Originally Seen in CoinDesk’s Crypto Long & Short

From developer and decentralized application (dapp) counts to progress along its roadmap to general public awareness, there are many metrics that may be used to measure Ethereum’s progress over time. One of the most popular is transaction count, which is notable not only due to its correlation with items like adoption and fee generation, but also as it measures actual usage of the protocol itself. Unfortunately, transactions on Ethereum are now down ~26% from their May 2021 peak, suggesting that Ethereum is, at best, temporarily moving backwards and, at worst, in long-term decline. This, however, couldn’t be further from the truth.

To better understand why Ethereum is thriving despite a falling transaction count requires an understanding of Ethereum’s plans for the future1. While Ethereum can directly facilitate all blockchain activities on mainnet (consensus, execution, data availability, settlement), it is pioneering a more modular approach, enabling certain functionality to be outsourced to separate, optimized protocols for improved performance. Chief among these is execution, with transactions outsourced to layer 2 (L2) rollups for more efficient processing.

Rollups are a type of L2 scaling solution that bundle multiple transactions together, executing them in batches offchain before posting a smaller amount of data back to mainnet that’s sufficient to reconstruct the rollups state. Moving transactions offchain in this regard vastly increases throughput, and, as the state of the rollup can be recreated and verified using the data posted on Ethereum mainnet, rollups inherit many of the security properties of mainnet itself. This strategy was a shift in Ethereum’s scaling roadmap proposed by Vitalik Buterin in 2020, dubbed the rollup-centric roadmap, which prioritized outsourcing execution to rollups and bolstering Ethereum’s data availability layer to reduce the cost of posting data back to mainnet. In short, it retrenched the focus of Ethereum mainnet to consensus, settlement, and data availability.

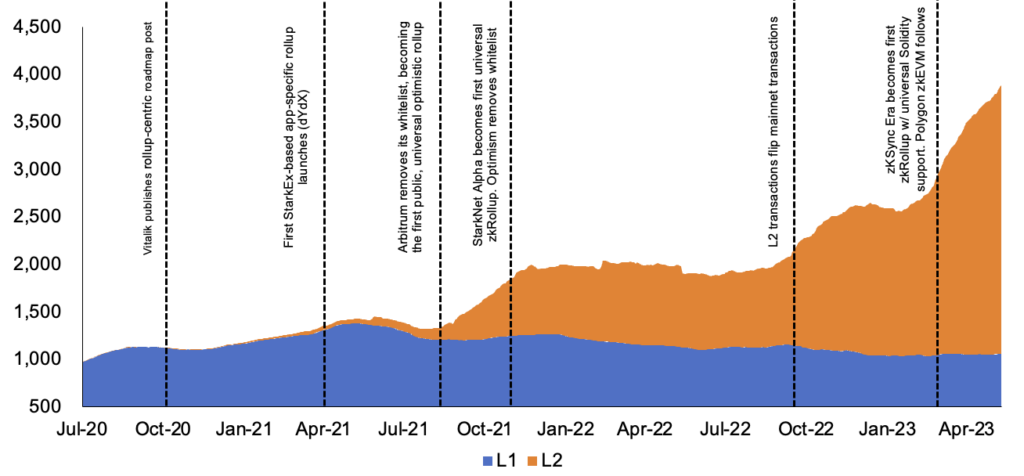

With that as background, we can now view Ethereum’s declining mainnet transaction count in a different light. And when adding in L2 transactions, we see that total ecosystem transactions, including those on mainnet and layer 2s, are up a strong 146% over the last two years. Not only does this show that usage of Ethereum continues to increase rapidly, but also that it continues to progress along its roadmap exactly as intended.

Lastly, we see strong growth and a shift towards offchain execution continuing for several reasons. First, the Ethereum protocol continues to move in this direction and will particularly do so with its next upgrade featuring proto-danksharding that expands Ethereum’s data availability capabilities. Moreover, in addition to the base layer itself improving, so too are the layer 2s, with improved decentralization and new paradigms around interconnectivity and shared security ahead. And these base and secondary layer improvements will come together to enable new use cases and functionality, creating a virtuous cycle. Portended by rising ecosystem transaction counts, Ethereum is perhaps on its way to one day becoming the world’s settlement layer.

Ethereum Transactions Per Day Across L1 & L2s, 90-Day Average (thousands)

Source: L2Beat, GSR. Data as of June 7, 2023.

Footnotes:

- See The Surge section specifically for a deeper dive into layer 2s and Ethereum’s danksharding roadmap.

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Required Disclosures

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.