Bitcoin and Ethereum

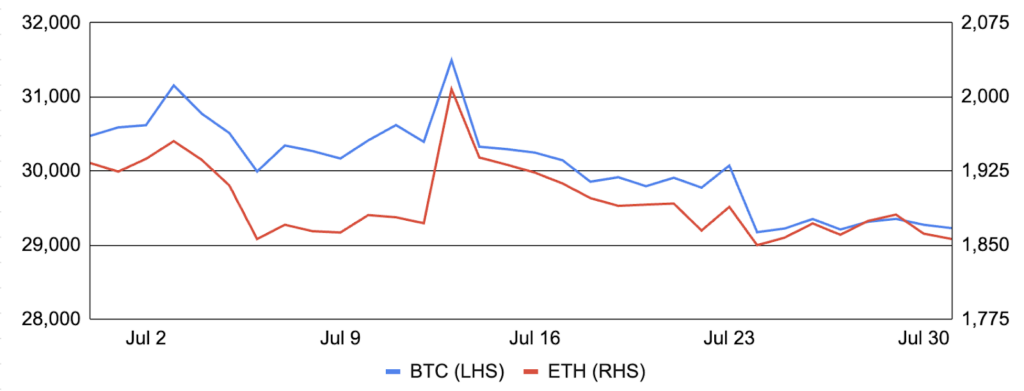

Bitcoin fell modestly in July, declining ~4% after entering the month around $30,500 and finishing at ~$29,200. Performance was weak early in the month as the Fed minutes and the ADP jobs data sparked concerns that more restrictive monetary policy could follow. The challenging performance reversed sharply on July 13 as a wave of shorts were liquidated after the US District Court for the Southern District of New York delivered a seemingly pro-crypto judgment in the SEC vs. Ripple case, covered more below. However, the biggest beneficiaries of the ruling were coins facing more regulatory scrutiny than bitcoin, particularly those previously alleged to be securities by the SEC, and bitcoin’s gains were fully offset a day later as the market reversed course and longs were liquidated. The latter half of the month featured a steady downtrend with historically low volatility. Moreover, the options market isn’t anticipating a rise in volatility over the near term, as Deribit’s Bitcoin Volatility Index (DVOL) fell to a record low beneath 35, implying bitcoin options are priced to realize an annualized volatility of just 35% over the next month. In other news, Ordinals returned to favor and set a daily record with more than ~420,000 inscriptions on July 30; BadgerDAO released its “purple paper” outlining its fee-less protocol for borrowing synthetic bitcoin (eBTC) collateralized by Lido’s stETH; Bitcoin Depot became the first publicly-traded crypto ATM operator after listing on the Nasdaq; Amazon’s blockchain-as-a-service platform added Bitcoin querying services; and, BlackRock CEO Larry Fink claimed crypto is “going to transcend any one currency and currency valuation” due to its global nature.

Ethereum similarly fell ~4% during the month after entering July around $1,930 and finishing at ~$1,860 (ETH lagged bitcoin early but outperformed after the Ripple ruling). Staking demand was unhampered by ETH’s weak performance, and Ethereum’s validator set grew beyond 700,000 validators, with another 80,000 validators still waiting in the activation queue (~36-day wait). Onchain activity accelerated modestly from June, and the ETH supply fell by ~19,200 ETH, marking its seventh consecutive monthly decline despite the increasing gross issuance attributed to the growing number of validators. The conference-heavy month featured a breadth of ecosystem announcements across L2s, bridges, and other applications, covered more below. In other news, Ethereum execution layer client team Nethermind partnered with EigenLayer to drive safe restaking innovation; Flashbots raised $60m to fund ongoing development for its end-game MEV solution SUAVE, selecting investors in a so-called “decentralization beauty contest”; Cymbal launched a human-readable Ethereum block explorer prioritizing UI/UX; Volatility Shares, the asset manager behind the recently launched 2x Leveraged Bitcoin Futures ETF, filed for an Ethereum Futures ETF, and their application was quickly followed by several competing filings despite numerous similar applications being withdrawn just three months earlier (rumors followed in early August that the SEC is now willing to consider such applications); and, an early ETH ICO wallet holding ~61.2k ETH was transferred to Kraken after laying dormant for eight years.

BTC and ETH

Source: Santiment, GSR.

Ripple’s Split Decision

The biggest news to hit crypto in months, perhaps years, was the split decision and partial victory awarded to Ripple Labs, where the SEC had sued Ripple alleging that sales of its XRP token constituted an illegal securities offering. Specifically, the judge found that while institutional sales of XRP to hedge funds and VCs were required to be registered, programmatic sales to retail investors directly on digital asset exchanges and distributions of tokens as a form of payment for services were/are not investment contracts in violation of the law.

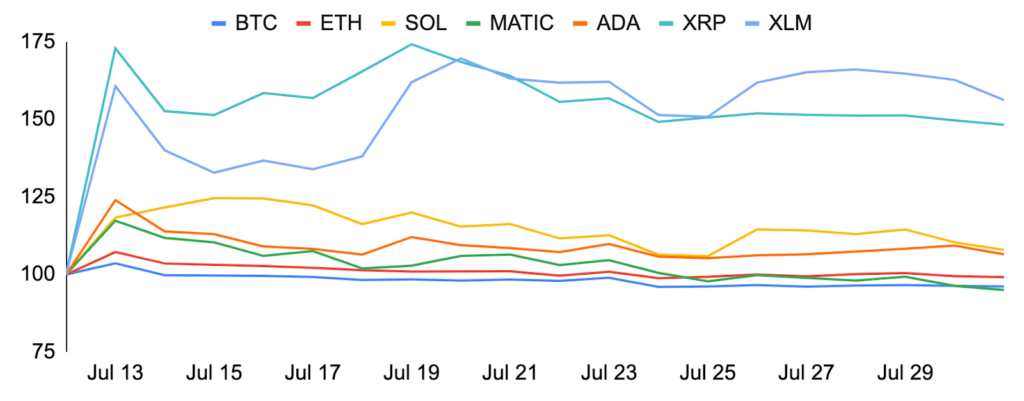

Token prices quickly gapped up in the wake of the ruling, with XRP rising by 73% over the following day to make it the fourth largest token by market cap. In addition, beaten-down tokens previously alleged by the SEC to be securities like MATIC, ADA, and SOL exhibited strong performance as well, increasing 17-24% after the ruling, while Coinbase stock increased 24% on the day. Additionally, several US exchanges like Coinbase and Kraken quickly re-listed XRP.

Despite this initial reaction, the ultimate impact of the ruling is likely to be determined. Indeed, some legal experts have urged caution, as the judgment is not binding precedent, the decision may be appealed by the SEC, and full resolution could take months or years, as the case wasn’t fully concluded. However, others have stated that the ruling implies secondary market crypto asset transactions should not be considered securities and that it may bolster industry arguments in other lawsuits like the SEC vs. Coinbase. For what it’s worth, a different US federal judge rejected the use of the Ripple ruling in a separate SEC lawsuit against Terraform Labs, stating ““the Court declines to draw a distinction between these coins based on their manner of sale” and that “Howey makes no such distinction between purchasers,” referring to the Howey test. However, when asked whether the SEC will appeal the Ripple ruling in a recent Bloomberg interview, SEC Chair Gensler stated that a potential appeal is still being decided upon and seemed to downplay his role, stating that he is just one of five commissioners.

Select Token Performance After the SEC vs. Ripple Ruling, July 12=100

Source: Santiment, GSR.

Curve Falls Victim to the Vyper Vulnerability

On July 30, decentralized exchange Curve Finance was exploited due to a vulnerability in older versions of the Vyper smart contract language that failed to properly implement reentrancy attack protection. As a result, hackers were able to drain four Curve pools and steal ~$70m ($52m after whitehat recoveries). Upon news of the attack, Curve immediately notified the community, disabled deposit and staking functions for the affected pools, delisted them from the interface, and later saw the emergency DAO end their gauge emissions (i.e., CRV token incentives). Though all other pools are safe, Curve TVL has fallen from $3.3b to $2.3b as LPs withdrew liquidity out of caution, and its CRV token is now down 20% since prior to the attack.

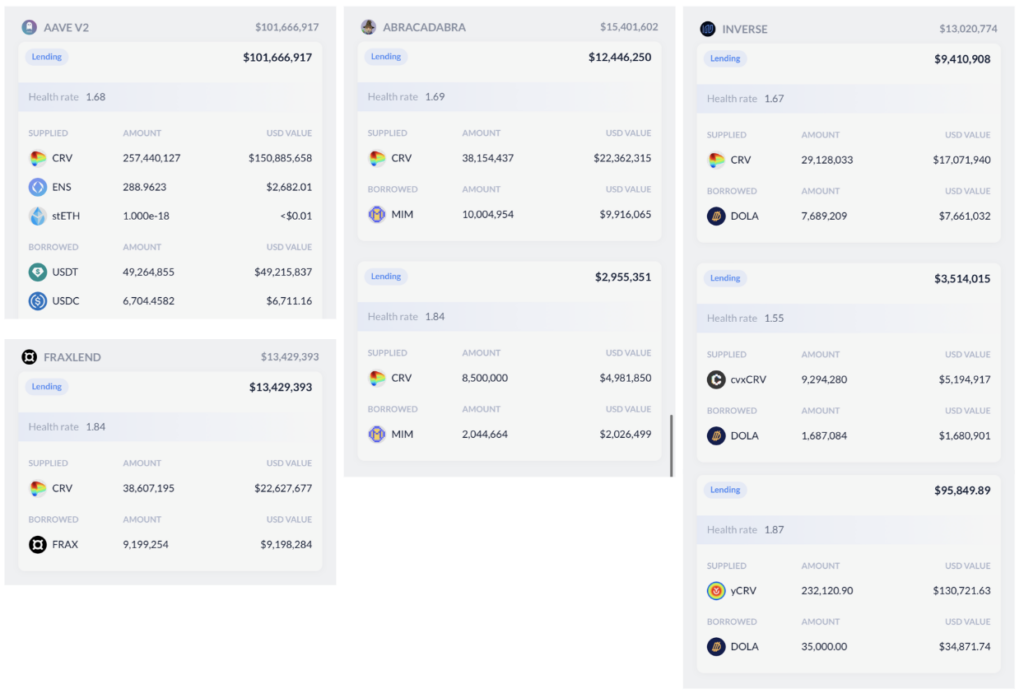

Despite Curve rectifying the vulnerable pools, traders continue to closely monitor the situation, as Curve founder Michael Egorov had taken out roughly $100m of loans backed by 475m CRV from various onchain lending protocols. More specifically, Egorov’s loans included a $63m loan on Aave backed by 305m CRV, a $17m loan on Frax backed by 59m CRV, and an $18m loan on Abracadabra. This represents an immense risk as the 475m CRV, which are 47% of the circulating supply, could be liquidated should CRV’s price fall materially, further pressuring the price of CRV and potentially putting Curve in jeopardy. Additionally, other DeFi lending protocols risk accruing bad debt in the event of such a liquidation. While the Aave loan was the largest, the Frax loan was at particular risk of liquidation given Frax’s time-weighted variable interest rate, while Abracadabra proposed to increase the interest rate on CRV cauldrons to 200%. Despite this, Egorov continues to improve loan health by paying down the loans via large OTC sales to high profile counterparties and inciting additional liquidity via a new CRV pool and gauge. More recently, the price of CRV has stabilized, some TVL has returned to Curve, and Erogov’s liquidation levels have fallen (available here), suggesting that the situation remains fluid but we may be past the worst of it.

Curve Founder Michael Egorov’s Outstanding Loans

Source: DeBank, GSR. Note: Data as of August 3.

Layer 2 Roundup and Other Protocol Developments

It was a loaded month for Ethereum events with EthCC and Modular Summit, and a busy month for Ethereum ecosystem announcements as a result. Perhaps none were more bountiful and prominent than from layer 2s. For example, Coinbase’s layer 2 Base went live on mainnet, but its initial launch strictly targeted developers and intentionally excluded a web-based UI to its bridge contract for this reason before its expected public launch on August 9. However, such restrictive measures failed to prevent activity and memecoin euphoria ensued, including a rug pull by the developer of the BALD memecoin that’s believed to be affiliated with FTX and Alameda. In addition to Base, ConsenSys announced the mainnet alpha launch of its zkEVM Linea; Mantle Network’s modularity-prioritizing layer 2, which will leverage EigenDA for data availability instead of Ethereum mainnet, also had its mainnet alpha launch; Gitcoin launched its OP Stack-based layer 2 network for financing public goods; and, Celo’s temperature check to transition to an Ethereum L2 passed with overwhelming support. In addition, Gnosis unveiled Gnosis Pay – its L2 payment network built on top of Gnosis Chain – and an associated Visa-powered Gnosis Card that enables the spending of onchain assets at any Visa terminal directly from a Safe wallet. Finally, zkSync revealed its new high-performance STARK-powered proof system dubbed Boojum, and Starknet deployed its TPS-enhancing Quantum Leap upgrade and revealed that Starknet Appchains can be deployed leveraging the Starknet Stack, rivaling earlier announcements from competing L2s like Optimism (Superchain), Arbitrum (Orbit), zkSync (Hyperchains), and Polygon (Supernets). Lastly, L2Beat released a report on the state of upgradability features across Ethereum L2s.

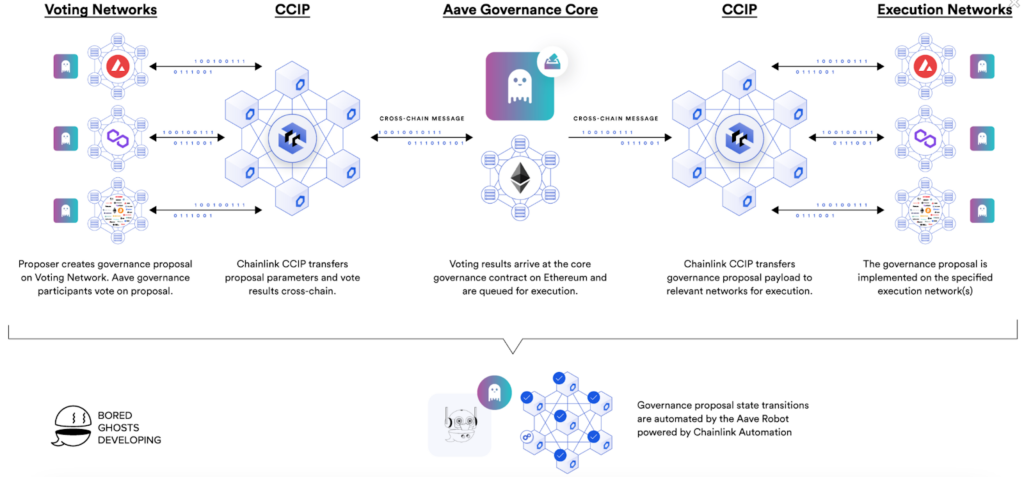

While the sheer number of L2 announcements may have been the month’s headlining theme, there were several other notable releases across app and infrastructure layers. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) entered its mainnet early access phase and launched on Ethereum, Optimism, Polygon, and Avalanche to bring security and simplicity to cross-chain interactions. Synthetix and Aave are the two early adopters so far, and Synthetix is using CCIP to burn and mint synths across chains to alleviate liquidity fragmentation concerns, while Aave introduced CCIP to facilitate its multi-chain governance and replace its reliance on multiple chain-native bridges. Elsewhere, Uniswap released the UniswapX white paper introducing a Dutch-auction-based decentralized trading protocol that aggregates both onchain and offchain liquidity and enables gas-free swaps; Lens v2 was unveiled and introduced Open Actions that enable any external smart contract-action to be embedded directly in a Lens post (i.e., mint an NFT or join a DAO directly from a Lens post); Arkham launched its ARKM token and introduced the Arkham Intel Exchange, a market for buying and selling onchain crypto intelligence; and, Solana Labs introduced the Solang compiler, which compiles Solidity-based smart contracts to run on Solana, enabling contracts written in the industry’s most used programming language to be easily ported onto Solana.

Aave’s Multi-Chain Governance Powered by CCIP

Source: Chainlink, GSR.

All Eyes on the Orb

July also featured the launch of Worldcoin, one of crypto’s most ambitious and controversial projects aiming to bootstrap a global privacy-preserving identity network that lays the groundwork for universal basic income (UBI). OpenAI’s Sam Altman co-founded the project, and the inception of Worldcoin stemmed from his work at OpenAI and growing belief that a UBI would be necessary as the world develops increasingly powerful AI systems. Moreover, being able to distinguish humans from AI, and doing so uniquely to maintain credibility and mitigate Sybil concerns is paramount in such a paradigm.

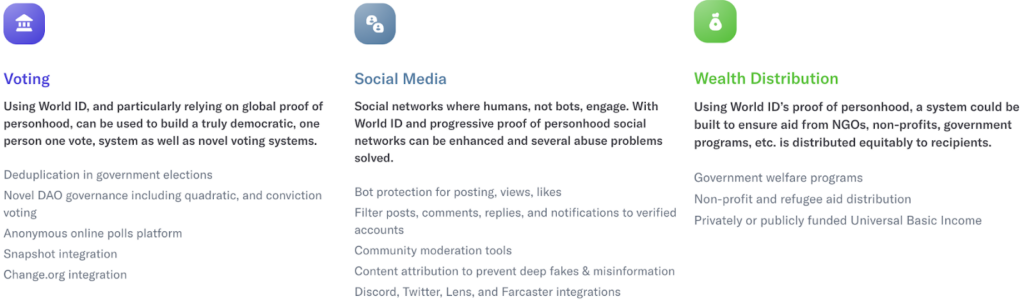

The core of the Worldcoin project is the World ID, a unique privacy-preserving identity that users can create from the World App wallet. Once created, users must verify their World ID by visiting one of Worldcoin’s physical imaging devices, known as an Orb, where they scan a QR code of their wallet-generated public key before having their iris scanned and their humanity uniquely verified, ensuring that only a single World ID corresponds with any individual. If the iris scan is unique, the corresponding public key is committed to the onchain Merkle tree, and users can verify their unique personhood via a zero-knowledge proof without revealing any further information about their identity. World ID serves as a privacy-preserving digital passport that one can selectively disclose to verify their humanity in an endless number of use cases. Additionally, it was planned for every verified individual to be entitled to UBI-like grants of WLD tokens on an ongoing basis simply for being a unique human, but this has been a challenge to execute in practice due to regulatory concerns, and WLD tokens aren’t currently claimable in certain jurisdictions for this reason.

Despite Worldcoin’s ambitious goal to revolutionize digital identity, the project has been criticized by some in the crypto industry, much of it seemingly emotionally biased and stemming from the dystopian aspects of getting one’s iris scanned by a specialized orb manufactured by the token issuer (although Worldcoin does not maintain the full iris scan by default, and only a numerical representation called an iris code leaves the Orb). Others have raised ethical concerns about harvesting biometric data under the guise of free money that was non-existent at the time of most sign-ups. There are technical concerns as well, including black markets for World IDs, hardware security, and others that Worldcoin is actively working to minimize. Vitalik Buterin outlined these shortcomings and the tradeoffs versus other proof-of-personhood implementations after the launch.

World ID Use Cases

Source: Worldcoin, GSR.

Japan’s Monetary Progression

The Bank of Japan (BoJ) surprised markets by paving a path toward the end of its years-long yield curve control (YCC) program at its July policy meeting. While the BoJ left short-term rates unchanged at -0.1% and its long-term target rate at 0%, it added flexibility to its YCC mandate and increased the upper bound by which long-term rates may rise above the target from 0.5% to 1%. Governor Ueda emphasized that the BoJ would flexibly conduct market operations beyond 0.5%, however, it would do so with consideration for variables like the yield level and speed of change to determine an appropriate response. Governor Ueda further noted that the BoJ “doesn’t expect the yield to move up to 1%, but have set this cap as a pre-emptive measure.” The 10Y Japanese Government Bond yield breached 0.6% for the first time in nearly a decade in response.

Other monetary policy decisions were less surprising. The Fed and ECB both hiked interest rates by 25 bps as expected, and both central banks characteristically indicated that future data releases would drive future policy actions. The BoE followed with a consensus 25 bp hike and similar messaging at the beginning of August. The path ahead for the Fed remains fluid as prominent economic data releases have been mixed since the July meeting, as hotter-than-expected GDP and cooler-than-expected Core PCE paint a conflicting picture for the trajectory of rates. The median forecast from June’s Summary of Economic Projections implies one additional rate hike will come this year, but markets haven’t bought into this view and continue to imply the most likely scenario is for rates to stagnate in the current range (~63%), with one more hike being the second most likely outcome (~26%).

Japanese Government Bond 10Y Yield

Source: Investing.com, GSR. Jan 1, 2015 to July 31, 2023.

GSR in the News

- Bloomberg – Bitcoin (BTC) Drops Below $29,000 as ETF Excitement Eases

- CoinDesk – First Mover Asia: Crypto Market Is on ‘Standby’ as Release of June Inflation Data Nears

- CoinDesk – Fed Preview: Crypto Observers See Powell Keeping Door Open for Rate Hikes Beyond July

- CoinDesk – Crypto Liquidity Network Paradigm Leans Into DeFi With StarkWare

- CoinDesk TV – Grayscale Bitcoin Trust Discount Narrows In Wake of Spot Bitcoin ETF Race in U.S. | Video | CoinDesk

- Fortune – Someone offered a $670 bounty for Elon Musk’s crypto wallet via ‘intel-to-earn’ app Arkham

- Traders Magazine – EDX Aims to Bring Transparency to Spot Crypto Markets

- Paradigm – GSR: The Great Reversal of ETH Option Vega Flows

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.