The Market

Bitcoin is down 5% this month, with the total market cap of all coins and tokens decreasing by $50 billion. Bitcoin is currently trading around $10,000, below its recent high of $13,700 just over a month ago on June 26th. Despite breaking the $13,000 mark again on July 10th, bitcoin has been trending downwards for the majority of July. Arguably this pullback was to be expected, as price essentially went parabolic during Q2, and has merely been consolidating its gains around the 5 figure mark. An event that can be tied to this decrease in value was U.S. President Donald Trump’s tweet about bitcoin on July 12th, where he claimed bitcoin was “based on thin air,” and highlighted that “unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity”. The recent negative market sentiment can also be tied to the regulatory conversation surrounding Facebook’s Libra project. The majority of major media coverage this month about their entrance into crypto was pessimistic, which culminated with Facebook’s David Marcus lackluster testimony before the U.S. Senate on July 16th. The Congressional tone of the conversation was one of scrutiny and concern.

There has been a slight uptick in the market on the 31st of July with bitcoin crossing the $10,000 mark. After starting the day around the $9,500 price point, bitcoin has seen steady increases, up 3.8% on the day.

Bitcoin July Market Cap. Source: CoinMarketCap

Despite the long list of differences between Libra and Bitcoin, for the time being, their fates seem tied together, (at least when analyzing the wider media perception). The total market cap of all coins and tokens stands at $275 billion. Despite bitcoin’s recent drop, its dominance sits at 65%, up over 2% from its high in June. On July 16th, bitcoin hit 65.8%, achieving its highest market dominance since December 2017. In defiance of the recent market downturn, the bitcoin network remains stronger than ever, with the bitcoin hash rate again climbing to new highs this month.

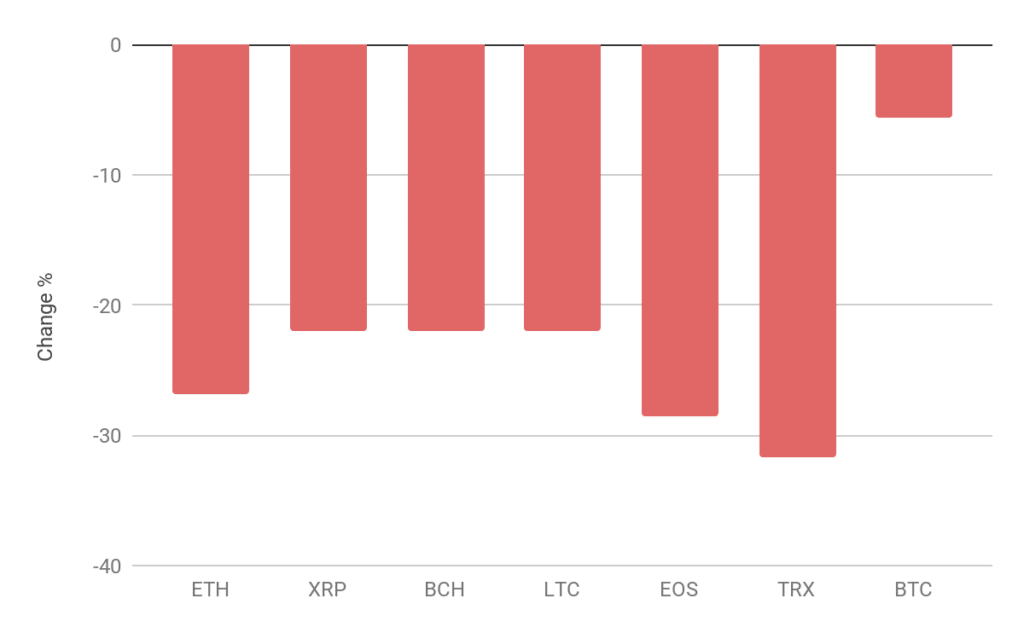

All major cryptos had large losses in July. Ethereum (ETH), Bitcoin Cash (BCH), Litcoin (LTC), EOS, Tron (TRX) and Ripple (XRP) all saw substantial price drops.

The losers in July

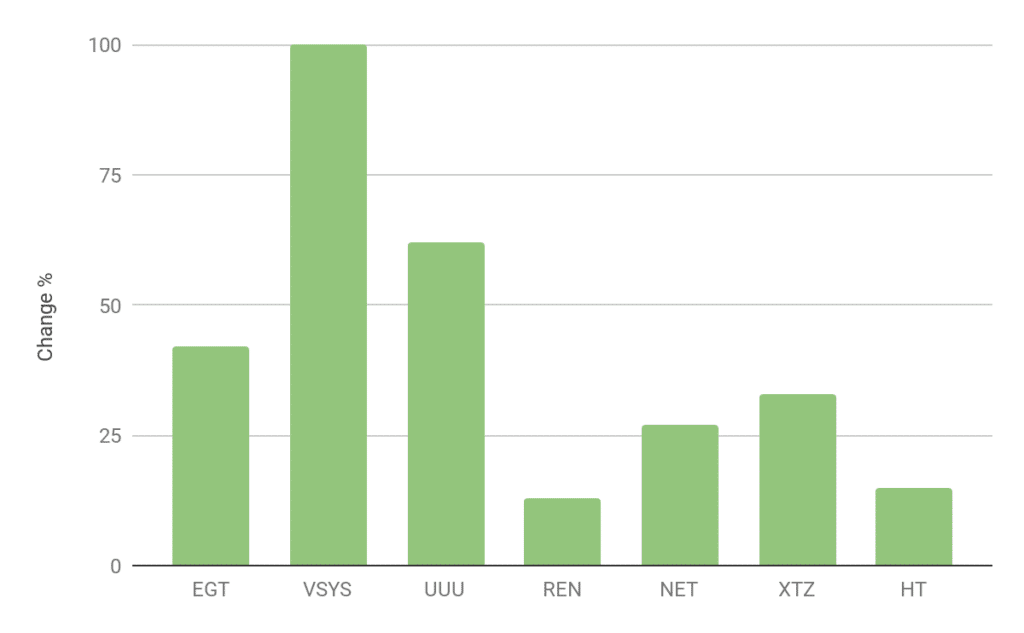

Conversely, there were some smaller altcoin projects in the green this month. Egretia (EGT), V Systems (VSYS), U Network (UUU), Ren (REN), and NEXT (Net), Tezos (XTZ) and Huobi Token (HT) all saw healthy gains.

The winners in July

Derivatives

Leverage is a critical force present in all capital markets, but it can have an outsized effect in crypto due to fragmented liquidity and irresponsible leverage. Bitmex is notorious for such offerings as 100x levered positions. In fact, much of the price action characteristic to bitcoin can be attributed to “stop hunting,” whereby market participants, namely “Whales” can swing the price back and forth, clearing out retail traders who are over-levered. Throughout July, this stop hunting occurred at a higher frequency than it did during the bullish Q2 move.

Related to leverage yet specific to crypto, another recent observable phenomena is the correlation of price and funding rates. Swaps that trade on exchanges like Bitmex have an incentive mechanism for market makers to keep the product’s price in-line with the index price of the underlying. Thereby if the swap price is lower than index price, shorts pays longs for that discount and vice versa when the opposite occurs. These rates can be quite expensive on an annual basis, especially on large dislocating types of price moves.

For example, during the Q2 bull run, longs paid shorts practically every day. However, since July 12th that trend has been broken, which coincided with the more recent pullback from $13,000. This metric therefore can identify which direction leverage is stacked up on, and inflection points from which participants may be deleveraging or taking profits. Ultimately, this correlation makes sense, if traders are willing to pay expensive interest rates to express a levered long or short view, then arguably that view is worth the expense.

Risk Management on the Rise

The cryptocurrency industry whose foundation is more volatile than any other asset class, is under-hedged to outright un-hedged against adverse price action. As a result in such uncertain times, derivatives have emerged as a customizable risk management solution.

“Structured products have emerged as a direct result of extreme uncertainty in this rapidly growing space,” Rich Rosenblum, Co-Founder, GSR.

Derivatives make future risks tradable, which creates the two main uses for them: hedging and investments. Institutions like to eliminate uncertainty by exchanging market risk, and they use derivatives to protect themselves from a change in a market that would put their business, or its profitability, at risk. In traditional finance, this can be anything from commodity prices, interest rates, and even the weather. The benefits of derivatives are essentially the same as an insurance policy against unwanted market swings, they provide risk protection for a small investment and allow for a high level of customization. Due to this adaptability, 92% of the world’s 500 largest companies manage their price risks using derivatives.

Foreign Exchange markets have a tendency towards low volatility, so their structured products are often developed to increase the volatility of returns. Commodities, and now cryptocurrency markets, experience high volatility. As a result, most of the interest in structured products is from established corporate entities looking for risk management solutions.

The recent release of new exotic options in the digital asset space is a result of the natural evolution and institutionalization of the crypto derivatives market. As the crypto market matures, the demand for futures, options, and more complex products continues to grow. It is prudent for companies to look for risk management solutions that can complement and help protect their portfolio and business models.

A First for Crypto

GSR has completed the first-ever cryptocurrency variance swap transaction with BlockTower Capital. A variance swap is a type of financial derivative product, common in traditional financial markets, that enables institutions and experienced traders to directly hedge against the volatility of a market or index, in this case bitcoin.

“It is natural for prudent CFOs to seek ways to isolate and mitigate unwanted risks on their balance sheets. Thankfully appropriate risk management tools are becoming more readily available. BlockTower is one of many highly sophisticated counterparties that GSR is working with, others include mining pools, lenders and exchanges. As the market evolves, more players have been wanting customizable protection against unwanted market swings.” Rich Rosenblum, Co-Founder, GSR.

Rich Rosenblum Co-Founder of GSR, Photo: Jose A. Alvarado JR. for the Wall Street Journal

The introduction of structured products to crypto aims to reduce undesirable risk, as it is generally in the interest of institutional players or corporate entities. Similarly, the latest suite of structured products from GSR are engineered to reduce volatility, and benefit the portfolio and business models of sophisticated counterparties in the cryptocurrency space by better defining and constraining their risk parameters. GSR’s Variance Swap allows institutions, like BlockTower, a direct means to hedge volatility, effectively introducing more options for stabilizing returns of the end investor.

Regulatory Pressures

Due to Facebook’s Libra announcement, regulators around the world are now sharply focused on the cryptocurrency market and its technology. David Marcus, the Head of Calibra at Facebook, faced a combination of fear, uncertainty and doubt this month when he met with both the U.S. Senate Financial Services Committee, and the U.S. House Financial Services Committee.

Ohio U.S. Sen. Sherrod Brown stated that “Facebook has demonstrated scandal after scandal that it doesn’t deserve our trust”. The murky history of Facebook’s past around data protection does not pair well with the stigmas that cryptocurrency already faces. Marcus clarified that Facebook has no intention of competing with sovereign currencies, and plans to work with the Federal Reserve to ensure it won’t affect monetary policy. But so far, his explanations have not assuaged lawmakers.

“I committed to waiting for us to have all the appropriate regulatory approvals and have addressed all concerns before moving forward,” David Marcus, Co-Creator of Calibra.

David Marcus addressing the U.S. Senate

“We’ve opened a period of ‘however long it takes’ to address regulators and different experts and constituents’ questions about this,” Mark Zuckerberg, CEO, Facebook.

In their latest Q2 report filing with the Securities and Exchange Commission, Facebook reiterated: “There can be no assurance that Libra or our associated products and services will be made available in a timely manner, or at all”. The uncertainty and evolving conversation around crypto regulations may therefore “delay or impede” the launch of Libra.

Circle Internet Financial recently moved the operations of their cryptocurrency exchange, Poloniex, to Bermuda due to frustration and lack of progress with the SEC. Other influential players such as Ripple wrote an open letter to Congress highlighting that “many in the blockchain and digital currency industry are responsible actors,” and asked for them to not paint the industry ‘with a broad brush’.

The U.S. Senate Banking Committee held a hearing yesterday titled “Examining Regulatory Frameworks for Digital Currencies and Blockchain” throughout the hearing skepticism was expressed towards the technology’s ability to bank the unbanked, and the amount of offshore activity in the industry. However, Chairman Mike Crapo did highlight the uniqueness of the situation that now faces the world’s financial regulators.

“If the United States were to decide we don’t want cryptocurrency to happen in the United States and tried to ban it, I’m pretty confident we couldn’t succeed in doing that because this is a global innovation.” U.S. Senator, Mike Crapo

There appears to be an upcoming inflection point in the global regulatory environment. Regulators state they are conscious of not hindering innovation, however, it remains to be seen how favourable or constraining these regulations will be.

What else happened this month?

The Market

- High-Frequency Trading Is Newest Battleground in Crypto Exchange Race — July 8

- U.S. Lawmakers Are Realizing They Can’t Ban Bitcoin — July 30

- Tether’s $5 Billion Error Exposes Crypto Market’s Fragility — July 16

- Credibility for cryptocurrency seen as gaining, but issues persist — July 8

- Bitcoin’s Mining Difficulty Just Posted Its Biggest Increase Since 2018 — July 9

- Fed Chairman Powell: Bitcoin is a store of value like Gold — July 11

- Donald Trump is not a fan of Bitcoin — July 12

- Blockchain Financial Firm Diginex Goes Public in Reverse Merger With 8i — July 12

- TD Ameritrade-Backed ErisX Gets Green Light to Settle Futures in Bitcoin — July 1

- ErisX Granted Derivatives Clearing Organization License For Physically Delivered Digital Asset Futures Contracts by U.S. Commodity Futures Trading Commission — July 1

Highlights from Exchanges

- Binance Exchange to Launch Crypto Futures Trading with 20x Leverage — July 2

- Blockchain.com Launches High-Speed Crypto Exchange for Retail Traders — July 30

- Crypto Exchange Bitfinex Repaid $100 Million to Stablecoin Operator Tether — July 2

- eToro Adds First Ethereum Tokens to Its Wallet — 120 of Them — July 3

- Investor Fortress Will Buy Mt Gox Creditor Claims for $900 Per Bitcoin — July 8

Highlights from Projects

- Ripple Pledges $500 Million to ‘Create Real Use Cases for XRP’ — July 2

- Drama at Tron HQ — July 8, Drama again at Tron HQ — July 23

- Facebook’s David Marcus Assures Congress That Libra Will Cooperate — July 2

- Blockstack Token Sale Becomes the First SEC-Qualified Offering in U.S. History — July 11

- Bank of England Governor on Libra as a Solution to Financial Problems — July 12

- Miami Dolphins to Endorse Litecoin as Team’s Official Cryptocurrency — July 12

Regulation Update

- Report: Facebook Seeks BitLicense From New York State Regulator — July 1

- UK Regulators Approve First Cryptocurrency Hedge Fund — July 2

- The U.S. proposes barring big tech companies from offering financial services, digital currencies — July 14

GSR Update

GSR was proud to partner with the Barcelona Trading Conference this month. GSR Co-Founder Cristian Gil gave his insight on cryptocurrency liquidity and crypto market-making on the panel ‘Understanding Crypto Market Structure’.

GSR is proud to partner with blockchain.com. GSR will be providing robust liquidity to their new exchange, The Pit, that was launched this week.