What is Market Making?

Market making is an activity whereby a trader simultaneously provides liquidity to both buyers and sellers in a financial market. Liquidity is the degree to which an asset can be quickly bought or sold without notably affecting the stability of its price. Market makers “make a market” by quoting prices to both buy and sell an asset. In this way, the crypto market maker (or liquidity provider) acts as both a buyer and seller of last resort where there would not naturally be another buyer or seller, thereby providing liquidity.

Why do we need Market Makers?

Market makers enable financial markets to become more efficient because they reduce price volatility and assist with fair price discovery. This is how it works: For a given asset, the difference between the best bid and the best ask is called the bid-ask spread. Markets that have low liquidity will generally have wide bid-ask spreads in their order books. The size of the spread has a direct influence on the volume traded in the market, with a tighter spread generally resulting in more volume traded. A market maker does nothing more and nothing less than facilitating tight markets by posting tighter spreads.

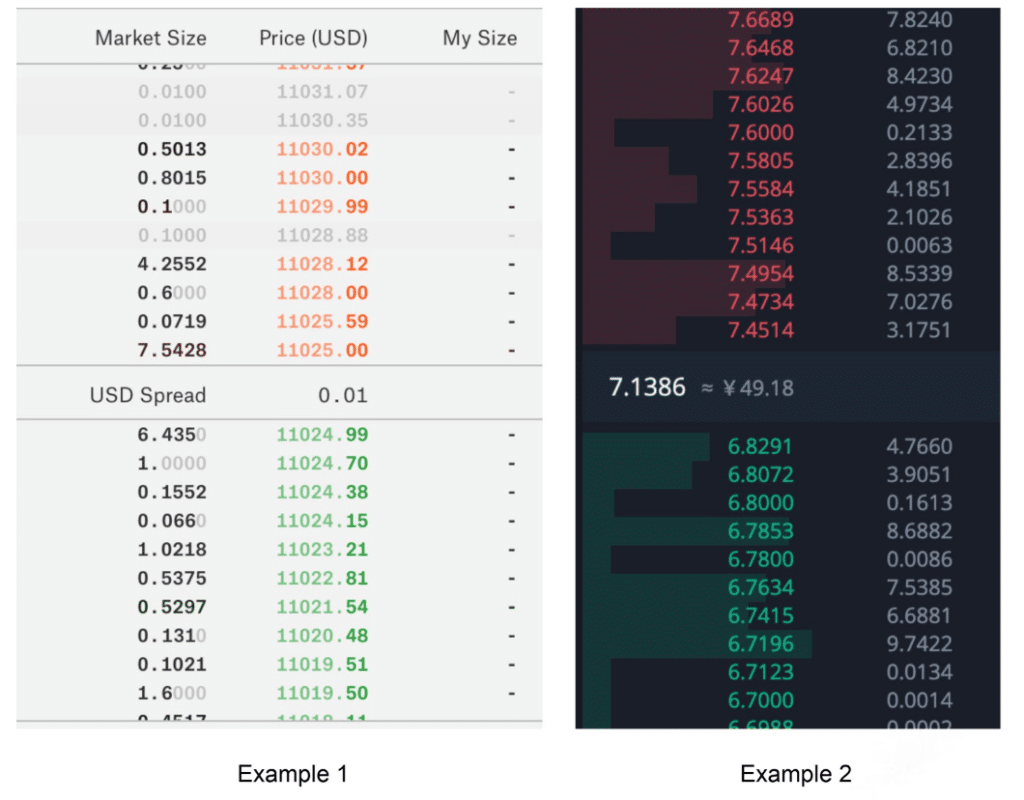

Example 1 is a snapshot of a healthy market with a tight spread on Coinbase pro (BTC/USDC). The spread is 1 cent wide (0.0001%) for BTC, being valued at $11,025. Example 2 is from the OEX exchange (at the time of writing ranked no.10 in reported volume on Coin Market Cap) showing the cross EOS/USDT with a spread that is 62 cents (8%) wide on an asset worth $7.14 (EOS).

In addition to the bid-ask spread, another factor in determining an asset’s liquidity is the order book depth, which is the amount of an asset that can be purchased at a given price level. In the above example, a market participant could buy and sell several thousand dollars of BTC for an insignificant loss (.00001%). Whereas on EOS, if a trader bought and sold just a small amount of the token, they would immediately realize an 8% loss on their investment. If they wanted to buy and sell a few thousand dollars worth of EOS, i.e., going deeper down the order book, the loss would be magnitudes worse. As projects compete for the attention of institutional participants, this is a crucial metric to consider that has serious impact on a project’s viability.

Advantages for Tokens

Reducing Friction

At present, cryptocurrency markets suffer from a lack of efficiency. This creates a daunting environment for traders to participate in, where friction — the direct and indirect costs of transacting — is high. As a result, token issuers suffer, as they need a seller if someone wants to buy, and a buyer if someone wants to sell. In crypto, this isn’t always the case, especially for lesser-known tokens. Market makers alleviate the friction for individuals wanting to participate in the market, providing well-organized and cost-effective entry points for traders.

Facilitating Growth of the Token Ecosystem

For the majority of projects, the utility of their token is what drives their business model and future aspirations of adoption. The market maker ensures there is always a potential buyer and seller for the token, supporting healthy token economics. Importantly, hiring a market maker to provide liquidity frees up token issuers to focus on building out their technology and driving adoption in the space.

Advantages for Exchanges

Price Discovery & Real Volume

The goal of the market maker is to provide liquidity, tighten the spread across trading pairs, and encourage order book volume. Ultimately, volume and exciting projects are what attract traders to an exchange. Unfortunately, many exchanges directly or indirectly endorse “fake volume” to entice projects and investors. The use of a reputable market maker can discourage volume manipulation while encouraging price discovery and order fulfillment. In turn, healthy order books increase investors’ level of confidence in the exchange, creating trust that is crucial in such a volatile space.

Concerns & Considerations

Unfortunately, some companies carry out questionable trading strategies under the guise of “market making”, which creates problematic situations for tokens. Market makers with no background in traditional financial products, for example, tend to over-promise and tie token issuers into questionable wash trading schemes. Others might promise price or volume targets, which is unethical, not to mention impossible to achieve in an efficient and orderly market.

Conclusion

Financial markets need to operate efficiently, enabling investors and traders to buy and sell assets seamlessly and cost-effectively. Without market makers, there would be fewer transactions and the overall efficiency of markets would decrease. That is why the practice of market making has been an integral part of traditional market infrastructure, and its influence will continue as long as we trade financial assets.

Any institutional-grade market maker will operate with programmatic execution and algorithms that integrate with exchange APIs that are designed to create efficient markets. A robust API allows market makers to act more efficiently with more reliable up-times, providing consistent liquidity.

Like many aspects of the cryptocurrency market, standard practices need to improve and bad actors need to be stamped out. By quizzing market making partners on basic aspects such as trading strategy, wash trading, and KPIs, crypto projects will be able to find a reliable partner that works for them. An efficient market maker encourages a healthy token market, allowing projects to build the future of their digital asset ecosystem.

To learn more, contact markets@gsr.io