Blockchain technology is beginning to permeate many facets of life, with sports being no exception. And with billions of fans around the world, blockchain-based applications can enhance fan engagement, create new revenue streams for sports entities, and potentially usher in the next wave of digital asset adoption. We review sports and the blockchain in this week’s Chart of the Week.

Sports & The Blockchain: Blockchain technology brings about many benefits, such as the removal of intermediaries, the democratization of value transfer, and the introduction of new paradigms around ownership, governance, and business models to name a few. As such, the technology is being rapidly integrated into many industries in a variety of capacities. And with a global market expected to reach $600b by 2025 with billions of fans around the world, sports is no exception. Efforts thus far have centered around digital collectibles, fan tokens, and ticketing, among others, and offer several benefits. For example, blockchain technology can enable improved fan engagement via new genres of collectibles, unique experiences like access to athletes, unique content, and VIP areas of the stadium, and the ability to partake in team decisions via fan token voting. Blockchain technology can also improve functionality and utility by combatting scalpers and enhancing transparency with NFT-based ticketing, fighting fraud with immutable authenticity and provenance, and improving exchange with global, trustless, real-time marketplaces. Lastly, the technology can improve revenue models via the selling of programmable sports-related digital assets, enhanced loyalty programs, greater data and analytics, and an instantaneous global reach. All in, blockchain technology can fundamentally change how fans and teams interact, turning fans from casual to avid, and potentially ushering in the next wave of digital asset adoption.

A Bevy of Use Cases: Blockchain technology is being used in a variety of capacities in sports. These include:

- Collectibles: Sports-themed NFTs offer fans the ability to own authentic, provably scarce, officially-licensed digital collectibles. Moreover, relative to analog collectibles where much of the engagement ends after the purchase, NFT collectibles can provide ongoing utility by displaying updated player/team statistics, being showcased digitally to an internet-wide audience, and offering exclusive access to new and exciting fan engagement experiences. And for issuers, collectible NFTs open up new revenue streams from both primary and secondary sales. And new innovations continue to permeate, such as with Proof of Attendance Protocol, which awards NFTs to event attendees to serve as a collectible digital memento and tokenize the fan experience.

- Fan Tokens: Primarily issued by Socios.com and the Binance Fan Token Platform, fan tokens are collectible utility tokens associated with a specific team or club that offer fan-related membership perks like unique experiences, rewards, and voting on team decisions. Unlike NFTs, fan tokens are fungible, and they also have a finite supply with a price determined by the demand for such experiences and governance participation. Sports leagues and teams use fan tokens to create an inclusive community experience and unlock additional revenue streams, while fans may access VIP rewards, exclusive promotions, games, special events like stadium tours, and the ability to vote on team-determined decisions such as the warm up songs, team bus designs, and even starting lineups. And players are getting into the act too, such as with Calaxy’s player/creator-issued tokens that offer similar benefits, including player video calls and messages.

- Ticketing: The current ticketing industry suffers from high secondary sale markups, often due to a limited public sale allotment and professional ticket brokers who quickly snap up tickets. Moreover, the authenticity of resold tickets may not be guaranteed, depending on the marketplace used. Blockchain-based ticketing apps solves these issues by putting the tickets on-chain as NFTs, increasing transparency, guaranteeing authenticity, and giving the issuer greater control over the entire sales process. Moreover, the use of the blockchain is abstracted away to offer a convenient, intuitive, easy-to-use experience, while fans also benefit from their tickets serving as a digital collectible. Ticket issuers benefit too, from an optimized primary sale, secondary market control via taking a cut of secondary sales or limiting markups, the ability to offer fan rewards and increase data capture.

- Other: While less developed than the above, blockchain technology is being applied to a variety of additional sports-based applications. For example, blockchain-powered fantasy sports increases transparency, removes the need to trust game creators, enhances league management with on-chain scoring and smart contract-locked buy-ins, and offers additional user benefits such as the ability to earn crypto or NFTs. Sports betting can similarly benefit from blockchain-based applications by removing the traditional sportsbook intermediaries, offering lower fees, automating transparent, user-based betting odds, offering a wider array of betting sizes and user-created prop bets, and automating real-time payouts. And beyond these, the technology will likely be applied to many new and innovative areas in the future. The metaverse, for example, will unlock additional applications, such as athlete-designed or branded digital wearables, access to metaverse viewing parties that may include a direct feed into the locker room or player cams. New models may emerge, such as the crowdfunding of athletes, community-purchased stadiums, and tokenized team ownership. And blockchain-based sports applications are even moving from spectator to participatory with new move-to-earn applications.

Blockchain-Based Sports Apps: To illustrate the above, we provide examples of specific sports-related applications utilizing blockchain technology and review some of their advantages relative to traditional applications.

- Flow: Created by Dapper Labs, the company behind CryptoKitties, Flow is a fast, decentralized, developer-friendly blockchain for games, apps, and digital assets. The Flow blockchain was designed to facilitate a best-in-class user experience to encourage mass adoption as well as developer ergonomics to make building on the network easy. Flow’s unique architecture offers speed, throughput, and fast finality to meet the needs of projects of almost any size. For example, Dapper Labs’ NBA Top Shot, a marketplace built on Flow for NFT-based NBA video highlights called moments, has amassed nearly $1b in lifetime sales, placing it sixth for all-time NFT collection sales volumes. Dapper Labs is also behind the recently released NFL All Day and the upcoming UFC on Flow, to name a few, both of which will be based on the Flow blockchain.

- Chiliz: Chiliz is a leading blockchain-based fintech provider helping sports and entertainment entities better engage and monetize their audiences. Chiliz is the developer of Socios.com, a fan engagement platform built on the Chiliz blockchain infrastructure that allows sports fans to buy branded fan tokens from some of the biggest and most renowned sports teams in the world including FC Barcelona, Juvetus, and Paris Saint-Germain. Fan tokens are bought using Chiliz’s native CHZ token and allow teams to provide customized experiences, such as the ability for holders to vote on club decisions like new uniform designs, celebration songs, stadium names, and in a few instances, starting lineups. Moreover, Socios.com periodically burns fan tokens based on team performance, allowing holders to benefit as their teams play well. Over 130+ sporting organizations in 26 different countries use Socios.com to engage with their fans, and over 1.3m individuals from 167 different countries use the Socios.com mobile app.

- Sorare: Sorare is a blockchain-based global fantasy football game allowing players to manage a virtual football team through officially-licensed NFT player cards from over 230 different clubs. Sorare allows fans to form deeper connections to the teams and players they love as they create teams of five collectibles, each with varying levels of rarity, and requiring a goalkeeper, defender, midfielder, attacker, and an extra player. Players then enter tournaments to earn rewards in the form of ether or additional collectibles, with their performance based on their players’ real-life performances on the pitch. Sorare utilizes Starkware’s Ethereum scaling solution, and ~18,000 Sorare owners own ~330,000 tokens.

- GET Protocol: GET Protocol is a Polygon-based smart ticketing infrastructure provider. All tickets processed through GET are registered on-chain as NFT tickets. Ticket holders enjoy a safe, easy-to-use, flexible experience free from fraud and scalping and with additional unique benefits such as digital collectibles and fan rewards, while ticket issuers receive full control over the primary and secondary market, receive new forms of data for improved marketing efforts, and unlock additional revenue streams. GET offers a whitelabel product with complete ticketing infrastructure as well as a Digital Twin solution that allows existing ticketing companies to tap into blockchain technology without any risk to existing ticketing operations. GET has processed roughly 1.5m tickets on-chain serving nearly 10,000 events since its founding in 2016.

Teed up for Success: A flurry of sports-related crypto activity over the last year demonstrates just how ingrained blockchain technology is becoming in sports and why we believe its teed up to become even moreso. For example, various high profile athletes have elected to receive some of all of their salaries in bitcoin, including Lioneel Messi, Aaron Rogers, Klay Thompson, and Francis Ngannou. There have been countless partnerships between cryptocurrency companies and sports leagues/teams, including crypto.com with Formula 1 and UFC, FTX and MLB, Coinbase and the NBA, Voyager Digital and the National Women’s Soccer League, BitMEX and AC Milan, and Terra and the Washington Nationals, which is even exploring in-stadium payments using the UST stablecoin, just to name a few. Moreover, high profile athletes are increasingly being featured in marketing campaigns, including Tom Brady for FTX and Lebron James for crypto.com, and the Super Bowl featured so many crypto-related ads this year that it was dubbed the Crypto Bowl. Crypto companies are even purchasing stadium naming rights, such as with the Crypto.com Arena in Los Angeles and the FTX Arena in Miami. And sports icons continue to drop NFT collections, such as Rohit Sharma and Steph Curry, or own various sports-related exchanges or platforms such as Tom Brady’s Autograph and Michael Jordan’s HEIR.

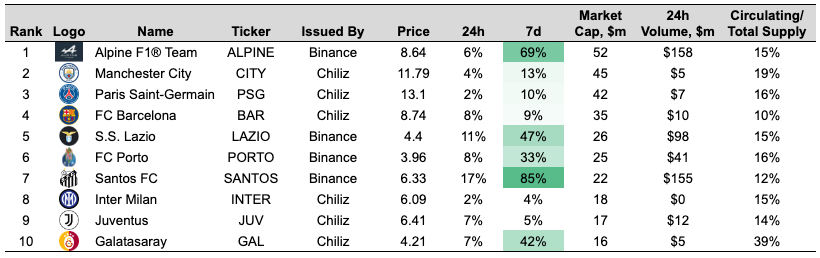

Exhibit 1: Fan Token Overview

Source: FanMarketCap, GSR, Note: Data as of March 16, 2022

To download this article as a PDF, click here.

Authors:

- Brian Rudick, Senior Strategist

- Matt Kunke, Junior Strategist

Sources:

- Flow Website

- Chiliz Website

- Sorare Website

- Get Protocol Website

- ConseSys: Blockchain in Sports and Esports

- Neilsen: Fans are changing the game

- Capgemini: Emerging Technologies in Sports

- Deloitte: From trading cards to digital video: Sports NFTs kick sports memorabilia into the digital age

- PWC: Sports Outlook 2022

- 42 Analytics: SSAC22: Blockchain, Technology, and Sports

- Fan Market Cap

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.