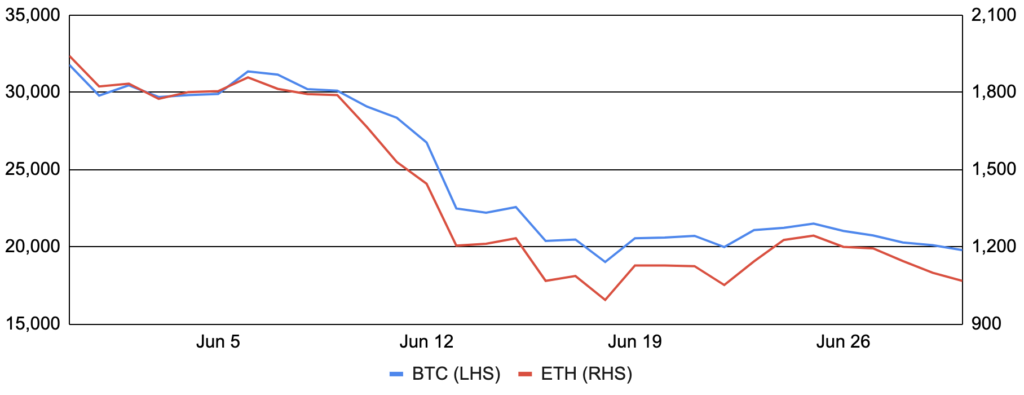

Bitcoin’s three-month downtrend accelerated in June, with bitcoin falling ~38% during the month after entering around $31,800 and finishing near $19,800. The majority of losses came during the middle of the month and were due to several reasons. First, the macro backdrop remained challenging as worse-than-expected inflation caused investors to increase their rate hike expectations. Second, several prominent crypto companies either experienced insufficient liquidity amidst declining crypto prices and leveraged investment strategies or suffered significant losses lending to such companies. These include the likes of Celsius, Three Arrows Capital, and Voyager, among others, and detailed more below. Beyond these challenges, however, the month was rife with Bitcoin-related developments. On the asset management front, both Bitwise and Grayscale’s applications to launch a spot Bitcoin ETF were again denied by the SEC, with Grayscale immediately filing a lawsuit against the SEC after the ruling. The SEC did approve ProShares to launch the first short Bitcoin futures ETF in the US. On the regulatory side, the US Supreme Court issued a ruling limiting the Environmental Protection Agency’s ability to regulate carbon-emitting power plants, which was viewed as a small positive for Bitcoin mining. Conversely, New York’s proposed Bitcoin mining moratorium was approved by the state senate and the bill now only requires the governor’s signature to go into effect. Businesses also continued to bolster their Bitcoin-related services during the month, with Deloitte partnering with NYDIG to expand its Bitcoin capabilities, Binance US cutting its bitcoin trading fees to zero for select crosses, Cash App unveiling a new feature allowing users to invest their spare change in bitcoin, and Visa rolling out its first bitcoin cashback card in Latin America. Finally, other notable news included: Iran temporarily restricted crypto mining to curtail power demand during the summer; Kenya appealed to Bitcoin miners to leverage its excess geothermal power; Compass Mining’s CEO and CFO resigned following the termination of a hosting contract after alleged missed payments; a new green energy focused Bitcoin mining pool called Terra Pool was launched; El Salvador and Microstrategy purchased additional bitcoin; Avalanche introduced a Bitcoin bridge in its new browser-based wallet; GBTC’s discount hit an all-time-low of ~35%; SEC Chair Gensler reiterated that bitcoin is a commodity; and, Jack Dorsey unveiled plans for a new decentralized web centered around Bitcoin called Web5.

Ethereum underperformed bitcoin for a second consecutive month, declining ~45% after entering June around $1,950 and ending the month around $1,050. Ethereum’s progress towards Proof-of-Stake continued to be the highlight of the month with the successful merge of the Ropsten testnet and the launch of the Sepolia testnet Beacon Chain in advance of its testnet merge (Sepolia’s merge, which was the penultimate testnet merge prior to the final testnet merge on Goerli and the official merge on mainnet, was successfully completed yesterday). The Gray Glacier hard fork also went into effect without incident, delaying the difficulty bomb for roughly three months. ConsenSys’ partnership with Starkware was another big development during the month as StarkNet, a layer-2 platform leveraging zero-knowledge roll-ups, will integrate with MetaMask and Infura. Many other companies continued to expand their suite of offerings in the Ethereum ecosystem, with Anchorage and Blockdaemon unveiling Ethereum staking solutions targeting institutional investors, Wintermute revealing plans to launch a DEX aggregator on Ethereum, and Goldman Sachs trading its first non-deliverable forward tied to ETH. Despite the many positives in the month, dYdX, the largest decentralized derivatives exchange, revealed plans to abandon Ethereum in its v4 implementation to build its own application-specific chain in the Cosmos ecosystem. Other notable news included: ApeCoin holders voted to stay on Ethereum despite Yuga Labs’ wishes; and, Lido DAO voted not to limit the amount of ETH that can stake through the protocol.

BTC and ETH

Source: Sansheets, GSR

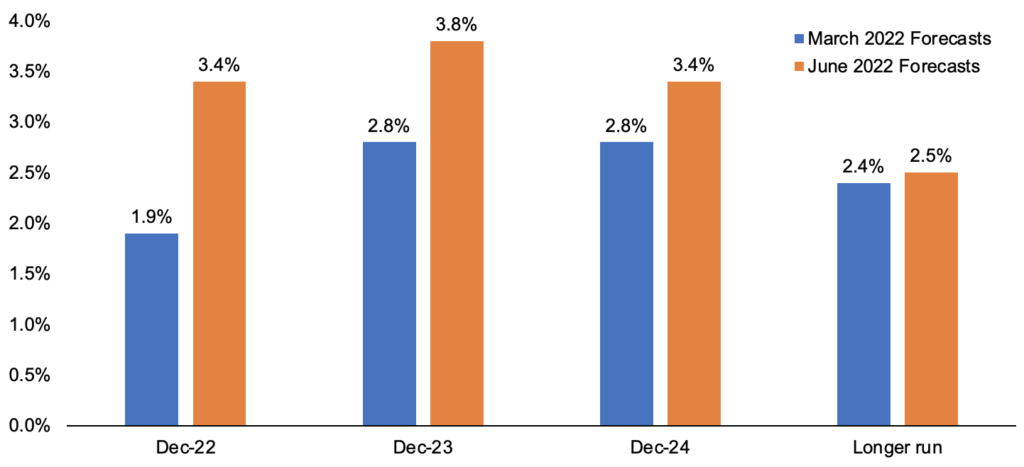

The Market Backdrop Worsens

One factor contributing to crypto’s poor performance in June was the sell-off in the equity markets amidst continued inflation worries and recession fears.

Inflation generally met or exceeded expectations in many jurisdictions and continues to reach new heights. US inflation, for example, rose 8.6% in May, exceeding expectations and reaching its highest mark since 1981. UK inflation rose 9.1% YoY, its fastest pace of growth in 40 years, while the 7.7% inflation reading in Canada surprised to the upside. Eurozone inflation in May was confirmed to have risen 8.1% YoY, with data last week indicating June inflation increased further to 8.6% YoY, the highest level since the creation of the Euro in 1999.

In response to such high inflation, central banks tightened policy more aggressively or set the stage to do so near-term. The Fed raised interest rates 75 bps mid-month, its largest single meeting rate hike since 1994, and the Swiss National Bank surprised markets with an unexpected rate hike, its first since 2007. And while policy actions from the BOE (raised rates 25 bps) and the ECB (maintained rates) were as expected, the ECB did reiterate plans to raise rates this month and in the future.

Rising rates and muted economic data gave way to increased recession fears, highlighted by the 2-10 US Treasury spread nearly inverting (it has inverted subsequent to June), the World Bank lowering its global growth forecast and warning of potential stagflation, and several banks such as Citi increasing their odds of a recession. Indeed, US Fed Chair Powell called the possibility of a soft landing “very challenging” during his semi-annual testimony to Congress, though did state that recession risk was not “particularly elevated right now” in his view. All told, the worsening macro backdrop certainly weighed on risk assets, with crypto no being exception.

Federal Reserve’s Summary of Economic Projections: Median Federal Funds Rate Forecasts

Source: Federal Reserve, GSR

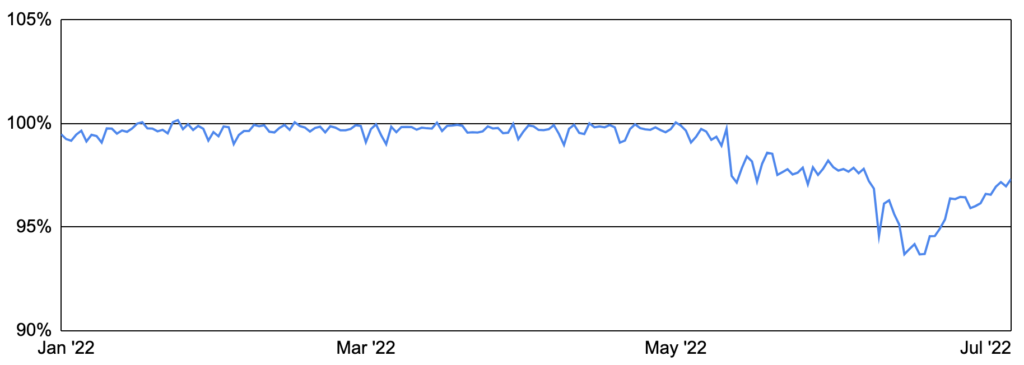

stETH Discounted Amidst Market Jitters

Ethereum is currently in process of moving to Ethereum 2.0, which includes enhancements such as moving its consensus mechanism from proof-of-work to proof-of-stake, adding sharding for improved scalability, switching from merkle to verkle trees, and allowing full nodes to store less historical data to ease validator processing and storage requirements. Unlike proof-of-work, where miners hash proposed blocks to be the first to solve the mining puzzle, post their block to the blockchain, and receive the block reward and miner tips, proof-of-stake will require validators simply to stake ether and run node software in order to receive the right to post a block in proportion to the amount of ether staked. To usher in this transition, which is known as The Merge, Ethereum developers released the Beacon Chain in late 2020 as a separate chain from Ethereum’s mainnet, where both execution and consensus (under proof-of-work) are currently occurring. The Beacon Chain is a new consensus layer that serves as a ledger of accounts, conducting and coordinating the network of validators, and will be merged into mainnet, with the network switching to its proof-of-stake consensus once it has hit a terminal total difficulty. While moving to proof-of-stake won’t improve Ethereum’s speed or costs by itself, it will reduce the network’s energy consumption by over 99%, reduce annual supply issuance to potentially turn ETH deflationary, increase network security and enable upgrades like sharding by creating a registry of validators with slashable stake at risk, and improve decentralization by removing the need to purchase expensive hardware/power and the resulting economies of scale inherent in proof-of-work.

In order to contribute to network security and earn staking rewards currently around 4-5%, holders with 32 ETH can run a validator node to process transactions and create new blocks on Ethereum. Conversely, holders with less than 32 ETH or those not wanting the operational complexity and slashing risk of running a validator can stake their ETH through other parties, such as a centralized exchange like Coinbase or a staking-as-a-service provider like Figment. The catch, however, is that in order to simplify The Merge, ether staked on the Beacon Chain flows through a one-way bridge contract, meaning that staked ETH cannot be unstaked until after The Merge and after an upgrade enabling unstaking is added, which is estimated to be at least a year away. Thus, ETH staked to the Beacon Chain is effectively locked, prohibiting stakers from selling it or using it in other ways such as for collateral to take out loans. Enter Lido Finance, a decentralized finance protocol offering liquidity for staked assets.

Lido Finance is a liquid staking solution for Ethereum and other proof-of-stake blockchains such as Solana, allowing users to earn staking rewards without locking up assets or maintaining staking infrastructure. Users may deposit assets such as ETH to the Lido smart contract, which it then routes through 29 community-approved node operators such as Certus.One, InfStones, stakefish, Figment, Everstake, and Blockdaemon to earn staking yield. In return for depositing ETH through Lido, the user receives a receipt token, in this case Lido Staked ETH (stETH), that represents a claim on the staked ETH, accrues staking rewards, and unlike ETH staked to the Beacon Chain, can be freely used for other purposes, such as for collateral to borrow funds or to provide liquidity to a decentralized exchange. Moreover, Lido reduces counterparty risk by distributing pooled user funds to many validators and also aggregates staking token liquidity by alleviating the need for each staking-as-a-service provider to have their own staking token. However, Lido does introduce smart contract risk as well as the risk that its stETH deviates from the price of ETH. Nevertheless, Lido has been so successful that roughly one-third of all ether staked is done through Lido.

While stETH is not technically pegged to ETH, it should in theory trade around one ETH, since it will be redeemable for ETH and accumulated staking rewards in the near future. Note that some users may prefer stETH to ETH given its added functionality, but stETH is unlikely to ever trade at a consistent premium to ETH, given a one-sided arb where users can simply convert one ETH for one stETH on Lido and then sell the stETH for a premium on Curve or a centralized exchange, pushing its price back towards parity. Conversely, a user may prefer ETH to stETH given the absence of smart contract risk and its significantly greater liquidity, which is exactly what we’ve seen in the current market backdrop. In fact, when Terra’s UST broke peg, many stETH holders sold stETH for ETH, preferring to hold the actual asset itself rather than a derivative. Moreover, the delay of Ethereum’s difficulty bomb implying that The Merge may be further away than thought, and thus a holders’ ability to redeem stETH for ETH, also likely caused some to sell their stETH and push down its price.

While a user who has deposited ETH to Lido for stETH and plans to hold until his or her stETH is redeemable doesn’t have to worry about the discount as it will close once it is redeemable, this isn’t true for users who may be forced to sell discounted stETH prior to redeemability or for users who have utilized leverage. For example, Curve, which has the highest stETH-ETH liquidity of any trading venue, has already seen significant sales of stETH for ETH from the likes of Alameda Research, Amber, and Three Arrows Capital, and the pool remains imbalanced with 73% of the ~$680m pool in stETH, limiting the liquidity and increasing slippage costs for anyone wishing to swap large amounts of stETH for ETH (note that the $680m pool TVL is down from over $5b in April as LPs balked at the likelihood of selling cheap ETH and getting trapped in illiquid stETH). As for the leveraged component, many had utilized stETH to generate leveraged staking yield, doing so by converting ETH to stETH on Lido, using stETH as collateral on Aave to borrow ETH, depositing the borrowed ETH onto Lido to receive more stETH, and so on, looping the original ETH several times over and levering up the 4-5% staking reward. This, however, introduces liquidation risk if the value of the stETH collateral on Aave falls, and many users employing this strategy appear to have been liquidated, putting further pressure on the relative price of stETH. As we’ll see in subsequent sections, this stETH discount has had large ramifications across crypto.

stETH to ETH, Year-To-Date

Source: Santiment, GSR

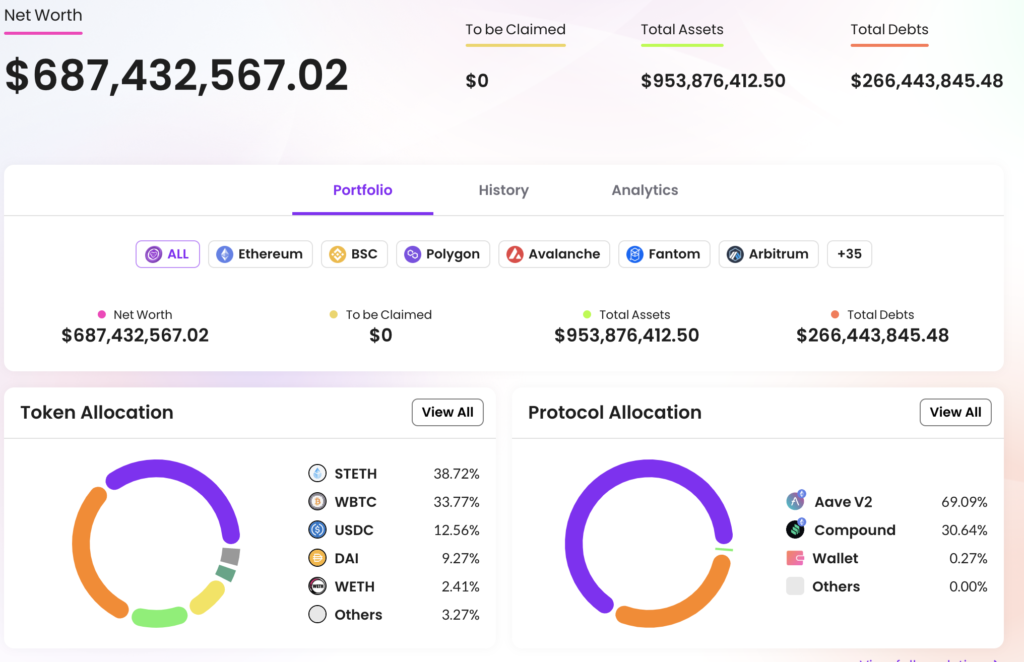

Celsius, Three Arrows Capital, and Other Collateral Damage

With 1.7 million users and nearly $12b in assets as of mid-May, Celsius is one of the largest centralized crypto borrow-lend operations, allowing users to buy, swap, earn, borrow, and send crypto all in one app. Initially operating similar to a bank, Celsius would allow users to deposit crypto in exchange for yield, and would allow other users to take out loans using crypto as collateral. Over time, however, it appears that Celsius engaged in riskier actions to generate yield, including lending user deposits to institutions, staking user funds to capture staking rewards, and participating in various DeFi protocols, sometimes with leverage. Such activities were corroborated by various notable events, such as Celsius losing $70m via staking service provider Stakehound, getting caught up in last year’s Badger DAO hack, and on-chain analysis indicating Celsius had deposited over $500m into the essentially-now-defunct Anchor Protocol (though Celsius did withdraw funds before experiencing losses). Moreover, Huobi Research reported that of the total ETH deposited onto Celsius, just 27% were in native ETH able to be immediately withdrawn, while 29% were locked on the Beacon Chain and 44% had been converted to stETH, likely to generate additional leverage for Celsius. And demonstrating the illiquidity of Celsius’s stETH position, the firm currently has 410,200 stETH, per ApeBoard, far more than the 166,500 ETH remaining in the stETH-ETH Curve pool. Between unfounded rumors of Celsius losing money from the collapse of Terra, the newly formed stETH discount, and a particularly poor market backdrop, users started to question Celsius’s financial position, and the company was hit with a flood of withdrawal requests that it was unable to meet. Citing “extreme market conditions”, Celsius activated a clause in its Terms of Use and paused all withdrawals, swaps, and transfers between accounts on June 12. Subsequently, several states have opened up investigations into the company, and Celsius has stated that it is exploring all options to stabilize liquidity and operations for the benefit of the community and its clients, including pursuing strategic transactions and restructuring its liabilities, among other avenues.

Another firm that has been at the center of the crypto turmoil is Three Arrows Capital (3AC), a highly regarded, Singapore-based crypto hedge fund founded by Su Zhu and Kyle Davies. We caution that many of the details surrounding 3AC are still coming to light and are not fully verified, but those close to the situation and on-chain data suggest the firm was on the losing end of many trades. First, we do know that 3AC was heavily invested in the Terra ecosystem and had invested over $200m in LUNA tokens in its February raise to support its UST bitcoin reserve, and now these LUNA tokens are essentially worthless. Moreover, 3AC disclosed in January 2021 via an SEC filing that it held $1.3b worth of Grayscale’s GBTC, making it the largest holder at the time with 6.1% of all shares outstanding. 3AC had allegedly utilized a levered GBTC strategy, borrowing funds to capitalize on the then-premium and more recently on the discount, which likely led to large losses as the premium turned into a discount and as the discount widened further. 3AC was also allegedly involved in the stETH leveraged staking trade as well, which is seemingly corroborated by 3AC’s 60,000+ cumulative stETH for ETH swaps on June 14th alone, per Nansen. Finally, the amount of leverage employed is coming to light as well, such as a $1.0b loan from BlockFi and a $665m loan from Voyager, which if all true, make the fund more akin to leveraged farming than a well-risk managed fund. Amidst the leverage, likely exposure to many soured trades, non-payment of funds, and additional accusations of negligence by funds that would trade through 3AC accounts and DAOs whose treasuries 3AC had managed, 3AC’s founders went silent on Twitter and reportedly ignored creditors and colleagues. In the wake of the collapse, Singapore’s MAS censured 3AC for falsified records, a court in the British Virgin Islands ordered Three Arrows to liquidate its assets, and the firm filed for Chapter 15 Bankruptcy in the Southern District of New York late last week.

Finally note that Celsius and Three Arrows are far from the only firms to get caught up in the market turmoil. Others who have been impacted include:

- Voyager Digital, a crypto trading platform that filed for chapter 11 bankruptcy due to “prolonged volatility and contagion in the crypto markets” as well as the non-repayment of the $665m unsecured loan it had made to 3AC

- Genesis, a crypto prime broker that reportedly suffered “hundreds of millions” of losses due to exposure to 3AC and Babel Finance

- BlockFi, a prominent centralized crypto-borrow lend firm that secured a revolving line of credit from FTX that also included an option for FTX to purchase BlockFi after the crypto lender experienced heightened withdrawal requests in the wake of Celsius’s withdrawal pause and after losing $80m due to exposure to 3AC

- Bable Finance, a Hong Kong-based crypto lender that paused withdrawals amidst “unusual liquidity pressures”

- CoinLoan, an Estonian crypto lender that reduced its daily withdrawal limit by 99% as a temporary, cautionary measure to balance the flow of funds, despite stating that it was not impacted by the Terra/UST collapse, 3AC, or DeFi protocol issues

- Vauld, a Singapore-based centralized crypto borrow-lend firm that paused operations due to the market turmoil and recently signed a term sheet giving Nexo the exclusive opportunity to purchase it

- Finblox, a high-yield crypto savings platform that limited customer withdrawals in light of 3AC exposure

- Maple Finance, an on-chain corporate lending market that warned its lenders that they must wait until cash is available to withdrawal their funds

- CoinFlex, a crypto exchange that paused customer withdrawals citing extreme market conditions and uncertainty involving a single counterparty

Celsius Wallet 0x8ac Overview

Source: Apeboard, GSR

DAO Governance in Question

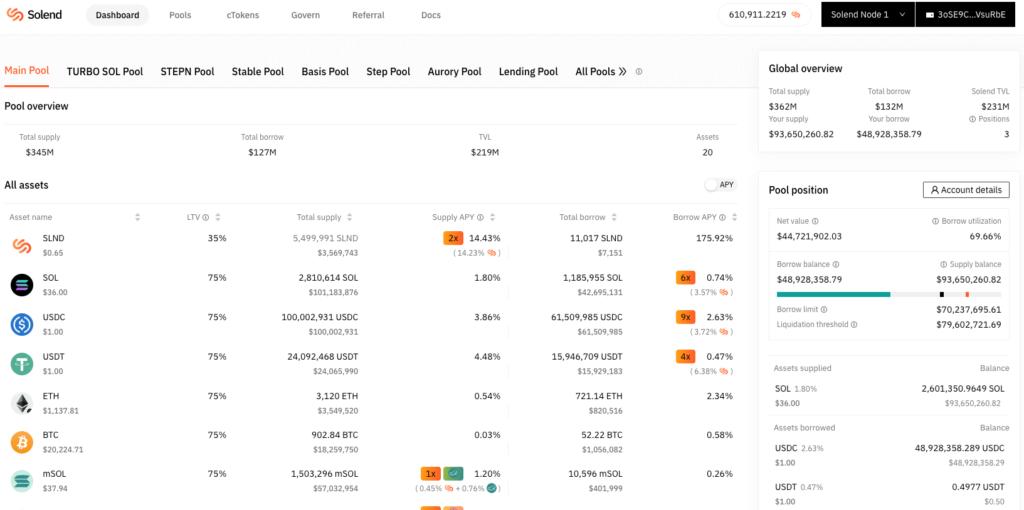

June saw several controversial DAO governance decisions, with many in the community lamenting the outcomes and questioning whether they were in the best interest of the sector. Some prominent examples included Solend DAO, Merit Circle DAO, and Tribe DAO, detailed more below.

Solend, a Solana-based DeFi lending protocol, found itself in a precarious situation as it revealed on June 19th in a Solend DAO governance proposal that a single user on the platform had 5.7m SOL posted as collateral to borrow $108m worth of USDC and USDT. At the time, this single user’s position represented 95% of SOL deposited and 88% of USDC borrowed in the Main Pool. Investor concerns caused a series of outflows from the protocol which in tandem with this large position resulted in both USDC and USDT spiking to 100% utilization. This prevented depositors from withdrawing and meant positions collateralized by these assets could not be liquidated. Additionally, the large account was inactive for nearly two weeks and the position was moving closer to liquidation as the SOL price fell, which posed risks to the Solana ecosystem given the scale. The Solend DAO governance proposal seeked to retroactively “enact special margin requirements for large whales that represent over 20% of borrows” and “grant emergency power to Solend Labs to temporarily take over the whale’s account so the liquidation can be executed OTC and avoid pushing Solana to its limits.” The proposal was approved but received harsh community backlash. Critics noted that the DAO was only created one day in advance, the voting period only lasted for six hours, and a single, unidentified wallet represented about 98% of “Yes” votes. Just hours later, another proposal was made and passed that revoked the prior proposal and it increased the required vote time for future proposals from six to 24 hours. This situation highlighted the lack of standardization in governance processes between DAOs, illustrated how decentralized governance may not be inherently democratic, and demonstrated how thoughtful processes need to be constructed in advance of difficult situations to reduce risk and control by a powerful few.

Yield Guild Games (YGG) and Merit Circle are two of the largest gaming DAOs that provide play-to-earn gaming scholarships. YGG made a $175k early stage investment in Merit Circle’s SAFT in October 2021. However, in May 2022, when the market value of the SAFT was worth ~30x the initial investment, a Merit Circle community member made a governance proposal that “aimed to demonstrate the lack of value YGG has provided the DAO since becoming a seed investor” and further proposed to terminate Merit Circle DAO’s financial obligations to YGG by “removing YGG’s seed tokens and refunding their initial $175k USDC contribution.” Members of Merit Circle DAO overwhelmingly approved the proposal. YGG responded noting that its only responsibility in the agreement was to provide financing and that regardless of how the proposal had been presented to the community, the DAO does not have legal authority to nullify a contract that Merit Circle Ltd signed on its behalf. The argument concluded with a negotiated settlement between Merit Circle and YGG that was subsequently approved by the Merit Circle DAO in June. The legal agreement prevented future litigation and it bought out YGG’s token allocation for $1.75m which allowed YGG to realize a 10x return on the initial investment, but still this only represented about one-third of the fair market value of the tokens at the time. Given the settlement and private nature of the SAFT terms, the legal precedent is unclear, but the situation raises concerns around investor protections and it could potentially dissuade capital from entering the space in the future.

In late April 2022, a decentralized lending protocol created by Rari Capital called Fuse was exploited for $80m. Before this exploit in December 2021, Rari Capital and Fei Protocol merged together, combining a decentralized lending market with an algorithmic stablecoin backed by protocol-controlled value (PCV). The merger brought these two distinct protocols under a single governance model controlled by TRIBE token holders. In May 2022, TRIBE token holders overwhelmingly voted for the DAO to make the community whole by absorbing the loss from the Fuse exploit. Although the vote lacked precise implementation details, it was generally understood that the only source of funds to implement this proposal was Fei’s PCV. About three weeks later, another proposal to whitelist the Fuse Repayment Contract as a safe PCV address was made to implement the previously approved proposal, but this proposal was vetoed by a subDAO, which forced the proposal into a normal on-chain DAO vote on June 15th. Additionally, on the day of the vote, Fei Labs came out and signaled that it would not support any proposal leveraging its PCV assets to reimburse users of Fuse. The proposal was narrowly rejected as TRIBE holders reversed the initial vote in a much closer 60/40 split. At this point there are no longer any imminent plans to reimburse victims of the exploit, but future proposals could be raised and alternative methods of reimbursement could still be discussed. Nonetheless, these events raised concerns about the permanence of a passed DAO proposal when another directly related proposal can simply be proposed shortly thereafter and come to a different conclusion.

While community governance may be used as a force for good, restoring power to the masses, it is clearly early in its development and will likely take time to figure out how to avoid potentially detrimental situations such as these.

The Solend Whale’s Current Position on Solend

Source: Solend.fi, GSR

Bitcoin Miners Capitulate on their HODL Strategy

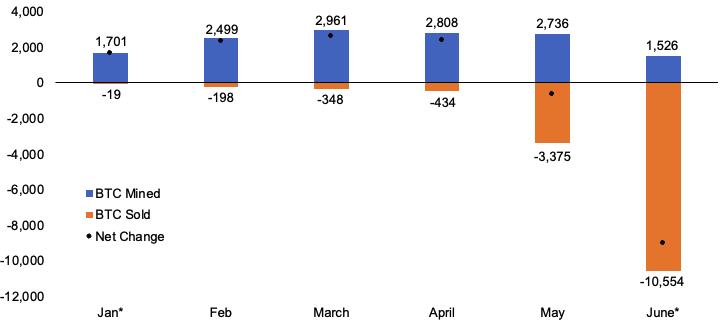

While a subset of Bitcoin miners such as Iris Energy, Mawson, Greenidge, Stronghold, and CleanSpark have regularly sold some or all of their mined bitcoin, many of the largest publicly traded miners such as Core Scientific, Marathon, Riot, Bitfarms, Hut8 and Argo strategically held on to their bitcoin production and aimed to finance operations through alternative means. Miners cited the rationale for this HODL strategy as a core belief in the asset as well as greater interest in their stocks, allowing investors to gain bitcoin-like returns without having to worry about fund mandates, custodying the digital assets, and other challenges related to investing in crypto. In recent months, however, we’ve seen many of the largest miners deviate from this strategy as market conditions have deteriorated and external financing has become difficult to obtain.

As shown in the exhibit below, the miners analyzed were generally holding onto almost all of their bitcoin production each month. As the year progressed, however, bitcoin selling began to increase as miners used bitcoin production to fund operating expenses, debt payments, and expansion efforts, including for rig procurement and site development. This trend of bitcoin selling accelerated materially as the environment worsened and the group in aggregate was selling more bitcoin than they were producing by May 2022, selling all of their monthly production and drawing down portions of their bitcoin reserves which they had built up over the years. While the data set is not yet complete for June, it appears this trend accelerated last month with large sales from Core Scientific and Bitfarms, both of which sold material amounts of bitcoin held on their balance sheets. While June data is not yet available for Riot, Marathon, or Hut8, these companies have bucked the trend in this peer set. Marathon and Hut8 have continued to maintain their full HODL strategy and neither company has sold any of their bitcoin production so far this year. Riot on the other hand, has begun selling a portion of their monthly production, typically around half, so they have still managed to grow their bitcoin reserves each month despite beginning to sell some production to help finance operations.

While the sentiment around bitcoin miners remains dire, we believe the situation is more nuanced than at first glance. First and perhaps most importantly, the most efficient bitcoin miners are still profitable with positive cash flow at current prices. And while many miners have large rig order payments and in-process site development expenses to contend with, most large public miners can cover remaining rig delivery payments, which may be adjusted down by the manufacturers or sold to peers, with their cash and HODL on hand. And while we do admit that ~$20k seems to be the worry zone from conversations with management, the network hashrate has fallen from its peak, aiding mining profitability, and miners finally appear willing to hedge against further deterioration in the price of bitcoin. While the situation is certainly very challenging and there will likely be casualties from overleveraged, subscale miners, we simply believe the situation is not quite as grim as the rock bottom multiples or simple ratio analyses would imply.

Bitcoin Miner Production & Sales Per Month

Source: Company Reports, GSR

Note: The peer includes Core Scientific, Marathon, Riot, Bitfarms, Hut8, and Argo. *Core Scientific was excluded from January as they did not release a production report in the month. June includes only Core Scientific and Bitfarms as the other miners have not yet released their June monthly statistics.

Authors: Brian Rudick, Senior Strategist | Telegram, LinkedIn Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

GSR In the News

Blockworks – PolySign Nets $53M To Improve Services for Institutions, Asset Managers

CoinDesk – Fintech Firm PolySign Raises $53M to Expand Staff

CoinDesk – Peaq Raises $6M in Funding Round Led by Fundamental Labs

Nasdaq TV – Risk Management in the Crypto Ecosystem

Reuters – Cryptoverse: The bonfire of the NFTs

SiliconAngle – Orderly raises $20M for decentralized crypto exchange on the NEAR protocol

Disclaimers: “This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.”