With a positive view of the market, we identify major upcoming drivers and present thoughts on each.

Relative to traditional markets, we believe that digital assets over short periods of time are driven mostly by sentiment and less so by fundamentals. In equity parlance, this is tantamount to saying that prices are driven more so by the multiple rather than next year’s earnings. This makes crypto prices particularly hard to forecast as it’s generally much easier to predict underlying fundamentals than it is the sentiment of others. That said, we also believe that crypto markets are much less efficient than their traditional market counterparts. Whereas breaking news is immediately and accurately priced into equities upon dissemination, crypto prices often do not react until the catalyst becomes a narrative, nears, or even comes to fruition. In this respect, generating alpha in crypto markets is much easier than in traditional markets, where one almost only needs to have a sense of what matters, uncover more information than peers, and be highly organized in order to make sound decisions that are correct more often than not.

With that as background, we anchor our market view in terms of upcoming catalysts and risks, before combining them using an expected value framework. While precise estimates around unknown and opaque future events are not possible, such a method involves examining all positive and negative catalysts and attaching both the probabilities of each occurring and the expected market impacts, before, in excel speak, simply running a sum product function on the catalysts. For example, if there are many positive catalysts with a high likelihood of occurring that would have a large, positive impact on the market compared to few negative catalysts with low probabilities of occurring and little market impacts, then our market outlook would be skewed quite positively. Conversely, if there are few, low probability, inconsequential positive catalysts relative to an abundance of high impact, high probability negative catalysts, then we would take a negative view of the market. And while positive and negative catalysts are often somewhat balanced, they periodically become heavily skewed in one direction, giving one the confidence and conviction to double down when prices and sentiment peak or trough.

Moreover, despite our belief that prices move over the near term due to sentiment more so than fundamentals, we confine our analysis to the fundamentals, as it’s the fundamentals that ultimately influence sentiment. Furthermore, examining fundamentals enables more objective analysis, backed by more tangible analysis and avoiding the frequent pitfall of letting price inform one’s view that definitionally is a recipe to buy high and sell low. Finally, we’d note that all analysts will not just be wrong, but wrong often. Here, one could accurately assess all drivers, their odds, and market impacts AND make a smart decision ex-ante, only to have a low-probability event counter to one’s position come to fruition and result in a loss. Our not-so-scientific intuition from years of running a fundamental relative value long-short equities book suggests that any trade starts out as a 50/50 proposition, countless hours of digging and expertise can push the odds of making a correct call to 55%, but 20% luck bands in both directions can and will throw off a trade, a month, or even a whole year. However, as long as the analyst correctly identified the offending catalyst as a possibility prior to placing the trade, then the analyst did their job. And, a 55% hit rate with 20% luck bands averaged out over time and across multiple analysts is exactly how many of the most successful funds are built.

With that as a way-too-long prelude, we present our current market analysis.

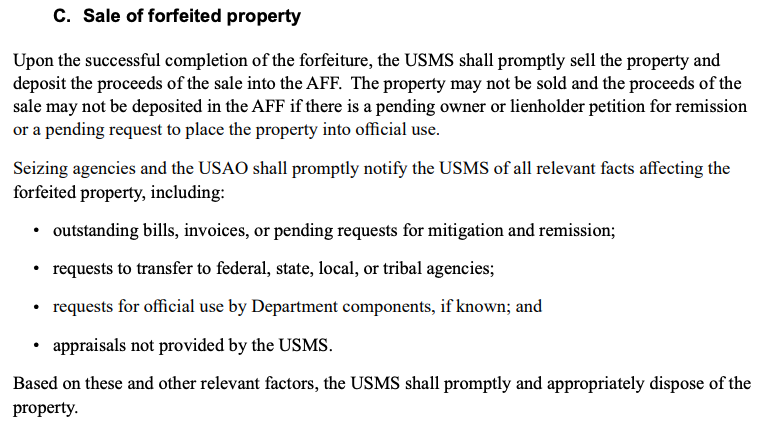

| The Four Near-Term Drivers |

We see four main drivers of crypto prices over the next three to four weeks, including election tea leaves, global monetary policy, the US economy, and potential US government sales of Silk Road Bitcoin. In rough order of importance and in more detail:

US Election Tea Leaves

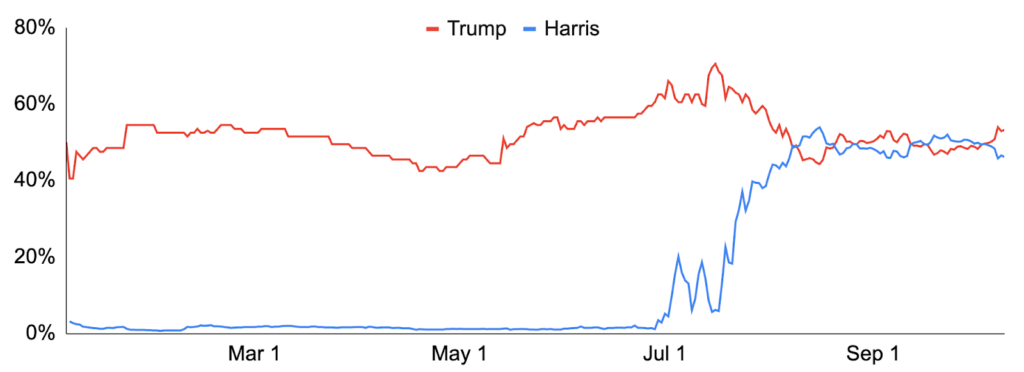

The US Presidential election is likely the biggest driver of crypto prices through mid-November, with both clues regarding candidates’ views towards crypto as well as signs regarding who may win being particularly important into election day. Regarding the former, Donald Trump has promised to deliver the industry’s collective wishlist, vowing to fire SEC Chair Gensler on day one, clarify crypto regulation within 100 days, and create a US strategic Bitcoin reserve. As such, further digital assets commentary by Trump is unlikely to materially impact markets. Kamala Harris, by contrast, has yet to share a detailed policy position outside of vague promises to support innovation and investor protection. As such, additional clues regarding Harris’s views will be particularly impactful.

Outside of candidates’ stances towards digital assets, the other, larger election-related driver is who will win. And while it is unclear if Trump is willing or able to implement his many promises, he is generally viewed as the more crypto-friendly candidate and prices would likely surge should Trump be elected. This could bleed into prices leading up to the election should Trump take a large lead in the polls prior to the election, or could come all at once on election night should the race be too close to call when voting commences. By contrast, should Harris win, we see much less downside, and potentially even upside, than many have implied as a) election uncertainty is weighing on the markets and will be removed regardless of who wins, b) Harris will almost definitionally be more friendly towards the industry than the current administration, and c) crypto prices are lower than when US politicians began to embrace digital assets in May suggesting that there isn’t much priced in for a more friendly US stance. On a side note, we do see the election as more important for alts than the majors, as Bitcoin and Ethereum’s regulatory status is clear, while those of most alts are not.

Overall, we believe the importance of having clear digital assets rules and regulations in the US cannot be underestimated, with such rules likely igniting a wave of investment, activity, and innovation. And with the US finally having a legit shot at clear guardrails regardless of who wins and seemingly not too much priced in for such an occurrence, we see the election as a squarely positive catalyst.

Presidential Election Winner Odds on Polymarket

Source: Polymarket, GSR.

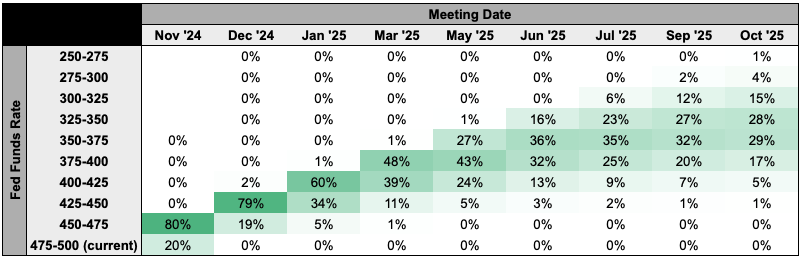

Global Monetary Policy

Increasing global liquidity has historically supported risk asset prices, including that of Bitcoin and other digital assets. As such, central bank actions will also have an outsized impact on market performance, with the Fed and Bank of Japan the most important, in our view. Regarding the Fed, clues related to what the Fed may do at its November 7th meeting will be key, with the Goldilocks scenario including a dovish policy stance combined with a confident message on the economy. Solid economic data and the recent FOMC minutes, where participants were divided over the size of the recent September rate cut, suggest the Fed will opt for a smaller 25 bps cut in November. However, incoming data as well as Fed commentary will be important to keep an eye on in the meantime.

The Bank of Japan, which is attempting to remove accommodation after a long period of negative rates, will also be particularly important to watch. Recall, its late July rate hike caused the yen to appreciate, resulting in carry trade unwind and market turmoil. As such, the BOJ has the difficult task of normalizing policy without spooking markets or stymying economic growth. Moreover, the selection of Shingeru Ishiba as Japan’s next prime minister by Japan’s ruling Liberal Democrats party adds additional uncertainty, with markets at least initially believing Ishiba will support increasing interest rates, though a recently falling yen would suggest otherwise. At any rate, the BOJ has stated multiple times that it expects to raise rates in the future if its economic forecast comes to fruition, and economists expect one rate hike by year-end. And while such a hike at the BOJ meeting at the end of this month may be too soon, any clues regarding if and when the BOJ will raise rates will move markets.

Overall, though the above bears monitoring, we see global monetary policy as generally becoming more accommodative over time and supporting crypto markets, and thus see monetary policy as another wholly positive catalyst.

Fed Funds Futures Implied Probabilities

Source: CME FedWatch, GSR.

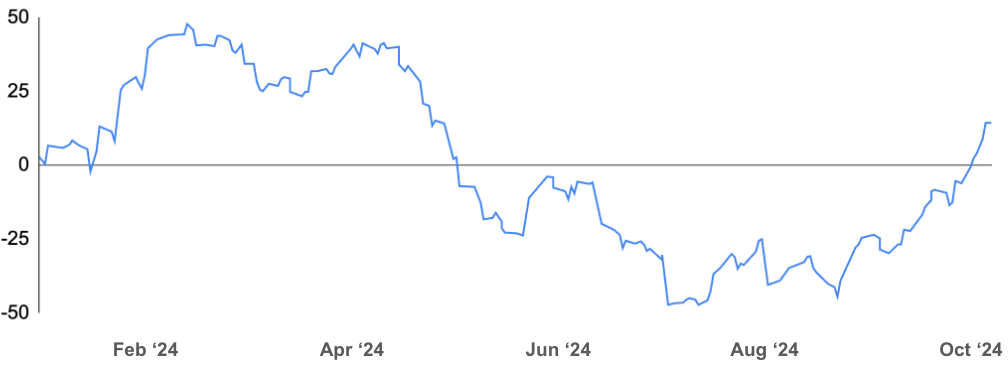

The US Economy

Another main driver for crypto prices over the near term will be US economic data, given worries that the economy is slowing or even headed for a recession. Such fears have stabilized recently due to better-than-expected incoming data and positive commentary by the Fed (Powell called the economy “solid” and “in good shape”), though several metrics are periodically coming in as worrying, such as September consumer confidence that saw its largest drop in three years. Here, we see the employment report and manufacturing PMI reports as key, as these are the economic releases that previously stoked earlier fears.

Overall, though incoming data bears watching, it appears that the US is in for a soft landing, and we regard this key catalyst as positive.

Citi Economic Surprise Index

Source: MacroMicro, GSR. Note: The Citi Economic Surprise Index represents the sum of the difference between key macroeconomic data releases and forecasts. A reading above zero means incoming economic data generally beats market expectations, while a reading below zero means economic conditions are generally worse than expected.

Potential Silk Road Bitcoin Sales

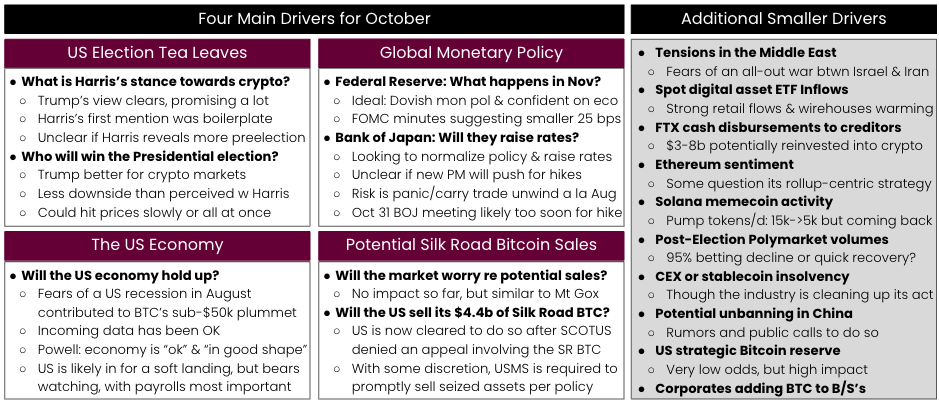

The final main near-term driver of crypto prices, in our opinion, regards the potential sale by the US government of confiscated Bitcoin related to Silk Road. Just this week, the US Supreme Court decided not to hear an appeal regarding the ownership of ~$4.4b of seized Silk Road Bitcoin. Moreover, media outlets reported that this decision removes a hold on the assets and allows the government to sell all $4.4b of BTC in accordance with the law. While the market reaction to this news was muted, perhaps due to complacency, uncertainty, or unawareness, we believe potential government selling or worries thereof are likely to negatively impact crypto prices at some point.

Moreover, we do believe the government is more likely than not to sell its Silk Road Bitcoin. This is because the US government signed an agreement in July with Coinbase Prime to “safeguard and trade” its large scale digital assets, the US government sent $600m of seized Silk Road Bitcoin to Coinbase Prime in August, and as shown below, the Department of Justice’s Asset Forfeiture Policy Manual requires the US Marshals Service to promptly sell seized assets. While the government does appear to have some discretion around timing to maximize the return on the sale or avoid crashing the market, we believe the government may not have a choice in whether to hold onto the assets, similar to how Germany was forced to sell its $3b Bitcoin stockpile recently per its seized asset protocol.

In fact, a large, potential upcoming supply overhang against a muted market reaction is reminiscent of the recent Mt Gox disbursements, where the Mt Gox trustee announced in 2023 that it would return $9b of BTC to creditors (which could be sold and pressure price) by the end of Oct 2024. But, it wasn’t until we got closer to the start of the disbursements in June 2024 that the narrative picked up and caused a significant decline in the price of Bitcoin.

Overall, while a sale may not commence and the markets may ultimately be able to absorb it without too large of an impact, we believe it is probable that the US government sells its $4.4b of seized Silk Road Bitcoin in the foreseeable future or that worries around the possibility of such a sale will at some point negatively affect markets, and thus we view this key catalyst as decidedly negative, especially with it not appearing to be priced in.

US Department of Justice’s Asset Forfeiture Policy Manual

Source: US Department of Justice, GSR.

| Additional Drivers |

In addition to the main catalysts above, we see many secondary drivers of crypto prices, outlined below. Note that some of these are general items that will impact many asset classes, while others are specific to crypto. Some are metrics where the incoming levels or changes will be important to watch, while others are more binary / event-based. And others are of very low odds, though with a high market impact causing them to still be worth something in our expected value framework. Finally, note that some of the below are more longer-term catalysts unlikely to occur over the next several weeks, but nonetheless are worthy of being on the radar. Additional catalysts/drivers include:

Tensions in the Middle East

Tensions in the Middle East remain high after Iran launched a missile attack on Israeli security and military targets in response to the killing of a Hezbollah leader. Fighting between Israel and Hezbollah in Lebanon has intensified, and Israel vowed retaliation for Iran’s missile attack, causing fears of an all-out war between Israel and Iran.

Spot Digital Asset ETF Inflows

The spot Bitcoin ETFs have brought in an astounding $18.7b of net inflows since their launch on January 10th. Thus far, flows have been mostly retail-driven, with holders generally HOLDing through rough market conditions and buying into strength. As such, we continue to see positive flows from retail. In addition, wealth managers like Morgan Stanley and Wells Fargo are now allowing financial advisors to solicit investment, and it won’t take many advisors to allocate 1-3% of client portfolios to digital assets to really move the needle, given $50T of overall US wealth assets under management. Advisor demand will not be a tsunami, but should amount to a slow-but-steady TWAP buy. Lastly, options on the spot Bitcoin ETFs are likely to launch this quarter, dampening volatility, enhancing liquidity over time, and given the additional means to manage risk, perhaps even inciting demand.

FTX Cash Disbursements to Creditors

Despite objections, a bankruptcy court recently approved FTX’s reorganization plan, paving the way for $14.7-16.5b in cash to be returned to creditors. While exact distribution dates are not yet set, it appears most likely that small creditors owed less than $50,000, which sum to ~$1.2b, will receive funds in December and January, while large creditors could receive their funds as early as February. Though an estimated $6-7b is due to creditors who are distressed funds and thus unlikely to reinvest the proceeds into crypto, some of the remainder is indeed likely to find its way back into the markets, with analysts pegging this to be anywhere from $3b to 8b.

Ethereum Sentiment

Mainly due to lagging price performance (in our opinion), sentiment around Ethereum is decidedly low right now. In fact, many see Ethereum as stuck between Bitcoin as the best monetary asset and Solana as the best high performance smart contract blockchain, and are openly questioning Ethereum’s rollup-centric strategy. While we disagree with the stuck-in-the-middle characterization, sentiment around Ethereum will be a key variable for ETH as well as for alts in general.

Solana Memecoin Activity

While Solana has been clicking on all cylinders, it has also been the main beneficiary of the memecoin craze, with heavy memecoin activity materially adding to transactions, network fees, and the price of SOL. The frenzy took off earlier this year in March, while memecoin factory Pump.fun later rose to prominence and became the fastest crypto app to generate $100m in lifetime revenue. Memecoin activity has since ebbed and flowed – there were routinely 15,000+ memecoins created per day on Pump.fun in May which fell to ~5,000 per day just last month – but activity has come roaring back with the success of memecoin Moo Deng and the popularity of Murad’s memecoin supercycle thesis.

Post-Election Polymarket Volumes

While Polymarket is undoubtedly the break-out blockchain-based app of 2024 and we are extremely bullish on its long-term prospects, it remains to be seen how quickly activity on the predictions market platform can recover after the election, with 95% of current volumes related to the election.

CEX or Stablecoin Insolvency

While we are quite encouraged that centralized exchanges are cleaning up their practices after recent crises, there remains the possibility that an exchange is engaging in nefarious activity or that a stablecoin goes under.

Potential Unbanning in China

Former Chinese Vice Minister of Finance Zhu Guangyao recently urged China to rethink its crypto approach following a more positive US stance. While there have not been any official statements, rumors that China may unban crypto have circulated since late 2022 due to Hong Kong’s crypto push, more positive crypto-related reporting from state-owned media, and the development of the digital yuan.

US Strategic Bitcoin Reserve

Though several think tanks have labeled it a bad idea, Donald Trump pledged to establish a US strategic Bitcoin reserve, while Senator Lummis introduced a bill that would do exactly that and direct the government to purchase 1m BTC, or 5% of supply, over time. We see the establishment of a US strategic Bitcoin reserve as extremely low odds, but it could spark a global, nation state-level war for Bitcoin, with the sky being the limit for price should it occur.

Corporates Adding Bitcoin to their Balance Sheets

Public companies such as Metaplanet, Semler Scientific, OneMedNet, Cathedra Bitcoin, and Marathon Digital have recently adopted MicroStrategy’s playbook of maximizing Bitcoin per share. And with public company stocks generally being rewarded for doing so, it may just take one large company added to the ranks to spark a true movement. Maybe Dell (see here, here, and here)?

| The Market View |

We believe the four main drivers of crypto prices over the near-term to be election tea leaves, global monetary policy, the US economy, and potential US government sales of Silk Road Bitcoin. Further, we see many additional, smaller drivers, from trends in important data to event-driven catalysts.

Overall, we believe there are more positive catalysts with higher likelihoods and market impacts than negative catalysts, and thus hold a positive market view. Indeed, three of our four main drivers are very much supportive of markets, while the vast majority of our additional drivers are positive as well. The one caveat is that there is a sequencing aspect to this, especially for more nimble traders, where if one believes worries around potential Silk Road Bitcoin sales will grow prior to material movement on the other positive catalysts, it may be prudent for such traders to hold a more neutral view. Should that occur and markets pull back, however, we would view it as an attractive buying opportunity, with the one major negative catalyst removed and a much better entry point now available. Lastly, note that these views are shorter-term and fluid in nature, which we constantly adjust with incoming information, and very much differ from our long-term Crypto Thesis, where we remain supremely bullish on what crypto will ultimately become. Happy trading.

GSR’s Near-Term Market Drivers

Source: GSR.

Note: GSR is long BTC and SOL.

Authors:

Brian Rudick, Head of Research

Carlos Guzman, Research Analyst

Toe Bautista, Research Analyst

View The Market View October 2024

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.