Author: Brian Rudick, Senior Strategist

After falling 45% from its peak in May, DeFi total value locked has come roaring back to near-peak levels, leading some to call for a potential DeFi Summer 2.0. Alternative measures of DeFi activity, however, suggest it never left.

DeFi Summer: Decentralized finance, or DeFi for short, is a form of finance that uses blockchain technology, smart contracts, and decentralized applications (dApps) to offer typical financial services such as lending, trading, and investment without intermediaries and in a transparent and open way. DeFi has existed for some time, but it really began to take off in the summer of 2020 – known as DeFi Summer – when borrowing and lending platform Compound introduced its COMP governance token, which it used to reward its users in a process called liquidity mining. Such rewards, paid in COMP, dramatically increased yields, made more complex yield farming strategies possible, and allowed token holders to participate in governance. As other protocols mimicked these concepts, users piled into defi, token prices increased, and defi activity in general skyrocketed.

TVL Explained: Total value locked (TVL) is the total amount of assets locked in DeFi smart contracts at a particular time, and is the de facto measure of DeFi activity. While TVL is informative, several considerations are needed. First, leverage can increase TVL, for example, as one who deposits ETH on Maker to get DAI, trades the DAI for ETH on an exchange, and then deposits that ETH back onto Maker will increase Maker’s TVL. In addition, it can be difficult to compare TVL between dApps, as some such as Maker mint new tokens (DAI) upon receiving a deposit, increasing TVL, while others like Compound or Aave let one user borrow tokens from another, reducing the total supply in the smart contract. Lastly, TVL is significantly impacted by token prices, and therefore makes it more difficult to compare the amount of underlying activity over time.

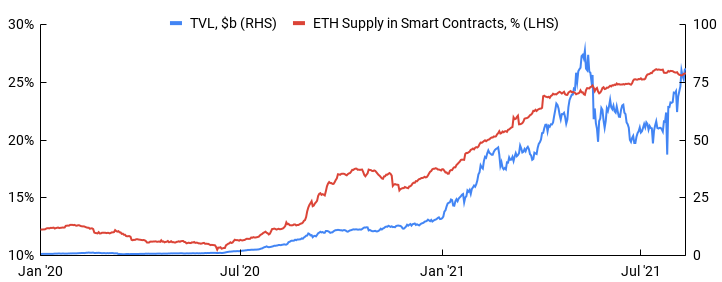

Measuring DeFi Activity: There are many additional measures of DeFi activity that we can use to supplement TVL, such as the number of dApps, transactions, and total and active wallet addresses. Other measures such as decentralized exchange volumes, outstanding DeFi loans, stablecoin supply, and even capital raises are also informative. One of our preferred metrics is the percentage of ether locked in smart contracts. While similar to TVL in that it examines what is locked in a protocol at any given time, this metric removes the price of ETH from the equation, giving a more direct view into activity. Note that the numbers below include the Eth2 Deposit Contract, which went live late last year and contains ~7m ETH or 5.7% of the total supply. As shown in Exhibit 1 below, while it may seem like DeFi activity took a major step backwards over the last few months before recovering, the percentage of ether locked in smart contracts shows DeFi activity never left.

Exhibit 1: DeFi Total Value Locked vs. Percentage of Ether in Smart Contracts

Source: DefiPulse, Glassnode, GSR

DeFi Catalysts: While there are certainly many risks, we contend the future of DeFi is bright. User experience continues to rapidly improve, with interfaces being simplified and made more intuitive, and transaction speed and costs improving through layer two scaling solutions and Ethereum 2.0. DeFi activity is also proliferating to other smart contract blockchains like Solana and Terra, and second order derivatives protocols are launching on top of base layer primitives like Aave and Compound. Moreover, smart contract risk should decline as protocols become battle-tested, auditing increases, and insurance becomes more commonplace. Awareness and education will also help. Even regulation, which will inevitably hit DeFi hard at some point, should usher in ever-important institutional participation. In other words, DeFi never left and isn’t going anywhere.

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.