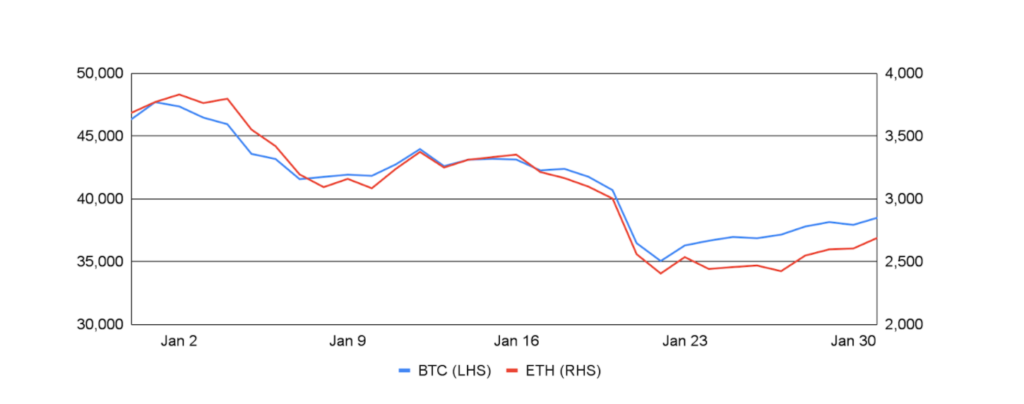

After falling 19% in December, bitcoin fell another 17% in January, entering the month at $46,300 and ending at $38,500. Risk assets sold off across the globe as investors assessed forthcoming central bank policy tightening, geopolitical tensions, Omicron worries, and supply chain disruptions. In addition, crypto investors also contended with US President Biden’s coming crypto executive order, which is expected to outline a comprehensive government strategy around cryptocurrencies and could be released as early as this month. Sentiment soured amidst all the uncertainty, evidenced by the Crypto Fear & Greed Index remaining in Extreme Fear for most of the month, institutions withdrawing $232m in net flows from crypto funds through January 28th, bearish derivatives data such as falling bitcoin futures open interest and a rising put-call ratio, and negative institutional research reports from JPMorgan, which lowered its bitcoin fair market value estimate to $38,000 due to the volatility, and UBS, which warned about the impact of tightening monetary policy on crypto prices. Outside of market conditions, the American Banker estimated that 300 US community banks will start offering bitcoin trading services in 1H22, and the Bitcoin network hash rate hit a new record during the month.

Impacted by the same factors, Ethereum underperformed BTC but generally followed its path, falling 27% after entering January at $3,700 and ending at $2,700. During the month, Vitalik Buterin estimated that the smart contract blockchain is 50% of the way through its ultimate endgame state, and also proposed a “Multidimensional EIP-1559” in a blog post to improve the network’s fee structure based on resource usage. In addition, the Kintsugi test net, which launched in December to help prepare for the merge, was split by a bug after developers stress tested it. The Ethereum Foundation also retired the term “Ethereum 2.0” in favor of “consensus layer” to better reflect the fact that the coming upgrade is not an entirely new network. Additionally, the ETH burn rate averaged ~9 ETH/minute during the month amidst high NFT trading volumes compared to 6.6 ETH/minute since EIP-1559 was launched in August. Lastly, there was significant progress by several Ethereum services. For example, the creators of Etherscan launched the Blockscan Chat service allowing wallet to wallet instant messaging. The Ethereum Push Notification Service (EPNS) introduced a tool allowing DeFi protocols, NFT platforms, and web3 infrastructure providers to send push notifications. And the Ethereum Name Service (ENS) hit the 500,000 registered .eth names milestone and introduced the first version of an implementation of ENS off-chain resolution, an important first step towards adopting layer two support for ENS domain names.

BTC and ETH

Source: Sansheets, GSR

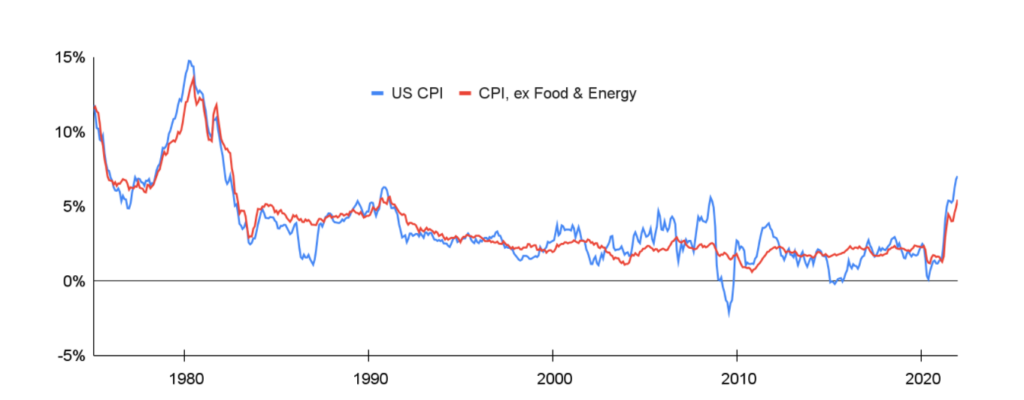

Central Bank Policy Tightening

One concern for the crypto markets is tightening monetary policy, as particularly accommodative policy is often cited as a major factor contributing to the strength in crypto prices over the last year. Much of the focus recently has been on the US Federal Reserve, given the size of the economy and the imminence and potential magnitude of the policy changes. Indeed, inflation in the US rose 7.0% year-over-year in December, up from November’s 6.8% and the highest inflation since 1982. And even excluding the volatile food and energy components, core prices rose 5.5% year-over-year, the largest 12-month percentage increase since 1991. In response, the Fed laid the groundwork to begin tightening policy with its December FOMC meeting minutes released early in the month and Fed Chair Powell pledging “to prevent higher inflation from becoming entrenched” when speaking to congress later on. And the Fed revealed more information about its plans during its late-month FOMC meeting, where it teed up a March rate hike and indicated that bond purchases will end in March. And while it did not say when it would begin reducing its balance sheet, it did release a paper outlining principles around doing so. The post-meeting press conference took a hawkish tone, as Fed Chair Powell emphasized the economy’s strength, stated that inflation had likely gotten worse since the last meeting, and pledged to raise rates as needed. Investors now turn their attention to the January CPI report, set to be released on February 10th, and to the December FOMC meeting minutes, due out on February 16th.

US Inflation: Consumer Price Index

Source: Bureau of Labor Statistics, GSR

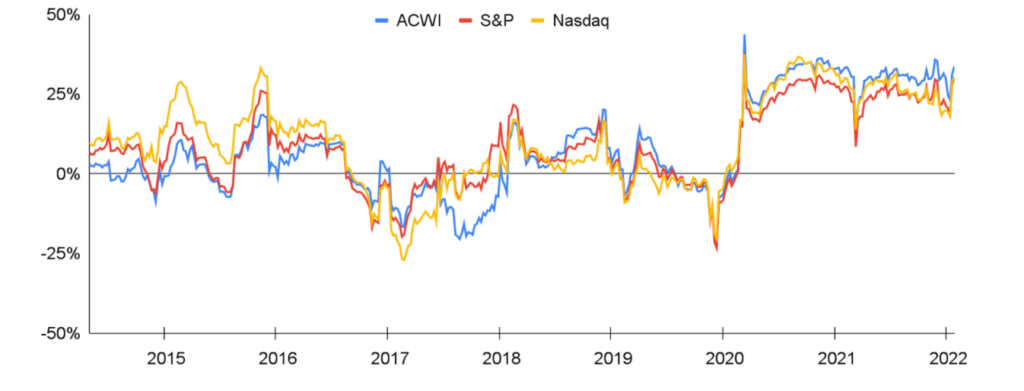

Equity Market Pressures Also Impacting Crypto

Very much related to central bank actions, many also attributed poor crypto performance to equity market pressures. Indeed, the Nikkei, S&P 500, Euronext 100, and DAX all fell during the month. Moreover, tech stocks were particularly weak, with the tech-heavy NASDAQ down 9% in January and growth names falling out of favor. In fact, Goldman Sachs published a report arguing that mainstream adoption of crypto is a “double-edged sword” as it can raise valuations but also raise correlations with other financial market variables. While elevated compared to history, we show rolling 52-week correlations between weekly bitcoin returns and weekly equity market returns below. We’d note that while correlation has increased, it has been this way since mid-2020 (at least with our 52-week time horizon), and remains relatively low at 20-35%.

Bitcoin Rolling 52-Week Correlations

Source: Santiment, Google Finance, GSR

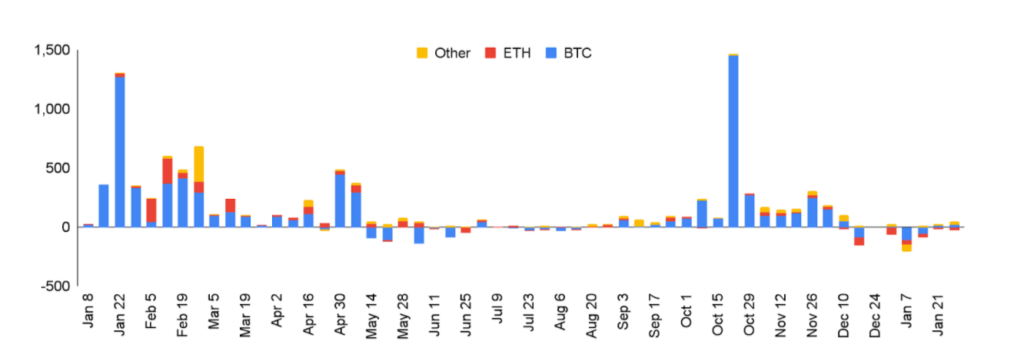

Institutional Crypto Appetite Softens

The concerns named above have caused institutional demand for cryptocurrency to reverse, with digital asset investment product flows remaining negative for five consecutive weeks from mid-December through late-January. In fact, the week ending January 7th saw record outflows of $207m. Interestingly, fund flows for non-BTC, non-ETH products were fairly diminimus over that five week period, and while bitcoin-related products saw more negative flows, Ethereum-based products saw greater outflows as a percentage of AUM. Note that crypto derivatives data also pointed to poor sentiment, with futures open interest falling throughout the month and well below last year’s peak, perpetuals funding rates hovering around zero, and put/call ratios steadily increasing.

Weekly Institutional Crypto Products Fund Flows

Source: CoinShares, GSR

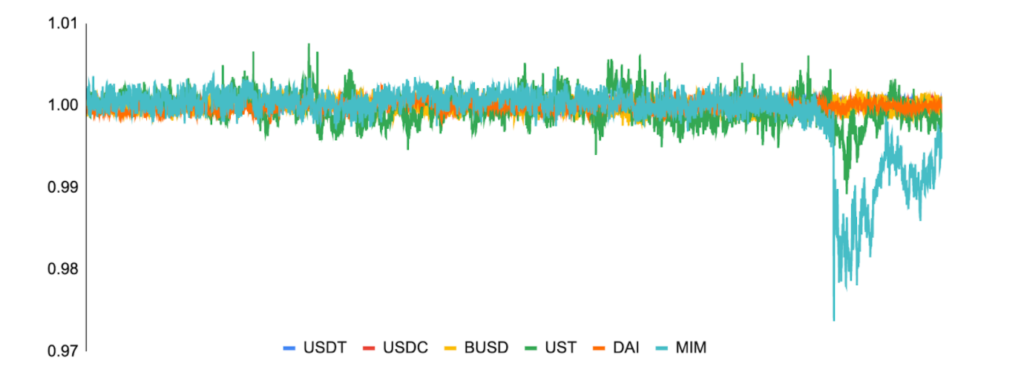

Stablecoin Pegs Hold Amidst Controversy

With a 0% return, stablecoins handily outperformed nearly all other tokens, though the month was quite eventful and included both de-peg and contagion fears. It all started when it was revealed that the treasurer of Wonderland, an Avalanche-based fork of Olympus DAO started by famed developer Daniele Sestagalli, was actually Michael Patryn, a former convict and co-founder of collapsed Canadian crypto exchange QuadrigaCX. Not only did Sestagalli confirm the news, but he also admitted he had known the information for roughly a month. This caused many to lose confidence in Wonderland, which saw its TIME token fall as much as 40% on the day, and other projects Sestagalli had founded. Abracadabra Money, another Sestagalli project that allows users to mint the USD-pegged Magic Internet Money (MIM) stablecoin by depositing interest-bearing collateral, became a focal point. In addition to Wonderland and Abracadabra being connected as Wonderland TIME holders used Abracadabra to leverage their Wonderland returns, turning (3,3) into (9,9), some simply lost confidence in the MIM stablecoin despite its over-collateralization. This caused users to flee MIM on Curve, for instance withdrawing USDC/DAI/USDT out of the MIM-3pool, causing MIM’s price to temporarily de-peg. Moreover, several questioned whether a MIM de-pegging could impact Terra’s UST stablecoin, as over $1b of MIM was collateralized by UST via Abracadabra’s degen box offering leveraged UST yield via Anchor Protocol, as well as through Curve pools connecting the two. When all was said and done, both MIM and UST drifted back towards their pegs as confidence improved and stabilization mechanisms worked as designed.

Stablecoin Performance: January 2022

Source: Santiment, GSR

Continued Progress on CBDCs

Central banks continued to advance their CBDC efforts, which we discuss in our recent article At the Peak of Central Bank Digital Currencies. While an official launch date has not been disclosed, the digital yuan made significant progress leading up to the Winter Olympics in Beijing, long-slated to be the digital yuan’s global coming-out party. In fact, China is allowing overseas visitors to use its digital yuan for the first time at the games, and all Winter Olympics merchants now accept digital yuan. Major corporations continue to integrate the digital yuan too, such as food delivery giant Meituan and major payments app WeChat. All this has led to over 260m users of digital yuan wallets, over $13b in transactions made using digital yuan, and more than 8m merchants now accepting the CBDC despite it still being in pilot mode.

It was also a big month for a potential Fed dollar as the US Federal Reserve released its highly-anticipated CBDC discussion paper. Though the paper stated it “does not favor any policy outcome,” it did provide a thorough review of the pros and cons of issuing a CBDC. The Fed concluded that a CBDC could provide a safe digital payment option for households and businesses as the payments system continues to evolve and may result in faster payment options between countries, but that it would also introduce risks, such as those around monetary and financial stability. The Fed has now opened up a 120 day comment period with questions for the public around benefits, risks, design, and policy considerations.

CBDC efforts continued elsewhere, such as in South Korea where the Bank of Korea finished the first phase of its CBDC simulation project testing basic functions such as manufacturing, issuance, and distribution. The Swiss National Bank also completed a successful CBDC test, this time integrating a wholesale CBDC with commercial banks as part of an effort to integrate tokenized financial assets with mainstream markets. The Bank of Jamaica successfully completed its CBDC pilot, keeping it on track for its 1Q22 targeted roll out. And Iran revealed plans to roll out a CBDC pilot in the near future. Lastly, other countries stepped up their CBDC research efforts, such as Malaysia and Poland.

Odds and Ends

It was a busy month for NFTs as trading volume surpassed a record $6b, per The Block. While OpenSea had record monthly transaction volume, much of the activity was also driven by the recently launched launched LooksRare NFT marketplace, though this includes a material amount of wash trading. Elsewhere, Fantom briefly surpassed Binance Smart Chain in terms of TVL, while the number of USDC surpassed the number of USDT on Ethereum. Lastly, while far from a comprehensive list, some of the more notable protocol news during the month included:

- Shiba Inu launched a beta version of its DOGGY DAO for community governance

- Solana reportedly went down or slowed after a suspected DDOS attack

- Cardano’s first usable decentralized application, MuesliSwap, went live

- Crypto betting service Polymarket was fined by the CFTC for offering unregistered swaps

- The Yearn community passed a governance proposal requiring YFI holders to stake their tokens to participate in governance

- Borrow lend protocol Aave revealed that it is developing a mobile wallet

- Cosmos-based DEX Osmosis crossed $1b in TVL

- Ethereum layer two scaling solution Arbitrum went down

- Moonbeam became the first fully operational parachain on Polkadot

- Decentralized derivatives exchange dYdX outlined plans for full decentralization in late 2022

- The Iota Foundation was selected as a contractor by the EC to develop blockchain and DLT tech in the region

- Fantom briefly flipped BSC to become the third-largest DeFi ecosystem by TVL

- The MIM stablecoin faced pressure given its connection to Wonderland and caused contagion fears

- Axie Infinity’s Ronin blockchain launched its RON governance token

- Sonic, the first DEX on the Internet Computer, went live

Author: Brian Rudick, Senior Strategist

GSR in the News

- eFinancialcareers: Citadel Securities’ European CTO quit for a crypto market maker

- The Block: Crypto trading shop GSR announces new CEO, CTO as part of management reshuffle

- Blockworks: Citadel CTO Leaves for Position at Market Maker GSR

- Fortune: Citadel forms an unlikely partnership for its next big move

- CoinDesk: GSR Markets President: Crypto still in a bull market

- The Block: GSR co-founder says the crypto market maker will enter the NFT space this year, CoinMarketCap

- The Block: Crypto traders fret an overheated futures market amid fall in spot prices

- Fox Business: Secular bull market still intact

- The Block: Can wall street algo traders win at the NFT game?

- Forbes: Market Now Braced For A Game-changing White House Executive Order

- The Block: 2022 outlook webinar

- Live Bitcoin News: The US is looking to implement new crypto rules

- Cointelegraph: Aave launches its permissioned pool Aave Arc, with 30 institutions set to join

- The Block: Aave launches permissioned DeFi platform Aave Arc

- Blockworks: Aave Arc to provide 30 financial institutions access to private pools of DeFi liquidity

- CoinDesk: Fireblocks ‘Whitelists’ 30 Trading Firms for Aave’s Institutional DeFi Debut

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.