Staking provides holders of proof-of-stake-based cryptocurrencies a way to earn yield while also helping to secure the network. We review staking and various staking providers in this week’s Chart of the Week.

Securing Proof-of-Stake Networks

One defining characteristic of a blockchain is its consensus mechanism, where a decentralized network of unknown parties agrees on which transactions should go into a block and onto the blockchain. Moreover, given network latency and block producers’ ability to include the transactions of their choosing, public blockchains must decide which block producer gets to add a valid block to the network. As open networks where participants may be malicious, however, public blockchains must also prevent bad actors from simply flooding the network to be the one chosen to add and maintain invalid transactions on the blockchain. Blockchain networks accomplish this by requiring block producers to expend something of value, making it prohibitively expensive to attempt to take over the network. Bitcoin’s proof-of-work consensus mechanism, for example, requires miners to contribute significant computational and energy resources, and the odds that any individual miner solves the mining puzzle and receives the block reward/transaction fees are proportional to the amount of work, or hash rate, contributed, encouraging and rewarding greater participation in the consensus process.

Proof-of-stake blockchains, by contrast, have block producers called validators, rather than miners. Such validators run full nodes, bond or stake the protocol’s native token, propose blocks when chosen to do so, and validate/sign the transactions and blocks of others when not. Validators are chosen at random to produce a block in proportion to their stake, and additional balancing mechanics may be implemented as well, such as how long it’s been since a validator was last selected. Importantly, by requiring and choosing block producers based on stake, proof-of-stake blockchains similarly making it extremely costly for bad actors to control the network and add invalid transactions. Validators receive staking rewards for the work they perform but may be prohibited from participating in consensus or see some or all of their stake slashed if they intentionally or unintentionally perform their duties poorly, for example, by going offline or double-signing a transaction. While fewer validators on a network help with throughput, it also hurts security. Thus, the more validators a network has and the more assets that are staked, the more secure the network.

Staking Basics

To participate in the consensus process and partake in staking rewards, individuals may run a validator node, which typically requires a certain amount of staked native tokens (eg. ETH 2.0 requires 32 ETH; Avalanche requires 2,000 AVAX) as well as procuring, running, and maintaining node infrastructure that meets the minimum, network-specific technical specifications. Many proof-of-stake blockchains, however, have built-in delegation systems, where any token holder, particularly those without the minimum stake, technical know-how, or desire to run a validator, may delegate tokens to a validator to earn staking rewards in exchange for a fee paid to the validator. Validators who accept transferred tokens from delegators are known as staking-as-a-service providers and stake the user’s tokens on behalf of the user to earn the fee, which is typically a percentage of the staking rewards generated. By incorporating delegation, a proof-of-stake blockchain allows for anyone to access staking rewards, broadens consensus participation, and helps secure the network. Note that validator/staking services may be custodial, for example where a provider maintains control of the user’s assets such as with exchanges that often outsource validator operations to third parties, or maybe non-custodial, where, for example, a proof-of-stake blockchain that natively supports delegation distributes a delegator’s share of rewards directly to the delegator.

Benefits & Risks

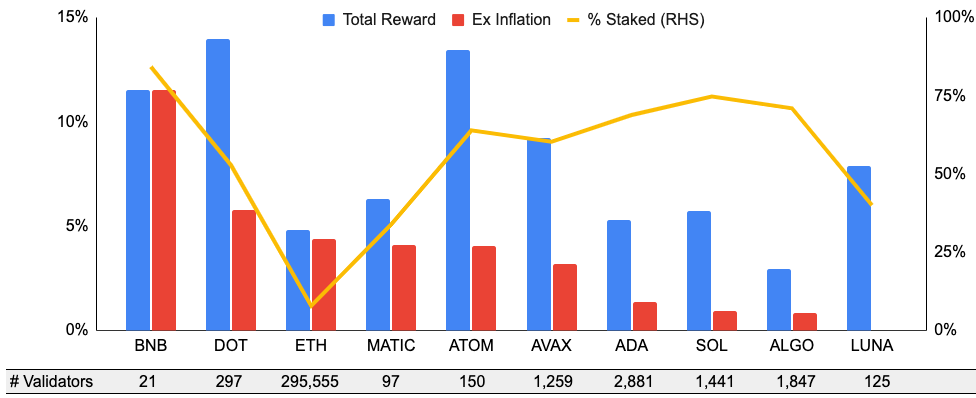

One obvious benefit of staking is to participate in the staking reward. Importantly, the native token of many proof-of-stake blockchains is often inflationary, which helps to distribute the token, encourages and rewards validators/stakers, and otherwise entices token use in some capacity. As such, the staking reward consists of both inflation and transaction fees. Staking rewards vary based on protocol design, the staking participation rate (more staking causes a lower yield as the staking reward is distributed across more stakers), activity on the network, vesting periods, and for the delegator, which validator they chose. Of note, those that stake will own more of the network overtime at the expense of those that do not stake, though everyone benefits from greater network security.

Staking, though, is not without risks. First, staking typically requires locking up staked assets for a period of time specific to each blockchain, prohibiting the immediate withdrawal of staked assets and ensuring the blockchain’s security is maintained. This exposes stakers to underlying price volatility, preventing them from selling should the token rapidly fall in price. Staking also introduces opportunity costs, precluding the tokens to be used in other activities such as for lending or providing liquidity. However, many staking-as-a-service providers, particularly decentralized staking pools that accumulate and distribute staking deposits to validators, distribute derivative assets that not only represent staked tokens but also accrue interest and can be used in DeFi protocols. Examples include Lido’s stETH or Binance’s BETH. And both validators and delegators are subject to slashing risk, with the latter dependent on whether the staking provider reimburses for slashing costs.

The Business of Staking

Staking providers operate a simple business model, earning revenue, often amounting to 5-10% of clients’ staking rewards, in exchange for running validator nodes and staking client assets. Similar to an asset manager or a bank, staking provider revenues increase or decrease based on the growth in staked assets as well as any change in the margin earned on such assets. On the cost side, staking providers have significant upfront capital and equipment costs and require continued operational and investment expenses to maintain and grow current operations, often to new proof-of-stake blockchains, with the main expenses being staffing, equipment, and insurance. At scale, such expenses are low and lead to very strong margins. Staking providers also benefit from being allowed, or even required, to participate in governance, with the rules for delegated token voting varying by blockchain but often allowing staking providers to vote using such tokens. From a competitive standpoint, there are many staking providers offering fairly homogenous products, though they do compete on safety, reliability, brand/reputation, liquid staking derivatives, rates, and supported protocols, among other items.

While underlying fundamentals are strong, the business of staking has risks and is operationally demanding. In addition to slashing risk and high upfront capital and equipment costs mentioned above, revenues are highly dependent on token prices, and thus may be highly volatile. Moreover, operational demands are high, requiring, for instance, exceptional information security, protection against denial of service attacks, and the maintenance of redundant systems, and this must be done 24/7/365. Lastly, the regulatory landscape is unclear, as US SEC Chair Gary Gensler has stated that staking products “take on all the indicia” of securities.

Staking Providers

We provide a brief review of various staking providers below.

- Figment: Figment offers staking and application layer solutions for token holders and developers in the web3 space. Its staking services allow token holders to earn crypto native rates on over 50 proof-of-stake blockchains. Figment offers secure staking infrastructure with a unique focus on governance, in-depth reporting, and industry-leading service level agreements. Figment generates the bulk of its staking revenue from its 100+ institutional clients, and as of December, was projecting $100m in revenues for 2021 from the over $7b in assets it looks after.

- Coinbase: Coinbase offers staking for certain proof-of-stake tokens to its users, of which 2.8m customers were earning yield on their crypto in 3Q, primarily via staking. Coinbase takes a 25% commission of staking rewards earned by customer crypto in its custody and reported $81m in blockchain reward revenue (again, primarily staking) in 3Q, though the $81m is on a gross basis. In addition to offering custodied staking rewards, Coinbase Cloud, formerly Bison Trails, offers a full suite of blockchain development services and infrastructure. Coinbase Cloud lets users run managed validator nodes on 25+ protocols, and offers easy infrastructure management, in-depth protocol reports, and a 99% uptime guarantee and multi-cloud, multi-region resiliency. As of November, Coinbase Cloud had $30b of crypto assets staked on its non-custodial platform from a diverse set of customers including Coinbase Institutional and a portion of retail staking for ETH 2.0. Coinbase takes an 8% commission of staking rewards earned via its non-custodial Coinbase Cloud platform.

- Lido Finance: Lido is a liquid staking solution for Ethereum and other proof-of-stake blockchains such as Terra and Solana, allowing users to earn staking rewards without locking up assets or maintaining staking infrastructure. Users may deposit assets such as ether to the Lido smart contract to receive a liquid staking token such as stETH. The smart contract then pools deposited funds and stakes them in a non-custodial manner with top node operators such as Certus.One, InfStones, stakefish, Figment, Everstake, and Blockdaemon. Liquid staking tokens such as stETH may then be freely transferred or used within DeFi, such as for lending and yield farming. Lido reduces counterparty risk by pooling user funds, though introduces smart contract risk as well as peg risk for its liquid staking token.

What’s Next

Going forward, we see strong growth in both staked assets as well as staking provider revenues. While staking provider take rates will surely compress with competition and as individual blockchain token rewards decline, total staked assets, and thus staking rewards, are in a strong position to grow, powered by continued growth in activity on proof-of-stake blockchains as well as from the creation of new proof-of-stake chains. Both of these are in some sense a bet on the activity taking place on proof-of-stake chains, such as DeFi, NFTs, etc. In fact, total staking rewards in 4Q21 totaled an annualized $15b, up 939% over the prior year and far outpacing the increase in proof-of-stake-based protocol market cap. By 2025, JP Morgan estimates that industry staking rewards will total $40b, with Ethereum’s move to proof-of-stake adding $350b in stakable assets and $20b in staking revenues alone.

Moreover, given the synergies, we may see more crypto intermediaries such as exchanges acquire third-party validator services. Meanwhile, stakers will likely benefit as staking provider rates compress due to competition and slashing insurance becomes the norm. There will likely be greater liquid staking derivative usage as integration into more protocols occurs. And the ability to earn yield will likely spur additional institutional interest in crypto. And as the number of validators increases and more token holders stake their tokens, network security will continue to increase.

Exhibit 1: Staking Rewards, Number of Validators, and Percentage Staked for the

10 Largest Protocols by Staked Value

Source: StakingRewards.com, Cosmos Hub, Binance.org, Algorand.org, GSR

Author: Brian Rudick, Senior Strategist

Sources

Messari: What’s at Stake in Staking-as-a-Service?, Staked: The State of Staking, 4Q 2021, The Block: Crypto Staking Businesses Are Making an Absolute Fortune, Onomy Protocol: Proof of Stake & Validators: An Overview, JPMorgan: A Primer on Staking, Lido: Docs, Figment: Website, Coinbase: Cloud & Investor Relations Websites

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.