Bitcoin and Ethereum

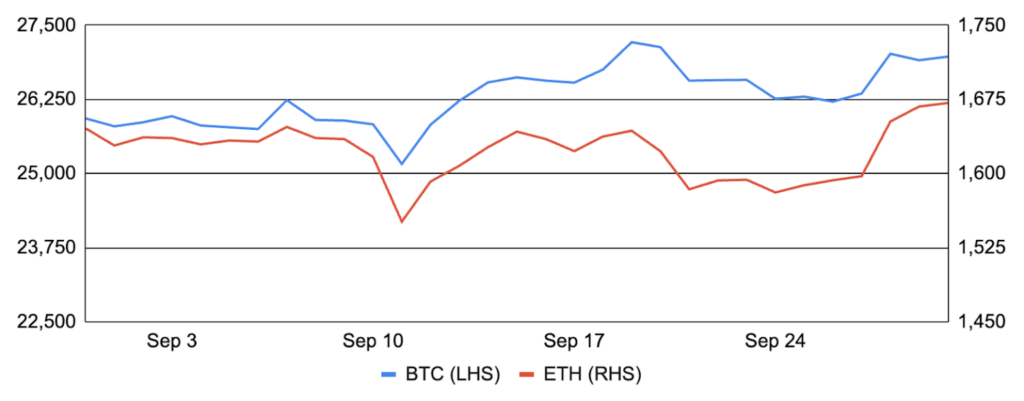

Bitcoin gained ~4% in September after entering the month around $25,900 and finishing at ~$27,000. Performance trended sideways during the first third of the month until concerns over potential FTX asset sales temporarily rattled markets on September 11th. Price quickly recovered and trended higher during the middle third of the month until the Fed’s “hawkish pause” and lower-than-expected jobless claims dampened risk appetite on the 20th and 21st, but positive performance returned towards month-end behind better-than-expected inflation data and the approval of several Ethereum Futures ETFs. In other news, the creator of Ordinals proposed changing the inscription numbering system, and also introduced a new fungible token protocol named Runes aiming to replace BRC-20 and other legacy fungible token projects on Bitcoin; Microstrategy added 5,445 more bitcoin to its balance sheet during August and September; and, the Mt. Gox trustee extended the repayment deadline until October 2024 but noted certain creditors may begin receiving payments before year-end.

Ethereum gained a modest ~1.5% during the month after entering September around $1,650 and finishing at ~$1,670. The month featured the one-year anniversary of The Merge, which changed the network’s consensus mechanism and drastically altered its inflation schedule. In fact, Ethereum’s supply has decreased by ~300k ETH since the upgrade was enabled. Short-term ETH supply dynamics recently flipped inflationary, however, as a larger validator set and greater L2 activity led to a supply increase of ~23k in September (i.e., greater gross issuance and lower fee burn), the first monthly increase in 2023. Incremental demand for ETH staking slowed meaningfully and the validator activation queue has nearly cleared for the first time since Shapella (~4 day wait). In addition, Ethereum developers successfully launched the new Holesky testnet, which features the largest validator set on record and will help test limits on messaging overhead. Updates across L2s / modular scaling solutions were also notable. Eclipse detailed its modular architecture that will use Solana’s SVM for execution, Celestia for data availability (publishing), Ethereum for settlement, and ETH as the network’s gas token. Additionally, Canto unveiled plans to transition to an Ethereum L2, while Astar announced its expansion beyond Polkadot with its own zkEVM leveraging Polygon’s stack. Elsewhere in Ethereum news: Safe introduced a standard for displaying audit reports onchain (ERC-7512); SSV.Network launched its public mainnet using distributed validator technology (DVT) to help decentralize Ethereum staking; Metamask introduced a cash out feature enabling users to redeem crypto for fiat; and, Vitalik Buterin co-authored a paper on Privacy Pools, which allow users to publish zero-knowledge proofs to show “their funds (do not) originate from known (un-)lawful sources, without publicly revealing their entire transaction graph.”

BTC and ETH

Source: Santiment, GSR.

Global Central Bank (in)Action

September was a busy month for monetary policy, with interest rate decisions from nearly every major central bank. Taking center stage was the Fed, which paused hikes and kept its target rate unchanged at 5.25% to 5.5%. However, the market largely perceived the meeting as hawkish, with rate expectations, per the Fed’s dot plot, continuing to indicate one more hike before year-end, while rate expectations for the end of 2024 and 2025 rose by 50 bps, signaling a “higher for longer” rate environment. Despite this, Powell downplayed the dot plot during the press conference, reiterating that it’s simply a collection of individual forecasts rather than an agreed-upon path forward. Powell also noted that the full effects of tightening have yet to be felt and that a “soft-landing” was not his base case forecast, which added some dovish nuance. Overall, the market doesn’t fully believe the updated dot plot as Fed Fund futures indicate short term rates have peaked, but sharp increases in longer-dated bond yields imply that rates will remain at elevated levels for longer than previously anticipated.

Most other central banks generally followed a similar playbook and paused rate hikes. The Bank of Canada and the Reserve Bank of Australia both paused as markets expected. The Bank of England and the Swiss National Bank similarly paused but surprised markets as they deviated from the expected hike. And, the European Central Bank was a notable standout as it delivered another 25 bp hike, though it signaled that rates are now sufficiently restrictive, all but declaring an edit to its hiking cycle.

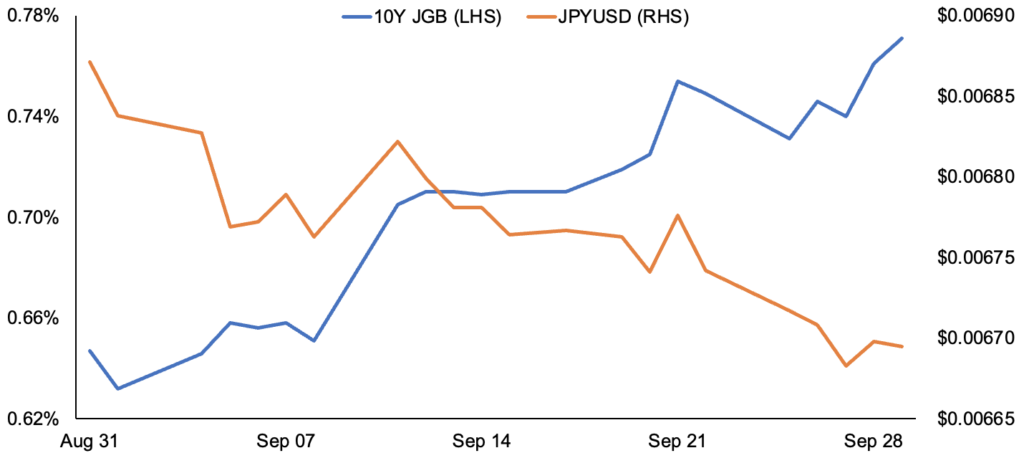

Lastly, the Bank of Japan (BoJ) unanimously voted to maintain its short-term policy rate at -0.1% and uphold its 10Y target and yield curve control program. As a reminder, the BoJ added flexibility to its yield curve control mandate, increasing the upper bound by which 10Y yields may rise from 0.5% to 1.0%. At the time, Governor Ueda noted that the 1% level was a pre-emptive cap and that the BoJ would conduct market operations flexibly beyond 0.5%, taking variables like the yield level and the speed of change into consideration while further acknowledging that he didn’t expect yields to rise to 1%. Following that decision, 10Y JGB yields have steadily increased. To counteract this, the BoJ intervened with an unexpected bond purchase on the last trading day in September. However, the relatively modest $2b purchase only reduced yields by ~1 bp, and yields currently sit just under 0.77%. Overall, the BoJ is in a precarious position trying to temper the rise in interest rates without further devaluing its currency.

10Y Japanese Government Bond Yields Rise and the JPY Depreciates vs. USD

Source: Marketwatch, GSR.

Nouns Rage Quit

Nouns is a fully onchain, experimental NFT project on Ethereum that generatively mints and auctions a new Noun from the pixelated PFP collection every 24 hours. As such, only 867 Nouns have been auctioned since the project launched in August 2021, but the supply will continue to increase in perpetuity. Moreover, the daily auction proceeds accrue to the project’s treasury, which is supervised by the Nouns DAO and governed by Nouns holders. These funds have been used to finance a diverse range of proposals from public goods to philanthropy, community initiatives and partnerships, as well as more frivolous endeavors like naming a new frog species and attempting to send a 3D-printed Noun to the International Space Station.

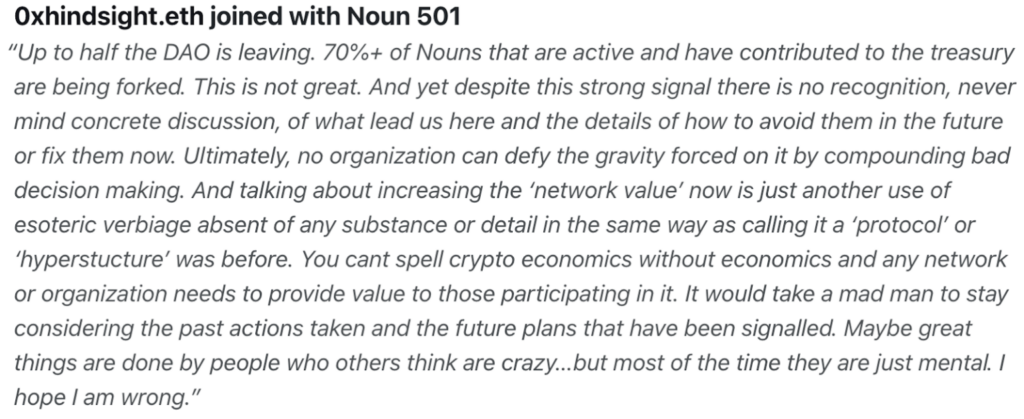

Despite the relatively long-standing success of Nouns, the Nouns community fractured during the month after a fork mechanism was proposed and subsequently executed to give agency to the disillusioned minority. Specifically, the mechanism allowed any Noun to signal a fork in response to a governance proposal, essentially allowing a minority to voice opposition. And if the fork gathers a quorum of 20%, a new version of the DAO is launched, inheriting the departing members’ pro-rata share of the original DAO’s treasury. The forking Nouns returned their NFTs to the original DAO and received replacement tokens with the same art and ID in the newly formed DAO. Additionally, the new DAO included a vanilla rage quit mechanism that allowed token holders to forfeit their NFT in exchange for their share of the treasury, so the fork wasn’t necessarily a sign of a preferred strategic direction for the DAO, but more so an opportunity to exit the community entirely. All told, ~56% of the Nouns joined the fork, transferring nearly ~17k ETH into the new DAO’s treasury. However, much of that was temporary, and ~66% of the forked Nouns rage quit and exited the community after the fork.

A Disgruntled Forker’s Departing Remarks

Source: Nouns, GSR.

A New Addition to the Rekt Leaderboards

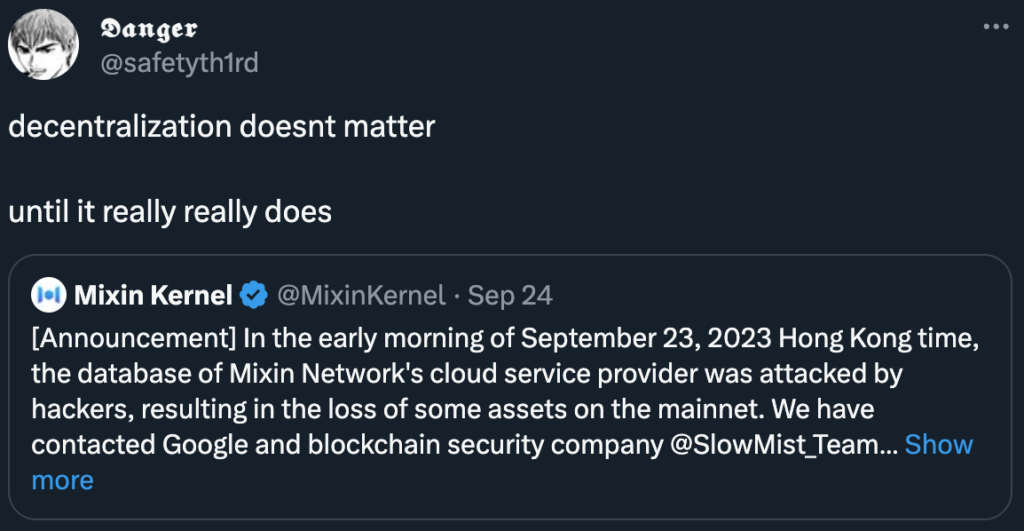

September was the worst month of 2023 so far for crypto exploits and hacks, with nearly $330m stolen during the month according to CertiK. While there were several high profile heists during the month, none were more prominent than the $200m hack of Mixin Network, the largest loss to hack or exploit since November 2022. Mixin claimed to be a decentralized transaction network, but it suffered ~$200m of losses from an attack against its third-party cloud service provider, implying its private keys were recoverable on the cloud. Details remain sparse beyond the initial announcement and one update claiming the situation is better than originally feared, but there remains little clarity around the underpinnings of the exploit, details on the recovery value, or timeline until withdrawals are re-enabled.

Beyond Mixin, there were several other large exploits during the month that each stemmed from compromised private keys, were believed to be executed by North Korea’s Lazarus Group, and perhaps more coincidentally, were all flagged by Cyvers’ AI-powered suspicious transaction monitoring system (here and here). The first exploit arose on September 4th with the ~$41m hit on crypto casino Stake’s hot wallets. Eight days later, ~$54m was drained from crypto exchange CoinEx’s hot wallets. After the attacks on Stake and CoinEx, there were two more exploits from compromised private keys that were similarly flagged by Cyvers (here and here), but each had less compelling evidence identifying the perpetrator as Lazarus. These included the exploits of Remitano and HTX’s (formerly Huobi) hot wallets that were drained for ~$2.7m and ~$7.9m, respectively.

Mixin’s Hack Announcement

Source: Twitter, GSR.

Ethereum Futures ETFs Approved

Coming full circle on last month’s ETF coverage, the SEC cleared the way for Ethereum Futures ETFs in September and several products providing exposure to Ethereum Futures or a blend of Bitcoin and Ethereum Futures went live on October 2nd. Interestingly, the SEC deviated from the approach used in 2021 when it approved ProShares to launch the first Bitcoin Futures ETF before its competitors, and it took a more egalitarian approach this time around, enabling several ETFs to go live simultaneously.1 Indeed, ProShares had immediate competition from VanEck and Bitwise on the first day of trading. While early demand has been relatively lackluster thus far, particularly compared to the launch of Bitcoin Futures ETFs that coincided with the market top, the approval provides an increasingly viable path towards a spot ETH ETF in the wake of Grayscale’s victory in court last month. We’ll likely gain a better sense of a spot ETH ETFs chances by January 2024, when a final decision is required on the Ark 21Shares spot Bitcoin ETF filing.

In other ETF news, Grayscale filed to convert its Ethereum Trust (ETHE) into a spot Ethereum ETF, the Invesco & Galaxy partnership filed for a spot Ethereum ETF, and VanEck announced it would support Ethereum developers by donating 10% of the profits from its Ethereum Futures ETF to The Protocol Guild. Lastly, the SEC delayed several spot bitcoin ETF applications, including BlackRock’s, well before the required extension deadline (see exhibit 3 in this report for an explainer). While the delays are not surprising by themselves, the pre-emptive delays are unusual but likely stemmed from concerns of a potential government shutdown before a deal was reached by Congress last weekend.

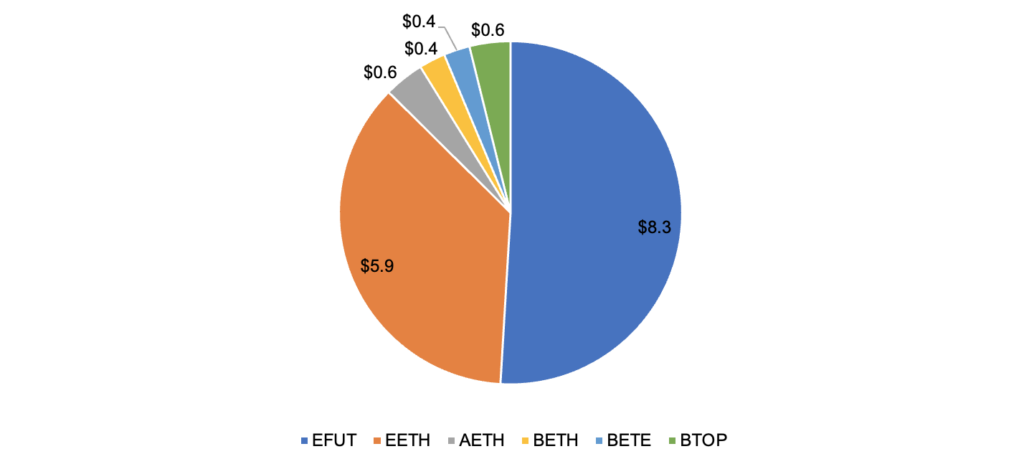

ETH Futures ETFs AUM by Product ($M)

Source: GSR, manager websites. Note: Funds investing solely in Ethereum Futures have led the AUM charge so far, particularly VanEck and Proshares, while blended BTC & ETH products have seen little demand. EFUT = VanEck ETH Futures; EETH = Proshares ETH Futures; AETH = Bitwise ETH Futures; BETH = Proshares Mkt Cap Weight BTC & ETH Futures; BETE = Proshares Equal Weight BTC & ETH Futures; BTOP = Bitwise Equal Weight BTC & ETH Futures.

Footnotes:

- When Bitcoin Futures ETFs were first approved in 2021, the SEC allowed applications to go effective automatically at their respective deadline dates under Rule 485(a). This allowed ProShares, who sat at the front of the review queue, to enter the market alone days before any competitor, which allowed it to raise ~$1b more AUM than peers that were approved days or weeks later.

GSR in the News

Twitter: Token2049 GSR Highlights

Cointelegraph: Crypto liquidity provider GSR receives regulatory approval in Singapore

CoinMarketCap: Crypto Trading Firm GSR Receives Payment License from Monetary Authority of Singapore

CoinMarketCap: GSR Gets on Path Towards Full Regulatory Approval in Singapore

Coindesk: Coinbase Obtains Payment License in Singapore

CryptoNews: Crypto Trading Platform GSR Receives In-Principal MPI License in Singapore

Crypto News: GSR secures in-principle approval for Singapore payment institution license

Regulation Asia: Coinbase, Sygnum, GSR Win New Approvals in Singapore

Investing.com: Coinbase secures Singapore MPI license, GSR receives in-principle approval

AmbCrypto: Another crypto exchange receives regulatory node in Singapore

Coincu: GSR Singapore Regulatory Win With MAS New License Approval

CryptoNews: Peter Thiel-Backed Founders Fund Invests in Layer N’s Ethereum Scaling Tech

CryptoNews: Bitcoin Miners Consider Hedging Options for Revenue Stability

Fortune: Layer N’s $5 million round includes support from Peter Thiel

The Block: Peter Thiel’s Founders Fund backs Ethereum scaling network Layer N

Investing.com: Coinbase and GSR Markets expand their reach in Singapore and Canada

Forbes India: GSR Secures Regulatory Approval as Crypto Liquidity Provider in Singapore

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

View September 2023 Market Update

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.