS tapped the Linea tech stack for its Namechain L2.

BTC and ETH

Source: Santiment, GSR.

In Search of a US Strategic Bitcoin Reserve

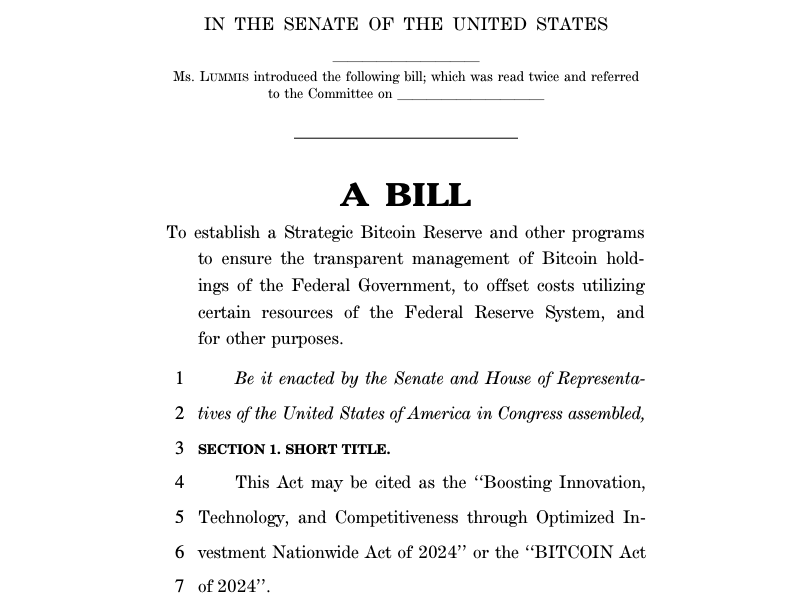

There have been various recent efforts to establish a US strategic Bitcoin reserve, prompting debates around the advantages and disadvantages of doing so. Recall, Donald Trump first pledged to create a strategic US reserve in July 2024 by converting the $20b of confiscated Bitcoin the US currently holds into a reserve, while Senator Lummis authored a bill that directs the government to purchase 1m BTC, or ~5% of supply over time. Proponents of the idea cite economic and monetary advantages like hedging against monetary devaluation and diversifying the reserve base, geopolitical advantages like strengthening the US’s global monetary position, and financial and human rights benefits emanating from Bitcoin’s decentralized and permissionless nature. However, noted economists and former government officials have heavily criticized the proposal citing negative impacts on the dollar as the world’s reserve currency and the US’s ability to run deficits, Bitcoin’s limited use cases beyond a store of value compared to other reserve assets like petroleum, Bitcoin’s smaller size, more volatile nature, and shorter history, and the establishment of a reserve amounting to a handout to existing holders. This pushback, combined with the fact that a large and permanent reserve would likely require Congressional approval, has led most to assign low odds of it coming to fruition, but one that could spur a nation state-level war for Bitcoin if it happens.

December saw various strategic reserve-related developments, most of which were positive and caused observers to increase their odds of it being created. For example, Trump answered “yes, I think so” when asked whether the US will create a strategic reserve, Trump reportedly discussed the idea with the CEO of crypto.com, Senator Lummis reportedly discussed her bill with Treasury Secretary nominee Bessent, and some suggested that Trump will issue an executive order upon taking office to create one. Moreover, several US states are getting in on the act, with Texas, Pennsylvania, and Ohio introducing bills to create state-level strategic reserves, while legislators from large jurisdictions proposed to create national Bitcoin reserves, including a member of Russia’s state Duma, a European MP, and a Japanese lawmaker. All in, we suspect Trump will direct the government to maintain its existing Bitcoin stockpile, which would not result in new Bitcoin demand from the US government, but would both remove potential US selling and add credence to Bitcoin as a reserve currency, though continue to place low odds on the US acquiring additional Bitcoin in the creation of a larger strategic reserve.

Senator Lummis’s Proposed BITCOIN Act

Source: Senate.gov, GSR.

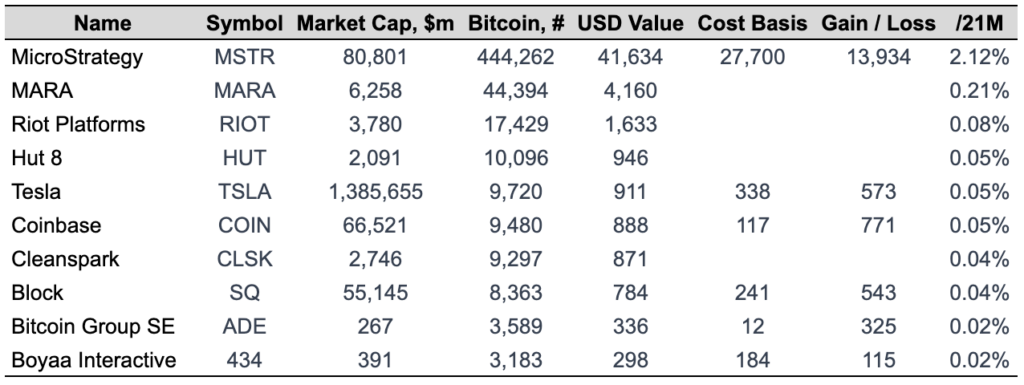

A Corporate Bitcoin Buying Spree

December also featured continued heavy Bitcoin buying by corporations. For example, energy management firm KULR Technologies, Bitcoin development firm Matador Technologies, auto accessories maker Worksport, and Indian computer networking institute Jetking Infotrain bought Bitcoin for the first time. In addition, several corporations were repeat buyers in December, including MicroStrategy, which acquired $4b in December after buying $14b in November, as well as Bitcoin treasury stalwarts Semler Scientific and Metaplanet. These purchases are in addition to the many corporations who added Bitcoin as a treasury asset earlier in the year, including Thumzup, Solidion, Nano Labs, Cosmos Health, Genius, SOS, Rumble, and Remixpoint to name a few.

Outside of direct buying, there were also various notable developments. For example, Microsoft shareholders voted against a proposal to study adding Bitcoin to the company’s treasury. However, the conservative think tank behind the initiative has filed similar proposals with 60 other companies, including Amazon, offering many additional chances for continued Bitcoin adoption in corporate treasuries. In addition, Sora Ventures launched a $150 million fund dedicated to investing in companies adopting Bitcoin treasury strategies. With the eroding purchasing power of fiat, the success of MicroStrategy, and the market rewarding companies who have taken the plunge, the trend just may continue or even accelerate in 2025.

Top Corporate Bitcoin Holders

Source: BitcoinTreasuries.net, GSR. Note: Data as of Dec 30, 2024

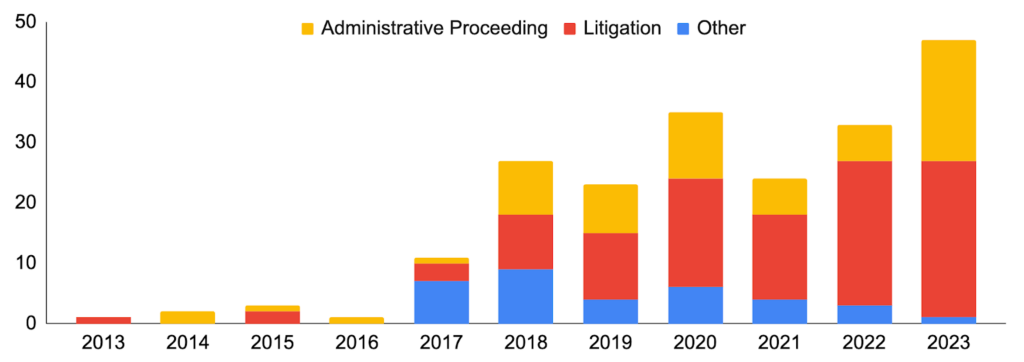

US Political and Regulatory Happenings

President-elect Trump nominated various key figures for positions in his administration in December, many of which will have a large impact on the digital assets industry. For example, Trump nominated David Sacks, co-founder of Craft Ventures and prominent crypto advocate, to serve as the White House AI and Crypto Czar. Sacks, a former PayPal executive, has expressed strong support for a clear crypto regulatory framework. Additionally, Trump appointed Paul Atkins, a former SEC Commissioner and vocal crypto supporter, as SEC Chair. These December appointments follow a series of high-profile nominations in November, including hedge fund manager Scott Bessent as Treasury Secretary, Cantor Fitzgerald CEO Howard Lutnick as Commerce Secretary, RFK Jr. as Health Secretary, Pete Hegseth as Secretary of Defense, and Elon Musk and Vivek Ramaswamy as co-heads of the Department of Government Efficiency.

The appointment of Paul Atkins as SEC Chair in particular could mark a turning point for crypto regulation in the US. As a former SEC Commissioner and Co-Chair of the Token Alliance, Atkins brings deep institutional knowledge and a clear pro-crypto stance. As such, Atkins could potentially revisit ongoing enforcement cases, advocate for a Safe Harbor rule to enable token issuance without litigation risk, and/or collaborate with Congress to instill regulatory clarity for stablecoins and DeFi. In addition to the Chair position, the composition of the SEC under Atkins is another critical factor. Currently, the commission comprises three anti-crypto Democrats (Gary Gensler, Jaime Lizárraga, and Caroline Crenshaw) and two pro-crypto Republicans (Hester Peirce and Mark Uyeda). However, both Gensler and Lizárraga have announced their forthcoming resignations, and Trump will likely promote Peirce or Uyeda to Acting Chair until Atkins is confirmed. Such a move would enable either to push on digital asset rulemaking fairly immediately should they wish to do so. Moreover, Trump will have the opportunity to further shape the SEC via Lizárraga’s replacement. While protocol typically allows the minority party to nominate one seat to maintain a 3-2 balance, Trump could bypass this custom and appoint another pro-crypto Republican. And even if Trump adheres to tradition, Senate Majority Leader Chuck Schumer’s now pro-crypto stance could lead to a favorable Democratic nominee. These political developments, combined with Trump’s proactive appointments, suggest a regulatory environment poised for greater clarity and support for the crypto industry in 2025 and beyond.

SEC Cryptocurrency Activity by Type, 2013-2023

Source: Cornerstone Research, GSR. Note: Other includes stop orders, delinquent filings, and trading suspensions. For full exhibit notes, see the original exhibit here.

Bitcoin’s Quantum Computing Threat

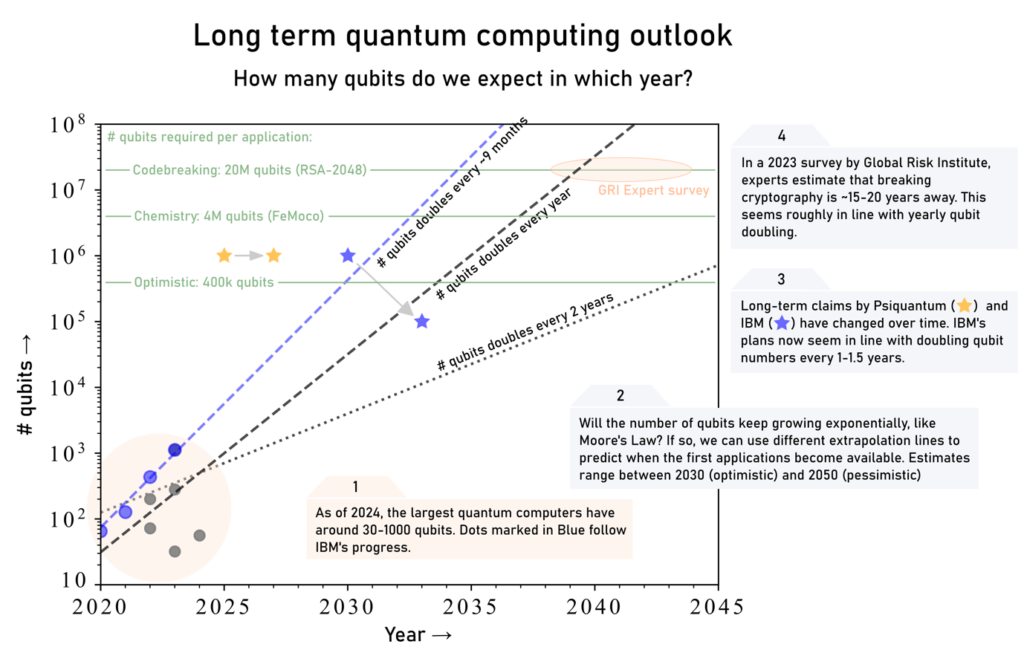

Google announced a breakthrough in quantum computing with its new chip named ‘Willow’, causing concern that Bitcoin and other blockchains may be now vulnerable to having their encryption broken by quantum computers. However, such fears are largely overblown. While Google’s Willow chip represents a genuine breakthrough towards practical quantum computers that could eventually break cryptographic algorithms, most experts believe such systems are still over a decade away. To put things in perspective, Google’s Willow chip is 105 physical qubits in size (where qubits are the quantum computer equivalent to a classical computer’s bits), but breaking quantum-vulnerable cryptographic algorithms is estimated to require quantum computers that have millions or tens of millions of physical qubits. Even under aggressive scaling assumptions equal to or exceeding the pace of Moore’s Law, this size is not expected to be reached until the mid-to-late 2030’s, as shown in the exhibit below.

While the quantum computing threat to blockchains and the internet’s cryptography likely remains a ways off, the threat is real and should prompt continued vigilance. Fortunately, the dangers that quantum computers pose to cryptographic systems are fairly well understood. For one, there is widespread understanding of the cryptographic schemes that are believed to be secure against quantum computers, including lattice-based and hash-based cryptographic schemes. Unfortunately, vulnerable schemes are some of the most widely employed today, including RSA which undergirds the internet’s Transport Layer Security (TLS) protocol, and elliptic-curve schemes which are widely used in blockchains including Bitcoin’s Shnorr signatures and Ethereum’s ECDSA and BLS signatures. Achieving quantum resistance will require these systems to be migrated over to quantum secure cryptographic algorithms. The US Department of Commerce’s National Institute of Standards and Technology (NIST) has issued guidelines which call for RSA and ECDSA schemes to be deprecated after 2030 and disallowed after 2035 in favor of quantum resistant algorithms for the protection of sensitive information. Blockchain systems will likely follow similar timelines. While such migrations are not worth doing today with quantum-resistant cryptographic algorithms significantly more inefficient than currently used ones, migrating will become increasingly urgent as quantum computing improves. These migrations will require hard forks of blockchain systems and may force blockchain communities to make contentious decisions, which could include freezing Satoshi’s coins on Bitcoin. So while the threat is not imminent, quantum computers pose a non-trivial challenge that blockchains will have to face in the coming years.

Quantum Computers Are Not Expected to Break Cryptography Until Late-2030s

Source: Koen Groenland, GSR.

GSR in the News

- Fortune – XRP soars 11% after Ripple’s RLUSD stablecoin gets regulatory approval

- DL News – Ethereum will ‘catapult beyond $5,000,’ says analyst. Here’s when the surge will happen

- Fortune – Crypto markets crash after epic rally, sending Bitcoin back below $100,000

- CoinDesk – Crypto Daybook Americas: BTC Hits Mid-Cycle Peak as Retail Interest in Altcoins Soars

- The Block – Crypto OTC desks say trading volumes are ‘going gangbusters right now’

- Fortune – Bitcoin reaches new all-time high of $107,000 after Trump confirms plans for Bitcoin reserve

- Blockworks – Bitcoin sets new all-time high above $100K

- Blockworks – Why bitcoin’s $100K breakout is just the start

- Dataconomy – Bitcoin at $107,822: Trump’s crypto move could change global finance

- NBC – Memecoins like Fartcoin are riding Trump’s victory to huge valuations. Experts say it may have only begun.

- Fortune – Inside The Wild Money Machine Fueling Crypto’s Stupidest Bubble

Authors:

Carlos Guzman, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Head of Research | Twitter, Telegram, LinkedIn

Toe Bautista, Research Analyst | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments. Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.