Crypto Binary options are a financial derivative that is not only the building blocks of many structured products but can also provide a compelling investment opportunity by themselves for both speculators and risk managers alike. As their name suggests, the payout is either something or nothing. Binaries turn a trade into a straightforward question: will the price be above (or below) a strike price at a future point in time. If the underlying asset is above the strike on the maturity date, then the payout will be a fixed payout. If the underlier is below the strike, then the payout is zero. The buyer of the Binary Option will pay a premium upfront to enter into this trade.

Crypto Binaries Payout

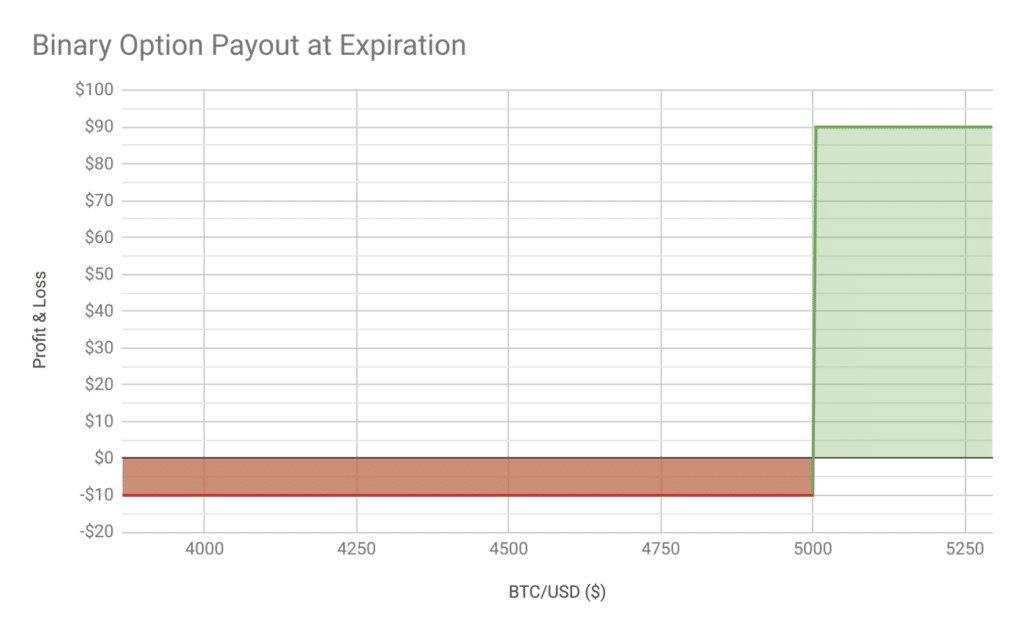

The simplicity of the payout is one of the key advantages. The maximum downside for the buyer is the premium paid upfront and the maximum upside is the payout minus the premium. The example below illustrates the payout on BTC/USD with a strike of $5000. If the settlement is below $5000, then the premium of $10 is not recouped. If we settle above $5,000 the payout is $90 ($100 payout minus the $10 premium). For reference, the example was a snapshot when BTC/USD is $4,000 for a 1-month binary.

Due to the simplified payout structures, Binaries are also usually easier to risk manage. If the price is above the strike price by any amount, the buyer gets paid a fixed amount of money and if the price is at or below by any amount the seller keeps the fixed amount paid. As a simplification, binary options are priced and can be thought of as what is the percentage chance of the final outcome on a scale of $0 to $100, in the above case 10% or $10.

Pricing and Market in-efficiencies

The existence of volatility in the cryptocurrency market enables GSR to offer products such as these. A volatility surface holds a lot of information about expected future price movements and it is important that these instruments are priced in a non-arbitrage and risk-neutral manner, however herein lies a way for the savvy investor to recognise the value in the product or help formulate a trading view. A Binary Option can be viewed as the present value of the expected payoff, which is equivalent to the probability of being in-the-money, this probability could be compared to a historical probability distribution to determine whether the current volatility market is over or underpricing the event. In the example above, the approximate probability of BTC being above the $5000 strike at expiry is 10%.

Types of Crypto Binary Options

So far we have discussed European Up Binaries which will payout if we are above the strike at maturity, however there are also European Down Binaries which payout if we are below the strike at maturity allowing holders to take a bearish view.

Furthermore, the settlement can be tailored either through Cash or Nothing or Asset or Nothing. In the latter the option holder will receive a number of units of the Cryptocurrency if the option is in-the-money.

Three variables can be chosen to customize the options: product, strike & expiration. The available range of products are extensive. In the case that there are not reliable index prices provided for an altcoin, a specific exchange’s price is possible to use. The strike is simply the price at which the price needs to be above for the buyer to get paid and expiration the time at which the contract is settled. For Binary options the amount you pay is always maximum you can lose, so the risk is known and capped.

Combinations

Multiple binaries can be combined in a wide variety of ways to create unique payouts. In the same way bets can be parlayed in normal betting, these products can be combined with other crypto binaries to increase potential gains. To keep the scope of this article we will not elaborate here, but plan on more information on these exotic structures later.

Applications

GSR’s offering of Binaries can be useful to a variety of counter-parties and a means of hedging either long or short crypto exposure.

Even simpler, this product can be used for a speculator to get leveraged long or short exposure with known potential loss to express a market view. Quite often a view on the market is more easily assimilated on a simple hypothesis, such as:

“BTC/USD will be above $5000 in 3 months time but I’m not confident how much beyond that it will go.”

Which is where the Binary can be used instead of the Vanilla option, since the Vanilla call will payout in direct proportion to the performance beyond the strike.

Advantages & Risks of Crypto Binaries

Compared to vanilla options which have linear payouts and uncapped risk, binaries have constant payouts and capped risk. Further, for fragmented crypto markets physically settled options represent an illiquidity premium and risk of trading out of the underlying after settlement, while binaries are simply exchanges of cash based on the outcome of a discrete event.

Binary options ultimately allow investors, hedgers and speculators alike a means of taking known risk positions on discrete outcome events in the crypto markets.

About GSR

Founded in 2013, GSR is one of the original leaders in algorithmic digital asset trading. We have traded billions of dollars of digital assets utilizing our proprietary software suite, capable of satisfying all liquidity needs, from basic execution services to highly complex solutions. We have a deep understanding of digital asset liquidity and microstructure, having integrated into over 35 trading venues. Our team leverages decades of experience from Goldman Sachs, Two Sigma, Nomura International, Oracle, Circle and IBM across trading, quantitative investments, and trading technology. GSR’s algorithmic platform has been trusted by many of the top players in the space, including miners, protocols, ICOs, exchanges, custodians, and banks.

If you would like to learn more about this type of structured product, contact markets@gsr.io