Bitcoin and Ethereum

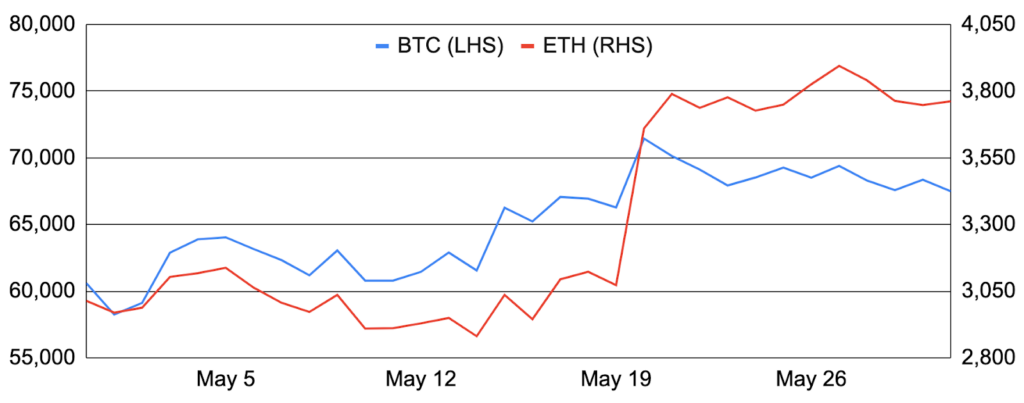

Bitcoin entered May around $60,600 and increased 11% during the month to finish at ~$67,500. Crypto’s apex digital asset traded relatively sideways until it started to climb higher on several mid-month catalysts that included a better-than-feared US CPI, improving inflows into the spot Bitcoin ETFs, and an impressive breadth of 13F spot Bitcoin ETF holders. The real action, however, came on May 20th when reports surfaced that the SEC may approve the spot Ethereum ETFs, with Bitcoin benefitting not only from ETH’s move but also the improving US view towards digital assets. Bitcoin spent the rest of the month moving slightly lower, with the largest negative catalyst being the transfer of over 140,000 BTC by the Mt Gox trustee, likely in preparation to repay creditors by October 31. Other notable news includes: Bitcoin surpassed one billion cumulative transactions; developers called for the Bitcoin testnet to be reset due to frequent “block storms”; Runes increased its share of Bitcoin transactions after experiencing a mid-month lull; hybrid L2 BOB and CeDeFi protocol BounceBit both launched their mainnets; Bitcoin staking protocol Babylon partnered with pSTAKE for Bitcoin liquid staking; MetaMask revealed intentions to integrate native Bitcoin; medical device maker Semler Scientific adopted Bitcoin as its primary treasury reserve asset; the NYSE announced plans to launch Bitcoin options; and the Bitcoin white paper returned to Bitcoin.org.

Ethereum materially outperformed Bitcoin, increasing 25% during May after entering the month around $3,000 and finishing at ~$3,750. While Ethereum was impacted by the same macroeconomic variables as Bitcoin, the vast majority of Ethereum’s performance came on May 20th due to the aforementioned movement on the spot ETFs, specifically after Bloomberg ETF analyst Eric Balchunas tweeted that he was increasing his approval odds from 25% to 75% just days before the SEC was set to opine on VanEck’s application. ETH closed out the month relatively unchanged after May 20 despite the SEC’s actual approval of the spot Ethereum ETF 19b-4 filings on May 23 and the apparently improving US stance towards crypto. In development/protocol news, ETH flipped to inflationary due mainly to the Dencun upgrade; L2 TVL hit a new record; Ethereum developers set the Pectra upgrade for 1Q25, Vitalik proposed EIP-7706 to create a new gas model for call data and authored a blog post on MEV solutions, and ENS announced plans to migrate to a layer 2. In staking news, Ethereum validator P2P.org enabled ETH restaking on EigenLayer; Blockdaemon integrated Liquid Staked ETH (LsETH); Lido proposed an alliance promoting a stETH-based staking ecosystem; Ethereum developers sparked controversy by joining EigenLayer as advisors; and the proposed spot Ethereum ETFs all removed staking from their plans. Finally, there were many notable developments with L2s, including from Optimism, Polygon, Taiko, and StarkNet.

BTC and ETH

Source: Santiment, GSR.

The US Changes its Stance Towards Crypto

The most notable item during the month was a marked and sudden shift in the US stance towards crypto. It all started early in the month when Donald Trump announced intentions to accept crypto campaign donations and stated he “is good with” crypto. Trump continued to express pro-crypto messages across multiple platforms, including at an NFT Gala at Mar-a-Lago and with a promise to pardon Silk Road founder Ross Ulbricht. Despite some believing Trump’s embracement of crypto rings hollow – he was less than friendly to the industry while President – the Democrats quickly took notice, with many realizing an anti-crypto stance was unlikely to win votes, but it could cost votes in a tight election year. This about face is demonstrated by and culminated in three particularly notable events during the month.

The first notable event demonstrating a less hostile approach towards crypto regards SAB 121, a controversial SEC accounting policy released in 2022. Specifically, SAB 121 mandates that companies offering digital asset custody services include the custodied assets on their balance sheet, creating material capital and accounting complications for banks wanting to work with crypto clients. But with significant industry pushback and more openness by politicians, both the US House of Representatives and the Senate passed a measure overturning SAB 121. While Biden ultimately vetoed the measure, a promise he had made before it passed in the House and before crypto became more influential in the election, Biden did express a desire to work with Congress to develop digital asset legislation, and the bipartisan support demonstrates lawmakers’ desire to both protect consumers / the financial system and to foster innovation.

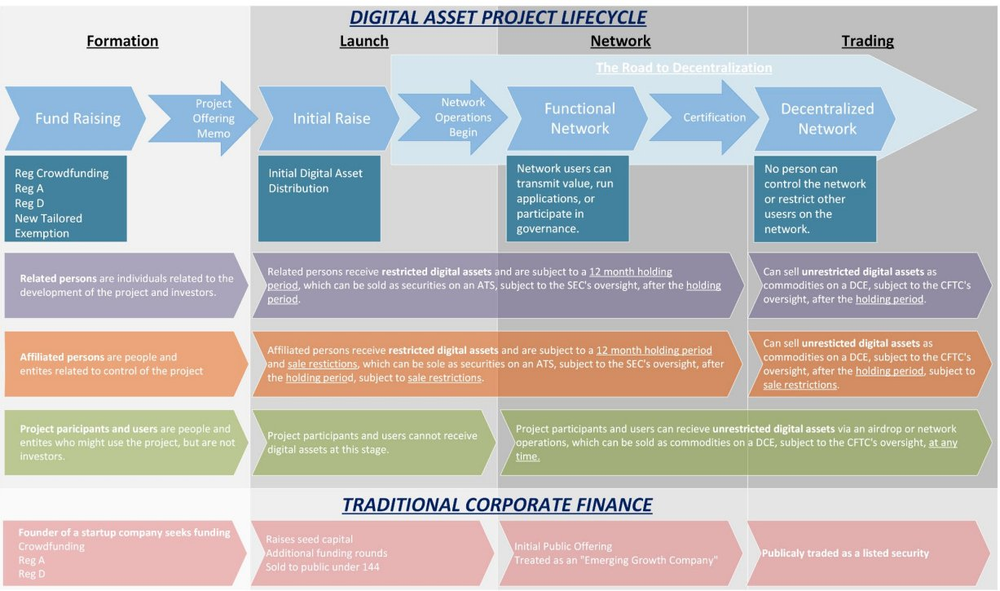

Next up was the Financial Innovation and Technology for the 21st Century Act (FIT21), a bill seeking to establish a comprehensive regulatory framework for digital assets in the US. FIT21 proposes to divide regulatory responsibility of digital assets between the SEC and CFTC based on various factors, such as the digital asset’s level of decentralization and functionality of its associated blockchain system, how the digital asset is acquired, and who holds the digital asset. While the bill is not perfect, over 50 crypto companies voiced support for it, and it passed in the House by a vote of 279-136, including 71 Democrats voting in its favor. While moving the bill through the Senate is a complex process and it is unclear if it will even reach the Senate floor or how it would do if it does, the passage in the House alone is notable for the level of bipartisan support and the amount of progress made, with FIT21 being the furthest a comprehensive crypto bill has made it in the US.

Finally, the last notable item demonstrating, accompanied by, and arguably due to the changing US view towards crypto is the recent approval of the spot Ethereum ETF 19b-4 filings, discussed more below.

FIT21 Proposed Digital Asset Project Lifecycle

Source: Congress.gov, GSR.

Spot Ethereum ETFs Approved

In a historic move, the SEC approved pivotal 19b-4 filings for the spot Ethereum ETF applicants on May 23, putting the products squarely on the road to launch. The approval surprised nearly everyone involved, including ETF experts and the issuers themselves, as there had been little communication between the SEC and the issuers, the SEC had received political pressure not to approve additional digital asset ETFs, and the presence of the SEC’s investigation into ETH as a security complicated the matter. However, just three days prior to the SEC’s May 23 decision deadline, Bloomberg ETF analysts Eric Balchunas and James Seyffart materially increased their approval odds to 75% and noted “chatter that SEC could be doing a 180” on the issue. Issuers soon after began updating their 19b-4 filings on an accelerated basis, most notably removing staking, and saw their proposed ETFs listed on the DTCC before the SEC ultimately approved the 19b-4 filings via delegated authority (delegated authority is the norm for approvals, though this precluded seeing public commissioner votes). The 19b-4 approvals now pave the way for the ETFs to launch, and more importantly, added some regulatory clarity to spot ETH, will ease access to the digital asset and further legitimize crypto as an asset class, and is accompanied by and due to a shift in US crypto policy that is likely more important than the ETF itself.

Looking ahead, while the hard part is done and most consider the spot Ethereum ETFs a matter of when, not if, the SEC must still approve the S-1 registration statements in order for the ETFs to launch. ETF experts had pegged S-1 approval to occur anywhere from two weeks to two months after the 19b-4 approvals, though SEC Chair Gensler recently stated S-1 approval will “take some time”. Finally, note that once launched, inflows into the spot Ethereum ETF products may be a large driver of price, as they were for Bitcoin, and market participants are split, but mostly subdued around inflow expectations. Specifically, those who believe flows may underwhelm point to a lack of staking, the poor futures-based Ethereum ETF launch, the fact that Ethereum is less well known and more complicated than Bitcoin, the lack of buzz from a long run-up to approval as was the case with the spot Bitcoin ETFs, and the potential for large Grayscale Ethereum Trust (ETHE) outflows. However, others believe inflows may positively surprise due to low expectations, some of the above arguments being invalid (egs. Ethereum futures ETFs launched in a bear market; a 3% staking yield on an 80 vol asset doesn’t matter), significant advantages to the spot Ethereum ETF product (egs. The ability to diversify BTC holdings; the potential for deflation; a more straightforward ESG story), the potential for Grayscale to lower fees or spin out its Mini Trust immediately to temper outflows, and the potential for animal spirits to win the day with early flows likely highly driven by retail.

Spot Ethereum ETF Applicants

Source: @JSeyff on Twitter, GSR. Note: Data as of May 20.

Memecoin Activity Continues

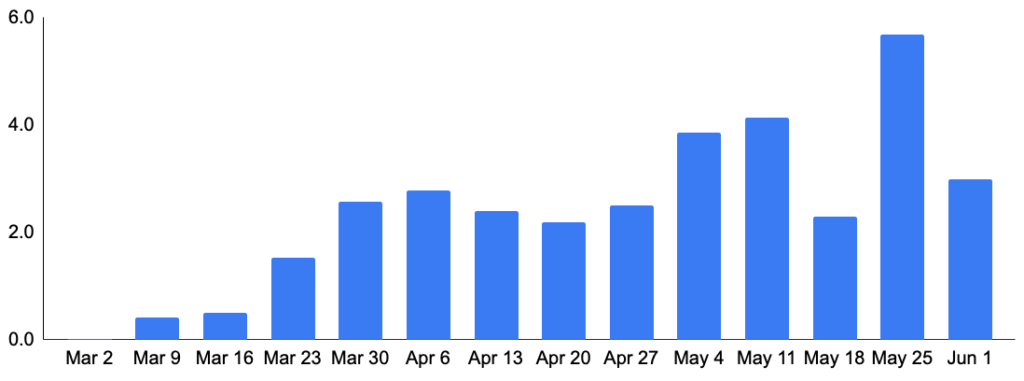

Outside of politics and traditional finance, memecoins continued to remain in the spotlight in May, with four main storylines. First, memecoins continued to proliferate, with tens of thousands created every day on memecoin launchpad pump.fun alone. The trend has been so strong that it pushed pump.fun into the top ten protocols by fees generated, despite having been exploited by a former employee on May 16. Another notable memecoin trend during the month was celebrities launching memecoins, including Caitlyn Jenner, where many questioned whether she was actually behind the coin, and Iggy Azalea, where she continues to heavily promote her MOTHER coin on Twitter. Despite the fun, some questioned the merits of such activity, including Vitalik Buterin who stated he is “quite unhappy” about it. Also during the month, political memecoins like Jeo Boden, Doland Tremp, and MAGA saw elevated trading volumes, particularly after Trump was found guilty on 34 felony charges, though the political memecoins experienced varying performance (BODEN -25% in May vs. TREMP +393% and TRUMP +247%). Lastly, memecoins received a large boost following the return of Keith Gill, also known as Roaring Kitty, who played a key role in the GameStop short squeeze in 2021 with his posts on Reddit. Gill began tweeting on X again on May 12th for the first time in 3 years, which caused many memecoins to pump, including the Solana-based GameStop token GME that skyrocketed 718% during May.

Pump.fun Weekly Revenue, $m

Source: DefiLlama GSR.

GSR in the News

- Bloomberg – Token Launches Are Back as Startups Embrace Now-or-Never Mantra

- Barron’s Bitcoin Nurses Its Wounds After Its Worst Stretch This Year. What Comes Next.

- TechCrunch – Masa Finance gets $3.5M pre-seed to build its decentralized credit protocol

- Bloomberg – Crypto Startups Turbocharge Valuations as Investment Picks Up

- Bloomberg – Crypto VC Firm Polychain Makes Payouts to Investors in Two Funds

- Bloomberg – Banks Want In on Private Credit – Matt Levine

- Bloomberg – A Hot Button Issue for SEC Threatens to Erode Ether-ETF Demand

- Cointelegraph – Can Ethereum ETFs thrive without staking amid SEC scrutiny?

- Bloomberg – US Paves Way for Ether ETFs in Test of Crypto Demand Beyond Bitcoin

- The Block – Why crypto traders are bullish on the delay before Ethereum ETFs go live

- Coindesk – The Unintended Consequences of FIT21’s Crypto Market Structure Bill

- The Block – The Ethereum ETFs took the market by surprise. Are they priced in?

- The Block- ETH ‘bucking’ crypto market downturn thanks to spot ether ETF excitement, analysts say

- DL News – Solana surge to $140 shows investors couldn’t care less about the Fed

- DL News – How this crypto hedge fund will trade the Ethereum ETF decision

Author:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.