Author: Brian Rudick, Senior Strategist

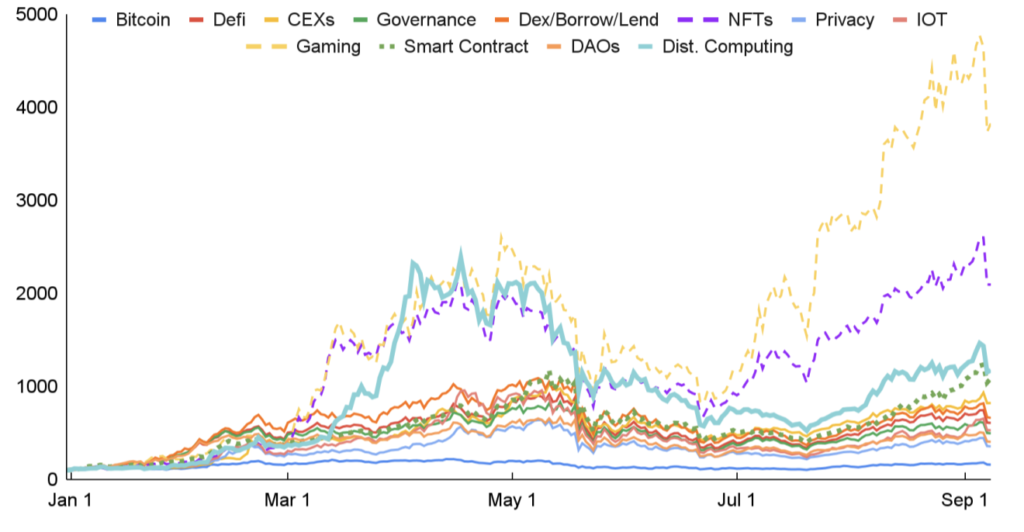

Two of the biggest themes in crypto this year have been the rise of blockchain-based gaming and NFTs, both of which have caused associated tokens to soar. In this week’s Chart of the Week, we examine token performance by category.

More than Just Bitcoin: Bitcoin, the decentralized, censorship-resistant, immutable, permissionless, open-source, pseudonymous, and fungible native asset to the proof of work-based Bitcoin blockchain, is considered by many to be the world’s original digital currency. And while Bitcoin was initially intended to be an electronic payment system, it has evolved into a store of value given technical limitations and a fixed supply. Cryptocurrency, however, is about so much more than just Bitcoin. Blockchain technology enables the removal of intermediaries, cost-free value transfer, distributed computing platforms, and new business models, governance forms, and ownership paradigms, to name a few. Such powerful use cases are being put to work in a variety of applications, from decentralized finance to Web 3.0 to entertainment and gaming. And as the technology develops, advantages become more clear, and adoption continues, token performance will follow.

Performance by Categories: To track the performance of various categories/types of cryptocurrency, we created equal-weighted custom baskets. Importantly, we exclude tokens with market caps below $500m to avoid over-influence by small tokens, and also keep constituents static to eliminate survivorship bias. Lastly, note that categories are not mutually exclusive, with, for example, a DeFi protocol with DAO-based governance in both our DeFi and DAO categories and NFT-based gaming tokens in both our Gaming and NFT categories. As shown in Exhibit 1, gaming tokens have led the pack, increasing 38x this year, followed by NFT-related tokens, up 21x. Distributed computing (+12x) and smart contract layer one platforms (+11x) have also been particularly strong. On the other end, privacy-related coins have increased 3.6x, the lowest increase for any category. Note that all categories have outperformed Bitcoin (BTC), which is up 1.6x YTD, as it’s hard for Bitcoin to increase many times over when its starting market cap was already over $500B. Indeed, given altcoin strength, BTC dominance has fallen from 71% to 41% over the course of the year.

Blockchain-Based Gaming: One of the biggest trends this year has been the rise of blockchain-based gaming, where digital pet universe play-to-earn game Axie Infinity has led the charge. Indeed, incorporating blockchain technology into a game has many benefits including enabling users to own assets, improving security, transparency, trust, and traceability, expanding developer revenue streams, enabling rich incentive schemes, and introducing composability. Axie Infinity, for example, allows players to own their Axies, gives out Smooth Love Potion (SLP) token rewards to players for accomplishing certain tasks, and increases its revenue by taking a cut of all marketplace sales. Axie now boasts over 1.5m daily active users and has been making $10-20m in daily revenue, causing its AXS governance token to rise over 125x this year. Other gaming-related tokens have increased more than 10x too, such as Decentraland (+11x) and Enjin Coin (+13x), causing gaming to be the top-performing token category so far this year.

NFTs: Closely related to the strong performance of gaming tokens is the performance of our NFT basket, which is up 21x this year. While immediate applications of NFT technology are most prevalent in gaming and collectibles, these blockchain-based digital representations of ownership can be employed in a variety of additional use cases like media, music, and finance, and in the future will usher in new paradigms around content, ownership, value, and exchange. Outside of the gaming tokens discussed above, blockchain-based sports platform Chiliz and digital collectibles marketplace creator ECOMI have seen a particularly strong performance this year.

Meme Coins, Distributed Computing & Smart Contract Protocols: We’d be remiss if we didn’t mention the phenomenal performance of meme coins, such as Dogecoin, up 55x YTD due at least in part to retail speculation and Elon Musk comments, and Shiba Inu, up an astounding 88,180x over that time. Distributed computing has been strong, driven by Holo (+17x) and BitTorrent (+14x), while smart contract protocols have seen material dispersion in token performance, though those with increased user and developer adoption are seeing a commensurate increase in their token price, such as for Solana, Fantom, Terra, and Harmony, up +126x, 93x, 45x, and 33x respectively, this year. Though difficult to predict what corner of the cryptosphere will be next, we’re confident that over the long run, continued development, increased utility, and greater adoption will continue to drive token prices.

Exhibit 1: Token Performance by Category (12/31/20 = 100)

Source: Santiment, GSR

Note: Categories are not mutually exclusive.

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.