Options are like the Swiss army knife of the finance world – a versatile tool lauded by traders looking to maneuver their way through dynamic market conditions. These derivative products exhibit a non-linear risk profile making them attractive to speculators, but also offer the ability to protect portfolios and earn supplemental yield on underlying holdings.

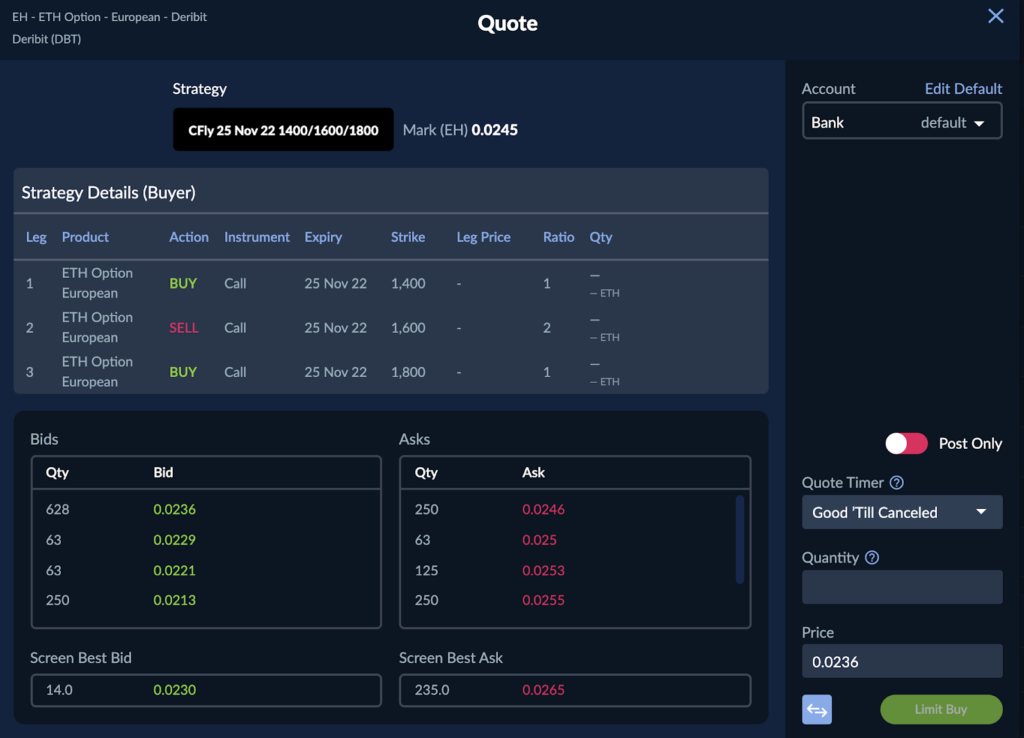

Though call and put options are not complex structures, managing a portfolio of options quickly becomes challenging as the underlying measures of risk are spread across various tenors and strikes. In what follows, we discuss butterfly spreads, the rationale for putting them on, and how Paradigm helps solve some of the execution risks of more complex multi-legged butterfly spread strategies.

What is a butterfly spread?

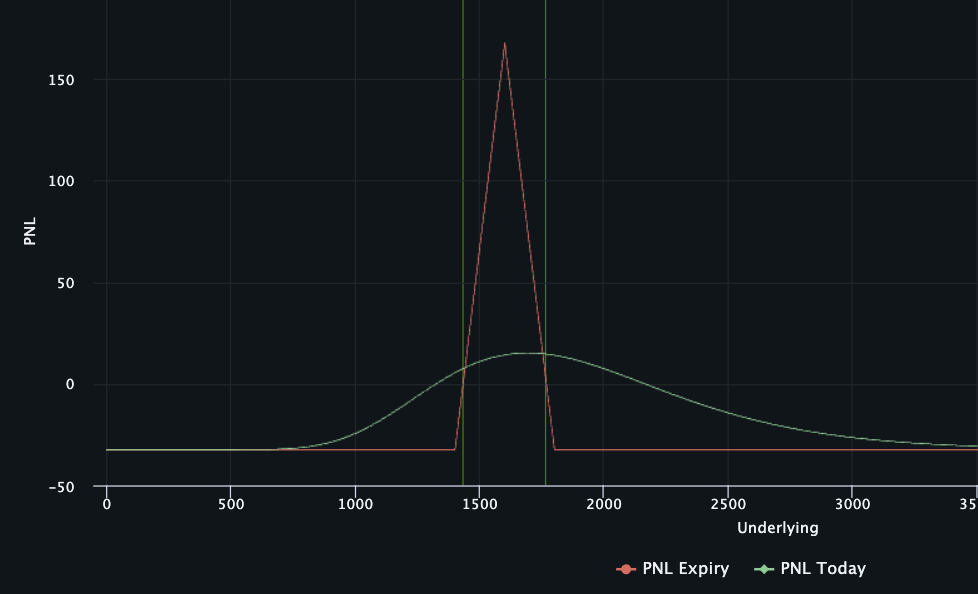

There are a variety of different ways to construct your butterflies, but in essence the butterfly spread comes from a series of positions with a payout that looks like the one below. The name butterfly spread comes from the payout profile – if you squint hard it looks like a butterfly, right? A trader would profit from such a position – here a long ATM butterfly spread – should the price of ETH not move much at expiration.

Long Call Butterfly Spread

Source: Laevitas Position Builder, GSR

*Position: +1 1.4K Call, -2 1.6K Calls, +1 1.8K Call in ETH expiring December 30th 2022

In a more technical description, there are multiple ways to achieve the payout shown through different combinations of puts and calls. In addition, the strikes can also be modified to change the payout of the structure while still maintaining a somewhat similar view on the overall market environment.

Butterflies are structured with a specific ratio, 1:2:1 with the single options purchased or sold collectively known as the wings and the two options at the same strike purchased or sold referred to as the body. The body and wings are also executed with opposing directions of the trade – I.e., traders buy the wings and sell the body or sell the wings and buy the body.

There are a variety of ways to get the “butterfly-like” payout structure. For the following examples, assume the price of ETH is $1,600. To construct a typical long ATM call butterfly, one would purchase one 1.4K call, purchase one 1.8K call, and sell two 1.6K ATM calls. Here, the 1.4/1.8K strike long calls are the wings, and the 1.6K strike short calls are the body.

Similarly for puts, one could construct a long-put butterfly by purchasing the 1.4K put, purchasing the 1.8K put, and selling two of the 1.6K ATM puts, with the wings and body the same as in the previous example.

The final way to construct a butterfly payout structure is known as an “Iron-Fly” in which the body consists of two short options and the wings consist of two long options of equidistant strikes from the body. For example, assuming an ETH price of $1,600, an Iron Butterfly could be constructed by buying a 1.4K put, buying a 1.8K call, selling a 1.6K put, and selling a 1.6K call.

You might notice that the Iron Butterfly structure is essentially a short straddle position with a long strangle as protection – this of course has an impact on the payout versus a pure straddle and the Greeks assume a combination of both straddle and strangle characteristics.

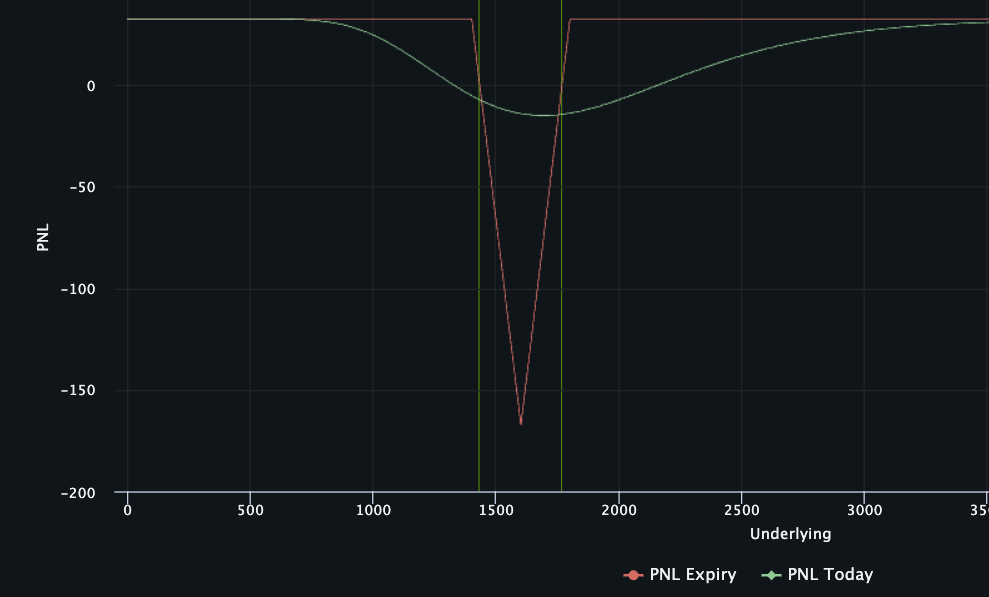

The previous structures are examples of being long a butterfly (ie. long the wings and short the body), though traders may also construct a short butterfly by taking the opposite positions as above. For example, a short call fly would be short a 1.4K strike call, short a 1.8K strike call, and long two of 1.6K strike calls. The payout of the short butterfly structure is shown below.

Short ATM Butterfly Spread

Source: Laevitas Position Builder, GSR

*Position: -1 1.4K Call, +2 1.6K Calls, -1 1.8K Call in ETH expiring December 30th 2022

What happens when you break the wings (skip-strike)?

As an aside, there are certain times when traders will construct “broken-wing” flies, which essentially modify the payout and have a slight impact on the Greek profile, though the end goal is similar to that of a symmetric butterfly position. Broken wing butterflies simply refer to the same above butterfly structure but without equidistant wings – I.e. The 1.4K/1.6K/1.8K structure could be turned into a broken wing butterfly by skipping over the 1.6K strike and purchasing the 2.2K strike instead for a payout shown below.

Long ATM Broken Wing Butterfly Spread

Source: Laevitas Position Builder, GSR

*Position: +1 1.4K Call, -2 1.6K Calls, +1 2.2K Call in ETH expiring December 30th 2022

What are traders hoping will happen?

Traders employ butterfly spreads for a variety of reasons, however the main idea for those who are long a butterfly structure is to have the underlying asset end up as close to the short strike as possible at expiry. So in the case of the above long call fly strategy – the buyer’s view is that ETH will rally but will not rally too much and is likely to be capped around 1.6k at expiry.

In addition, traders may modify characteristics of the strategy based on their market view, including time to expiry, strike selection, skip-strike/broken wing, and long or short the structure. As characteristics are modified, the predominant Greeks for the structure shift and can be used to determine underlying risk characteristics as well as where most profit is derived from.

Greeks

Regardless of the exact construction, how the P/L of the structure reacts is highly dependent on the Greek position established at inception as well as changes in the time to expiry, implied volatility, and spot movement. It’s simple to generate a payoff diagram of a butterfly at expiry, however it’s far more important to understand how its P/L is derived and how it may change while the trade is live, prior to expiry.

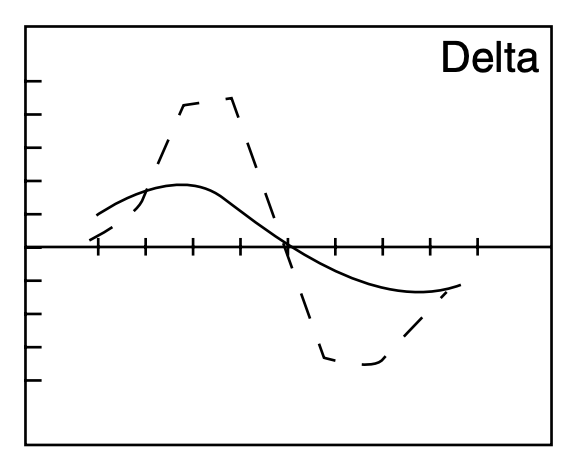

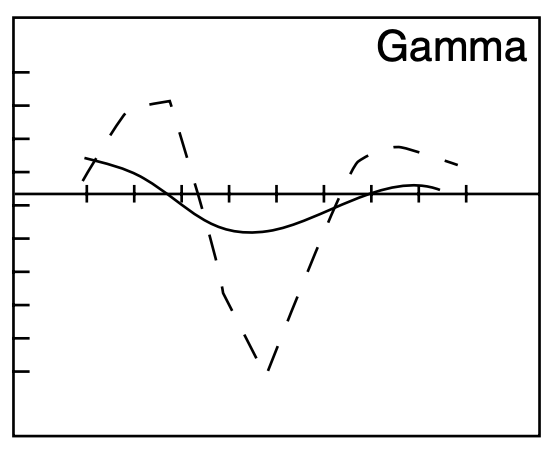

To represent the Greek profile, we’ll use a long iron butterfly (Long Straddle, Short Strangle, same expiry, equidistant strike wings). It should also be noted that delta, gamma, and theta are typically quite minimal for longer dated expiries.

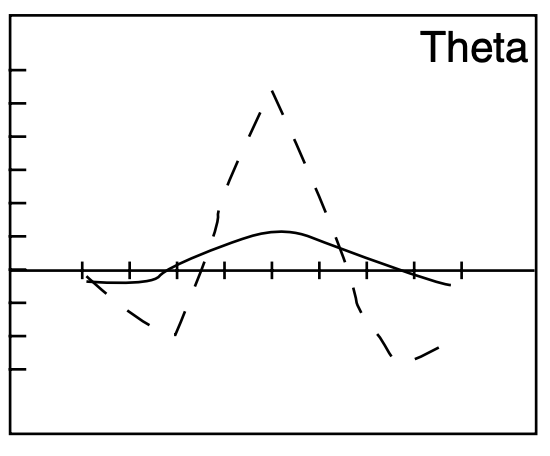

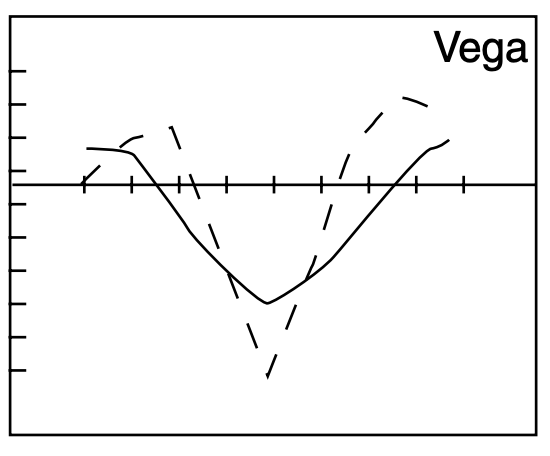

*In the graphs below, solid lines represent at inception, and dotted lines represent in the future (as time to expiry decreases) with the center of the X axis representing an ATM option

Long ATM Butterfly Spread: Delta vs. Price

Source: Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits, GSR

A relatively simple interpretation of how the greeks react for a butterfly would be:

- Positive Delta when the underlying price is below the inside/ATM strike

- Neutral Delta when the underlying price matches the inside/ATM strike

- Negative Delta when the underlying price is above the inside/ATM strike

Long ATM Butterfly Spread: Gamma vs. Price

Source: Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits, GSR

Note that a shorter time to expiry or lower implied volatility environment makes delta significantly “punchier” with a much sharper peak near the wings. This impact on the delta also has a large impact on deltas just outside or inside the ATM strike while having little impact on the ATM strike.

- Positive Gamma when underlying price moves outside the wings of the butterfly

- Negative Gamma when the underlying price is in between the wings of the butterfly

Note that A shorter time to expiry or lower implied volatility environment will make gamma significantly “punchier” with definitively larger regions of positive and negative gamma concentrated around the option strikes. *This is particularly important to consider when dynamically delta hedging options positions.

Long ATM Butterfly Spread: Theta vs. Price

Source: Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits, GSR

- Negative Theta when the underlying price is outside the wings of the butterfly

- Positive Theta when the underlying price is in between the wings of the butterfly

Note that a shorter time to expiry or lower implied volatility environment causes a significant peak in the theta profile of the structure near the short ATM strike, with sharp negative thetas concentrated near the OTM wing strikes.

Long ATM Butterfly Spread: Vega vs. Price

Source: Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits, GSR

- Positive Vega when the underlying is outside the wings of the butterfly

- Negative Vega when the underlying is inside the wings of the butterfly

Note that a shorter time to expiry or lower implied volatility environment will tighten the Vega profile to express a bit more of a peak near the option strikes rather than a smoother profile with quieter peaks.

How dynamic hedging of butterflies can impact market dynamics

Impact of butterfly delta on hedging and market movements

Market participants entering into a long butterfly derive a very interesting gamma profile, typically long gamma outside the wings and short gamma near the ATM. But many market participants are expressing a directional view on spot – i.e. they think spot will be in that range at the end. This means their attitude is one of ‘I buy this option strategy which has a fixed premium, put it in a drawer and hope it pays off at the expiry’ without much in the way of dynamic hedging of greeks.

However, the more interesting case is the gamma profile of the dealer on the opposite side of the trade. As market participants RFQ for butterflies and enter into the long side of the trade, dealers end up becoming net short the wings and long the ATM strike, causing gamma outside of the wings to be negative and gamma near the body to be positive.

Most dealers will hedge their flows, and such a gamma position, where the dealer has negative gamma outside of the wings and positive gamma near the body, can impact the underlying market. In a simplified example, as expiry approaches, gamma becomes more and more of a factor in the trade as gamma is greatest for options with short dated expiries. Regions where there are a significant amount of dealers long gamma create more stability in the market as dealers hedge through buying at lower prices and selling at higher prices. Regions where there are a significant amount of dealers short gamma adds instability and volatility as dealers must buy into rallies and sell into dips, adding more pressure on both ends of the orderbook as markets start to test regions where dealers are short wings. This situation is represented in the above tweet by GVOL, which also covers dealer hedging and market dynamics in more detail.

With that said any assumption regarding the impact on the underlying market depends, however, on being able to infer which trades are being blocked with market makers/dealers, who are assumed to hedge their underlying risk. We know that there are still other market participants such as high net worth individuals who block trades and do not hedge their underlying risk, so figuring out a way to differentiate between dealer positioning (assumed to hedge underlying delta exposure) and non-dealers is important. Genesis Volatility uses a proprietary algorithm to infer and estimate the correct directions of the trade and infer dealer positioning, which allows us to better make conclusions on underlying market dynamics caused by short-dated gamma exposure.

Why use a butterfly?

As discussed previously, an iron butterfly is simply a straddle combined with a strangle, and a long iron butterfly is a short straddle with a long strangle as protection. The phrase ” as protection” is key here. Butterflies are an important structure for a trader who might want to sell straddles but is uncomfortable with the possibility of an unlimited loss structure.

A long butterfly thus allows a trader to take on a similar market view as selling straddles naked. A trader might find that buying a block of 300 butterflies on ETH (+300/-600/+300) is less risky than selling 100 straddles due to the capped risk profile. Additionally, this defined risk position typically allows for the structure to be quoted at a tighter bid-ask spread than that of the equivalent strangle.

*In options trading, size and risk are not always correlated. Some strategies done in large sizes can have relatively small risks, while other strategies, even when done in small sizes, can have a relatively large risk.

Conclusion

Long butterflies are a versatile strategy, offering traders a way to speculate on the price of the underlying asset staying/finishing within a chosen range. Moreover, such a structure offers a similar market view as selling straddles, but with the added protection of removing unlimited market exposure. Traders well-versed in butterflies and how market makers/dealers hedge may also gleam valuable insights into potential market dynamics, all making butterflies a must-have tool in the trader arsenal. Paradigm is able to help traders execute butterflies in a single order rather than having to construct single leg blocks on exchange, thus allowing minimal execution risk and a way to start trading butterfly structures in an easy and efficient way.

Source: Paradigm Trading Platform, GSR

Author: Chris Newhouse, Trader, GSR.

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.