Bitcoin and Ethereum

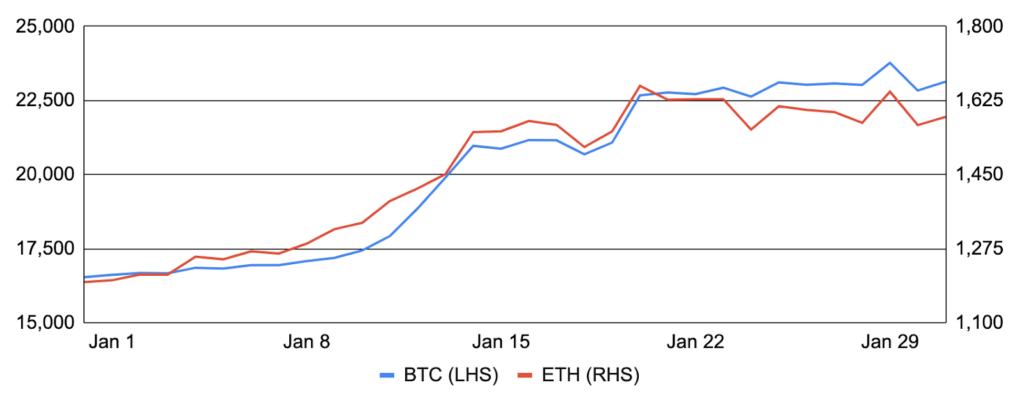

Bitcoin reversed its recent weakness in January, rising ~40% after entering the month around $16,500 and finishing at $23,100. It was an up-and-to-the-right type of month, barring a few exceptions, with a large portion of the gains materializing alongside ~$335m of short BTC liquidations between the 10th and 13th. While the market backdrop was positive for risk assets broadly, Bitcoin’s correlation to core equities fell during the month as its performance diverged meaningfully to the upside. Tailwinds driving the divergence likely included: a reentrance from tax loss harvesters, decreased sell pressure from tokens tied up in bankruptcies, and general short covering. Performance took a short breather on the morning of the 18th as the DoJ announced that it would disclose “a major, international cryptocurrency enforcement action,” causing a quick ~5% selloff as investors de-risked ahead of the announcement. The selloff was short-lived, however, and crypto markets rebounded after being positively surprised that the enforcement action was against Bitzlato, a largely unknown Russian crypto exchange that seemingly posed minimal risk of sparking contagion. Elsewhere, Bitcoin mining difficulty reached a new all-time high, bitcoin dominance reached its highest level since June 2022, Tesla continued to hold its nearly 10,000 bitcoin, and the Mt Gox repayment registration deadline was extended by two months. Lastly, we dive into a new Bitcoin NFT protocol in the final section of this report.

Ethereum slightly lagged bitcoin on a relative basis over the period – its first time doing so in a positive month since February 2022 – but it too generated impressive returns, rising ~33% after entering the month at ~$1,200 and finishing around ~$1,600. Ethereum’s on-chain activity returned from its December lull, and the total ETH supply decreased in a virtually monotonic fashion, falling by more than 10,000 ETH during the month. Beyond market dynamics, it was also a prominent month for fundamental developments. Developers executed their first mainnet shadow fork to test the upcoming Shanghai hard fork that will unlock staked ETH withdrawals. This was followed by the launch of the Zhejiang testnet on Feb 1, and developers reiterated the targeted March timeline for the mainnet fork. Hype behind Shanghai led to a huge rally in the tokens underpinning various liquid staking providers, discussed more below. Ethereum’s KZG Ceremony also went live to create the randomness required to secure the new blob data layer underpinning Ethereum’s sharding roadmap. With contributions to the ceremony being permissionless, it quickly set the record for having the largest set of contributors to a trusted setup. In other Ethereum-related news: Aave v3 deployed on Ethereum; ConsenSys opened its zkEVM testnet to whitelisted users; Solana-based oracle provider Pyth Network expanded to the Ethereum ecosystem with its Arbitrum integration; Vitalik published a blog post evaluating the use of stealth addresses to boost user privacy; and, two new reports from Crypto.com and Alchemy illustrated the resiliency of Ethereum’s fundamental usage in 2022 despite the bear market, with smart contract deployments growing by ~293% and the number of ETH holders growing by ~250%.

BTC and ETH

Source: Santiment, GSR

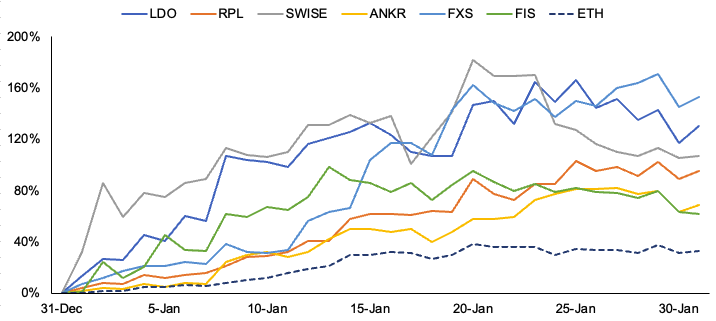

Liquid Staking Providers Rally

As the Shanghai upgrade approaches and staked ETH becomes withdrawable for the first time since the Beacon Chain’s launch in December 2020, excitement has been brewing around the tokens underpinning the various liquid staking derivative providers. As a brief overview and with more detail in our Guide to Ethereum Staking report, many stakers leverage third-party staking-as-a-service providers to mitigate the high technical and capital requirements of staking directly. Additionally, many of these staking providers leverage smart contracts to tokenize the stake outsourced to them, providing the end user with a liquid IOU token, known as a liquid staking derivative (LSD), that represents a claim on the ETH staked in the Beacon Chain. Such LSDs accrue staking rewards and can be instantly used for other purposes, such as for collateral to borrow funds or to provide liquidity on a decentralized exchange. Furthermore, LSD providers commonly have a native token that enables governance or other features that vary greatly by protocol. For example, Lido’s LDO token only enables participation in governance, and similar to the commonly cited Uniswap fee switch example, LDO’s value is based on the assumption that token holders will use the governance process to claim a share of revenue in the future, as there is no mechanism linking the success of the protocol to the value accrual of the token today. Conversely, in addition to governance, Rocket Pool’s RPL token is required to be posted by node operators as collateral to insure against slashing or other penalties, creating incremental demand for RPL as the protocol’s usage grows. Despite the various use cases and value-accrual mechanisms embedded in each LSD protocol’s native token, the theme was universally rewarded in January. Looking at the performance of the native tokens across Lido, Rocket Pool, StakeWise, Ankr, Frax, and StaFi, the worst-performing token nearly doubled ETH’s return in January, while the average performance eclipsed 100%, more than tripling ETH’s return.

While the hype behind Shanghai is likely the largest contributor to the strong performance, there are some fundamental drivers potentially at play as well. One narrative is that since LSDs charge fees by withholding a percentage of the ETH-denominated staking rewards they generate, they are just now gaining liquidity on multiple years of revenue. However, it’s unlikely this is a core driver as this doesn’t necessarily accrue in any tangible way to token holders, as previously discussed. Another narrative is that the total amount of ETH staked still sits far below competing chains, and with withdrawals soon to be enabled, the total amount of ETH staked will likely increase as upgrade-specific risks are alleviated. This is a somewhat controversial view, as some argue that the amount of ETH staked will fall as liquidity is enabled, at least in the short term. Beyond the near term, we anticipate that the total ETH staked will grow and that LSDs will command an increasingly large percentage of the growing stake as accessibility is increased via direct staking integrations with MetaMask and other service providers. Lastly, the utility provided by these protocols continues to increase from the benefits of composability as more DeFi protocols like Aave and Euler continue to support a growing number of LSDs.

Token Performance of Liquid Staking Provider Tokens vs. ETH

Source: Santiment, CoinGecko, GSR.

Developments at Genesis & DCG

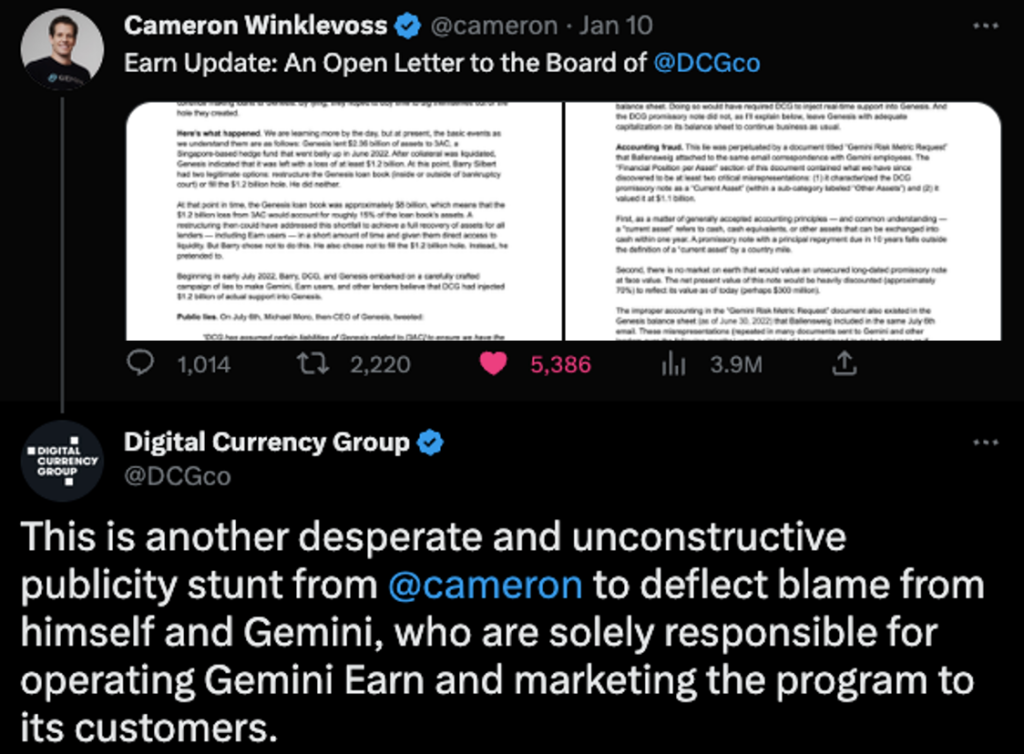

The challenges at crypto prime broker Genesis and its parent company, Digital Currency Group (DCG), have grown since our previous coverage in November. As a brief recap, Genesis’s woes began with the bankruptcy of Three Arrows Capital, a crypto hedge fund that borrowed ~$2.4b from Genesis against ~$1.2b of posted collateral, leaving a crater-sized hole in Genesis’s balance sheet. Genesis’s financial standing appeared to have stabilized in the following months behind support from DCG, though subsequent events again called this into question. Genesis revealed its trading business had $175m stuck on FTX in the wake of its collapse, sparking a contagion that caused lenders to recall their loans en masse. Genesis halted withdrawals and ceased new loan originations in mid-November, citing “unprecedented market turmoil,” and it later reiterated in December that a path to resolution was still “weeks” away.

Genesis’s challenges became increasingly public in January as creditors took to the offensive. Cameron Winklevoss, the co-founder of the Gemini cryptocurrency exchange whose customers had $900m of inaccessible loans outstanding to Genesis via its Gemini Earn product, penned an open letter to Barry Silbert that accused the DCG founder of engaging in “bad faith stall tactics.” Cameron followed with another letter to the DCG board a week later, detailing a series of alleged lies by Genesis and DCG leadership and publicly requesting the board to relieve Barry Silbert of his responsibilities at the helm of DCG. DCG responded to the letters by calling it an “unconstructive publicity stunt.” Adding to the challenges, the SEC charged Genesis and Gemini with facilitating unregistered securities sales just two days later. With seemingly little progress occurring in the public arena, substantial employee layoffs and a suspension of DCG’s dividend made prospects look even more dire. Rumors spread that DCG was looking to offload venture investments to raise cash, and CoinDesk, the crypto media company also owned by DCG, engaged Lazard to explore a sale. Ultimately, Genesis filed for Chapter 11 bankruptcy on Jan 19th. Notably, the bankruptcy did not include all Genesis entities, and Genesis continued to operate many of its non-lending businesses, like spot and derivatives trading, that were held outside of the legal entities that sought bankruptcy protection.

Though it occurred outside of January, an in principle restructuring agreement was reached between Genesis, DCG, Gemini, and two other groups of creditors on Feb 6. While details are still being hammered out, it would require the sale of Genesis’s trading and lending businesses while restructuring the debt that DCG owes Genesis. Gemini confirmed it would also contribute up to $100m of additional capital for Gemini Earn users as part of the plan. One Genesis creditor confirmed the proposal is seeking to return about 80 cents on the dollar, with a potential path to full recovery depending on multiple variables, including the performance of a to-be-issued convertible preferred equity note.

Gemini and DCGs Public Feud

Source: Twitter, GSR

Silvergate’s Depositors De-Risk

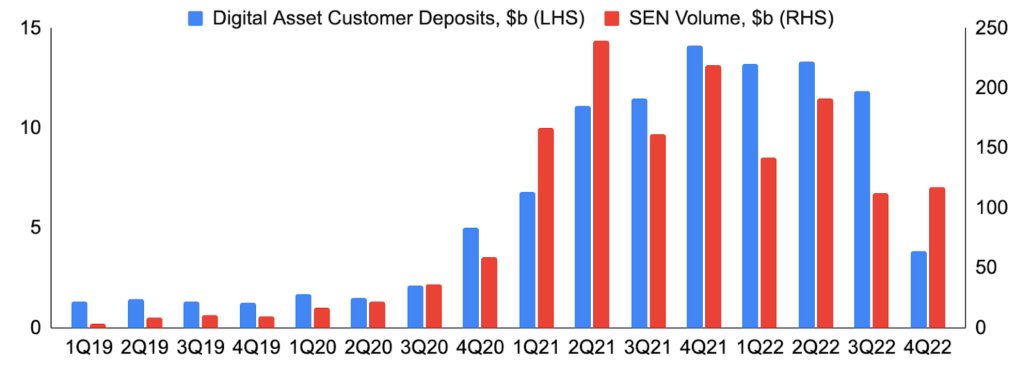

One company directly impacted by the slowdown in digital asset activity and general loss of trust has been Silvergate Capital, one of the main U.S. banks serving digital asset customers and the owner of the Silvergate Exchange Network (SEN), which enables clients to send and immediately settle U.S. dollar transfers to others on the network 24/7/365. The turmoil started in earnest after FTX’s collapse, as Silvergate provided banking services to the bankrupt exchange, though Silvergate stated in November that it only maintained a deposit relationship with FTX, and such deposits amounted to less than 10% of total deposits from digital asset customers. Still, some questioned whether Silvergate should or could have caught some of FTX and Alameda’s wrongdoings, and the bank was hit with a class action lawsuit in December.

Despite its strong balance sheet, access to ample sources of liquidity, and oversight by the Federal Reserve, many digital asset clients reduced risk by withdrawing deposits from Silvergate. In fact, Silvergate pre-announced select 4Q financial data and various business actions on January 5 that included a 68% decline in deposits from digital asset customers, the sale of $5.2b in securities resulting in a $718m loss and a significant increase in wholesale borrowings to meet the withdrawals, a 40% reduction in its workforce to align with the go-forward environment, and the write-off of its ~$200m purchase of Facebook’s Diem IP. Silvergate’s stock fell 43% that day. Subsequently, Silvergate suspended its preferred dividend, and Bloomberg reported that the Department of Justice is investigating the bank related to its dealings with FTX and Alameda, though the bank has not been accused of wrongdoing.

Silvergate Deposits & SEN Transaction Volume

Source: Silvergate.com, GSR

The Revival of NFTs

January saw a resurgence in NFT activity, with organic sales rising 38% over December and NFT-backed loans reaching a new all-time high. Yuga Labs’ NFTs were the largest contributor to the recovery as trading in BAYC, MAYC, and BAKC NFTs picked up alongside Yuga’s latest Sewer Pass NFT launch, which itself traded nearly $60m in volume despite only launching on the 18th. Sewer Pass NFTs are freely claimable by BAYC and MAYC holders, with different tiers of passes being claimable by different underlying Yuga assets (e.g., MAYC claims a tier 1 pass, BAYC + BAKC combination claims a tier 4 pass, etc.). Sewer Passes act as a ticket to participate in Yuga’s skill-based game Dookey Dash where players compete in an endless runner game, avoiding and/or breaking obstacles while collecting other items known as fragments. The longer one survives, the more points one accrues, but points also scale by one’s Sewer Pass tier and other purchasable items. The competition ends on February 8th, and a week after that, Sewer Pass holders with a score greater than zero will be able to burn their Sewer Pass to “summon a power source.” While specific details remain sparse, the traits behind the summoned NFT are associated with the strength of one’s highest score in Dookey Dash, and the summoned power source will be used in another upcoming game in Yuga’s pipeline.

Another prominent story was the polarizing resurgence of NFTs on Bitcoin. A new protocol launched by Bitcoin Core contributor Casey Rodarmor called Ordinals enabled the creation of Bitcoin-native NFTs known as inscriptions. At a high level, the idea is that individual satoshis (sats), which are the smallest denomination of bitcoin equal to one hundred millionth of a bitcoin, can be assigned an order and immutably inscribed with content.

Inscriptions are created by adding arbitrary data on chain in the SegWit witness using a Taproot-compatible inscription transaction, and once that transaction is mined, the first sat in the first output of that transaction will be permanently marked, giving that sat non-fungible elements that allow it to be distinctly tracked and traded. While a special wallet that performs sat control must be used to avoid losing one’s inscriptions, the project is entirely native to Bitcoin and doesn’t rely on a side chain or require any adjustments to the Bitcoin blockchain.

While many praised inscriptions as a positive that increases demand for Bitcoin blockspace, an essential requirement for Bitcoin’s long-term security model that’s transaction-dependent, others, particularly those in the self-identified ‘Bitcoin Maximalist’ community, weren’t as receptive, with some calling it an attack on the network and encouraging miner censorship. While Bitcoin has a hard cap of 4 MB of data per block, one common criticism is that inscriptions will increase the frequency of large transactions, increasing the percentage of blocks near the cap and bloating the storage requirements of full nodes. While this is true, as seen by the rise in average block size to a record level, many would counter that it’s valid demand for blockspace in a permissionless system. There are also more technical counters that could mitigate chain bloat by enabling nodes to opt-in to pruning.

In other NFT-related news: Amazon is reportedly planning an NFT initiative this spring; OpenSea’s NFT volume on Polygon surpassed that of Ethereum for its second month in a row; decentralized NFT exchange SudoSwap airdropped and launched its SUDO token to eligible users; Doodles 2 launched on Flow; Pudgy Penguins partnered with Layer Zero to support cross-chain transactions beyond Ethereum; NFT standards protocol Metaplex announced an upgrade enabling royalty enforcement for Solana NFTs; Yuga Labs blacklisted exchanges that bypass creator royalties in its Sewer Pass contract; and, Moonbirds co-founder Kevin Rose lost more than $1m in NFTs after falling victim to a phishing scam.

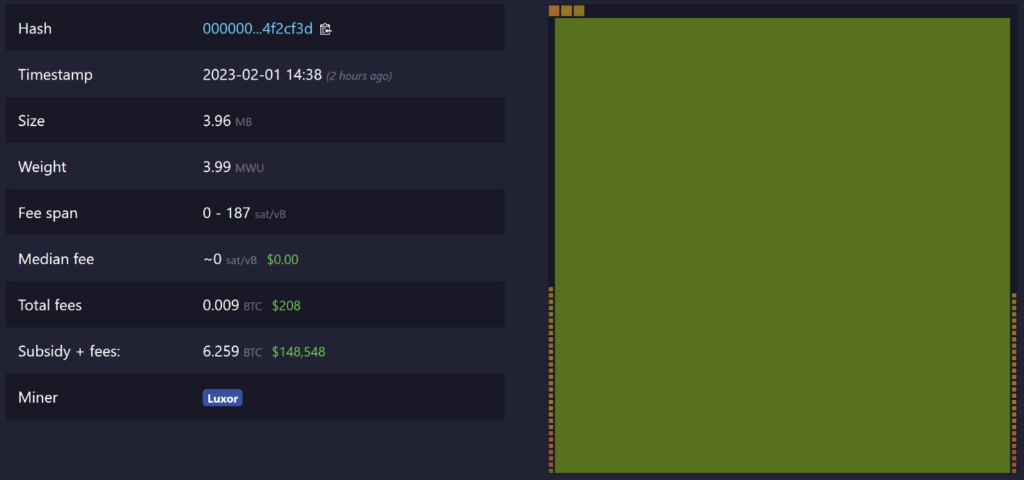

Taproot Wizard NFT Mint Contributed to the Largest Bitcoin Block Ever Mined

Source: Udi Wertheimer, Luxor, GSR. The transaction to create the Taproot Wizard NFT contributed 3.94 MBs, while the other 62 transactions only contributed 0.02 MBs in aggregate, rounding out the record-setting 3.96 MB block. The relative size of each transaction in the block is illustrated in the RHS of the exhibit.

GSR in the Media

- GSR – Believe: Our Crypto Thesis

- Crains New York – Veterans of past financial crises cash in on collapse of digital currencies

- Yahoo! Finance – Bitcoin closes out best January since 2013

- Coindesk – Crypto Markets Today: Layer 1 Blockchain Token Aptos Reaches Record High

- Coindesk – Crypto Analysts Warn Against Shorting DYDX Ahead of $200M Token Unlock

- Real Vision – Benoit Bosc: Crypto Prices Plow Ahead Despite Genesis Bankruptcy

- Coindesk TV – Rich Rosenblum: Why is Bitcoin Back Above $21K? | Video | CoinDesk

- Coindesk – Crypto Observers Maintain Risk-On Bias as US Debt Ceiling Nears

- The Block – Bitcoin Approaches $19,000, rises 8% following Inflation Data

- The Defiant – Will The Bank Run On Binance Continue?

- The Defiant – Crypto Kicks Off The Week With Broad-Based Rally – The Defiant

- Yahoo! Finance – Crypto investments hit a 2-year low at the end of 2022

Authors:

Matt Kunke, Junior Strategist | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View January 2023 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.