We discuss the recent market meltdown, how towering bull tenets and fading risks could propel Bitcoin to $1m, and why the recent dip is a gift, all combining to make cryptocurrency’s risk reward its most compelling in years.

Originally seen in CoinDesk’s Crypto Long and Short

The Anatomy of the Meltdown

There has been much consternation in traditional markets of late, with a variety of reasons to blame. First, the Bank of Japan raised interest rates to combat the falling Yen, causing traders to unwind Yen carry trade positions. Second, worries around US economic growth came to the fore after a series of disappointing releases, especially the latest employment report. And finally, fears of a wider war in the Middle East arose after Iran vowed retaliation for the assassination of a Hamas political leader. Such financial, economic, and geopolitical uncertainty caused widespread panic, resulting in, for example, Japan’s Nikkei recording its largest single-day drop since 1987 and many large US tech stocks falling by double digits over several days, just to name a few.

Cryptocurrencies, which would have been expected to fall by a greater amount than equities anyway, had the added pleasure of additional idiosyncratic negative drivers, including impending Mt Gox distributions, mixed spot digital asset ETF flows, a rising appreciation that the pro-crypto Trump isn’t a lock for President, and reports of a large market maker dumping hundreds of millions of dollars of crypto during the panic’s peak. All in, Bitcoin touched $49,200, down 30% from just a week earlier, while Ethereum fell below $2,200, dropping 35% over that time.

Towering Bull Tenets and Fading Risks Offer Chance at $1m BTC

Despite the downturn, we remain as convicted as ever in the bull thesis, with its core tenets towering in place. These are:

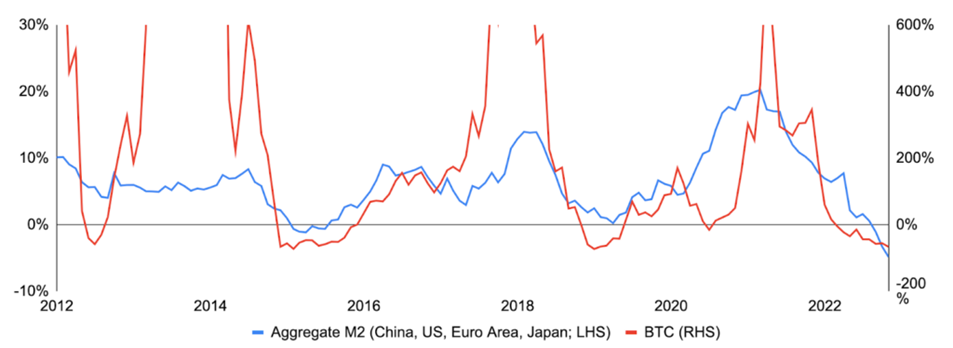

- Central Bank Rate Cuts: We stand at the beginning of global monetary easing. As shown below, rising global liquidity has historically catalyzed Bitcoin.

- ETF Flows: The spot Bitcoin ETFs have garnered $17b of net flows, the spot Ethereum ETFs are getting over the ETHE outflow hump, and the wirehouses are starting to allow FAs to solicit allocation, all amounting to a slow-but-steady TWAP buy.

- Improving US Stance: Regardless of who wins the Presidency, a greater desire from both parties to institute clear guardrails that protect consumers and foster innovation will ultimately ignite a wave of corporate activity.

- Bitcoin for Governments: Though of low odds and likely requiring a Trump victory, the creation of a US strategic Bitcoin reserve could prompt a nation state-level war for Bitcoin, given the potential implications and game theoretic buying by others.

Oh, and these near-term bull tenets say nothing of crypto’s supreme driver, which is what it will, over decades, ultimately become.

Global Liquidity vs. Bitcoin Price, Year-Over-Year Growth

Source: The People’s Bank of China, Federal Reserve, European Central Bank, Bank of Japan, Investing.com, Glassnode, GSR

Note: Converts local currency M2 to US dollars and aggregates before taking year-over-year growth. Note that different countries may define M2 slightly differently, but the general concept of M2 is that of a measure of the money supply that includes cash, checking deposits, and non-cash assets that can easily be converted into cash.

And while there may always be a black swan event, it’s hard to identify many large and likely risks. For example:

- Dissipating Overhangs: The specters of past sins are resolving, whether it be FTX returning $13b of cash to creditors or Mt Gox disbursing BTC to victims of its hack. To boot, these may turn into catalysts as FTX cash is reinvested and the Mt Gox overhang is removed.

- Traditional Markets Risks: Financial and economic uncertainty may be ebbing, with the BOJ suggesting rate hikes are done for now and Goldman Sachs ascribing just a 25% chance of a US recession (and the Fed pledging to “fix it” should growth slow).

- Others: Other risks like the US selling its $13b seized BTC portfolio, heavy altcoin unlocks, or CEX/stablecoin insolvencies could go the other way, seem manageable, or appear of falling odds.

All in, should the bull tenets materialize, risks fade, and crypto make strides towards its endgame – perhaps with a dapp that goes mainstream or Bitcoin/Ethereum’s adoption as the world settlement layer – we believe Bitcoin would easily surpass $1m, skewing the risk-reward exceedingly positive at just about any odds of the above occurring. Imagine, instead of Bitcoin as “digital gold”, gold becomes relegated to “physical Bitcoin”.

The Dip as a Gift – Time to Buy

Ultimately, we see the recent dip as a gift, offering a solid entry point and pushing crypto to its greatest risk-reward in years. Indeed, ETH is lower than prior to the SEC’s stunning about face on the Ethereum ETFs, while Bitcoin is down from prior to the US changing its stance towards crypto. Yes, we’re in a very different macro environment than before, but it’s hard to argue these catalysts are priced in any major way.

So while 30%+ drawdowns are indeed disconcerting, they create compelling opportunities. And while it’d be easy to come away negative after the events of last week, using price to inform one’s view of the underlying fundamentals is a recipe to buy high and sell low. Instead, the best analysts check whether the cause of any adverse price movements invalidated their thesis, and if not, they grow the position given the now-much-greater upside. So with the bull tenets squarely in place as risks fade, a legit chance at $1m Bitcoin, and greater potential upside after the recent dip, the risk-reward has rarely looked so compelling. Time to BTFD.

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Toe Bautista, Research Analyst | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.