Bitcoin and Ethereum

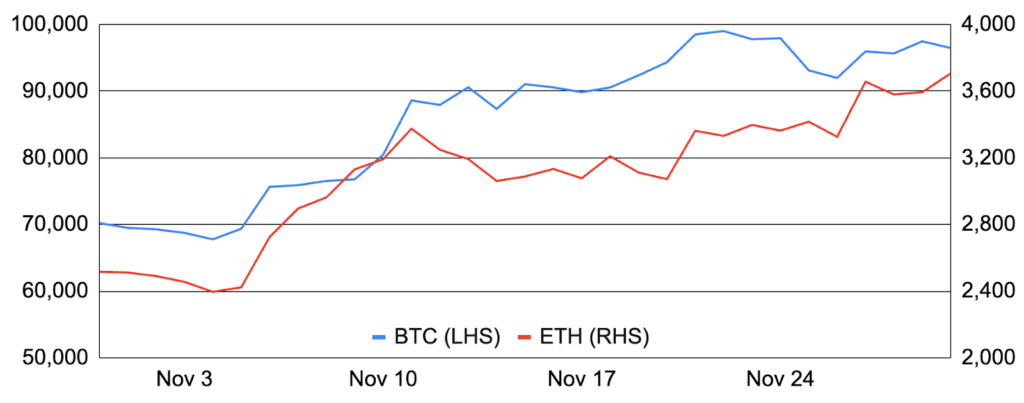

Bitcoin entered November around $70,200 and rose 37% during the month to $96,500. Crypto’s apex asset set frequent all-time highs during November, added a monthly record $520b to its market cap, and surpassed silver to become the seventh largest asset in the world. While initially declining on uncertainty into the US election and pausing late month amidst profit-taking, Bitcoin spent most of November melting higher after the pro-crypto Donald Trump won the US Presidential election and enthusiasm around an improving US stance catalyzed demand from myriad sources. Indeed, the retail-driven spot Bitcoin ETFs saw $6.5b of monthly inflows, corporates like MicroStrategy, MARA, Thumzup, Solidion, Nano Labs, Cosmos Health, and others bought or announced Bitcoin treasury strategies, and even sovereigns including the US, Argentina, and Brazil made progress on potential Bitcoin strategic reserves. There were also many positive political/ government/ regulation-related items, including SEC Chair Gensler’s resignation announcement, as well as key finance-related items, including the launch of options on the spot Bitcoin ETFs as well as record CME BTC futures open interest. Finally, other notable items include: key developers announced a new method for adding covenants; MicroStrategy announced plans to buy $42b of BTC over 2-3 years, purchased $13.5b of Bitcoin in November, and saw its stock increase 58%; and, Mt Gox sent $4.6b of Bitcoin to unknown wallets.

Ethereum also had a phenomenal month, rising 47% after entering November around $2,500 and finishing at ~$3,700. Ethereum’s outperformance during the month was likely due to a confluence of factors. First, with recent underperformance and poor sentiment, investors were likely underweight ETH headed into the month. In addition, inflows into the spot Ethereum ETFs finally picked up, moving from negligible flows in October to $1.1b in November. Further, network activity materially increased, bringing inflation down to 0.3% annualized and as evidenced by a 71% increase in DEX trading volumes, a 39% increase in network revenue, a 9% increase in active addresses, and a 20x increase in total blob fees. Lastly, a more open US stance is seen as particularly beneficial for Ethereum, given its varied use cases including some with still-evolving regulations like DeFi. In fact, there were already positive movements on this front as a US federal judge struck down the SEC’s broker rule and a US appeals court overturned the Treasury’s sanctions on crypto mixer Tornado Cash. Elsewhere, the Ethereum community gathered for a successful Devcon event; developers rolled out the Mekong testnet to trial the coming Pectra upgrade; Base saw surging activity with TVL crossing $10b; and, Starknet introduced native staking.

BTC and ETH

Source: Santiment, GSR.

Republicans (and Crypto) Sweep the US Election

On November 5th, former President Donald Trump defeated Vice President Kamala Harris in the 2024 US election to become the 47th President of the United States. While a few states had yet to be awarded, The Associated Press called the race for Trump at 5:35am EST on November 6th after Trump retook Wisconsin, giving him the 270 electoral college votes needed to win. Exit polls indicated that Trump made significant progress with minorities and independents compared to past elections, all combining to make him just the second president in US history to serve non-consecutive terms. In addition to Trump winning the Presidency, Republicans took control of both the Senate and the US House of Representatives to complete the sweep. While blockers remain such as the use of the filibuster, the Republican sweep will make it easier for Trump to enact his policies, many of which are positive for the digital assets industry.

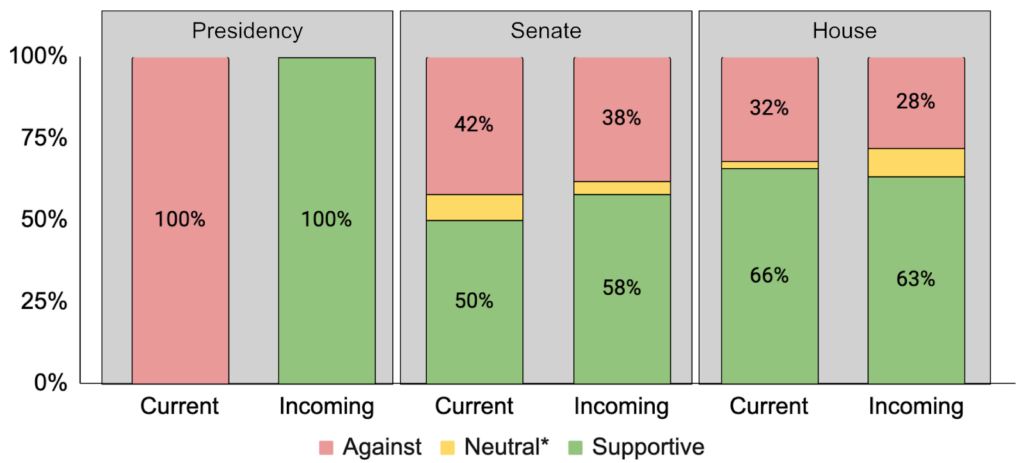

Of particular importance for the US crypto industry is the shifting composition of both the President and Congress with respect to their views toward digital assets. Indeed, the pro-crypto Trump will replace the less-than-friendly Biden, a full 58% of incoming Senators are pro-crypto, and 63% of the next House support the industry. Thanks to efforts by grassroots advocacy group Stand With Crypto and crypto PAC Fairshake, the industry had a large impact on the election and can influence policy to both protect consumers and foster innovation. Moreover, crypto is now provably important to US voters, and with over $100m already raised for the 2026 mid-terms, the momentum will only expand from here.

Composition of the Current & Incoming US Government by Stance on Crypto

Source: StandWithCrypto.org, Wikipedia, GSR. Note: The Neutral category is overwhelming composed of candidates labeled “No Stance” or “Neutral”, though there were a few instances of “not enough info”, candidates not being rated, or races that are undecided. Still, these are few in number and do not have a material impact.

Trump Makes Positive Crypto Moves in the Wake of the Election

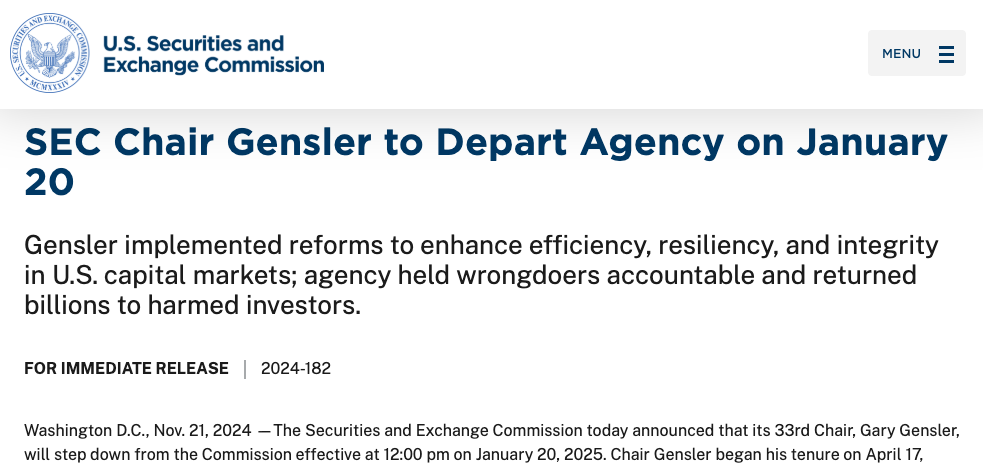

While the Trump administration doesn’t take office until January 20th and it will take time to institute new policies, there have already been a bevy of positive items for the industry. First and foremost, SEC Chair Gensler and Commissioner Lizárraga, who have had a contentious relationship with the industry, announced they will step down. Further, Trump was reported to be assembling a Crypto Advisory Council to make policy recommendations and potentially help with a strategic Bitcoin reserve, while he explored creating a Crypto Czar position (and appointed David Sacks to the position this month). In addition, nearly all of Trump’s appointees to key positions have been crypto advocates, including Paul Atkins as SEC Chair, Scott Bessent as Treasury Secretary, Howard Lutnik as Commerce Secretary, and Pete Hegseth as Defense Secretary. It was also reported that Trump is examining giving oversight of digital assets to the CFTC, suggesting that his administration views most digital assets as commodities. Lastly, the President-elect further dove into crypto by raising additional funds for World Liberty Financial, consulting with key industry leaders on appointments, and positioning Trump Media to buy crypto firm Bakkt.

Excerpt from SEC Press Release Announcing Chair Gensler Will Step Down

Source: SEC, GSR.

Ethereum’s Beam Chain Proposal

With Devcon occurring in mid-November, Ethereum’s roadmap was once again a major topic of discussion. One proposal, dubbed ‘The Beam Chain’, gathered much attention and debate. The Beam Chain, put forward by Ethereum Foundation researcher Justin Drake, focuses on tackling the most ambitious elements of Ethereum’s consensus roadmap in a single effort, accelerating the timeline for Ethereum’s consensus layer to reach its final state. A key point that criticisms of the proposal largely ignored is that the Beam Chain proposal is squarely focused on the consensus layer – that is, it runs in parallel to planned upgrades to the execution and data layers and is fully compatible with them. The Beam Chain also focuses on the difficult consensus upgrades that require a substantial rearchitecting of the consensus layer. It therefore won’t impact incremental upgrades to the existing consensus layer, which will continue to be shipped as they have been in a roughly yearly hard-fork cadence. Thus, while critics expressed frustration at the proposed 4-year timeline for the Beam Chain, this criticism is arguably off-target as the proposal is meant to accelerate the long-term parts of the roadmap that would have otherwise taken even longer.

Planned upgrades to Ethereum’s consensus layer fall into three categories 1) block production, 2) staking, and 3) cryptography, with the exhibit below showing different upgrade areas in each. Upgrades in green and yellow are achievable in the near to medium term via incremental hard forks, while those in red require significant rearchitecting of the consensus layer and are slated for longer-term implementation. The Beam Chain will encompass all these upgrades, with its primary purpose being to batch and accelerate the more complex upgrades marked in red. Meanwhile, the upgrades in green and yellow will be implemented on the current consensus layer, with insights from these incremental improvements informing the development and deployment of the Beam Chain.

Zero Knowledge (ZK) will be the technological underpinning of the Beam Chain and the expectation is that it will heavily utilize zkVMs. This has several consequences. First, by making Ethereum’s core consensus logic zk-provable, the Beam Chain can ease the verification burden of attesters. Second, ZK will be used to create more flexible signature aggregation schemes than Ethereum’s existing BLS signatures. Additionally, the use of hash-based SNARKs across both consensus logic proofs and signatures will make the consensus layer quantum-resistant, a key property to ensure Ethereum’s security if/when quantum computing becomes practical. This so-called ‘snarkification’ of the consensus layer, combined with a new 3-Slot-Finality consensus protocol (or future iterations on it), will result in significant benefits, including bringing layer 1 slot times (ie. opportunities for a block) down to 4 seconds from the current 12 seconds and finality down to 12 seconds from the current ~15 minutes, while at the same time improving decentralization. The upgrade will also clear technical debt accumulated since the current Beacon Chain design was finalized five years ago. Thus, in spite of the criticisms, we’re excited to see work on the Beam Chain proposal progress given its potential to accelerate the timeline to Ethereum’s end state.

Ethereum Consensus Layer Roadmap

Source: Justin Drake, GSR.

The Rise of AI Agents

The AI memecoin trend continues to intensify, giving rise to widespread excitement and speculative frenzy around ‘AI Agents’. The term AI agent refers to AI systems that can autonomously act in a goal-directed manner by reasoning and executing tasks in pursuit of their objectives. Agents caused a buzz in AI in 2023 with systems like AutoGPT and BabyAGI, and frameworks like Langchain, implementing agentic systems based on LLMs. Since then, there’s been growing experimentation and interest in AI agents within crypto, with the thought that crypto provides the most natural financial rails for agents to transact. This potential captured the imagination of many with Terminal of Truths and its associated GOAT memecoin. Though Terminal of Truths is not itself autonomous and operates through its creator, it gave the impression that it was pursuing its own evangelizing goals and utilizing crypto to achieve them. This woke many up to the promise of a digital economy of AI agents using crypto, with many speculators latching on to the potential opportunities of having autonomous agents promoting their memecoins on social media.

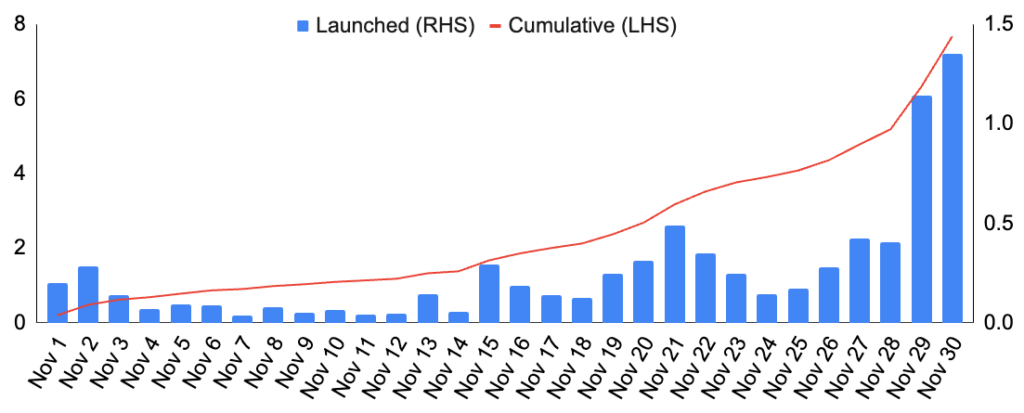

Throughout November, a couple of AI agent platforms rose to prominence. These platforms enable developers to create AI agents and/or provide launchpads for AI agent-related tokens. For example, Virtuals is a platform that provides both: the team behind it is working on a framework called G.A.M.E. to allow developers to create custom-built agents, and they’ve launched a pump.fun style interface to enable anyone to launch an agent with an associated token on Base. Over seven thousand agents with tokens were launched using Virtuals throughout November. In addition, Eliza is another popular open-source framework for developing AI agents that can interact through various forms of social media. Eliza is built by the team at ai16z, a DAO that aims to surpass a16z’s investment success through the use of AI agents. The ai16z team has launched AI agents that post on Twitter and have drawn a fair amount of engagement, similar to Terminal of Truths, including with Marc AIndreessen and degenspartanAI. Of note, Virtuals has similarly been used to launch AI agents that have become popular on social media, including Luna which generates TikTok style influencer content, and aixbt which provides commentary about crypto.

Beyond Virtuals and ai16z, several other AI agents and related experiments received attention in November. Zerebro in particular was the subject of much excitement as it went beyond posting comments on Twitter and was used to generate art across various mediums, including a full music album. An AI agent interaction on Farcaster also generated interest as one agent, aethernet, called on another, Clanker, to successfully create a token on Base. Separately, a team associated with Flashbots entered the fray with an attempt to solve the problem of creating an AI agent that is provably autonomous and independent of its human creators. Their proposed approach combines AI agents with TEEs, using trusted hardware to provide proof that the agent is operating on nothing but its code, and resulted in another popular Twitter AI agent, tee_hee_he. Finally, another example is Freysa, which highlights both the potential and risks that come with combining AI and crypto. Freysa is part of a game where users pay to interact with the AI agent and try to convince it to give them the pot of crypto funds it holds. As more attempts are made, the more both the pot and the fee to play grow. Across the two times the game has been played, Freysa successfully rebuffed many attempts, before finally being convinced to give up its funds. The game demonstrated the novel use cases and experiences that AI and crypto can unlock, but it also shows that a crypto-holding AI agent can be hacked to give up its funds despite what it’s been directed to do. As such, we are likely still far from having AI agents that are reliable enough to be trusted to autonomously transact and use crypto.

Virtuals Agents and Associated Tokens Launched in November, Thousands

Source: Dune @hased_official, GSR.

GSR in the News

- BBC – Bitcoin soars after Donald Trump’s victory

- DL News – Bitcoin price stumbles as Trump lead slips in prediction markets

- Decrypt – How Bitcoin Traders Are Playing the US Election

- OKX Institutional – Crypto Commentary October 2024

- Empire Newsletter – 🗳️ Election Day

- MarketWatch – Bitcoin bulls eye $100,000 by year-end after Trump win. But watch for this catch

- Unchained – Will There Be a Wave of Crypto IPOs Following Trump’s Victory?

- Forbes – Inside the wild money machine fuelling crypto’s stupidest bubble

- Decrypt – Dogecoin Could Soar ‘Far Beyond’ Current All-Time High Price: Analyst

- Cointelegraph – Bitcoin investment ‘material impact’ captures pension funds’ attention

- Empire Newsletter – 🤑 Six figure bitcoin

- Blockworks – Why bitcoin’s $100K breakout is just the start

- DL News – The Trump Bitcoin rally is slowing. Here’s what three experts say will drive the price next

- Axios – A strategic reserve

Authors:

Carlos Guzman, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Head of Research | Twitter, Telegram, LinkedIn

Toe Bautista, Research Analyst | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments. Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.