Bitcoin and Ethereum

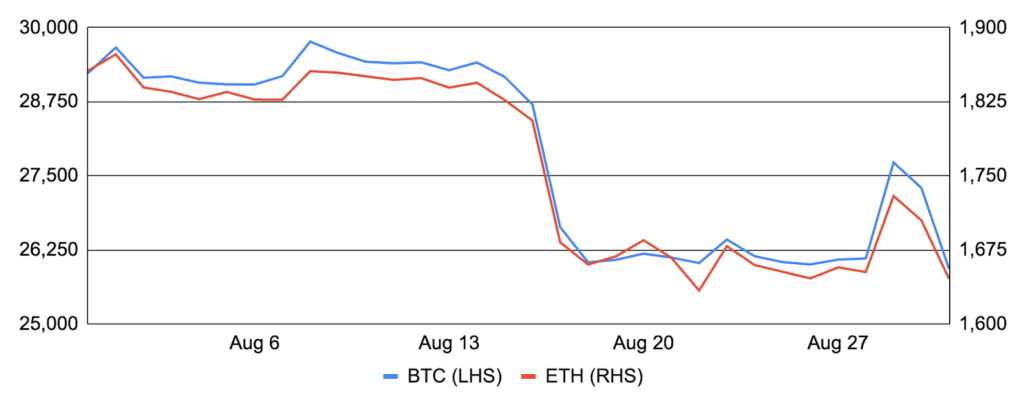

Bitcoin fell ~11% in August, delivering this year’s worst monthly performance after entering August around $29,200 and finishing at ~$25,900. Performance trended sideways during the first half of the month until August 17th, when bitcoin fell more than 7% as ~$860m of crypto longs were liquidated in the largest daily liquidation of the year. With no clear catalyst, the decline was attributed to various items including a WSJ article implying Elon Musk’s SpaceX had sold its bitcoin, the shaky macro backdrop, low liquidity, and concentrated dealer gamma positioning. After the selloff, bitcoin quickly resumed its sideways price action until August 29th when it jumped 7% after a US federal appeals court overwhelmingly ruled in Grayscale’s favor in its bid to convert GBTC into an ETF (covered more below). The rally proved to be short lived, however, as post-ruling gains were reversed over the final two days of the month. In other news, the Bitcoin network hashrate breached 400 EH/s; Arkham revealed that Robinhood controls the third largest bitcoin wallet; the SEC delayed its decision on seven spot Bitcoin ETF filings; the Bitcoin Frontier Fund launched the first Bitcoin Ordinals Accelerator program; blockchain oracle Pyth Network integrated with Stacks; and, more details emerged surrounding the mysterious wallet thefts enabled by poor cryptography in the popular Libbitcoin Explorer wallet tool.

Ethereum similarly fell ~11% during the month after entering August around $1,850 and finishing at ~$1,650. Ethereum provided little diversification benefit during the month as performance moved in tandem with bitcoin with correlation reaching 0.95. Demand for ETH staking continued unabated despite ETH’s weakness, and the validator set grew meaningfully during the month though the activation queue showed its first material decline falling to ~45k validators (~19-day wait). ETH’s supply decreased by ~5,300 during the month, its eighth consecutive monthly decline, albeit the smallest monthly decline of the year. While indicative of decreased mainnet activity, it’s a sign of Ethereum’s progression along its scaling roadmap as total transactions are at record highs but a greater percentage of them are occurring on L2s. This was perhaps best illustrated by the spike in transactions during the month on L2-deployed apps like friend.tech that did not cause notable congestion on Ethereum mainnet. In other news, EigenLayer filled its 100k ETH restaking demand cap within hours of raising its upper bound; five liquid staking service providers committed to self-limiting at 22% of stake as concerns over Lido’s dominance continue to increase; and, the month included meaningful new Ethereum ETF developments, including new spot and futures-based filings covered more below.

BTC and ETH

Source: Santiment, GSR.

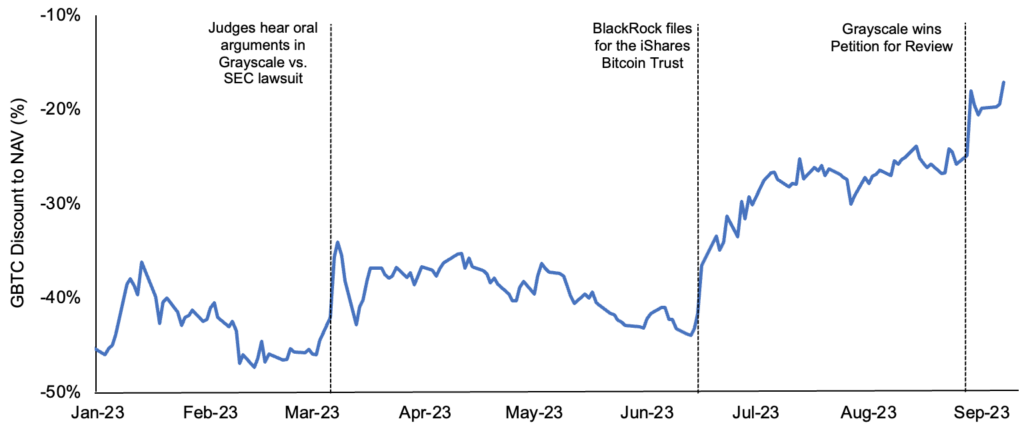

Grayscale’s Win

August was packed with crypto ETF developments, but none were more notable than the long-awaited appeals court ruling in Grayscale’s lawsuit vs. the SEC. As a brief reminder, Grayscale filed a Petition for Review after its bid to convert GBTC into an ETF was denied by the SEC in June 2022. Grayscale’s petition sought to vacate the SEC’s denial, arguing that its spot ETF proposal was materially similar to several approved futures-based products, and thus the Commission’s failure to treat similar cases alike without a reasonable explanation constituted arbitrary and capricious action in violation of the Administrative Procedures Act.

The Court of Appeals for the D.C. Circuit unanimously ruled in Grayscale’s favor on August 29th, granting Grayscale’s Petition for Review and vacating the Commission’s denial. The court said it agreed with Grayscale’s assertion that “its proposed bitcoin exchange-traded product [ETP] is materially similar to the bitcoin futures exchange-traded products and should have been approved to trade on NYSE Arca.” Notably though, the ruling does not guarantee GBTC’s ability to convert into an ETF. Assuming the SEC does not appeal the court’s ruling1, the agency must review Grayscale’s application again with many of its long-standing claims from past denials rejected.

The commonly cited paths forward for the SEC include: 1) approving GBTC, 2) revoking the past approval of bitcoin futures ETFs, or 3) denying GBTC on new grounds. While the SEC’s next move is uncertain, some believe that approving GBTC is the path of least resistance in light of the court’s unanimous ruling. Moreover, revoking past approvals presents an unprecedented challenge, while denying GBTC on new grounds has its own challenges as other concerns should have already surfaced across the fifteen other spot rejections that have occurred since bitcoin futures ETFs began trading. Lastly, legal analysts have even noted that denying GBTC on new grounds may be entirely off the table, as the SEC’s “significant markets” test, covered more in our report on Bitcoin ETFs, created a sufficient condition for approval that the court determined was met, a point also raised by Grayscale’s legal counsel in a post-ruling letter to the SEC seeking to expedite GBTC’s approval.

The Grayscale Bitcoin Trust (GBTC) Discount to NAV

Source: GSR, Grayscale Investments. Data as of Sep 7, 2023.

Ethereum Futures ETFs

Beyond the Grayscale court ruling, positive sentiment quickly built around Ethereum Futures ETFs after Volatility Shares, the manager behind the recently approved 2x Leveraged Bitcoin Futures ETF, surprisingly filed for an Ethereum Futures ETF just months after several similar filings were withdrawn. It’s widely understood that the SEC has historically asked such filers to withdraw their applications, allowing the agency to inhibit approval without detailing an application denial. However, this is a voluntary decision by the filer in an attempt to gain regulatory goodwill, and a more adversarial filer may ignore the request and force a response from the SEC that can be subsequently appealed. While we can’t say for sure this is what happened, it seems highly plausible since all past Ethereum Futures ETF filings were withdrawn in a matter of days (which generally doesn’t make sense for the filer to do on their own accord), including those filed just a few months earlier. However, once Volatility Shares’ maintained their application, rumors quickly began to circulate that the SEC would consider such applications, causing more than a dozen other applications to quickly follow suit. In fact, several experts like Davis Polk’s Scott Johnsson and Bloomberg’s Eric Balchunas posited that once Volatility Shares maintained its application, the SEC decided to consider them as it realized it may not win in court. Moreover, it’s likely this was the same move Volatility Shares used to get the first leveraged bitcoin futures ETF approved, as previous attempts were withdrawn by other managers.

Looking ahead, it appears increasingly likely that Ethereum Futures ETFs will be cleared for trading by early-to-mid October. However, a final question still remains around timing and whether the SEC will allow the filings to go effective automatically at each one’s respective deadline date, effectively picking a winner as was the case for BITO2, or take a more egalitarian approach and approve multiple applications simultaneously. Elsewhere in crypto ETF news, Ark 21Shares became the first manager to re-enter the SEC’s review queue for a spot Ethereum ETF filing, but was quickly followed by Van Eck, which filed later the same day.

ETH Futures ETF Applications

Source: Bloomberg’s James Seyffart, GSR. Note: The filing process for futures-based filings under the 1940’ Act is distinct from spot filings under the 1933’ Act. Rule 485(a) provides for automatic effectiveness within prescribed time periods of certain investment company registration statement amendments. A simplified explanation of this is that new funds can launch in 75 days while existing funds can make material changes to their registration statements within 60 days. After Volatility Shares filed for an Ethereum Futures ETF (75 days), Valkyrie sought to front run them by taking the faster approach and modifying the existing mandate of their Bitcoin Futures ETF to include Ethereum Futures, allowing them to theoretically launch a blended portfolio with Ethereum Futures ahead of Volatility Shares. See the SEC Date in the graphic above.

Legal and Regulatory Happenings

Grayscale’s legal victory wasn’t the only notable legal or regulatory happening during the month, as there were several others, mainly in the US. Perhaps most prominent was the SEC’s first-ever NFT enforcement action, where the SEC accused Los Angeles-based media and entertainment company Impact Theory of executing an unregistered offering of crypto asset securities in the form of NFTs. Specifically, the SEC stated that Impact Theory sold NFTs, known as Founder’s Keys, and represented them as an investment in the business, suggesting that the NFTs would deliver “tremendous value” should Impact Theory accomplish its goal of becoming “the next Disney”. The SEC found that the NFTs were investment contracts and therefore securities and that Impact Theory violated federal securities laws by selling them via an unregistered offering. Impact Theory did not admit or deny guilt, but consented to a cease-and-desist order requiring it to pay a $6m fine and establish a fund to return money to injured investors, among other items. Notably, two SEC commissioners dissented on the enforcement action, in part due to disagreeing on the application of the Howey analysis, and stated that the Commission should have offered more guidance long ago.

Elsewhere, the US Department of Justice (DOJ) charged Roman Storm and Roman Semenov, the founders of crypto mixer Tornado Cash, with money laundering, sanctions, and money transmitting violations, and stated that the pair aided criminals in laundering over $1b in illicit funds. According to the law enforcement agency, the founders deliberately avoided implementing controls to stop the criminals from using its platform for nefarious purposes. Also during the month: the judge in the SEC vs. Ripple Labs case granted the SEC’s request to file a motion enabling it to argue for an interlocutory appeal, while Ripple filed a motion to block the SEC’s attempt to appeal the court ruling; a US court dismissed a class action lawsuit against Uniswap, ruling that Uniswap cannot be held liable for damages caused by third parties misusing the protocol, and further labeled ETH as a commodity in the case; the DOJ is reportedly considering initiating criminal charges against Binance but may use alternative measures to avoid potentially inciting a run on the exchange, while the SEC took the unusual step of filing a sealed motion in its case against Binance; and, the former head of product at OpenSea was sentenced to three months in prison for insider trading.

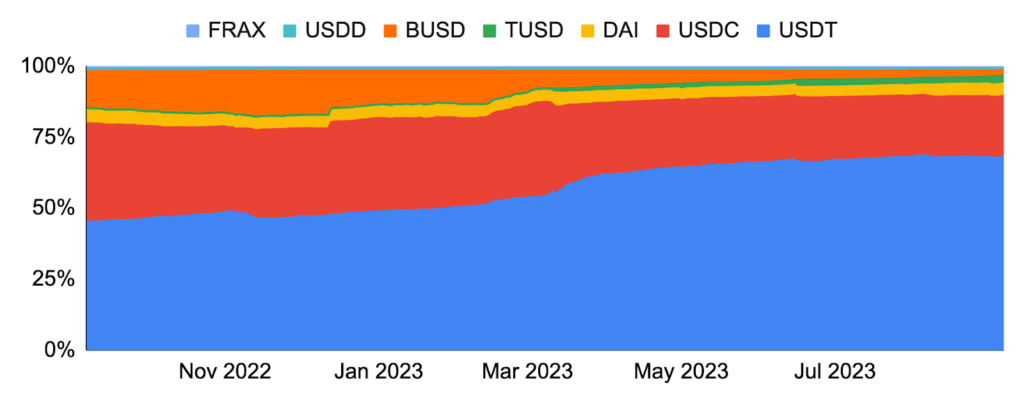

Stablecoin Update

There were several notable stablecoin news items during the month. Payments giant PayPal launched its dollar-pegged stablecoin PayPal USD (PYUSD) on August 7th. Designed for digital payments and web3, the fiat-backed stablecoin is issued by Paxos on Ethereum as an ERC-20. And with PayPal’s 50% global online payment processing market share and 350m active users, many hope the stablecoin will broaden adoption and introduce cryptocurrencies to the masses. Despite successful exchange listings, however, PYUSD has seen little uptake thus far, with Nansen reporting that ~90% of the outstanding supply is held by Paxos and that very few users are self-custodying it.

Elsewhere, Coinbase and Circle agreed to dissolve the Centre Consortium, which they jointly founded to issue USDC, giving Coinbase an equity stake in Circle and bringing USDC issuance and redemption in-house at Circle. USDC was also named the first stablecoin featured in Solana Pay’s new integration with ecommerce platform Shopify to enable immediate and direct settlement of USD stablecoins (Visa launched a pilot program enabling merchants to receive USDC payments via Solana after the month ended). Meanwhile, Binance announced that it will gradually stop support for BUSD by February and encouraged users to convert BUSD into First Digital USD (FDUSD), a stablecoin by Hong Kong-based trust company First Digital Group that grew its market cap from $20m to $360m over the month. Lastly, in an effort to stimulate growth, the MakerDAO community temporarily increased the Dai Savings Rate (i.e., the yield on DAI stablecoin locked into a DSR contract) to as high as 8%, causing the amount of DAI in the DSR to increase by ~$1b and the amount of DAI outstanding to increase by ~$0.8b over the month.

Stablecoin Market Share, Last 12 Months

Source: Santiment, GSR.

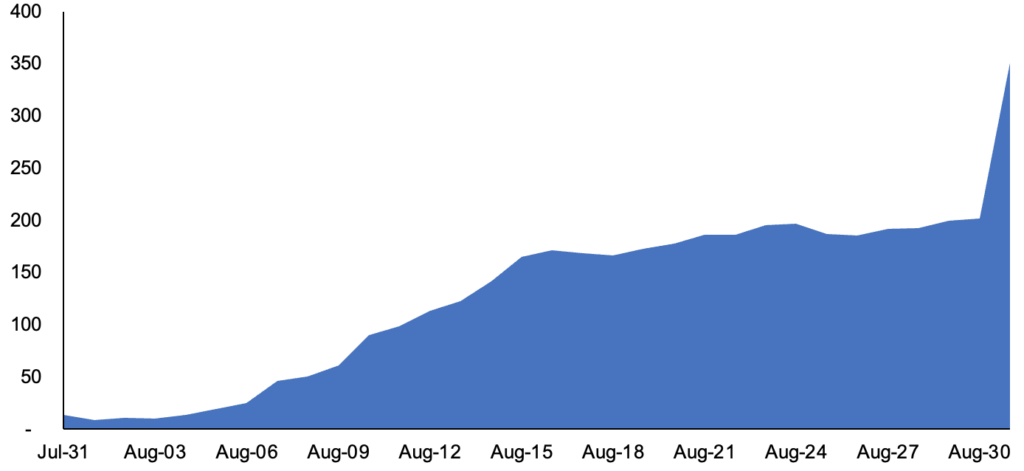

Base’s Mainnet Launch

Initially announced in February, Coinbase’s OP Stack-based Ethereum layer 2 chain Base opened its mainnet to the public on August 9th. Base, which offers fast, inexpensive, and secure transactions, is intended to bridge Coinbase’s products, users, and assets into the decentralized cryptoeconomy and has an ultimate goal of bringing the next million developers and billion users onchain. It is currently being incubated within Coinbase but plans for progressive decentralization.

Base launched its testnet in February and initially opened to developers in July, when it saw immediate uptake. However, without a well-developed dapp ecosystem yet, much of the activity focused on memecoins like BASED, COIN, and BALD, the last of which had increased over 40,000% at one point. Despite its steady growth, Base also experienced its share of growing pains, including rug pulls with the BALD memecoin and SwirlLend DEX, and exploits of RocketSwap and LeetSwap.

Base activity reached new heights with the launch of friend.tech, a mobile-only, Twitter-linked decentralized social media platform allowing users to buy shares (now called keys) of their favorite social media personalities. Similar to popular AMMs, the price of keys follows a bonding curve, and keys not only allow users to bet on and profit from the success of social media influencers, but also enable access to private chats. So popular has friend.tech been that the app reached its server capacity on its August 11th invite-only beta launch date, attracted several non-crypto celebrities like NBA player Grayson Allen, and at its peak, generated more daily revenue than Uniswap and even Bitcoin. Conversely, friend.tech has been criticized for its focus on speculation, and while it is still seeing material activity, it has certainly calmed from the initial frenzy.

All in, Base continues to see impressive growth, with over one millions users, $385m bridged to the network, the third highest ETH L2 30-day transaction count behind only zkSync Era and Arbitrum One, and 1.5m daily transactions on its August 21st peak, surpassing those on Ethereum mainnet.

Base Total Value Locked (TVL) ($M)

Source: Defi Llama, GSR. Note: TVL existed before Base’s public launch as devs and technical users could bridge to Base by interacting with the contracts directly before the Bridge UI was launched.

Footnotes:

- It remains to be seen if the SEC will petition for an en banc hearing or petition the Supreme Court for review, but both these avenues for appeal are a long-shot in this case as far as we understand.

- When Bitcoin Futures ETFs were considered for approval in 2021, the SEC allowed applications to go effective automatically at their respective deadline dates under Rule 485(a). This allowed ProShares, who sat at the front of the review queue, to enter the market alone days before any competitor, which allowed them to raise ~$1b more AUM than other competitors that were approved days or weeks later.

GSR in the News

- Coindesk – Crypto for Advisors: Bitcoin and the Bull.

- Coindesk – Ethereum Handled Friend.tech Frenzy Without ‘Gas Fee’ Spike. Why That’s a Big Deal

- Axios – Bitcoin miners take fresh look at hedging products

- Cryptonews – Bitcoin Miners Consider Hedging Options for Revenue Stability

- Businesswire – Standard Custody & Trust Company and GSR to Offer Clients Secure Settlement and Escrow Services

- Linera – Bringing Microchains to Web3 with an Additional $6M in Funding

- CoinmarketCap – The GSR team talks Bitcoin ETFs, Halving, and ETH Layer 2 recent developments

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View August 2023 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.